Abstract

Domain Name squatters and scammers affect ENS’s brand as a credibly neutral platform, and produces a net deadweight loss on stakeholders of the system. This proposal identifies a number of cases, provides a rough estimation of the loss in the cases shown which can be further analyzed, and a path forward to capture the loss as revenue for ENS stakeholders. Previous works on this topic involve the specifics of a market structure that implements fairness, but does not describe the path dependence on how to get there from here, without invoking harm or violating the ENS constitution. Also, it does not directly explain the revenue losses for the platform, leading to users who do not understand the direct harm to the system.

The main suggestion is to implement a Common Ownership Self-Assessed Tax (COST) on ENS domain holders, but start with an opt-in system to allow users to convert to COST empowered ENS. In this system, all holders are required to disclose a yearly fee to keep a domain but the system is also converted to a market for fees. At any point, any other user, subject to thresholds, may outbid the domains current fee and take control. This provides two benefits of requiring squatters to correctly assess the value of their name and generate transparent pricing for each name and pay the appropriate fee. This also reduces the likelihood of scammers since useful names will have additional “signal” in their price and names that are purchased for scamming, must pay a high tax in a fee price to receive marketability.

A COST empowered ENS will be more credibly neutral by offering fair and transparent pricing of domains, and drive users to convert as a better market than existing names. An opt-in system allows stakeholders to test the model, capture data, and generate new revenue streams from fairly priced transparent names. In the future this document suggests that a constitutional change be inacted to eventually convert all ENS to a COST model, if the COST empowered ENS domains are deemed successful and better for the system overall.

Motivation

Name Squatting and Credible Neutrality

facebook.eth

harvard.eth

newyork.eth

ferrari.eth

wallstreetjournal.eth

What do each of these ENS names have in common? The answer: over 300 ENS names including these were registered in 2017 by a user who was faster than the brands themselves in receiving these names. Each of these names, and their rivalrous nature, imposes a negative externality on the brands that could own and use them. As known in the Ethereum community, reaching out to brands to extract value from them, simply because these power users were first to the draw in the beginning stages of ENS, is common. A fair question to stakeholders of ENS?

Is this credibly neutral for all participants of the free market ENS system?

The answer is most certainly no. Simply put, the pricing of ENS names were incorrectly priced, as early squatters received a benefit of the system for being first and engaging in a bidding war game, rather than providing the correct price for the good they received. How can new users and current stakeholders, feel a system that gives all value to initial stakeholders for being first, want to engage and utilize this system where a name they want, is now held by a speculator that has no use for the name, but was simply first?

It is also clear, as evidenced by social interactions, that most people holding these names expect large payouts or favors by people who would utilize these ENS domains. The lack of a free market means no sales are completed without a large transaction, rather than fairly priced transactions that generate royalty fees. Because of this, the current user holding these 300 ENS names only paid 0.52901321902 ETH to maintain their holdings, which at current prices is less than $2000 US. More details of an estimation for how much value is not captured by the ENS by allowing this fee market type to exist is given below.

A system that is not credibly neutral, risks defectors leaving and creating newer, more equitable systems that have greater use, and this serves as an existential risk to ENS. If ENS wants to be a profit generating system, this behavior should be mitigated with an appropriate pricing structure that reduces the speculative aspect of ENS names. Not only this, as evidenced by the fact that a single user is able to hoard valuable names while paying next to nothing to ENS and it’s stakeholders, this is bad business.

The “SPAM” Problem

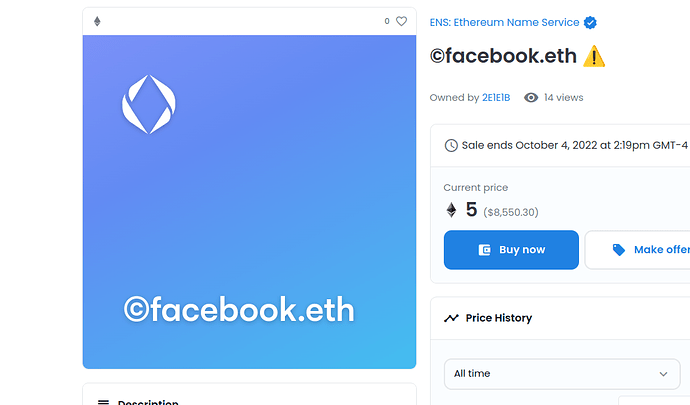

While not a large issue today, mitigating spam and scam should be an important goal of ENS. For example, a quick search for facebook.eth on Opensea shows this:

While normal power users of ENS might recognize this as a scam, as extra emojis and UTF-8 characters were added. These characters are not shown in the UI image, but it is up to the hosting marketplace to appropriately visualize these encodings. Along with this, the listed price is somewhat close to a pricing that would be fair for the ENS name.

How can ENS mitigate this time of spam posting that allows for users to purchase a cheap name, and produce a “nearby” distance price hoping to capture an accidental purchase? Typically, a fair response in the absence of the ability to automate scams, is to allow a free-market pricing of posting in general. Fees and payment stops “spam” in general, and prices “boost” desired goods well above spam. If ENS implements a COST system for ENS, spammers would be required to name a high fee to match the existing name the spam wishes to imitate, which is revenue ENS could capture directly. The benefit is overall harm reduction, while in the worst case, allowing scammers to pay ENS directly for the attempt to spam.

A Rough Analysis of Dead-Weight Loss

How much is ENS loosing on user 0x5807a8b4 alone?

As shown above, the user 0x5807a8b4 is squatting ENS domains. First, the assumptions for the model.

Assumption 1: The user paid roughly 1 ETH per domain, with a per domain price of only $300.

This assumption is obtained by checking a number of registrations on etherscan during the time they generated the registrations. A quick check for example, shows “digitaljackpot.eth” was purchased for only 1.4 ETH. At the time, ETH was roughly $300. This assumption has the highest error since resolution is across multiple transactions, but even with an order of magnitude change. $3000 per domain is shockingly low and suggests ENS lost value by locking the domain for even 1 year.

Assumption 2: The user pays less than $1500 a year to squat these domains.

This assumption is easier to normalize since bulk registrations happen in 1 transaction. The bulk renewal was for 1 year and can be found here. Each renewal was bulk added for only 0.001 ETH. At ETH prices at the time around $2700 US, for about 300 registrations, we arrive at an estimated price $1428 per year. Again, even by allowing an order of magnitude error, these names are held for less than $10000 US. This includes facebook.eth.

Facebook.com was purchased for $200K in 2005 alone. It’s clear from the above, just enabling correct pricing for just a single ENS domain held by the user 0x5807a8b4 would generate far more revenue for ENS.

Assumption 3: The user costs ENS at least $3M a year in deadweight loss.

Assume each domain holder in a fairly priced market for ENS, would pay just $10000 a year. This estimation is about an order of magnitude less than the acquisition of facebook.com for life. At this assumption, just the 300 names alone would generate $3M a year in revenue for ENS. Because of the squatter, ENS doesn’t capture any of this revenue at all.

How much is ENS loosing by hosting mock facebook.eth registrations?

Assumption 4: Scammers that engage in attempted sales would likely pay up to $1000 to ENS to list fake posts.

If we assume some well capitalized scammer is willing to pay some amount of the estimated $10000 a year it’s fair to say these scammers would be forced to pay $1000 to list mock posts. As unfair as it would be to list and allow fake posts, the ENS registration should be willing to capture revenue these scam postings. It’s difficult to analyze how many of these posts exists, but at a current registration and renewal fee, it’s clear the current prices are too low. A search of facebook.eth on gem.xyz shows a number of current listings for mock facebook.eth domains, which ENS likely captures the standard 0.001 ETH yearly renewal for. By increasing the penalty of scamming and spamming, ENS could capture the negative externalities of this spam.

Specification

Near Term: Implement Opt-In COST

The main topic of this posts asks ENS to enact a Common Ownership Self-Assessed Tax model for ENS names that is Opt-In. User can convert to this fee model. Specifically:

- Each name registration will require a deposit to pay for the domain, and a specification of the yearly fee. Each “second” the domain contract can subtract a pro-rata fee for the domain. At the current writing, utilizing Superfluid could allow for composability of domain fee streams.

- At any point, another user can revoke the name registration, provided some threshold of the yearly fee is met (10-20% more or less). This is a somewhat arbitrary number, but can be analyzed to optimize for good matching between users who want domains, and users willing to pay for them.

- Current ENS holders should be allowed to opt-into this registration. This should not be forced on ENS holders in the near term.

Medium Term: Update the ENS Constitution to Change the Fee Model to C.O.S.T.

While harm is extremely difficult to define for users who namesquat ENS domains, it may be the case that some users paid large amounts to speculate on these names. It would be in the best interest to minimize the harm of these users and allow them to appropriately sell their names to correct users who relatively value the names. Because of this, it would be in the interest to invoke an amendment to the Constitution and require a majority of holders to vote, and signal a desire to move the a COST model. During the constitution amendment, if ratified, the proprosal should allow a 1-5 year hard coded change to the fee model. All users should have enough time to extract appropriate value and minimize overall harm, since the speculative losses to some users could be high.

Long Term: Convert all Names to C.O.S.T.

After ratification, all names should be converted to the COST powered ENS model. In the constitutional change, it should allow a long term timeline to conversion and allow as many people who speculated to find appropriate buyers willing to pay fees to minimize the losses of speculators that overbid their registration.

Considerations

Reversibility

As mentioned in the Specification, this proposal is a significant change to the auction model of ENS. It should be clear that the opt-in model allows an initial set of users to convert to the new model at will, with consent. This allows for a small set of test users to cross over, and give the ENS DAO data about transfers and revenue generated from the conversion. If the conversion isn’t shown to be better for the DAO or ENS stakeholders, minimal harm is done to overall users and it is likely the change can be reversed.

Rewarding Users That Convert to the C.O.S.T. model

Because users who purchased ENS have some risks of losing their domain by larger bidders, the initial opt-in to convert to a COST ENS might be encouraged with a new airdrop for users that willingly convert. Since the ENS system will capture more revenue, the support of users who wish to convert signals to others a desire to evolve the system. In a version of this “revenue share”, these users receiving some amount of ENS may be good for the system. A direct analysis of the conversion, and a possible resolution increase for users with desirable names, is possible.

Speculative Losses

As evidenced by some recent large bids and purchases of ENS domains, it is clear that during expiry, bidding wars may have been generated. Users that are not the best holders of the names may suffer losses if their domains are converted to a COST model. To some, speculators on ENS domains deserve to be exposed to downside losses as governed by a free market. Fair auctions are a subject of many economist analysis, but without transparent prices, a core component of a free market, there is an argument this market was not “free”, and encouraged speculation in an incorrect auction.

Because of this, there are domains which will suffer significant losses for users that overbid them. It could be suggested that to minimize harm to these users, ENS token offerings should be given to them, as a long term stake in a vibrant platform that generates real revenue through better, liquid markets, may be more valuable than squatting.

Removal of Royalty Model

The current royalty model for OpenSea is a parameter that is still in debate. Fortunately, since royalty models for NFTs are avoidable with appropriate wrapper contracts, it is worth considering converting to a COST model and managing the auction and transfer of domains “in-house”.

Previous Discussions

A quick search of recent posts discussing the change in auction mechanism is discussed below, which references Vitalik Buterin’s post about the mechanism.

Increase premium fee or have a new auction mechanism

References and Further Reading

Georgian Models and Harberger Taxes

Combining the best of Georgian and Harberger taxes - LessWrong

Vitalik on ENS

Should there be demand-based recurring fees on ENS domains?

Radical Markets - The benefits and analysis of COST

Radical Markets: Uprooting Capitalism and Democracy for a Just Society