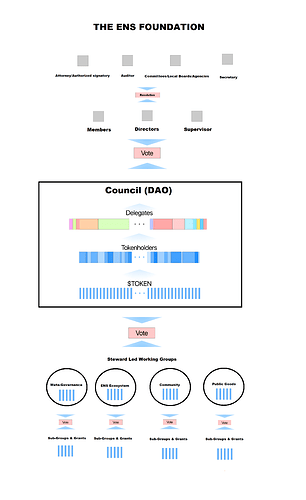

With confirmation by @nick.eth that the Treasury wallet/funds are an asset of The ENS Foundation controlled by the DAO/Council (the “Account”), I am reposting a diagram I modified from @inplco’s diagrams as it helps visualize some of the gaps between the authorized activities of the DAO/Council and the anticipated/actual activities by the DAO/Council at this time.

Essentially everything above the DAO/Council in the diagram is created by the Foundation Company Act and/or expressly authorized in The ENS Foundation Memoradum of Association/Articles of Association (beneficiaries intentionally omitted). However, everything below the DAO/Council has been created by the DAO/Council. Specifically, the DAO/Council has authorized the creation of the Working Groups to be led by Stewards elected by the DAO/Council that will be funded by the DAO/Council using funds from the Foundation Account which will be used to: 1) pay the Stewards compensation and 2) fund Sub-groups and grants in the discretion of the Working Groups. Unless I have overlooked something, the DAO/Council does not have express powers to create these Working Groups nor fund them using the Foundation’s Account. We can cure this by: 1) the Directors passing a Resolution empowering and authorizing the DAO/Council, in its sole discretion, to create the Working Groups and fund them using the Foundation Account; 2) memorializing these powers/activities in the Foundation’s By-Laws (to be drafted by Fenwick); or 3) revise the proposals such that the DAO/Council doesn’t create the Working Groups rather the DAO/Council authorizes the Directors to create the Steward Led Working Groups and we can create a transaction layer where the DAO/Council transfers the Working Group budgets/funding to the Directors and the Directors fund the Working Groups on behalf of the Foundation (note, the only reason I suggest #3 is that the Directors already have the power under the Articles to create “committees, local boards, agencies” and the Working Groups likely fall nicely within this existing framework, see Section 21-22). No matter the solution, inevitably I think this naturally leads to the question of the legal relationship between the Foundation and the Stewards, which should likely be codified in independent contractor agreements between the Foundation and the Stewards to minimize risks of any employment claims against the Foundation.