Hey everyone! On behalf of Golem Foundation, we’d love to introduce Octant and explore positive-sum synergies with ENS ecosystem.

Introducing Octant

Octant, part of Golem Foundation, is a project that facilitates sustainable, community-coordinated impact funding at scale. We’ve demonstrated the power of sustainable funding of impactful projects by staking 100,000 ETH (~$363M as of today) and using much of the yield to fund broad based public goods in the Ethereum ecosystem.

Over the past year, we’ve distributed millions of dollars to hundreds of open-source and impactful projects builders, supporting important projects such as Protocol Guild, Tor Browser, Funding the Commons, L2BEAT, BuidlGuidl, and many others.

Need for Sustainability

Our experience has shown that most impactful, open-source projects / initiatives lack sustainability, often relying on one-time (grant) allocations without a sustainable flywheel.

We aim on solving this by:

- Creating a provably fair, open, and minimally biased funding mechanism

- Leveraging substantial treasury resources and funding streams for maximum impact, powered by the Web3 ecosystems native value generating streams

- Fostering a sustainable ecosystem for open-source, real-world impactful projects development

- Rewarding users for participation in the sustainable impact funding ecosystem

- Coordinating with other web3 ecosystem on funding specific deliverables/initiatives

By staking 100,000 ETH and donating the yield, we’re not just talking about change — we’ve actively started driving it. Our goal is to contribute to a better, more accessible, fair, and open world by making funding impactful projects truly sustainable.

Alignment with ENS DAO

ENS DAO has been stewarding sustainable growth and development of critical, onchain public goods infrastructure ever since its inception, with core ENS contributors being critical to the growth of Ethereum and the ecosystem, experiencing firsthand the need to ensure long-term sustainability — leading to the creation of the ENS Endowment.

We believe there’s a need for a similar Endowment for sustainable public goods funding at scale, and the Sustainability Pool in Octant v2 offers a promising solution: a shared pool to which Dragons (protocols with large resources) allocate their generated yield to fund impactful projects within the Ethereum ecosystem.

According to the ENS DAO Constitution, ENS DAO treasury could be used to fund other public goods within web3 based on ENS governance decisions:

”Any income generated to the ENS treasury is to be used first of all to ensure the long-term viability of ENS, and to fund continuing development and improvement of the ENS system. Funds that are not reasonably required to achieve this goal may be used to fund other public goods within web3 as ENS governance sees fit.”

ENS has launched and continues to grow successful public goods and ecosystem development initiatives — including the ENS Public Goods Working Group, ENS Ecosystem Working Group, ENS Small Grants, among others.

All of the above signals a strong alignment between ENS DAO and Octant, and we believe that together we could create a long-lasting, sustainable impact while funding what matters at scale.

Octant V2 Vision

The DeFi space has largely been disconnected from regenerative models (ReFi) and use cases such as impact investing and public goods funding. We need to bridge this gap and align incentives in a way that benefits both individual users and impactful projects.

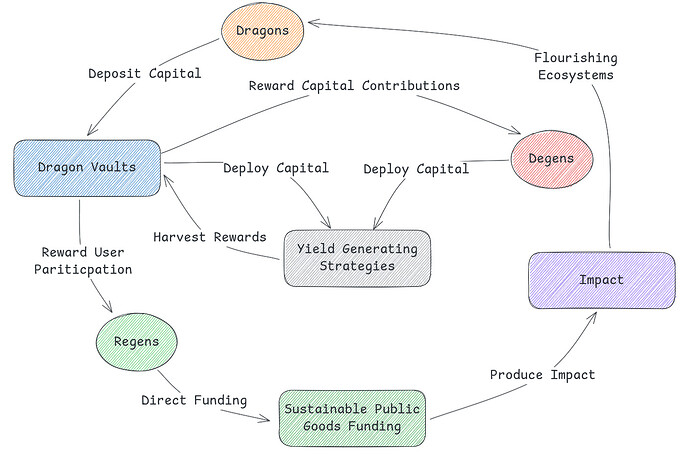

The image above illustrates Octant V2 flywheel, which brings together diverse ecosystem participants and creates incentives for collaboration. Our goal is to align ecosystem players with varying motivations, fostering cooperation to achieve a balance between individual rewards and funding for impactful projects.

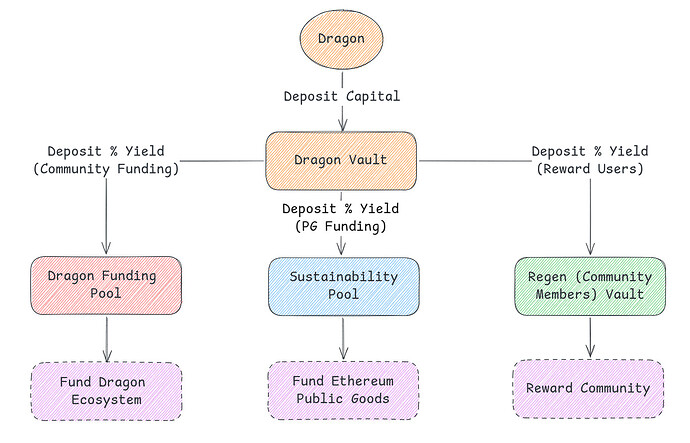

The diagram above illustrates the workflow of a Dragon (project with substantial principal capital) engaging with the system. The protocol allows individual Dragons to join and deposit capital into their own Dragon Vaults, while all Dragons contribute a percentage of their yield to the Sustainability Pool.

You can think about the Sustainability Pool as a Sovereign Wealth Fund that is used to fund public goods and impactful projects across the broader Ethereum ecosystem.

The Dragon Vault deploys that capital into yield-generating strategies. These strategies may include ETH staking protocols, DeFi protocols, etc. The Vault distribution is decided by the Dragon and can be divided between the Dragon Pool, Sustainability Pool, Regen Vault, and other pools/vaults the Dragon wants to utilize.

The community creates funding rounds from the continuously flowing funds into the Dragon Pool. Regens (community members) then vote with the accumulated tokens using an allocation method, and these votes determine how the funds are distributed.

Opportunities and Collaboration

We’re openly inviting ENS DAO to share your feedback and suggestions on this intro forum post. We see this as the beginning of our long-term, positive-sum collaboration that will directly benefit both ENS ecosystem and the larger web2 and web3 spaces.

With that said, here’re some collaboration opportunities:

- Community Activations

Meaningful community activations aligned with ENS DAO goals - Sustainable Impact Funding

Allocating a % of the ENS DAO treasury to generate yield in the Protocol, and streaming a portion of those rewards to the Sustainability Pool - Integrations with the ecosystem

Powerful integrations synergies with ENS ecosystem builders - Governance Contribution

Engage in shaping the future of impact funding via collaborative governance.

It’s time for sustainable evolution

Our industry desperately needs bold experiments in sustainable funding for what truly matters. While experimental approaches may not always succeed, our efforts since Octant launched in summer ‘23 have already shown tangible results and meaningful impact.

We believe that co-creating and nurturing impact funding flywheel will lead to the evolution of how impactful projects and initiatives are funded, laying the groundwork for a sustainable future across the entire ecosystem.

We look forward to hearing your feedback. Thank you!