Happy to move the staking discussion elsewhere!

I do want to clarify a point that maybe hasn’t come through.

If we reward delegation then the choice would be: “I hold my token, delegate it and earn rewards” vs “I deposit it in Defi and get rewards”. I agree with Nick that I fail to see why the concept of “staking” adds any value. We don’t need to stake in order to reward people.

We’re not specifically trying to reward people, we’re trying to create incentives for people to leave their voting power with the DAO. When they deposit it into DeFi, DeFi gets control over the DAOs security, and those potential votes become inaccessible to the DAO.

Importantly, the DAO can’t reward people without some sort of “exchange” of work. Token holders need to be incentivized to return security to the DAO, and the DAO can’t incentivize them directly because some folks would benefit without doing work to earn it.

We believe that DAO tokens today, as they are purely “governance tokens” are valued in the market based upon a speculative premium that itself is based on the assumption that one day the DAO will return value to the token holders.

When token holders become convinced that the DAO will indeed never return value to token holders, they have only two rational economic choices: sell the token, or find some other way to extract value from the DAO.

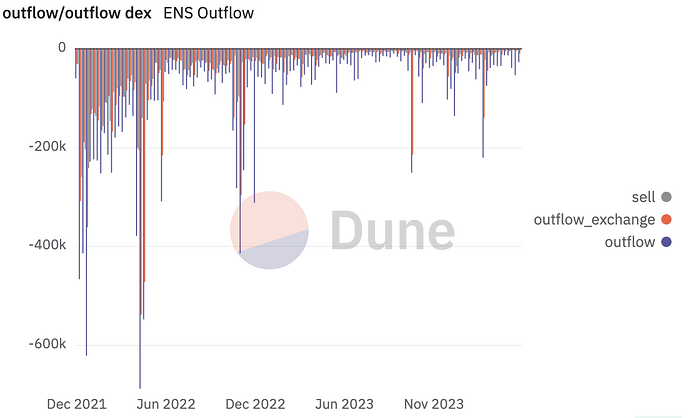

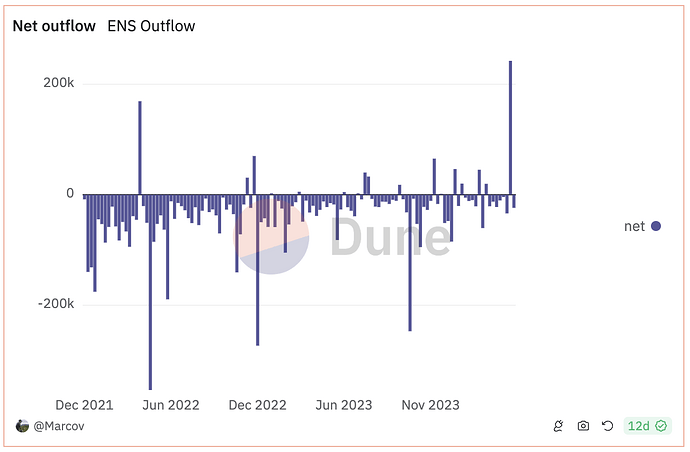

When we look at the outflow of delegations in ENS and the outflow of tokens to exchanges, we see that this assumption appears to be correct. Token holders who were once delegating are leaving ENS, and a significant share are moving their tokens to exchanges for sale.

It thus follows that the only rational purchaser of a DAO token, that will never return value to token holders, is a malicious entity that seeks to extract value in a different way. This is exactly what happened in the DAOs which were attacked in your analysis @AvsA and what we are worried about happing here. ENS isn’t alone in this struggle as you pointed out, and at Tally we have discovered that more mature (and successful) DAOs are experiencing this problem.

Essentially there is a fundamental economic misalignment between token holders and the DAO itself which leads to the illogical situation where the value of the DAO is not reflected in the security of the DAO.

The CANCEL role is a necessary tool, but it’s not a permanent fix, as we can expect delegated votes to continue to fall. Worryingly, the DAO security outflow is significantly higher than inflows.

Potentially eventually making it impossible to reach quorum unless new measures are introduced. In the long term, such a centralized option will jeopardize ENS’s claim to being decentralized.

The staking idea isn’t about giving rewards, it’s about incentivizing token holders to return security to the DAO so that we don’t need centralized options. For that reason I believe @bendi originally proposed it as a more scalable long term solution to the decline in DAO security.

Sorry if this seems to have hijacked your thread, happy to move it elsewhere.