Thanks for the proposal, @kpk team!

We agree with the comments by both @nick.eth and @katherine.eth.

For the objective of the investment policy, it is unnecessary to make large gain with this endowment because ENS DAO has income accrued continuously that has been covering expenses. That being said, we support the idea of investment as having larger treasury should help DAO or even Ethereum ecosystem. We should find the right objective to keep conservative fund management.

For ETH exposure, we agree to lower the share of ETH exposure to mitigate the risk that comes from ETH price volatility. RWA can be a good option as long as the endowment can create diversified portfolio of RWAs to avoid overexposure to any single asset class or currency. One point of consideration is the potential overreliance on USD-denominated assets, such as T-bills. T-bills have been popular tokenized RWAs and are traditionally seen as low-risk investments, but excessive allocation to such assets might create an outsized USD exposure, especially when combined with the stable exposure.

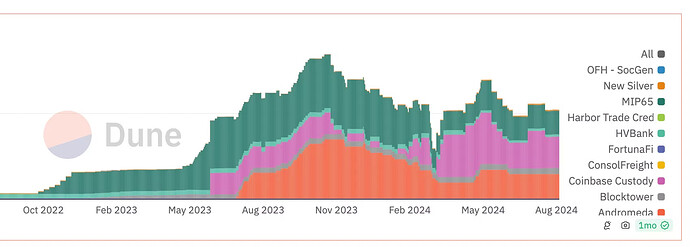

Therefore, we should be discussing RWA portfolio based on sub category of RWAs such as T-bills, private credits, real estate, etc. Maker DAO’s RWA dashboard can be a good example, though this is a custodian-based view.