The November 2024 Endowment Report is now available on karpatkey’s website.

The December 2024 Endowment Report is now available on karpatkey’s website.

The January 2025 Endowment Report is now available on karpatkey’s website.

The February 2025 Endowment Report is now available on karpatkey’s website.

karpatkey is pleased to present its first monthly Community Update to the broader ENS Community to increase awareness and transparency of its activities.

Market Update

- February saw heightened volatility across macro and crypto, with persistent trade war concerns and the Fed signalling higher rates amidst inflation concerns.

- The total implied network value (market cap) of the digital asset market stood at $2.92tn at the end of February, down 21% from January (from $3.71tn).

- Over the month of February, BTC is down 17.5%, and ETH is down 32.2%.

- Bitcoin dominance is 59.0%, up 4.1% from January.

- Major market news:

- Bybit hack: Hackers stole over 500,000 ETH, stETH, and mETH ($1.4bn at the time of hack) from Bybit by gaining access to a Safe developer’s computer to control the Safe UI. The broader Bybit hack has shone a light on critical vulnerabilities that can arise from blind signing practices and front-end security.

- FTX began redistributing funds to creditors on February 18; the initial round of distributions included $1.2bn for small claims creditor group (<$50k), recovery ratio is estimated to be ~120% of the account value. Next claims distribution is scheduled for May 30.

- Unichain went live on mainnet on February 11, less than 2 weeks after the launch of Uniswap V4 on January 31. Taken together, the two developments signal a rapid acceleration in new innovation from Uniswap, as Unichain becomes one of the first to host primarily V4-style liquidity.

- Lido announced v3 on February 11, introducing stVaults, which allows stakers to have complete control over the validator set, MEV management, and liquidity access. This can be seen as Lido vying for institutional adoption, especially as a potential provider for staking ETH ETF.

ENS Token Update

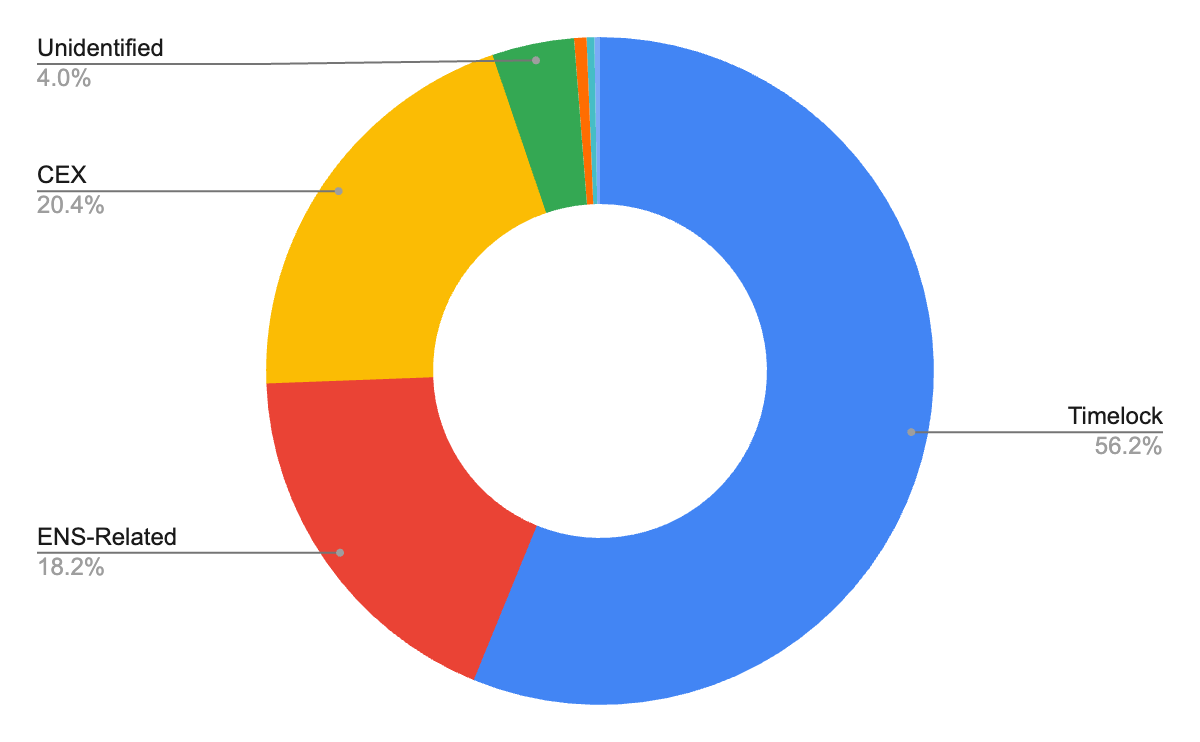

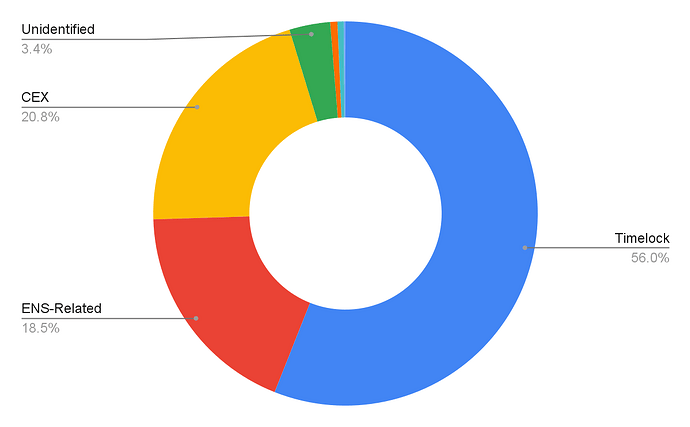

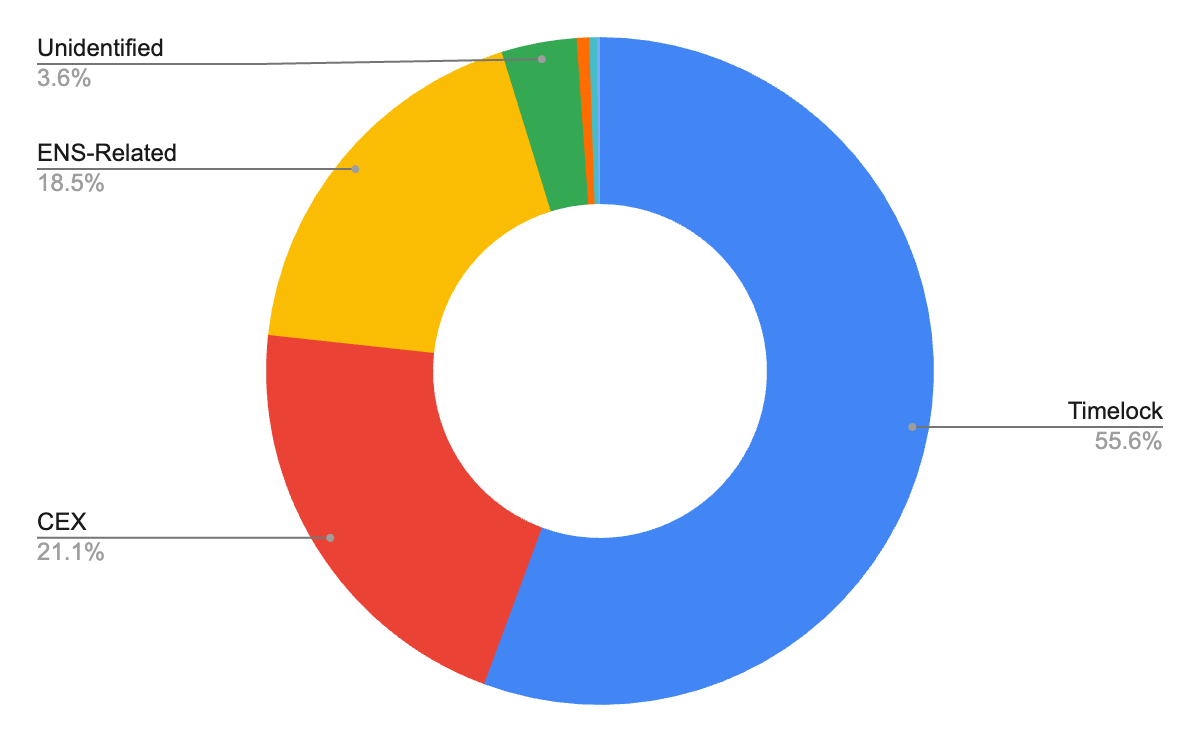

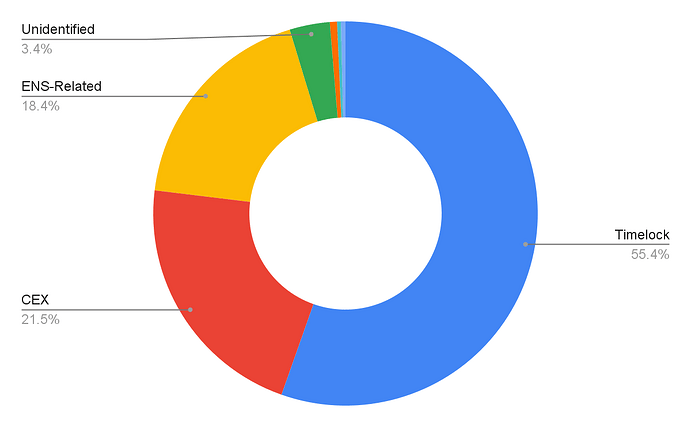

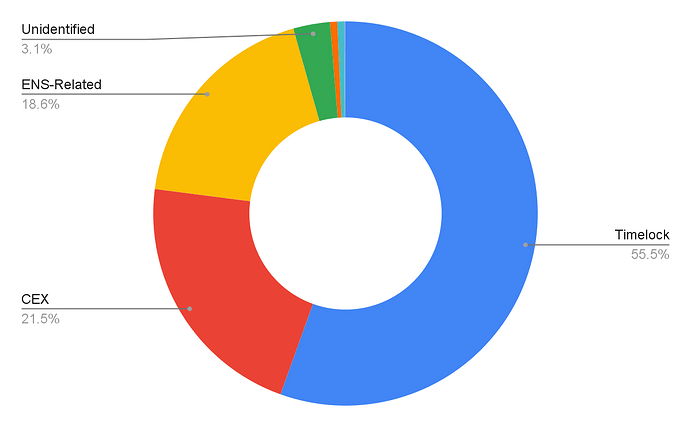

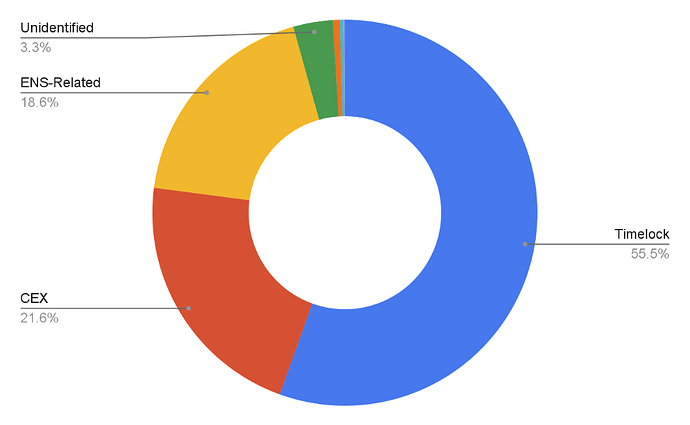

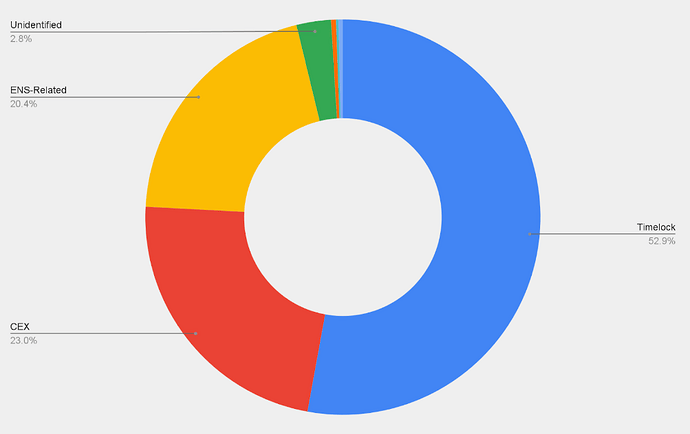

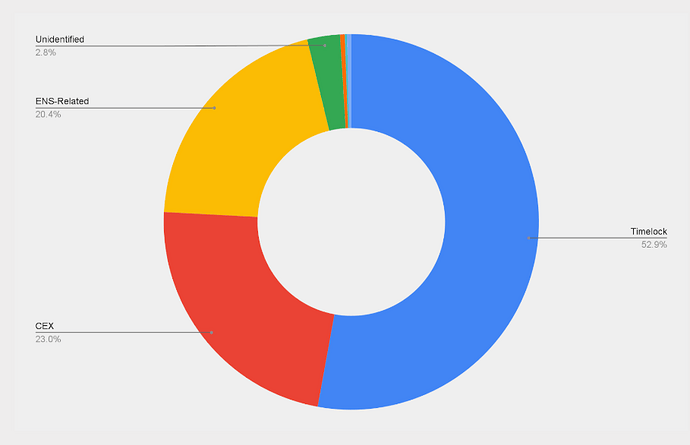

- Token holder distribution for Top 50 ENS token holders remain concentrated in the hands of Centralised Exchanges (“CEXs”) and ENS-Related wallets (DAO, ENS Labs, etc.)

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

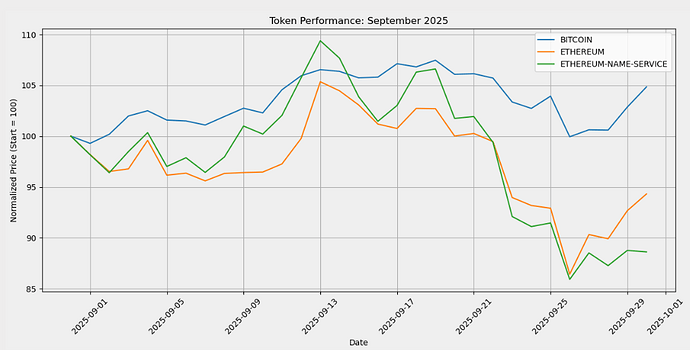

- ENS token price dropped 36.7%, in line with ETH price

- Despite the volatility, trading volume of ENS token also dropped across the venues. Binance’s ENS/USDT daily spot trading volume dropped from ~620k ENS/day to ~509k ENS/day, whilst Upbit’s ENS/KRW dropped from ~1.6M ENS/day to ~1.0 ENS/day; Uniswap v3 ENS/WETH 0.3% trading volume went up from ~38k ENS/day to ~52k ENS/day.

DAO Financial Update

Endowment Update

Please refer to the February karpatkey monthly report for further details.

- Asset Allocation

- AUM of $86M, with capital utilisation ratio of 99.9%

- Endowment Allocation: 72% ETH ($62M), 28% Stablecoins ($24M)

- Yield Generation (“DeFi Results”): $260k gross yield

- Marked-to-market (“MTM”): ENS Endowment’s suffered from $24.2M drawdown in MTM, due to decrease in ETH token price from $3,290 to $2,333.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) is to Sky/Maker as DAI/USDS continued to offer higher yield vs. USDC in other lending markets. However, Sky/Maker reduced Dai Savings Rate from 11.25% at the start of February to 4.75% at the end of February, resulting in narrowing of the interest rate differential across the lending markets.

- Across the Endowment’s various positions, exposure to each protocol does not exceed 30% of the total Endowment.

For details on the financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the February Steakhouse monthly report.

Other Updates

- Permissions Update #6 for the Endowment has been posted and will be put to vote shortly this month.

- TWAP to procure USDC for the DAO is successfully undergoing execution, and has executed 1,166.67 ETH at an average price of $2,642 for the month of February.

The February 2025 Endowment Report is now available on karpatkey’s website.

kpk is pleased to present its Community Update for the month of March to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

- March continued to see heightened volatility across macro and crypto, with crypto being whiplashed by macro headlines surrounding trade war / tariffs. Reintroduction of sweeping tariffs has disrupted markets and increased concerns about inflation and recession. The Fed held interest rates unchanged at 4.25%-4.50% and in line its 2025 interest rate projections.

- The total implied network value (market cap) of the digital asset market stood at $2.76tn at the end of March, down 5.3% from February ($2.92tn).

- Over the month of March, BTC showed relative strength, as market prices dipped ‘only’ 2.3% (vs. -6% for S&P 500 Index), while ETH suffered net decreases amounting to 18.4% on the month.

- Bitcoin’s dominance continued to inch upwards, reaching 62.8%, up 3.8% from the end of February.

- Major market news:

- The White House confirmed the issuance of an executive order establishing the long-awaited Strategic Bitcoin Reserve and Digital Asset Stockpile. The stockpile will use tokens (estimated 200k BTC) already owned by the US government. The executive order disappointed some in the market, who had hoped for purchase of new tokens.

- Gamestop announced updates to its Investment Policy, approving Bitcoin as a treasury asset, and completing a $1.5b debt offering, with the proceeds earmarked for strategic purchases of BTC and dollar-denominated stablecoins.

ENS Token Update

- Token holder distribution across the Top 50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (“CEXs”) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price dropped 26.5% in March, outpacing the drawdown in ETH, and therefore resulting in a decline in the ENS/ETH ratio.

- Trading volume continued to drop on CEXs. Binance’s ENS/USDT daily spot trading volume fell 23% from 509k ENS/day to 390k ENS/day, whilst Upbit’s ENS/KRW daily spot trading volume dropped 29% from 1.0 ENS/day to 733k ENS/day.

- Meanwhile, decentralised exchanges (“DEXs”) bucked the trend, as the Uniswap V3 ENS/WETH (0.3%) pool saw trading volume increase an inch (4%) from 52k ENS/day to 54k ENS/day.

DAO Financial Update

Endowment Update

Please refer to the March kpk monthly report for further details.

- Asset Allocation

- Assets under management (“AUM”) of $74.8M, with capital utilisation ratio of 99.9%.

- Endowment Allocation split into 68% ETH ($51M) and 32% Stablecoins ($24M).

- Yield Generation (“DeFi Results”): $232k gross yield generated in March.

- Marked-to-market (“MTM”) valuation: ENS Endowment’s suffered from an $11.2M drawdown in its MTM valuation. This was primarily due to the decrease in ETH token price from $2,333 to $1,826 throughout March.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) is to Sky/Maker, as DAI/USDS continued to offer higher yield when compared to. USDC in other lending markets. However, Sky/Maker continued to reduce its Dai Savings Rate in March, bringing the rate down from 4.75% at the start of March to 3.5% at the end of March. This resulted in a narrowing of the interest-rate differential across various lending markets, reducing the attraction to DAI/USDS over other assets.

- On-chain yields have been trending lower than off-chain yields throughout March, as US Fed Funds Rate stands at 4.25-4.50%. This is a sign of firmly bearish sentiments across the on-chain economy.

- The Endowment’s introduction of RWA through its upcoming Permissions Update #6 will allow kpk to deploy its assets into RWAs with flexibility, and to take advantage of the difference between on-chain and off-chain yields.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

- Endowment’s biggest position (protocol exposure) is to Sky/Maker, as DAI/USDS continued to offer higher yield when compared to. USDC in other lending markets. However, Sky/Maker continued to reduce its Dai Savings Rate in March, bringing the rate down from 4.75% at the start of March to 3.5% at the end of March. This resulted in a narrowing of the interest-rate differential across various lending markets, reducing the attraction to DAI/USDS over other assets.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the March Steakhouse monthly report.

Other Updates

-

Permissions Update #6 for the Endowment has been posted, and will be put to vote in the upcoming voting cycle.

-

TWAP to procure USDC for the ENS DAO is undergoing execution, but has been disrupted due to volatilities in the price of ETH. The execution limit price was initially set at $2,062, but the ETH price has subsequently broken firmly below the psychological $2,000 level. In total, 3,000 ETH has been sold at an average price of $2,556. For the month of March, 833.33 ETH was sold at an average price of $2,156.

The April 2025 Endowment Report is now available on karpatkey’s website.

kpk is pleased to present its Community Update for the month of April to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

- Financial markets were volatile in April, driven by US trade policy and President Trump’s announcement of tariffs that were broader and more punitive than expected. Following an initial, sharp sell-off across risk assets and extreme market volatility (VIX spiked to 60, the highest level since the pandemic), the market recovered through the month. Gold (reached all-time-high of $3,500/oz) and bitcoin shone through the turmoil as the market bidded assets that typically outperform in heightened geopolitical tensions and flush liquidity conditions.

- The total implied network value (market cap) of the digital asset market stood at $3.06tn at the end of April, up 10.6% from March ($2.76tn).

- Over the month of April, BTC showed relative strength, as price gained 14.2% (vs. -0.7% for S&P 500 Index), while ETH ended the month down 1.7%.

- Bitcoin’s dominance retraced slightly, from 62.8% in March to 61.7%.

- Major market news:

- Repeal of the Biden-era crypto tax rule: Trump signed into law a bill to overturn a revised rule from the Internal Revenue Service that expanded the definition of a broker to include decentralised exchanges (DEXs)

- Launch of 21 Capital, backed by Tether and SoftBank, signalled further institutional interest for Microstrategy- type vehicles for Bitcoin exposures. Twenty One expects to launch with more than 42,000 Bitcoin (~$4.2bn), which would make it the third-largest Bitcoin treasury in the world.

ENS Token Update

- Token holder distribution across the Top 50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (“CEXs”) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price increased 17.1% in April, outperforming both BTC and ETH.

- Trading volume showed a mix bag as Binance’s ENS/USDT daily spot trading volume rose 9% from 390k ENS/day to 425k ENS/day, whilst Upbit’s ENS/KRW daily spot trading volume dropped 12% from 733k ENS/day to 647k ENS/day.

- Meanwhile, Uniswap V3 ENS/WETH (0.3%) pool’s trading volume saw an uptick (+6%) from 54k ENS/day to 58k ENS/day.

DAO Financial Update

Endowment Update

Please refer to the April kpk monthly report for further details.

- Asset Allocation

- Assets under management (“AUM”) of $74.1M, with capital utilisation ratio of 99.9%.

- Endowment Allocation split into 67% ETH ($50M) and 33% Stablecoins ($24M).

- Yield Generation (“DeFi Results”): $192k gross yield generated in April.

- Marked-to-market (“MTM”) valuation: ENS Endowment’s AUM was largely flat, with small drawdown of $805k in its MTM valuation.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) is to Sky/Maker, as DAI/USDS continued to offer higher yield when compared to USDC in other lending markets. However, Sky/Maker continued to reduce its Dai Savings Rate in April, bringing the rate down from 3.5% (at the start of April) to 3% (at the end of April), whilst keeping its Sky Savings Rate steady at 4.5%. This resulted in a narrowing of the interest-rate differential across various lending markets, reducing the attraction to DAI/USDS over other assets.

- On-chain yields have been trending lower than off-chain yields throughout April, as US Fed Funds Rate stands at 4.25-4.50%, signalling bearish sentiments in the crypto space.

- The Endowment will migrate its DAI positions to USDS positions with the passing of Permissions Update #6, which should give a boost to the Endowment returns.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

- Endowment’s biggest position (protocol exposure) is to Sky/Maker, as DAI/USDS continued to offer higher yield when compared to USDC in other lending markets. However, Sky/Maker continued to reduce its Dai Savings Rate in April, bringing the rate down from 3.5% (at the start of April) to 3% (at the end of April), whilst keeping its Sky Savings Rate steady at 4.5%. This resulted in a narrowing of the interest-rate differential across various lending markets, reducing the attraction to DAI/USDS over other assets.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the April Steakhouse monthly report.

Other Updates

- Permissions Update #6 for the Endowment has been passed

- TWAP to procure USDC for the ENS DAO has been halted due to ETH trading firmly below $2,062, which was the limit price of the TWAP execution. Once the TWAP expires on May 9, 2025, the TWAP will be re-initiated.

- Changes to the Financial Reporting: we have incorporated community feedback with regards to presenting financial statements both with and without $ENS tokens.

- Public Endowment Dashboard: to increase transparency to Endowment activities and performance, we have created a Public Endowment LookerStudio Dashboard; it is still a work in progress, but offers more granular information with regards to the Endowment.

The May 2025 Endowment Report is now available on karpatkey’s website.

kpk is pleased to present its Community Update for the month of May to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

- The market continued its positive momentum in May as concerns over aggressive tariff threats and trade wars were alleviated, and institutional inflows continued.

- BTC (+12%) reached a new all-time high of $112k mid-month, whilst ETH (+47%) strongly outperformed, firmly reclaiming the psychologically-significant $2k level.

- ETHBTC bounced from local lows of 0.018 and ended the month at 0.02416. May was also marked by a bifurcation of performance across the crypto space; despite strong ETH outperformance relative to BTC, most other altcoins (except for memecoins and HYPE) struggled to outperform Bitcoin (XRP -3%, BNB +10%, SOL +7%).

- The end result was an increase in Bitcoin dominance by 1.82 percentage points (from 61.68% at the start of May to 63.50% at the end of May).

- The total implied network value (market cap) of the digital asset market stood at $3.37tn at the end of May, up 10.4% from April ($3.06tn).

- Despite the general market rally, funding rates (both on-chain and off-chain) and open interest still remained subdued, potentially reflecting higher levels of sidelined capital and/or retail and long-term holders selling. This indicates that such short-term rallies are not yet indicative of a longer-term bullish trend, indicating that caution in approach may still be prudent.

A few interesting developments in the crypto space in May were

- Increasing numbers of entities are copying the Microstrategy playbook (i.e. using financial engineering to purchase Bitcoin or other cryptocurrencies to become crypto treasury companies).

- Strategy (formerly Microstrategy) further entered into sales agreement to issue and sell up to $2.1bn worth of its Preferred Stock.

- Metaplanet (a publicly-listed company on the Tokyo Stock Exchange) announced it will adopt Bitcoin as a strategic treasury reserve asset, citing Japan’s poor macroeconomic environment and a weak JPY as motivating factors. It will be leveraging cheap JPY borrowing costs to issue long-dated JPY liabilities to buy Bitcoin (JPY/Bitcoin carry trade).

- SharpLink (SBET) announced a $425M private placement to initiate a first-of-its-kind Ethereum treasury strategy. SBET rallied from $33.93 to a high of $124, but has since mostly retraced its gains.

- Trump Media (DJT) announced that it will raise about $2.5bn ($1.5bn via shares, $1bn via convertible notes) to invest in Bitcoin as it looks to diversify its revenue.

- Circle filed for public listing on the NYSE under the ticker symbol “CRCL”, with target valuation of up to $6.71bn.

- CRCL opened at $69 on June 5th 2025, and finished its first week of trading at $117.2, making its market capitalisation over $26B. Comparing to on-chain tokens, this valuation would make CRCL a top 10 token by market cap.

Off-chain markets have proven to be exciting. Following the successful initial public offering (IPO) of Circle, we expect more crypto companies to target IPOs in the near future, as investor appetite for crypto stocks increases. Crypto treasury companies have also been getting rewarded for buying Bitcoin, and have outperformed Bitcoin in the last 1 year, leading to a virtuous cycle for the growing number of crypto treasury companies.

However, if this trend reverses and the market stops allocating surplus value to corporations following a strategy of buying crypto (as it did for DJT and Gamestop), corporate demand for Bitcoin may start to dry up. In such circumstances, the premium to net asset value (NAV) of these crypto treasury companies would likely compress eventually, like it did for Grayscale’s premium last cycle. We continue to observe these structural drivers as we formulate our market view, and apply caution in the face of short-term market rallies given the backdrop of a lack of participation and compressing premiums.

ENS Token Update

- Token holder distribution across the Top 50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (“CEXs”) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price increased 12.4% in May, narrowly outperforming BTC (but not ETH). Trading volume for ENS picked up strongly.

- On the CEX side, Binance’s ENS/USDT daily spot trading volume rose 16% from 425k ENS/day to 495k ENS/day, and Upbit’s ENS/KRW daily spot trading volume rose 27% from 647k ENS/day to 779k ENS/day.

- On the DEX side, Uniswap V3 ENS/WETH (0.3%) pool’s trading volume saw a good increase of 27% from 58k ENS/day to 74k ENS/day.

DAO Financial Update

Endowment Update

Please refer to the May kpk monthly report for further details.

- Asset Allocation

- Assets under management (“AUM”) of $94.9M, with capital utilisation ratio of 100.0%.

- Endowment Allocation split into 74% ETH ($71M) and 26% Stablecoins ($24M).

- Yield Generation (“DeFi Results”): $241k gross yield generated in May.

- Marked-to-market (“MTM”) valuation: ENS Endowment’s AUM enjoyed a sharp increase from last month, due to $20.5M increase in its MTM valuation.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) has been migrated from DAI (in Dai Savings Module) to USDS (Sky Savings Module) after successful passing of Permissions Update #6. Sky Savings Rate currently stands at 4.5%, offering still- higher yields compared to Aave and Compound USDC lending markets, but lower than other lending markets, such as Morpho, Euler, and Fluid.

- LP positions on Curve and Balancer (as well as Convex and Aura) have been yielding below ETH staking rates due to reduced emissions of incentives (in $ terms). As such, those LP positions have been disassembled and the Endowment is holding LST positions instead, reducing a layer of risk.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the May Steakhouse monthly report, which now presents financial statements both with- and without $ENS tokens.

Other Updates

- TWAP to procure USDC for the ENS DAO Wallet has concluded successfully. Between Feb 7, 2025, and June 4, 2025, 6,000 ETH was swapped for 15.32M USDC (an average price of $2,553). During this period, the average price of ETH was $2,160, effectively saving the DAO $2.36M through prudent execution.

- The initial TWAP expired on May 9, 2025. As ETH traded below the TWAP limit price of $2,062 from March to May, the TWAP execution was incomplete. When the price of ETH fell, the community endorsed the plan to wait for the price to rebound, instead of setting a new TWAP with a lower limit price. On May 16, 2025, the second TWAP was set and has been successfully completed. Details of the trades can be seen on Cow Explorer, and are detailed below:

- Initial block swap: 1,000 ETH swapped for $2.79M USDC (at average ETH Price of $2,788)

- First TWAP (Order Details: 5,000 ETH swap over 90 days; limit price of $2,062): 2,111 ETH swapped for $5.11M USDC (at average ETH price of $2,423)

- Second TWAP (Order Details: 2,889 ETH swap over 20 days; limit price of $2,062): 2,889 ETH swapped for $7.42M USDC (at average ETH price of $2,568)

- The initial TWAP expired on May 9, 2025. As ETH traded below the TWAP limit price of $2,062 from March to May, the TWAP execution was incomplete. When the price of ETH fell, the community endorsed the plan to wait for the price to rebound, instead of setting a new TWAP with a lower limit price. On May 16, 2025, the second TWAP was set and has been successfully completed. Details of the trades can be seen on Cow Explorer, and are detailed below:

The June 2025 Endowment Report is now available on karpatkey’s website.

There is no extended update this month (replaced by the H1 2025 Review).

The July 2025 Endowment Report is now available on kpk’s website.

kpk is pleased to present its Community Update for the month of July to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

- The crypto market extended its rally in July, marking the fourth consecutive month of positive returns.

- BTC gained+9%, reaching a new all-time high above $123K before settling in the $118–$120K range by month-end. ETH significantly outperformed, surging +52%; it briefly exceeded $4,000 before closing in the $3,780–$3,800 range. Institutional inflows reached $11.2B, with Ethereum-based products attracting nearly $5B and Bitcoin products around $5.5B.

- Bitcoin dominance declined slightly (62.34% to 60.87%) as ETH outperformed other majors; some altcoins did incredibly well (ZORA +702%, SPK +290%, ENA +138%, PENGU +127%). Ethena stood out as the rally was accompanied by an increase in USDe supply ($5.3B to $8.6B) and news of Digital Asset Treasury company for ENA. Other top-20 altcoins also ended the month positive, but underperformed ETH (XRP +45%, SOL +35%, BNB +17%, HYPE +3%).

- The total digital asset market capitalisation reached $3.85T at the end of July, up 12.2% from $3.43T in June.

- Crypto funding rates fluctuated significantly during July without reaching extreme levels:

- Off-chain Funding Rates: BTC and ETH funding rates stayed between 3% and 11% on Binance despite the positive price action. Open Interest for Binance BTC and ETH perps saw an increase (BTC Perps: 110K to 130K, ETH Perps: 2.35M to 2.56M)

- On-chain Funding Rates: On Hyperliquid, the rate fluctuations were much more pronounced; ETH funding moved between 6% and 64%, while BTC funding was between 6% and 47%. Open interest for ETH rose sharply from $1.35B to $4B, driven partly by price appreciation but still materially higher. BTC open interest increased from $3B to $4.5B.

Several notable developments in the crypto space in July were:

- Digital Asset Treasuries continued gaining traction and drove demand for ETH.

- BitMine Immersion Tech (BMNR), targeting to hold 5% of total ETH supply, purchased 300K ETH in July, bringing its treasury to 566K ETH.

- Sharplink (SBET) expanded its ETH treasury from 198K to 361K ETH.

- The Ether Machine (DYNX) and Bit Digital (BTBT) also increased their ETH holdings.

- SEC Chair Paul Atkins unveiled “Project Crypto”, a commission-wide push to modernise securities rules and move U.S. financial markets onchain. The plan replaces subjective Howey tests with clear, rule-based token classification. It creates tiered disclosure requirements based on market cap and trading volume. Safe-harbor provisions for tokenised securities and DeFi activities are also included. The draft rules are expected to come in Q4 2025, with potential final adoption by mid-2026. After years of regulatory uncertainty, crypto has a clear path forward.

As noted in previous updates, crypto treasury companies have been rewarded for buying digital assets, outperforming the broader market in the medium term. This has created a virtuous cycle, attracting more participants and driving some further along the risk curve.

However, we remain concerned that if this trend reverses and the market stops allocating surplus value to corporations following this strategy, corporate demand for crypto could dry up. In such circumstances, the premium to net asset value (NAV) of these crypto treasury companies would likely compress, as seen for Grayscale’s premium last cycle. This dynamic remains an important market signal, and we are monitoring it closely as part of our treasury outlook.

ENS Token Update

- Token holder distribution across the top-50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (‘CEXs’) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price increased 37.7% in July, outperforming BTC but lagging behind ETH.

- Trading volume for ENS rose significantly. On the CEX side, Binance’s ENS/USDT daily spot trading volume almost doubled from 333K ENS/day in June to 653K ENS/day in July, and Upbit’s ENS/KRW pair nearly tripled from 474K ENS/day to 1.2M ENS/day.

DAO Financial Update

Endowment Update

Please refer to the July kpk monthly report for further details.

- Asset Allocation

- Assets under management (AUM) of $127.8M, with a capital utilisation ratio of 100.0%.

- Endowment Allocation split into 77.5% ETH ($99M) and 22.5% stablecoins ($28.7M).

- Yield Generation (“DeFi Results”): $312.6K gross yield generated in July.

- Marked-to-market (“MTM”) valuation: increased by $34M, driven by the rise in ETH price.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) consists of staked ETH in Stader and Stakwise v3 each comprising about 24% of total funds. On the stablecoin side, sUSDS (Sky Savings Rate) is the highest allocation complemented by small allocations to Compound v3 and Aave v3. Morpho lending markets which have been generally comparable or higher than Sky Savings Rate will be introduced in the next permissions update request.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the July Steakhouse monthly report, which now presents financial statements both with- and without $ENS tokens.

Other Updates

- Starting July 24th, the Endowment started rebalancing by selling ETH. ~1,142 ETH were sold in July at an average price of ~$3.77k, netting ~$4.3M in stablecoins, which were deployed into yield-generating strategies.

ENS Monthly Community Update - August 2025

The August 2025 Endowment Report is now available on kpk’s website.

kpk is pleased to present its Community Update for the month of August to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

The digital asset market closed August on a strong note, with both BTC and ETH reaching new all-time highs (ATHs).

- BTC (-4.5% for the month) reached a new ATH of $124.12k mid-August, before retracing to close the month at $108.41k. ETH (+18.4% for the month) outperformed the broader market, peaking past $4.95k before closing the month at $4.38k.

- Institutional inflows slowed down to $4.37B, driven by growing adoption of ETH-based products ($3.96B), but partially offset by outflow from BTC-products (~$301M).

- Bitcoin dominance declined further (from 61% to 58%), driven by strong ETH outperformance. Some exchange-related tokens also made strong gains (OKB +262%, CRO +113%, MNT +67%, KCS +38%). OKB was up sharply after OKX announced the token supply will be cut in half. CRO was up on news of a new digital asset treasury company that will hold CRO, established in partnership with the Trump family. Other strong performers were LINK +48%, POL +43%, PUMP +36% and ARB +36%.

- The rest of the Top 20 digital assets by market cap showed mixed returns, with most underperforming ETH (XRP -5%, SOL +23%, BNB +13%, HYPE +3%).

- The worst performers for the month were BONK -17%, PENGU -16% and surprisingly SKY -16% as it failed to capitalize on the wider stablecoin narrative in August.

- The total implied network value (market cap) of the digital asset market stood at $3.84tn at the end of August and was largely flat for the month.

- Crypto funding rates fluctuated significantly during August without reaching extreme levels:

- Off-chain Funding Rates: Both BTC and ETH funding rates stayed between 5% to 12% on Binance despite choppy price action. Open interest for Binance BTC and ETH was almost flat (BTC Perps: 130k to 131k (BTC), ETH Perps: 2.56M to 2.64M (ETH))

- On-chain Funding Rates: On Hyperliquid, the rate fluctuations were much more pronounced; ETH funding moved between -6% and 38%, while BTC funding was between 5% and 38%. Interestingly, open interest for ETH and BTC was almost equal at $3.70B towards the end of the month.

Several notable developments in the crypto space during August were:

- Digital asset treasuries continued gaining traction, driving ETH demand.

- Tom Lee’s BitMine Immersion Tech (BMNR), which is targeting to hold 5% of total ETH supply, bought almost 1.30M ETH in August, and finished the month with a total of 1.80M ETH in their treasury.

- Sharplink (SBET) also continued to stack their ETH treasury, growing from 361K to 798K ETH.

- Other companies like The Ether Machine (DYNX) and ETHZilla Corporation (ETHZ) also followed suit. The total ETH held by public companies is now a staggering amount of 3.5M ETH or about 3% of the total token supply.

- In a landmark shift, the Commodities Futures Trading Commission announced that spot crypto asset contracts can now be traded on futures exchanges under its jurisdiction—ushering in enhanced federal-level clarity and collaboration with the SEC under “Project Crypto.”

- BlackRock crossed $100 billion in crypto holdings. As of August 14, BlackRock has accumulated approximately $104.00B in crypto assets, with Bitcoin comprising the lion’s share—underscoring a massive institutional commitment to digital assets.

- Crypto enters U.S. retirement plans as a Trump administration executive order now permits 401(k) and other retirement plans to invest in cryptocurrency investment vehicles, private equity as well as other alternative investments, potentially opening trillions in new capital flows, while raising concerns about risk for ordinary savers.

As we pointed out in last month’s report, many digital asset treasury companies are now trading below a multiple of net asset value (mNAV) of 1, meaning the market values these companies below their net asset value. This suggests that the frenzy of DAT may begin to slowly fizzle out, potentially leading to the drying up of corporate demand for crypto. This dynamic remains a vital market signal, and we are monitoring it closely as part of our treasury outlook.

ENS Token Update

- Token holder distribution across the top-50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (‘CEXs’) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price dropped 12% in August, underperforming both BTC and ETH as crypto majors siphoned liquidity from smaller-cap tokens.

- Trading volume for ENS was lower in August as well. On the CEX side, Binance’s ENS/USDT daily spot trading volume fell from 653K ENS/day in July to 481K ENS/day in August, and Upbit’s ENS/KRW volume fell from 1.2M ENS/day to 974K ENS/day.

DAO Financial Update

Endowment Update

Please refer to the August kpk monthly report for further details.

- Asset Allocation

- Assets under management (AUM) of $145.7M, with a capital utilisation ratio of 100.0%.

- Endowment Allocation split into 73.3% ETH ($106.8M) and 26.7% stablecoins ($38.9M).

- Yield Generation (“DeFi Results”): $370.5k gross yield generated in August.

- Marked-to-market (“MTM”) valuation: increased by $18.4M, driven by the rise in ETH price.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) consists of staked ETH in Stader and Stakwise v3, each comprising about 21% of total funds. On the stablecoin side, sUSDS (Sky Savings Rate) is the highest allocation complemented by small allocations to Compound v3 and Aave v3. Morpho lending markets will be introduced following the next permissions update request, further allowing the Endowment to diversify its protocol distribution.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the August Steakhouse monthly report, which now presents financial statements both with- and without $ENS tokens.

Other Updates

- Starting July 24th, the Endowment started rebalancing by selling ETH. ~2,486 ETH were sold in August at an average price of ~$4.04k, netting ~$10.04M in stablecoins, which were deployed into yield-generating strategies.

- In total, ~3,63k ETH were sold at an average price of ~$3.95k, netting ~$14,35M in stablecoins.

- Permissions Update Request #6 has been posted on the ENS forum; the permissions update continued to focus on diversification of protocols, and alignment of permissions with evolving market landscape and liquidity.

ENS Monthly Community Update - September 2025

The September 2025 Endowment Report is now available on kpk’s website.

kpk is pleased to present its Community Update for September to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

The digital asset market consolidated in September following the record highs of August. While volatility remained elevated, major assets saw a rebalancing of flows and relative positioning.

Market Performance

- BTC (+4.85.% for the month) traded lower after failing to reclaim its $124k ATH, closing September at ~$113k. Market sentiment around BTC weakened amid continued outflows from institutional products.

- ETH (-5.68% for the month) remained resilient, briefly testing the $4.7k level before closing the month at $4.11k. ETH remained the top institutional focus, with derivatives activity and treasury accumulation providing strong demand support.

Institutional Flows

Public ETF data showed that institutional flows cooled in September, with net inflows of ~$1.4 billion into Bitcoin ETFs, while Ethereum ETFs recorded net outflows of ~$669 million, reversing the prior month’s rotation trend toward ETH.

Market Structure & Dominance

- Bitcoin dominance declined from 58% to 55%, driven by ETH’s continued strength and increased participation in mid-cap assets.

- Exchange-related tokens remained in focus, though returns were more muted than in August: OKB (+22%), CRO (+14%), MNT (+8%), KCS (+5%).

- Other notable movers: LINK (+17%), ARB (+12%), DOGE (+9%), while POL (+3%) and PUMP (+2%) slowed after strong August gains.

Underperformers

Underperformers included BONK (-12%), PENGU (-9%), and SKY (-8%), all of which failed to recover from their losses in August.

Market Capitalisation

The total digital asset market capitalisation closed September at $3.72T, down 3.1% MoM, reflecting BTC’s retracement despite resilience across ETH and select altcoins.

Funding & Derivatives

- Off-chain funding rates (Binance):

- BTC: ranged between 4–9%, with open interest fell from 131 K to 127 K BTC.

- ETH: ranged between 6–11%, with open interest up slightly from 2.64M to 2.68M ETH.

- On-chain funding rates (Hyperliquid):

- ETH: ranged between -4–26%.

- BTC: ranged between 3-24%.

- Open interest remained balanced, with ETH and BTC both near $3.5B in OI by month-end.

ENS Token Update

Token holder distribution across the top-50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (‘CEXs’) and ENS-related wallets (DAO, ENS Labs, etc.).

The ENS token’s price dropped -11.38% in September, underperforming both BTC (+4.85%) and ETH (-5.68%) as crypto majors siphoned liquidity from smaller-cap tokens.

Trading activity for ENS declined in September, with total monthly volume reaching 7.68M ENS, equivalent to ~$171.35M. On centralised exchanges, Binance’s ENS/USDT daily spot trading volume fell from 481K ENS/day in August to 256.26K ENS/day in September.

DAO Financial Update

Endowment Update

Please refer to the September kpk monthly report for further details.

-

Asset Allocation

- Assets under management (AUM) of $140.14M, with a capital utilisation ratio of 100.0%.

- Endowment Allocation split into 72.13% ETH ($101.08M) and 27.87% stablecoins ($39.06M).

- Yield Generation (“DeFi Results”): $361.26k gross yield generated in September.

- Marked-to-market (“MTM”) valuation: decreased by $5.79M, driven by the decline in ETH price.

-

Protocol Distribution

- Endowment’s biggest position (protocol exposure) consists of staked ETH in Stader and Stakwise v3, each comprising about 20.41% of total funds. On the stablecoin side, sUSDS (Sky Savings Rate) is the highest allocation complemented by small allocations to Compound v3 and Aave v3.

-

A selection of Morpho markets (cbBTC/USDC (86% LLTV), wstETH/WETH, (96.5% LLTV), wstETH/WETH (94.5% LLTV), WBTC/USDC (86% LLTV), wstETH/USDC (86% LLTV)) will be introduced following the next permissions update request, further allowing the Endowment to diversify its protocol distribution and aim for more attractive yield opportunities.

-

Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

As a complement to our financial accounting, please refer to Financial Reporting Dune Dashboard and September Steakhouse monthly report, which now presents financial statements both with- and without $ENS tokens.

ENS Monthly Community Update - October 2025

The October 2025 Endowment Report is now available on kpk’s website.

kpk is pleased to present its Community Update for September to the broader ENS Community to increase awareness and transparency of its activities.

Market Update

October was a reset month for crypto markets. Risk premia widened across majors, funding conditions softened, and market participants rotated more aggressively into stablecoin positions.

Market Performance

BTC traded lower throughout the month, with spot prices unable to maintain support above $105,000. It closed October at approximately $97,800, down 13.5% month on month. The repricing reflected slower spot ETF flow momentum, reduced marginal buying, and a weaker macro backdrop.

ETH underperformed BTC for a second month, closing October at approximately $3,130, down 23.8% month on month. The liquidation episode on 10–11 October triggered forced unwinds of high-leverage ETH perpetual positions. Liquidations during that 48-hour period accelerated the drawdown, with cascading sell pressure pushing ETH perpetual funding lower and driving double-digit intraday moves across several L1 and L2 tokens, as visible in Hyperliquid onchain perpetual data.

Across the broader market, mid-caps and long-tail assets lagged as traders de-risked into more liquid majors and stablecoins. Exchange-related tokens (OKB, CRO, MNT, KCS) also retraced after several months of prior outperformance.

Institutional Flows

ETF flows weakened materially in October. Bitcoin spot ETFs recorded net outflows of approximately $940M, while ETH spot ETFs saw modest net inflows of $120M (BitMEX Research ETF Tracker). Market makers cited the 10–11 October liquidation window as the point where RFQ volumes and appetite for directional exposure contracted.

Market Structure & Dominance

Bitcoin dominance remained broadly unchanged month on month, holding in the mid-50% range. This indicated that the retracement was systemic rather than a rotation between majors.

Total digital asset market capitalisation closed October at approximately $3.36T, a 9.7% month-on-month contraction, reflecting the repricing across majors and the broader de-risking.

Funding & Derivatives

Funding rates moved lower following the 10–11 October deleveraging event.

Off-chain funding (Binance)

• BTC: ranged 1% to 7%

• ETH: ranged 2% to 9%

On-chain funding (Hyperliquid)

• BTC: ranged –2% to +18%

• ETH: ranged –5% to +22%

Open interest also compressed after the liquidations:

• BTC perpetual OI declined from approximately 127k BTC to 115k BTC by month-end.

• ETH perpetual OI declined from approximately 2.68M ETH to 2.41M ETH by month-end.

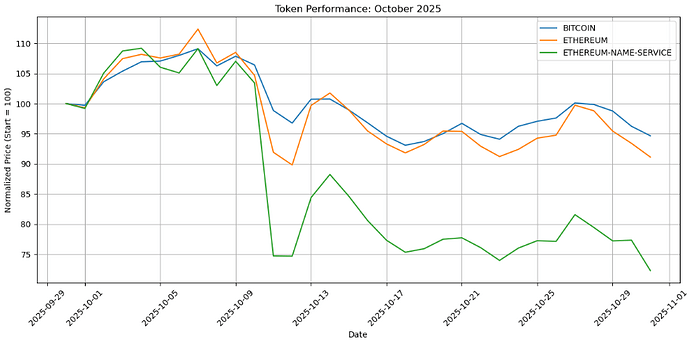

ENS Token Update

Token holder distribution among the top 50 ENS holders remained stable in October, with ownership concentrated primarily in centralised exchanges and ENS-affiliated wallets, including the DAO and ENS Labs.

The ENS token declined 27.73% over the period, materially underperforming both BTC, which fell 5.35%, and ETH, which declined 8.88%. The relative underperformance reflected continued rotation from smaller-cap assets into larger, more liquid majors.

Trading activity for ENS strengthened in October, with total monthly volume rising to 12.78M ENS (~$212.65M). On centralised exchanges, Binance’s ENS/USDT spot market saw average daily volumes increase to 412.2K ENS/day, up meaningfully from September levels (256.26K ENS/day).

DAO Financial Update

Endowment Update

Please refer to the October kpk monthly report for further details.

Asset Allocation

- Assets under management (AUM) of $133.37M, with a capital utilisation ratio of 99.9%.

- Endowment Allocation split into 67.63% ETH ($90.09M) and 32.37% stablecoins ($43.17M), in line with the 60/40 mandate and minimum stablecoin runway requirements.

- Yield Generation (“DeFi Results”): $367.22k gross yield generated in October.

- Marked-to-market (“MTM”) valuation: decreased by $7.26M, driven by the decline in ETH price.

Protocol Distribution

- The Endowment’s largest position (protocol exposure) consists of sUSDS (Sky Savings Rate), which accounts for 20.14% of the total funds. On the staked ETH side, staking in Stader (19.96%) and Stakwise v3 (19.76%), continue to be the largest ones.

- Following the approval of permission update #6, the Endowment successfully started to allocate Capital into Morpho markets with the following breakdown:

- cbBTC/USDC (86% LLTV): 2.54M USDC

- wstETH/WETH, (96.5% LLTV): 854.43 WETH ($3.28M as of October 31st)

- WBTC/USDC (86% LLTV): 2.54M USDC

These positions further allow the Endowment to diversify its protocol distribution and aim for more attractive yield opportunities.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

As a complement to our financial accounting, please refer to the Financial Reporting Dune Dashboard and the October Steakhouse monthly report, which now presents financial statements both with- and without $ENS tokens.