With the execution of proposal 5.11 now the metagov multisig has a total of 164k ENS which is earmarked for governance distribution. These distributions have been discussed in many occasions and have been subject to controversy and rule changes so in name of clarifications and transparency we thought it would be a good time to make a summary of what these ENS will be used for and how it’s being calculated.

Steward ENS compensation

Stewards are compensated with 4k USDC per month and in previous years have been compensated, at the end of their term with 10k ENS. Between term 4 and 5, social proposals 4.8 and 5.8 have changed the way these compensations (and ENS in particular) have taken effect.

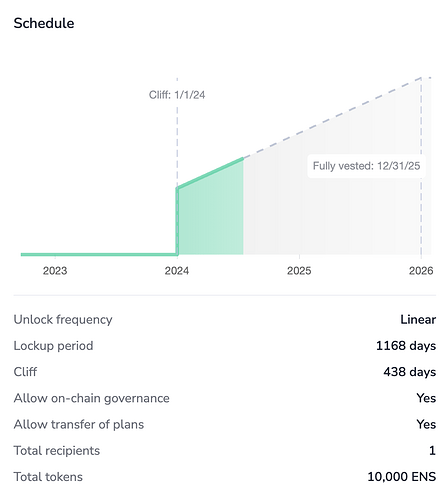

The main ones being that Meta Gov stewards could not change their own compensation and any changes can only take effect on the next term (to avoid self serving decisions) and all ENS is given with a 2 year vesting. More specifically social proposal 5.8 states that the vesting contract should count starting january 1st, except for 37.5% of the total, to account the fact this decision only taken 4 1/2 months into the year.

To comply with these, this is how we are going to execute the proposal:

- We will be using Hedgey.finance . One of the main reasons for picking this (instead of, say, Superfluid which is used for the Service Provider Stream) is that it allows delegated voting power. This means that tokens grant immediate voting power, which is the main goal of such grants.

- We will deposit 90k ENS on 9 different vesting contracts that will belong to each steward. These contracts will be unrevokable and transferable

- The only way to allow a 37.5% liquid token while keeping it all in Hedgey is to specify a different duration, which we will do by increasing duration by 60% with a cliff for the beggining of the term.

More Governance Distribution

After this we will still have over 70k ENS on the Metagov wallet. As we have specified in other proposal temp-checks we plan to use that to further distribute voting power to other contributors to the DAO. We believe Hedgey combination of immediate voting power with long vesting will be a great testing grounds for the concept. Lessons learned with the tech and reality of how vesting works will be used to inform all our future governance distribution decisions.