Introduction

We are submitting this proposal for you to consider our team for your endowment needs. Fyde provides a decentralised treasury management solution that solves the four pillars of cryptocurrency treasury management: diversification, asset liquidity, yield generation, and governance preservation. Fyde Treasury Protocol introduces an on-chain exchange pool, into which clients deposit their crypto to gain exposure to a basket of tokens from other depositors whilst maintaining their own native governance rights. We are working with several DAO’s, protocols and institutional investors already such as Merit Circle, Mantra DAO, Soma Finance and Stakeborg DAO. We hope to establish a partnership with ENS to be a cornerstone client in our protocol.

Recommendation for ENS

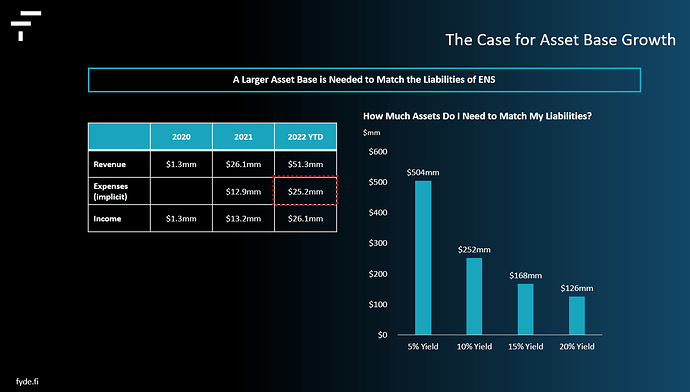

ENS has a favorable market position by generating income of $24mn to date with a significant treasury. Despite that, ENS has a current annual expense rate of $8mm (based on the latest budget proposal) and a starting asset base (just looking at the endowment) of $40mm in ETH. To cover (or to immunize) this liability, ENS would need to generate a 20% yield on the endowment assets, which we do not believe matches the risk appetite an endowment should have. Therefore, we believe that the baseline priority ENS should have with its current endowment is to grow the endowment assets in a volatility adjusted manner. In addition, we believe that ENS should consider putting ENS to work where possible given that it comprises the vast majority of ENS’s treasury. While the Fyde Treasury Protocol is only beginning to establish itself, when we are at scale, assuming the current annual expense rate ENS can deposit 25% of their overall treasury (ENS tokens) and receive enough yield to cover the annual expenses of ENS. This would create immunization of the portfolio that achieves matching of assets and liabilities, whilst achieving a well diversified portfolio and on-chain liquidity. Matching assets and liabilities of a portfolio is the goal for any endowment as it assures sustainability of the assets into perpetuity. That said, we do not believe that ENS should rely solely on Fyde. As with any endowment strategy, multiple managers are recommended to remove any idiosyncratic risk associated with choosing a single manager - this is the equivalent of not having all of one’s eggs in the same basket. As such we recommend an allocation of $10mn of $ENS (subject to risk parameters based on Fyde TVL) and $10mn in ETH toward the Fyde Treasury Protocol, with the remainder of the endowment split amongst multiple other managers

Summary

-

Diversification through the Fyde on-chain exchange pool allows crypto treasuries to access a product which reduces the idiosyncratic risk that their treasuries currently face, whilst preserving governance rights for the depositors. The pool itself will follow a beta targeting approach, thereby allowing for downside risk protection with risk adjusted upside. Depositors can deposit native governance tokens, thereby reducing a major barrier-to-use that exists with many other diversification vehicles (as many others only accept stablecoin or ETH).

-

Institutional-grade trad-fi founding team, with significant experience in portfolio management, investment banking, venture capital, digital asset management and web3 development. Team consists of investment bankers, portfolio managers, and researchers from JP Morgan Chief Investment Office, JP Morgan Equities, Deutsche Bank, and PwC. Development expertise from Stanford COFFIES DRIVE Center, NASA, Synthetix, Wintermute, Monolith, and Token Spice. Individual members of the team have won several global crypto hackathons as well.

-

Fyde Treasury Protocol will introduce two tokens: $TRSY which represents a share of the protocol and $MGMT which is the governance token of Fyde itself. Fyde has the goal of becoming a DAO itself upon launch of the $MGMT token and currently has jurisdiction in BVI with plans to establish a foundation in the Cayman Islands in the next year.

Proposal

- Allocation into Protocol

This proposal attempts to address a critical issue – sustainability of blockchain treasuries – by focusing on providing infrastructure for DAOs and protocols and allowing them to access a system that solves the key issues.

In terms of overall allocation, we will emulate the endowment and foundation model of having the majority of treasury assets in risk assets, whilst still being able to generate yield to cover a treasury’s expenses and liabilities (asset liability management model). With respect to the risk assets, we will have two broad targets and mandates to follow: beta and diversification.

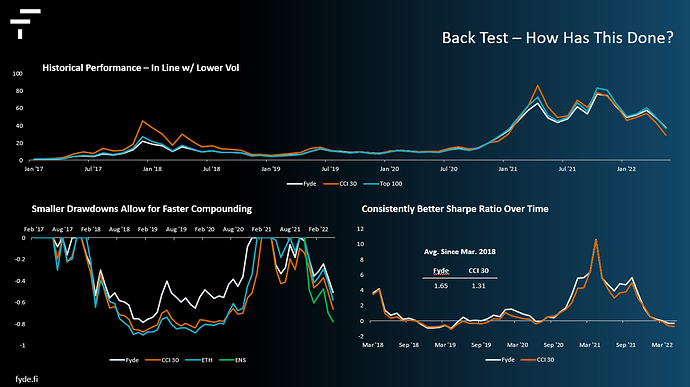

Beta can be defined as a function of both correlation and volatility, and remains generally used by risk modeling tools as a way to quantify performance relative to a benchmark. We will aim to keep the pool to 0.5-0.7 beta relative to the broad crypto space (i.e. CCi 30 Index). Through empirical back testing and analysis, we have found that a 25% allocation to stablecoin, 10% allocation to wBTC, 5% allocation to ETH, and the rest allocated to a “market” portfolio can result in a 0.6-0.65 beta to the broad crypto market consistently over time when rebalanced monthly.This means that if the market was down 90%, our pool would only be down ~50-60%. This is the difference between a billion dollar treasury going down to $100mm, vs a billion dollar treasury going down to $400-$500mm. This will be a much better approach for crypto treasuries than, for example, a market neutral yield strategy in that it allows for treasuries to capture market appreciation. This is also why traditional endowments and foundations (Harvard, Yale, Canadian Pension Fund as the often used examples) use this type of approach.

On the diversification front, we will aim to achieve diversification amongst hundreds of tokens across the crypto space. The benefits of diversification are multitudinous, and whilst many believe that crypto is a highly correlated asset class, our in-house research has demonstrated that to not be the case. In fact, in a normal market environment, cryptos exhibit similar cross correlations as equities. Similar to how a diversified equity portfolio provides numerous benefits over a single stock position, the same remains true for a diversified crypto portfolio. For example, the Metaverse tokens outperformed DeFi by 32x in the last bull run from trough to peak, and still outperforms DeFi despite the collapse. If your portfolio was solely concentrated in DeFi as many were, there would be a failure to capture the outsized returns that the Metaverse sector would have provided.

In addition to receiving a diversified return stream, a diversified portfolio also removes idiosyncratic risk. Assume the probability of a token going to $0 is 50%. The probability of two tokens going to $0 falls to 25%, and the probability of three tokens going to $0 falls further to 12.5%, etc. Therefore from this perspective having a diversified portfolio remains the best way to ensure that your assets do not lose all of their value.

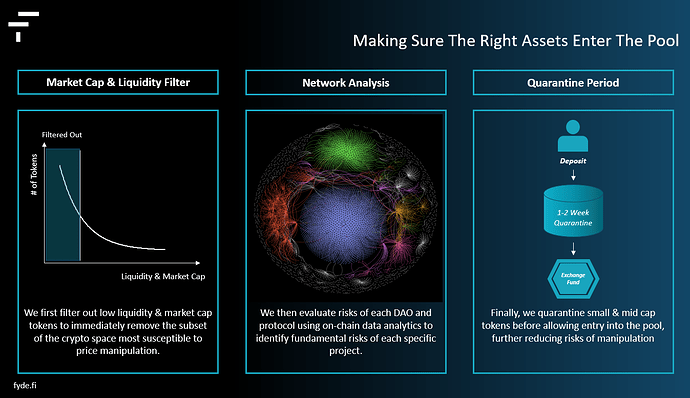

In order to achieve diversification, we will both have a very strict filtering process for tokens that wish to enter the pool (using liquidity, market cap, and network analysis), as well as specific concentration limits to ensure that no tokens comprise too much of the pool. All of these risk management measures will be executed via an algorithm and on-chain.

- Size of Ecosystem Protocol

We are currently preparing for the launch stage with an aim to be live on mainnet by the end of 2022. Currently targeting to launch the ecosystem wide fund with TVL of $100mn. Currently there are over 50 clients signed up to seed the pool from day one with notable names including Merit Circle, Mantra DAO, Stakebord DAO and Nym Tech. These early depositors will include their own native token (if available), partnership tokens, layer 1 assets and stablecoins.

The goal behind the project is to curate a highly selective list of top projects in the web3 space, from large and established tokens to small up and coming projects (see product documentation for selection criteria). By combining these different sources we can create a highly diversified and risk-adjusted pool of assets that will generate reliable and sustainable returns to the depositors. There will be token concentration limits put in place to limit any single asset exposure. As such, for the initial launch of the Fyde Treasury Protocol, we suggest no more than we are asking for $10mm in ETH, which is 25%? Also, does this matter since it’s ETH? of the ENS Endaoment to be deposited. As the protocol’s TVL grows in size, the DAO can select to increase their allocation as needed for their liquidity and diversification needs.

We are tentatively scheduled to receive code audits from Halborn and Arcadia. The assets in the Fyde Treasury Protocol will be held in a noncustodial multisig wallet. The protocol will be fully backed 1-to-1 with the assets in the underlying pool and can be redeemed back by the ENS team as they see fit. ENS can also exit its position by selling the Fyde Treasury ($TRSY) token in the open market.

- Assignment of Returns and Yield to ENS

The Fyde Treasury Protocol will be fully built on-chain. After deposit of ENS assets into the pool, the DAO will receive back the Fyde Treasury Token ($TRSY). That token will reflect the returns of the underlying pool. Using similar mechanisms as ETF’s in trad-fi, the net asset value (NAV) and token price will be kept pegged through a redemption mechanism.

The underlying assets will also be used to generate yield (roughly 2-4% per annum). Initially through stable coin and liquid staking through creation of smart contracts created by the Fyde team. Those returns will be returned and reflected through the price accrual of the $TRSY. Through the creation of an asset pool containing a variety of assets, a risk managed approach for yield farming and cash flow generating opportunities arises. The sources of these fixed income opportunities will be done in combination with internal processes and external partners to capture a wide array of opportunities while being mindful of proper risk-adjusted returns. The protocol will refrain from using leverage to protect against any margin calls that place the clients’ assets at risk.

Every quarter, the protocol will announce the expected cash flow available to be redistributed back to the pool’s investment partners. Having this upfront visibility will enable DAO’s and blockchain companies to better assess their available budget. Properly managing growth opportunities enables communities to grow sustainably into perpetuity. This method has precedence in trad-fi since wealth management firms announce expected rates of return for the future so their investors can create an appropriate approach in the financial planning and budgeting process.

- Fee Schedule & Ecosystem Incentives

There are two fees we are implementing for depositors. There is a two tiered annual management fee based on TVL which will be 1% for deposits without governance and 2% for deposits of tokens that retain governance rights. Secondly, we are implementing a yield watermark. On a quarterly basis we will share an expected amount of yield expected to be generated from staking. If we announce 3% yield generation for a 1Q 2023, but we manage to generate 3.2% yield, the protocol will keep the 0.2% difference to fund the protocol’s own runway and development.

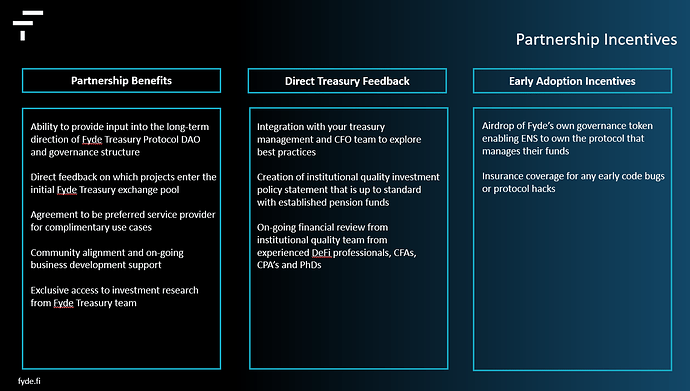

We expect to launch our own governance token $MGMT toward 2Q 2023, and early depositors will receive an airdrop of this token to align ownership of the protocol amongst all clients. Amout of airdrop will be a function of both contributed TVL and time in the protocol.

- Reporting Structures

Our user interface will include detailed analysis of both the assets in the Fyde Protocol and also allow depositors to analyze their own holdings. By being an on-chain treasury manager we can create as detailed of an analysis as needed to the benefit of the client. We would be open to working closely with the ENS team to create a dashboard that fully reflects the reporting needs of the DAO. This dashboard will be live and automated allowing ENS to track all specific financial, cash flow and working capital reporting requirements. We believe this will ease financial reporting and budgeting procedures that are required by ENS. For example, the dashboard may be toggled to indicate the yield that would be expected versus cash flow burn that is expected. We are in the process of iterating governance management with Snapshot and are open to partnerships for reporting based systems as required.

The Fyde Treasury Protocol will produce quarterly treasury reports detailing the sources of returns and allocation of the assets. We aim to have best in class standards with audited and verified financial statements and adoption of best in class reporting standards, typical in trad-fi but not usually found in crypto space. As we expect ENS to be one of our larger clients, we are more than happy to meet with the team regularly to keep up-to-date on the DAO’s needs and financial objectives. For Merit Circle, we are creating a treasury case study to have an in-depth view of short, medium and long term objectives of the DAO so that the protocol can continue to meet the needed goals for the client. We are able to do this same research for ENS.

To keep up to date with general macroeconomic conditions in the crypto space and beyond, we have processes in place to generate a robust and best in class data architecture. This data will power the algorithms of the portfolio and enable items such as MEV strategies that will protect the pool from outside actors.

Video Presentation

ENS Client Presentation

Fyde <> ENS Twitter Post