I agree, at it’s core you’re correct, but I think you can make the cost-prohibition vastly higher if token holders earn yield.

Example:

(note: I understand ENS can’t return revenue to token holders, but just for example sake)

- Current Scenario:

- DAO “A” market cap: $100m

- Revenue: $100m/year, not shared with token holders

- Quorum: 100m votes

- Treasury: $200m ETH

- Attack Cost: $100m for $100m profit

- Improved Scenario with Revenue Sharing:

- Token holders receive 100% of yearly revenue ($50m)

- Market cap now effectively earns $50m/year

- Valuation with Time Horizon:

- 1-year horizon: $150m (market cap + 1-year revenue)

- 10-year horizon: $600m (market cap + 10-year revenue)

- Attack Cost: Increases with the time horizon, making attacks more expensive.

Summary:

- A DAO that returns value to token holders increases in value based on the time horizon of token holders, making it more costly to attack.

- Non-Value-Returning DAO: Valued at X, attack cost is X.

- Value-Returning DAO: Valued at X + (Time horizon * revenue), increasing the cost of attacks proportionally.

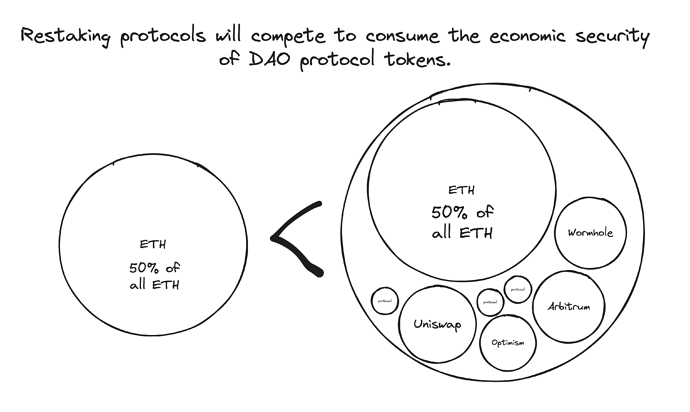

I think for the restaking platforms the TVL metric is the most critical metric. The higher their TVL the higher the “economic security” they can sell to Actively Validated Services. These AVS will be rational, and I suspect the switching cost of restaking providers to be minimal, thus they will always switch to the service with the highest economic security. They use TVL as the only mechanic by which they can compete for customers.

Eigenlayer, Symbiotic, Karak, now Babylon, are going to be locked in an insane war to suck up the most TVL. I personally worry that without liquid staked protocol tokens, they will consume every protocol in Ethereum. Because why not? They don’t even need to pay real yield to ENS token holders, they will pay them in “points” (promises).

The restaking services don’t care about the governance, just like they don’t care of ethereum validators, all they care about is: Can they take your money if you misbehave?

The governance part of ENS tokens makes ENS tokens more valuable, but it’s actually a cost, not an income. Token holders pay with gas fees and long nights reading forums to enact governance (for which they are not compensated). Eigenlayer doesn’t want the goverance piece.

I don’t know if it can only be implemented in an LST, but the LST is the only version I’ve thought of that splits the governance power from the economic yield component of the underlying token.

The feedback mechanism is specifically that token holders can look at their portfolio and see if their yield is going up or going down.

- If yield goes up, the DAO is performing well, the delegates should get more support from Token holders.

- If yield goes down, the DAO is not performing well, token holders will seek different delegates who promise more yield.

Yield is a proxy for revenue, and revenue is a proxy for success. I know it sounds overly capitalistic, but it does create a real feedback loop with token holders in a way that VE style does not.

In VE style staking, token holders can only evaluate the success of delegates at the end of the locking period: Are the resulting additional tokens worth more than the yield that could have been earned if the tokens had been locked in Eigenlayer?