I think thats probably more true in a DAO where the treasury is denominated in the native DAO currency and an attack would drive the token to zero.

In ENS’s case, the DAO is denominated in ETH which retains it’s value irrespective of the performance of ENS. So malicious actors are instead incentivized to acquire the treasury ETH, the loss of value on their ENS would simply be part of the attack-cost. Ironically, if the attack was successfull, AND the malicious entity valued the ENS tokens, an attack would drive the speculative premium of ENS down, and the entity would now posses the Treasuries ETH with which to buy the ENS back at a discount.

What I don’t understand here is how liquid staked tokens are meaningfully different from unstaked tokens.

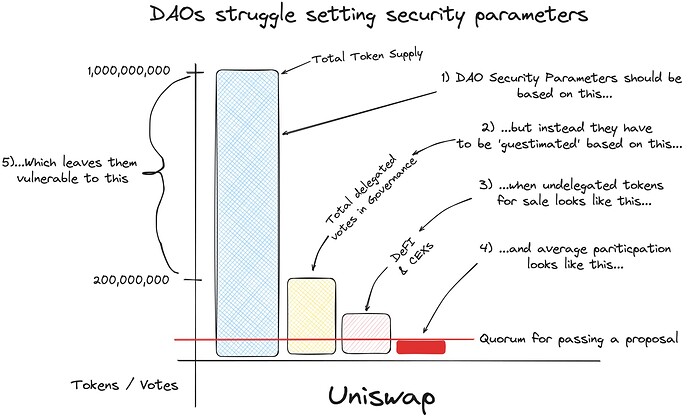

Unstaked tokens carry direct governance rights. Meaning that when users attempt to find some sort of yield on their token, (such a depositing on a centralized exchange, or locking) they necessarily remove voting power from access from the DAO. Thus the voting power gets pooled in DeFi Protocol or Centralized exchanges. I think this is going to become a huge issue when the restaking protocols come online for ERC20s, and now ENS users have to choose.

Here is an example I drew up for Uniswap:

Basically token holders are faced with the choice:

“Hold the token, vote, and get nothing”

or

“Deposit into Eigenlayer and earn yield”

You can imagine that maybe the majority of tokens holders will make the “earn yield” selection. Indeed the larger the ENS token holder, the larger the opportunity cost for them, meaning the DAO is forcing them between making money and participating in a DAO for free (or worse, participating in the DAO with extraction as the goal).

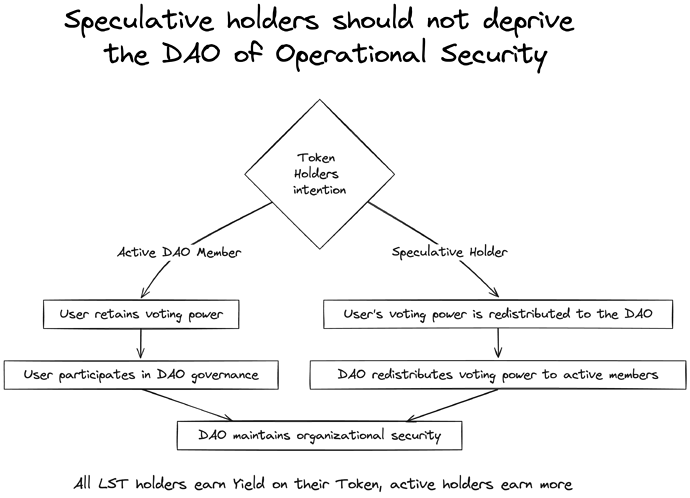

The idea of doing a Liquid Staked version is to remove the opportunity cost where speculative token holders have to deprive the DAO of security in exchange for earning money on their tokens. Since the liquid staked version pools the underlying ENS token in the contract, we can repurpose the voting power of speculative holders in a positive way for the DAO (the DAO can figure out what “active” means in this case, but we have a few ideas)

Liquid staking effectively splits the economic value of the token from the governance value of the token. Eliminating the opportunity cost that token holders face. The LST token only has governance power via proxy, the native DAO Token IS the governance power.

BTW: some nice ENS charts

https://dune.com/Marcov/dao-token-holders

You’re right that we can’t easily prevent people creating liquid wrappers for nonliquid staked tokens.

A big part of the idea we have is that we should build liquid wrappers as a public good, so that they aren’t captured via misaligned wrappers.

Note that the ENS constitution forbids distributing protocol revenue to ENS token holders.

Correct, would it be productive to instead think of this of paying active token holders for the act of governance? Something interesting here is that you can split the revenue generated by staking: part goes to the token holder while part goes to the delegate. If you want 100% you have to both hold the token (the liquid staked token) AND delegate, (and then ideally actively participate- I’ll punt the convo for what counts as active participation for now). Now you’re receiving rewards for doing work, and no token holders receive revenue for not doing work.

The LST layer is above the staking layer, so we can redistribute value to LST token holders by providing software that helps “active work” be accomplished, effectively LST token holders that hold for speculative reasons give their rewards to delegates who do work.