Intro

Hey all.

So as has been discussed a lot in Twitter in the last days and in the Space yesterday this is a really difficult vote to participate in.

Everyone has put so much time in these proposals and there has been so much back and forth here in the forums, twitter and in spaces.

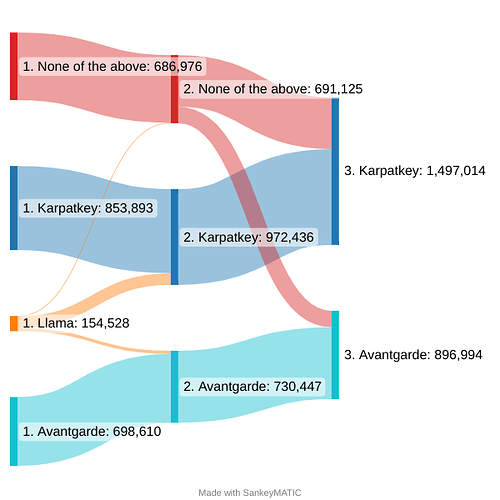

Vote ranking

I will list my vote preference here with a short explanation for each.

1. Karpatkey

Both Karpatkey and Avantgarde come really close in my opinion and it was difficult to choose one of the two as first choice.

Ultimately what made the difference was speaking with projects that have used them before and getting a feel for how their work looks like.

I believe that ultimately the tech stack of Karpatkey and the way their proposal describes they plan to use it will be of the highest benefit to the ENS DAO and guarantee that the Endaoment’s goal will be reached.

I also liked the fact that the strategies that will be followed with Karpatkey all seem safe and as risk averse as possible.

Finally gotta admit the statistics and the way that reporting seems to work in the Karpatkey proposal impressed me and think it will be really useful to the DAO.

2. Avantgarde

A very very close second. Had the pleasure of speaking to some people in their team, listened in the space and read the proposal.

I am aware of the enzyme protocol and had been following it even from when it was called Melon. It’s a really interesting approach and as a tech stack also quite powerful.

One of the things that put me off a bit from the proposal is that despite all we saw last year with insitutional crypto offerings collapsing, Avantgarde seems to insist on using them via Maple.

I do realize it’s only a very small part of their allocation and in the worst of worst case it won’t spillover but it’s one of the things that personally still puts me off.

Finally though I appreciate cryptio as part of the proposal I would appreciate tools that are opensource.

Again … I need to say though both proposal are stellar. Choosing one or the other was hard.

3. None of the above

I am choosing none of the above higher than Lama because I don’t believe we would need to have an external manager which passes every single financial action as a vote through the DAO.

Now about what would “None of the above” mean in reality for us I think it’s something we woudl want to avoid.

We would have to re-convene and find someone else, probably from inside the DAO and take small allocations here and there as suggested by @brantlymillegan here: https://twitter.com/BrantlyMillegan/status/1594799476480286726

Though inviting at first, I have to admit I liked the idea, … I can see how this would easily devolve into arguments about how to manage the funds and in the end we would need to end up giving the power to an individual or org. Plus it would take a lot of time.

So I view the “None of the above” as the option to go with a “non-professional” manager, maybe from within the DAO. For example I am the manager of rotki’s treasury … and I think I am doing okay with the small amount of funds we have.

But ENS is huge. It’s a big project and I think it deserves professional financial management. Which is why this option is ranked as 3rd.

4. Llama

Though I appreciate the proposal Llama wrote, I really don’t think financial management can be effective if it has to pass via a DAO vote for every decision.

As many of my peers wrote above when you manage funds at this size you really need to make quick adjustments and take financial positions within a very short time-frame (minutes or hour/s). A DAO vote and execution would take weeks.

I don’t think this is effective and as such ranked Llama as my last choice.

Closing notes

I want to thank everyone who participated in these discussions. You have all been amazing and especially Karpatkey and Avantgarde people have been so open and helpful in their discussions with me.

I learned a lot through this process.

Whatever the end result, I wish to see both teams thrive and in the end for us in ENS to have the most risk-averse but effective ENDAOment program.

_

_