A plurality (more than any other candidate but less than a majority) of first-votes were for None of the Above. Under IRV, if a majority had been cast for None of the Above in the first round, voting would have ended immediately with it as the winner.

This is untrue. Brantly’s first vote was for None of the Above, and since it was not eliminated, his vote counted throughout the process. His second and third choices would only have been considered if NOTA was eliminated.

To address the broader issue of people being forced to pick candidates after NOTA: note that in this election no choices after NOTA were considered, because NOTA was not eliminated; the results are exactly identical.

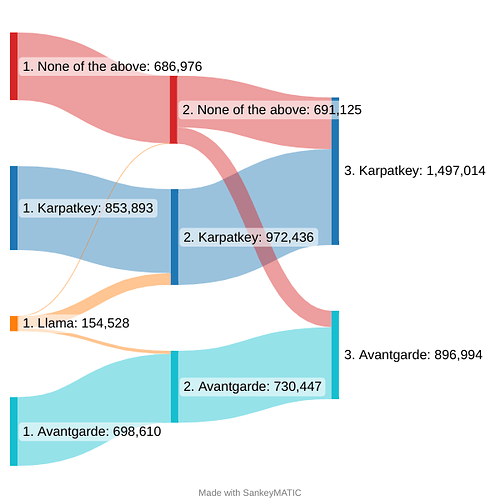

If we instead take the state from about 6 hours before the conclusion of the vote, when NOTA was in third place:

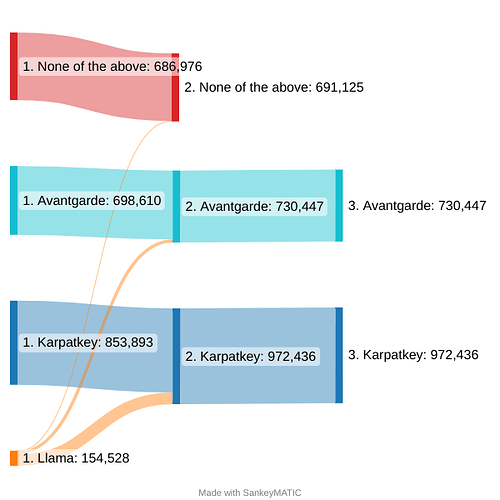

we can simulate the effect of disregarding all choices placed after NOTA:

The results are what you would expect: all the outflows from NOTA are gone, meaning those voters had no input in the selection of the eventual winner; instead, the round 2 results decide the outcome. Voting this way doesn’t give NOTA voters an increased chance of winning, it just means they do not have a say in their subsequent preferences.

We’re definitely committed to working in public, but it’s not viable to offer the DAO - or random commenters on the forum - input on every individual choice. We would never actually reach a conclusion. A more viable approach is for the MG WG stewards to work with Karpatkey on an initial proposal, which is put to the DAO for feedback and refinement; that process can continue iteratively until all serious concerns have been addressed.

Karpatkey will need to speak for themselves, but I doubt they would be willing to offer the same terms to manage a $2.6M fund as they offered to manage a $52M fund. I also don’t think that managing $2.6M for 6-12 months tells us anything much useful about either Karpatkey or the investments; the time horizon is too short and “past performance does not guarantee future returns” as investment professionals are fond of saying.

In my mind, the minimum sensible size for the endowment is all of the unearned revenue (presently ~$19.8k ETH). This is money we cannot spend, which needs to retain exposure to ETH (unless we change the accounting basis), and could be used to earn a modest return on very low risk investments such as a diversified basket of staked ETH (if in ETH), or lending via AAVE etc (if in USDC). It makes little sense for us to sit on it and do nothing with it, and diversification into several low-risk options such as different staking providers insures us against tail risks from those providers.