to sell the ETH into USDC

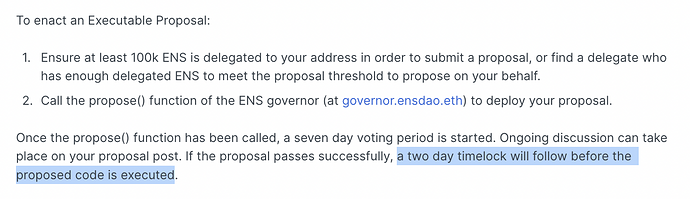

As explained above, the timelock is built into the contract.

All onchain proposals are all subject to a 2 day time lock.

This information is outlined in the Governance Docs.

Here is a screenshot of the relevant paragraph.

So this means that ANY and ALL activity involving 0xFe89cc7aBB2C4183683ab71653C4cdc9B02D44b7 ENS DAO Wallet ( PUBLIC TAG ) has a two day window?

In the time since we sold, ETH has gone down by 12% ($1622 → $1437). In that period it’s been as high as $1700 and as low as $1390. ETH isn’t a safe asset for us to hold operating expenses in, and the reasoning behind that hasn’t changed since the proposal was passed.

ENS isn’t a financial asset.

We should definitely diversify our stablecoin holdings.

My own view is that the current depeg is largely a result of people panicking. This Twitter Thread by Adam Cochran does a good job of laying out Circle’s exposure and the likely consequences, and it seems highly unlikely USDC will go under or permanently lose its peg as a result of this situation.

That said, yes, we should definitely be diversifying our stablecoin holdings into more than one provider. I’d welcome input from professionals as to what a reasonable balance is; failing that we can at least put together a proposal for a simple mix of the major stablecoins.

To address the other issue: Yes, the shortest timeline the DAO can take action on is 9 days - 7 days for a proposal vote and a 2 day execution timelock. This can of course be changed in the future, but there are risks and tradeoffs of making either the voting period or the timelock shorter.

Another option would be to move the funds to a Gnosis Safe managed in a similar way to the endowment, with some privileged users (eg, the secretary or a multisig of lead stewards) permitted to conduct a limited range of operations such as swapping between stablecoins. This could be useful for cashflow reasons in any case; it does require vesting some trust in those individuals, but it can be configured such that they do not have custody of the funds, as with the endowment.

This is the second big stable coin de-pegging situation. We may recover from this but I don’t trust the stablecoins anymore… Stablecoins becoming depegged means that someone is doing something wrong to the point where there is not $1 behind each “stable” coin.

You can’t borrow from the value of Ethereum because it’s only backed by the value of which it is traded.

Ethereum has unlimited upside just like bitcoin. If USDC can go down below $1.00 USD. Then what is preventing it from going above? Where is the excess above liquidity? Something about that makes me question and I would much rather preserve the value of a project on Ethereum through the confidence of the price of Ethereum. Not doing that just gives off that there is a lack of confidence in the value of Ethereum.

As an integral project within the Ethereum Ecosystem, on the Ethereum Ecosystem and entirely representing a link between all addressable assets on the Ethereum Blockchain, swapping ETH to a stablecoin backed by USD simply says we don’t believe in this digital currency. I don’t see what the problem issuing any payments in Ethereum at market price or just swapping into an asset with a locked value per.

Nonetheless, I am shocked to see maybe a total of 10 people become active on this forum in the past 2-3 hours.

![]() Relax everybody, absolutely nothing is going to happen, its just that markets are a bit panicky, thats all

Relax everybody, absolutely nothing is going to happen, its just that markets are a bit panicky, thats all ![]()

EDIT: in fact I’m going to very VERY carefully argue that its a good thing, if we see USDC swinging around like so, then it might just be the bottom of the market. Again this is a VERY careful argument based on my gut feeling.

Think about it, a lot of entities are already under the water, and domino effect was echoing around formidably. USDC swing is like one of those last convulsions before the sunrise.

Circle is backed by Goldman Sachs, that fact alone does not guarantee that Circle will stay above water, but market mechanics is more like psychology than physics. If everyone believes that Circle is good, then it’s good. On top of psychology it is very unlikely that Goldman will let Circle drown, too much is staked here, and Goldman’s resources are like ocean vs Circle being a bucket of water.

There is not a single hint of doubt in my mind, that right now several teams of GS’s analysts / vps / directors are siting in those cool cubicles and crunching every possible scenario. I just don’t see how they will suddenly bail on that investment.

delegates and signers need to be online right now. USDC needs to swap to ETH ASAP

This is definitely a wake up call. If/when USDC regains its peg, the DAO should certainly consider diversifying its stablecoin holdings. What that will look like is an open question at this point.

Better planning is probably more important than being able to react quickly.

While it remains to be seen, the delay and time lock for executable proposals could be a good thing in this instance because it stops knee jerk reactions based on market panic.

In the time since I posted this,

USDC has gone down 12%, which is the same loss at ETH.

Ref.: https://www.coingecko.com/en/coins/usd-coin

If you do not think USDC is a risk,

then there seems to be a disconnect from the financial reality of the current moment.

If the chance that the $17MM USDC in the ENS DAO goes to zero is even one percent, then ETH is safer, by degrees of magnitude; the treasury is not being financially responsible with ENS DAO funds, which should be in the native assets.

ENS is immutable names, with mutable treasury; not good for the ethos, IMO.

This is definitely a wake up call. If/when USDC regains its peg, the DAO should certainly consider diversifying its stablecoin holdings. What that will look like is an open question at this point.

It is infuriating that the lesson you get from being warned ad infinitum about the very foreseeable near term risk of stablecoins, is the desire to buy into more stablecoins. This is resignation level of documented and displayed incompetence imo. You’ve lost any support I had for you with this comment. I’m more sad for the community than anything though.

There should be an immediate proposal to exchange any stablecoins or alternative positions for Ether. There’s no need for salaries to make ENS succeed. If treated as open source and decentralized, there would be plenty of people willing to contribute for free.

The bigger problem in all of this is the registration shortfall. Because no study into pricing has been performed, and the insiders (delegates) lack expertise in economics or game theory, we have a huge market instability caused by something that could be mathematically defended, but instead is just random numbers pulled from thin air.

The drop in premium registrations is going to hurt just as much, or more as USDC going down.

Finally we get ETH sold to USDC, next week, USDC depegs, zzzzzz

Anyway, +1 with overall sentiment of diversifying stables, LUSD would be my vote - But re what @alisha.eth & @nick.eth have said, even if we submit a proposal today, it wouldn’t execute for 9 days.

I highly doubt USDC is going to entirely collapse this, and agree with the above statements that this is primarily market panic.

But once USDC re-pegs (or gets back closer) i’m super down to rip a proposal to convert x% (25? 50?) of the USDC to LUSD

If you would like to put forward a proposal, you’re welcome to draft one and put it to a vote.

+1 on LUSD.

I don’t think we need to do anything urgent there is not enough information. The risks were discussed and accounted for by delegates. Bills are still due in fiat currencies.

Coinbase is not Circle.

Slow controls for executing changes is desirable.

@garypalmerjr - Thanks for raising this and starting the conversation.

I’m in complete agreement with @alisha.eth, @nick.eth, @SpikeWatanabe.eth, @James, and @cory.eth. This conversion from Eth in EP3.3 was the correct decision for the reasons already stated.

This will be a long weekend for everyone in this industry. The info currently available supports patience. The best place to put our energy on this specific topic will be to plan the proposal to diversify into 2 or 3 different stables in the coming days/weeks. @James - did you volunteer for this?

Why not follow in the footsteps of the best money managers and have a well-diversified basket?

i.e. several Stablecoins, some Ether, some BTC, some gold, and some other asset types.

When something is as critical as the future of the ENS protocol, the more diversification to minimize risk and single points of failure the better.

INVERSE NOTE!:

IF $USDC will go back to $1.00 USD,

THEN maybe we should buy USDC now??!? ![]()

So all will go back to normal/peg?

Coinbase will reinstate deposits on Monday?

We have already in Day 1 of a 9-day proposal period.

We are in this “Day 1” now, and time is slipping into the future.

I hope everything will be okay on Monday,

but I think more banks are going to fall, and

I wonder how this will then effect USDC, further?

Here is more from the Twitterverse:

A.Tweet from RSA.eth:

Your bank runs on stablecoins.

- WellsFargo USD

- JPM USD

SVB USD

They’re all stablecoins. Which is next to fall?

They’re showing us that money is the bank is less safe than crypto native assets.

People holding ETH and BTC are sleeping like babies.

https://twitter.com/RyanSAdams/status/1634543975544528896

B. Tweet from Balajis:

What we’re likely to see in the coming weeks is that this wasn’t a single bank’s issue.

It was a central bank issue. Don’t take my word for it.

Just four days ago the FDIC chair said “most” banks are suffering unrealized losses thanks to the Fed’s rapid change in interest rates.

https://twitter.com/balajis/status/1634543503958212610

PS: In conclusion,

since right now, most delegates seem “fine with this meme”,

then what is the plan for “diversification” of Stablecoin-type assets?

Perhaps it’s worthwhile to insure the DAO’s stablecoin holdings.

Bridge Mutual seems to offer those types of policies to cover depegging, but the DAO might consider going a step further and going direct to insurance company/underwriter for a custom policy.