Unmitigated Potential Liability: ENS DAO Governance Risk from Unwrapped Assets

Abstract

This research examines the evolving legal landscape surrounding Decentralized Autonomous Organizations (DAOs), with a specific focus on the governance threat from liability exposure for the Ethereum Name Service (ENS) DAO stemming from its Endowment’s holdings in assets linked to unwrapped Assets and/or unwrapped DAOs. Recent judicial decisions classify such DAOs as general partnerships, potentially exposing token holders—including affiliated entities like the ENS Foundation and the ENS DAO—to joint and several liability. This poses a direct and potentially catastrophic risk to the governance integrity of ENS DAO.

This analysis dissects landmark cases, clarifying the distinction between governance tokens (like Lido’s LDO, which ENS does not hold) and other associated tokens (like Lido’s LSTs, which ENS does hold). It highlights the escalating risk posed by mechanisms granting governance rights to previously non-governing tokens, such as Lido’s impending Dual Governance (DG) for LSTs. This development transforms passive asset holding into potential active governance participation, exponentially increasing liability risk. The situation represents a ticking time bomb, where lawsuits can emerge unexpectedly, and failure to act proactively increases vulnerability. Crucially, even divestment may not negate liability for the period assets were held. The research concludes by proposing a refined mitigation strategy emphasizing immediate risk assessment and divestment where necessary, alongside robust governance protocols, while explaining why ENS DAO’s unique structure makes it an exceptionally attractive target for judgment creditors.

I. Introduction

Decentralized Autonomous Organizations (DAOs) represent a novel organizational structure, yet face significant legal challenges. The ambiguity surrounding liability protection has been partially clarified by recent California court decisions treating DAOs lacking formal legal wrappers as general partnerships, subjecting token holders involved in governance to joint and several liability. This precedent has profound implications, not just for individuals, but critically for the governance stability of DAOs like the Ethereum Name Service (ENS) DAO, especially when their treasuries or endowments hold any assets linked to unwrapped DAOs or protocols governed without a clear legal entity.

This research specifically examines the legal risk profile threatening ENS DAO’s governance through its Endowment’s investments, using Lido Liquid Staking Tokens (LSTs) as a prime example, but recognizing the risk applies more broadly to all assets. This work distinguishes between primary governance tokens (like LDO) and other tokens (like LSTs), but focuses on how holding such assets, especially with looming changes like Lido’s Dual Governance (DG)⁸ activating voting rights for LSTs, creates liability pathways that could jeopardize ENS DAO’s governance. This risk profile constitutes a ticking time bomb; liability can crystallize suddenly through litigation, and inaction now merely compounds the potential future fallout. This research proposes a targeted mitigation strategy centered on proactive risk assessment, divestment, and strengthened governance policies to safeguard the ENS DAO, particularly given its unique attractiveness as a collection target.

II. The Evolution of DAO Legal Structures

A. The Emergence of DAOs as Novel Organizational Forms

Decentralized Autonomous Organizations emerged as a governance mechanism for blockchain protocols, allowing token holders to collectively manage resources and make decisions without traditional corporate structures. Initially, many DAOs operated without formal legal recognition, existing purely as smart contracts on blockchain networks. This approach, while technically innovative, created significant legal uncertainties.

B. Limited Liability Protection Through Legal Wrappers

Some forward-thinking DAOs, including the ENS DAO, established legal entities to provide limited liability protection to their participants. As stated in ENS documentation: "Why have a legal entity? ‘It provides limited liability to DAO participants… Without a legal entity, participants may be individually held liable for anything the DAO as a whole does.’"¹ These legal wrappers typically take the form of foundations, limited liability companies, or other structures that can shield participants from personal liability while enabling the DAO to interact with traditional legal systems, enter into contracts, and hold assets such as intellectual property rights. However, this protection primarily applies to the DAO’s own actions, and not liabilities incurred through holding assets of other, unwrapped entities.

III. Judicial Treatment of DAOs: Emerging Case Law

Recent judicial decisions have begun to crystallize the legal status of unwrapped DAOs, with concerning implications for token holders and affiliated entities holding their tokens.

A. Sarcuni v. bZx DAO, 664 F. Supp. 3d 1100 (N.D. Cal. 2023)

This ruling established that an unwrapped DAO could be deemed a general partnership under California law. Key findings included:

- The DAO constituted an unincorporated association of persons who carried on a business for profit.²

- Governance token holders who voted on DAO proposals were partners in this association.³

- All voting token holders were jointly and severally liable for the actions of the DAO.

The court’s reasoning emphasized participation in governance.³ The court specifically rejected limited liability arguments for token holders without a recognized legal entity, stating participants remain general partners.⁴ This interpretation dramatically expanded potential liability.

B. Samuels v. Lido DAO (Central District of California, 2024)

This class action lawsuit involving the Lido protocol provided further nuances:⁵

- Liability was focused primarily on major token holders and those with demonstrable influence.

- However, the court did not foreclose potential claims against any token holder with voting rights.

- Critically, the court noted that holding assets conferring voting rights in an unwrapped DAO could potentially establish a partnership relationship. While stating "mere token ownership does not necessarily create partner status, but the exercise of governance rights… may establish the requisite intent,"⁶ this focus on voting rights becomes acutely relevant as tokens like LSTs gain such rights.

This ruling is particularly concerning for entities like ENS DAO holding tokens (like LSTs) associated with unwrapped DAOs, especially when those LSTs are poised to gain DAO governance rights.

IV. Liability Risk Analysis Focused on ENS DAO Governance

A. Direct Liability Through Token Ownership and Governance Participation

The precedents suggest participation in an unwrapped DAO’s governance via voting can lead to direct partner liability. While ENS DAO itself is wrapped, its holding of any assets that possess or gain governance rights in an unwrapped DAO creates significant risk. The Lido LST example is illustrative: historically lower risk than holding LDO, the impending activation of voting rights via Lido’s Dual Governance (DG) mechanism⁸ fundamentally changes this. DG gives LST holders governance powers ("dynamic user-extensible timelock on DAO decisions and a rage quit mechanism"⁸), aligning directly with the courts’ focus on governance participation. Once DG is implemented, holding LSTs transitions from passive asset ownership to potentially active governance participation, significantly increasing direct liability risk. This principle applies to any asset held by the ENS Endowment linked to an unwrapped DAO where the asset carries governance potential.

B. Indirect Liability Through Asset Ownership and Affiliation

Holding assets like Lido LSTs (especially post-DG) exposes the ENS Foundation to indirect liability:

- Voting Rights Activation: Exercising (or merely possessing) governance rights via held assets in an unwrapped DAO could deem the ENS Foundation a partner.⁷

- Economic Beneficiary Status: Significant economic benefit might support constructive partnership arguments.

- Cross-Jurisdictional Enforcement: Judgments against an unwrapped DAO (e.g., Lido) could be enforced against the ENS Foundation in its domicile (Cayman Islands) through a domestication of the foreign judgment under common law.

C. Governance Capture Risk: The Existential Threat

The most severe risk is governance capture. If the ENS Foundation is deemed liable for an unwrapped DAO’s actions (due to holding its tokens):

- A judgment is obtained against the unwrapped DAO.

- Plaintiff enforces against ENS Foundation as a “partner.”

- A court allows attachment of ENS Foundation assets, crucially including the >51% of $ENS governance tokens it holds.

- The creditor uses seized $ENS tokens to control ENS DAO governance and future protocol revenues.

With ENS DAO owning assets in protocols exceeding its own assets by many multiples, it is reasonably foreseeable a judgment now or in the future against any one of these protocols could exceed ENS’s total assets. Thus this unmitigated potential liability unnecessarily risks loss of control over ENS DAO governance.

D. The Ticking Time Bomb and Inescapable Past Liability

The current situation represents a ticking time bomb. Lawsuits against unwrapped DAOs can arise at any time, triggered by hacks, regulatory actions, or other unforeseen events. Each day that ENS DAO holds assets linked to unwrapped assets and/or governed by unwrapped DAOs extends its likelihood of exposure. Crucially, under the principle of joint and several liability for partnerships, liability attaches during the period of association. This means that even if ENS DAO divests risky assets like Lido LSTs now, it likely does not erase potential liability for the period it already held them if Lido DAO were later found liable for actions during that time. Liability, once incurred through partnership status, may be inescapable for past actions. This underscores the critical importance of this research and the urgency of mitigating ongoing and future risk accumulation immediately, while understanding that past exposure might persist. Failure to address these risks proactively simply allows the potential liability (and the complexity of defending against it) to grow.

V. Case Study: ENS DAO Liability Risk Profile (Revised Focus)

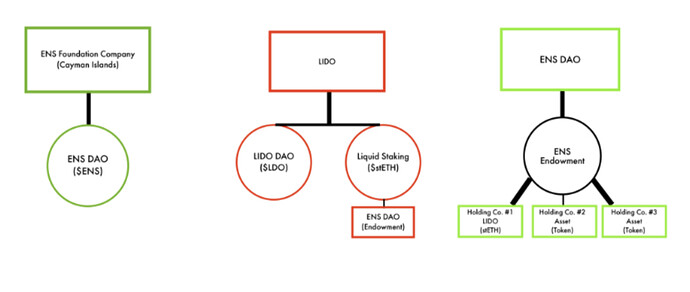

A. ENS DAO Structure and the Liability Bridge

ENS DAO utilizes the ENS Foundation for liability protection. However, the Endowment holds assets, including Lido LSTs and potentially others linked to unwrapped protocols and/or DAOs. Any such holding creates a potential liability bridge exposing ENS assets to the risks of associated unwrapped DAOs.

B. Liability Exposure Pathways via Unwrapped Assets

ENS DAO faces liability through its holdings linked to unwrapped DAOs:

- Direct Partnership via Token Voting: Holding tokens with current or future voting rights (like LSTs post-DG) in an unwrapped DAO is the primary vector for establishing partnership.⁷

- Judgment Enforcement: A judgment against an unwrapped DAO could lead to enforcement against the ENS’s assets via its connection through token holdings.

- ENS Governance Vulnerability: The critical risk is attachment of $ENS in DAO wallets, enabling governance capture.

C. Imminent Risk Escalation: Protocol Governance Changes (e.g., Lido DG)

The risk is actively escalating whenever underlying protocols change governance structures, as exemplified by Lido’s Dual Governance mechanism⁸ granting LSTs voting rights.⁹ This isn’t theoretical; it’s an active development transforming passive assets into potential governance instruments, directly triggering liability concerns highlighted by courts. This underscores the need for continuous monitoring and urgent mitigation before such rights are activated. Moreover, without ongoing monitoring consistent with this research, diversification of the Endowment seeking to minimize traditional risk counterintuitively increases this potential legal risk and threat to ENS DAO governance.

D. Historical Vulnerability Indicators

The DAO’s history of reactive legal cost absorption and suggests a vulnerability to both foreseeable and unforeseen legal risks, reinforcing the need for proactive identification and mitigation of legal risks.

E. Why ENS DAO is an Exceptionally Attractive Target for Judgment Collection

Consider a hypothetical scenario: A plaintiff secures a massive judgment (e.g., $1 billion) against Lido DAO due to a catastrophic failure. The plaintiff, under joint and several liability principles, can seek collection from any deemed “partner,” including potentially the ENS Foundation/DAO (due to its LST holdings). Even if other large LST holders or Lido contributors exist, the plaintiff’s counsel might strategically target ENS for several compelling reasons:

- Concentrated Control Asset: ENS DAO holds a uniquely valuable asset: over 51% of all $ENS tokens. This isn’t just monetary value; it represents controlling interest in the ENS DAO, its governance, its treasury, and crucially, its future revenue streams from domain registrations and renewals.

- Lack of Traditional Shareholder Protections: In traditional corporate law, creditors often face limitations like “charging orders,” which grant rights to distributions (dividends) but typically prevent the creditor from seizing the shares themselves, voting them, or forcing a sale, thus protecting corporate control. $ENS tokens, as governance tokens do not explicitly provide equivalent charging order protections under the law.

- Strategic Value Beyond Monetary Recovery: Seizing control of ENS DAO offers strategic value far exceeding the mere dollar value of the tokens needed to satisfy the judgment. A creditor could influence ENS policy, direct its treasury, or even liquidate protocol assets. This makes ENS DAO not just deep pockets that can satisfy a judgment, but makes ENS DAO an exceptionally attractive and strategic target for collection efforts, potentially prioritized over other liable parties who might only offer monetary compensation.

This hypothetical illustrates that the risk isn’t just about the value of the Lido LSTs held, but the disproportionate and existential threat posed by the potential seizure of ENS DAO’s core governance asset due to liability flowing from those LSTs.

VI. Comprehensive Mitigation Strategy Focused on Asset Risk

A. Immediate Risk Reduction: Assess and Divest Risky Assets

Given the clear, escalating, and potentially inescapable nature of liability from holding assets tied to unwrapped DAOs, immediate action is critical:

- Urgent Portfolio Review & Divestment: Conduct an immediate, thorough review of all Endowment assets. Identify all holdings linked to unwrapped assets and/or governed by unwrapped DAOs or protocols lacking clear legal entities, especially those with current or potential future governance rights. Direct Karpatkey to urgently liquidate high-risk assets, prioritizing those like Lido LSTs facing imminent governance changes (DG), within a defined, short timeframe (e.g., 30 days). This addresses the “ticking time bomb” by halting further accumulation of liability exposure, even if past liability cannot be erased.

B. Asset Segregation and Legal Wrapper Implementation

For any assets carrying residual risk deemed necessary to hold, segregation is key:

- Single Wrapper Approach: Creating a dedicated legal entity (e.g., subsidiary holding company) to hold Endowment assets to help isolate liability and limit liability to said assets protecting ENS DAO’s treasury and $ENS holdings.

- Multiple Wrapper Approach: Establishing distinct entities for each asset owned by the Endowment isolating risk and potential liabilities to a single asset. Based on the size of individual holdings and total Endowment this is a cost effective approach to risk mitigation.

These structures require careful jurisdictional analysis and should aim for robust liability protection.

C. Governance Standards for Risk Management

Formal governance standards are crucial to prevent recurrence:

- Strict Asset Review Protocols: Mandate regular audits specifically identifying exposure to unwrapped assets, protocols and DAOs. Maintain an inventory of the legal status of entities associated with all held assets.

- Revised Investment Policy Guidelines: Amend the investment policy to explicitly prohibit holding assets representing participation in unwrapped DAOs or carrying potential governance liability, unless held within structures offering robust, verified legal protection equivalent to the limited liability protections ENS Foundation offers $ENS holders.

- Proactive Legal & Protocol Risk Monitoring: Dedicate resources to continuously monitor legal developments and underlying protocol governance changes (like DG) that could alter asset liability profiles.

D. Proactive Legal Strategy Development

Develop proactive legal strategies:

- Legal Counsel Retention: Maintain relationships with counsel experienced proactively identifying and mitigating legal risks.

- Scenario Planning: Develop response protocols for risks and potential liabilities.

- Industry Collaboration: Participate and lead in efforts to establish clearer legal frameworks for DAO that protect DAO participants and token holders from risk of liabilities.

VII. Conclusion

The evolving case law classifying unwrapped DAOs as general partnerships poses a significant threat, particularly to the governance stability of DAOs like ENS holding associated assets. This risk extends beyond mere finances to potential governance capture via liability enforcement. The situation is a ticking time bomb, demanding immediate attention.

The risk applies to any ENS asset holding linked to an unwrapped DAO, with Lido LSTs serving as a critical current example due to the impending Dual Governance mechanism⁸ granting them voting rights. This change transforms LSTs from passive holdings into instruments of governance participation, potentially triggering liability under recent court precedents.

Therefore, a mitigation strategy prioritizing immediate, comprehensive review and urgent divestiture of high-risk assets (like Lido LSTs before DG activation) is paramount. This must be coupled with robust long-term solutions: potential asset segregation, strengthened investment policies prohibiting exposure to unwrapped entities without adequate protection, and continuous legal and protocol monitoring. Understanding ENS DAO’s unique vulnerability—where its core control tokens ($ENS) lack traditional protections and represent immense strategic value—makes proactive defense against this liability pathway an existential necessity. By taking decisive action now, ENS DAO can best shield its governance structure and uphold its fiduciary duties in a legally uncertain environment.

Footnotes

¹ ENS Documentation.

² Sarcuni v. bZx DAO, 664 F. Supp. 3d 1100 (N.D. Cal. 2023) (Order on Motion to Dismiss).

³ Id.

⁴ Id.

⁵ Samuels v. Lido DAO, No. 2:24-cv-08763-JVS-PVC (C.D. Cal. 2024) (Order on Motion to Dismiss).

⁶ Id.

⁷ Id.

⁸ Lido DAO Forum, "Dual Governance - Design and Implementation Proposal.” Dual Governance: design and implementation proposal - Proposals - Lido Governance (“The Dual Governance mechanism (DG) is an iteration on the protocol governance that gives stakers 1) a dynamic user-extensible timelock on DAO decisions and 2) a rage quit mechanism taking into account the specifics of how Ethereum withdrawals work.”)