Since ENS Endowment’s official establishment in March 2023, karpatkey has been serving as its Endowment manager, seeing through successful execution of the Endowment’s first and second funding tranches. As we move into the second half of 2024, we are excited to provide a brief overview of our collaborative efforts with the ENS DAO to date and outline future initiatives.

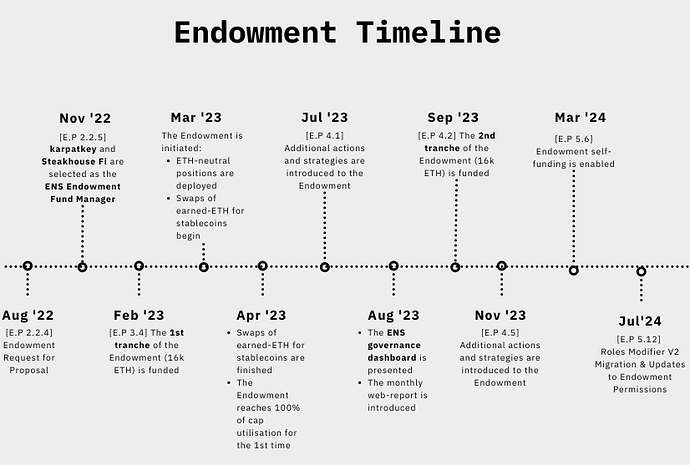

To begin, we present a summary tracing the timeline from the Endowment’s Request for Proposal (RFP) to the current state:

Endowment Update

Since its inception, the Endowment has achieved:

- Accumulated net revenue of $2.09 million USD

- A net average Annual Percentage Yield (APY) of 3.74%

According to the latest monthly report, which assesses the Endowment’s performance in June 2024, the following key metrics were observed:

- $100.23M of ncAUM (non-custodial assets under management)

- 100% of capital utilisation

- Projected APY of 4.3%

- Projected annual revenue of $4.31M

Additionally, based on the latest June report compiled by @steakhouse, for H1 2024 the following financial details for the DAO were noted:

- Operational Revenues for the DAO amounted to $15.68M

- Operational Expenses for the DAO were reported at $4.26M, with an anticipated coverage of 50.6% by Endowment revenues in 2024*

- DAO reserves concluded H1 2024 at $136M, indicative of a 16-year operational runway

*The projection of operational expenses does not encompass the potential costs related to new initiatives planned for funding.

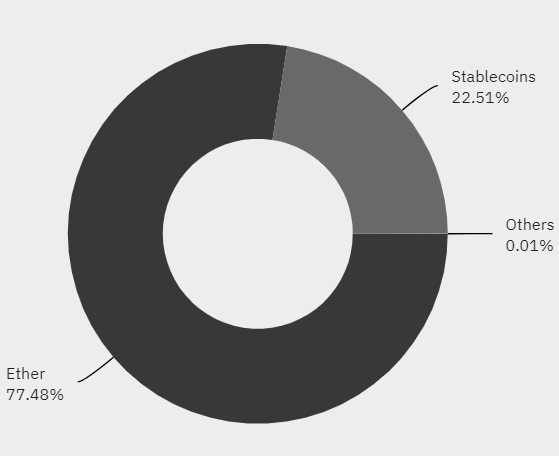

Furthermore, as per the June 2024 report, the distribution of funds by asset-class can be seen in the following graph:

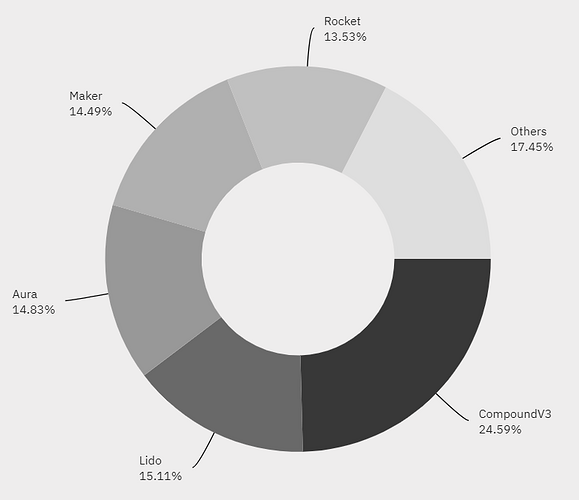

Subsequently, the protocol distribution of the Endowment’s funds is as follows:

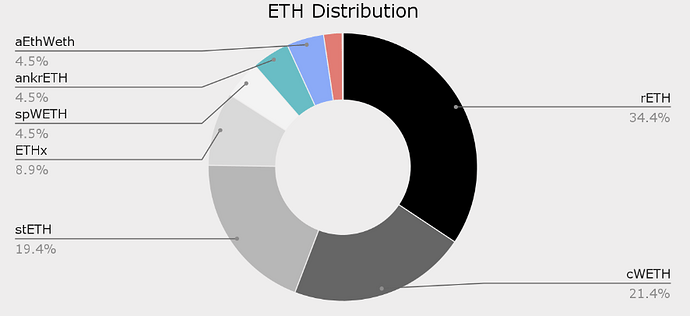

The Endowment established a maximum limit of 20% for its Ethereum (ETH) holdings to be allocated to Lido’s staked Ethereum (stETH). Below is a breakdown of the current ETH allocations.

Strategy & Implementation

Since the beginning of 2024, we have advanced several proposals within the ENS DAO, demonstrating our ongoing commitment to enhancing the protocol. The proposals we have put forward are:

- E.P.5.6 enabling a self-funding mechanism for the Endowment to autonomously finance its operations.

- E.P.5.12 migrating the current permissions module to Zodiac Roles Modifier v2 which allows for a more sophisticated filtering of encoded calldata and enhanced logic for complex permissions.

- Revenue Share Agreement with Stader Labs enabling higher effective staking yields for ETH on Stader Protocol. The agreement specifies that 80% of the protocol’s commissioned staking rewards (protocol fees) will be returned to the Endowment for the first three months, followed by a sustained return of 50% thereafter.

- To enhance the community’s comprehension of Manager Role preset updates and streamline the auditing process, the migration to ZRM v2 includes an interface that makes it simple to identify updates and deprecated permissions.

Future Roadmap

- Migration to Zodiac Roles Modifier v2 and execution of new permissions policy, and ensuring community familiarity with the v2 which would elevate the user experience of the auditing process for future preset permissions.

- Continued monitoring of ENS’ financial health, especially given increased spending of the DAO in 2024, with Service Provider streams and L2 expansion.

- Expansion of the ENS Endowment to enhance the financial health of the DAO through a new request for DAO assets to be allocated to the Endowment, along with regular transfers of monthly revenue from the Controller to the Endowment.

- Continued monitoring of potential governance attack on Endowment, as well as suggestions of open-market methods to minimise the said attack vector.

- Continued assessment and broadening the spectrum of LSTs (liquid staked tokens) within the Endowment in order to advocate for validator diversity, integration of more protocols and strategies that resonate with the Endowment’s risk appetite and long-term vision.

- Remain vigilant of market trends and explore new investment opportunities for the Endowment.

Risk Management

- Internally built an Agile Execution App (AxA) which enables asset managers of the Endowment to swiftly execute pre-designed strategies for emergency purposes (allowlisted swaps and exits).

- This solves the dependency on protocols’ user interfaces and minimises human error/time-consumption whilst ensuring dual-layer security (preset filters act as an initial security check, followed by the execution of predesigned strategies within the app).

- Hypernative alert setup for each of the protocols in the permissions policy.

- Various protocol, smart contract, and financial risk factors are monitored, including oracle pricing, contract ownership transfers, pool liquidity checks, withdrawal queues, collateral ratios / health factors.

- karpatkey conducts both weekly internal risk review and weekly external review with the Hypernative team.

Upcoming Risk Management Initiatives

- Development of enhanced emergency protocol: bots (referred to as guardians) are being developed to automate risk management strategies. The guardians will act based on predefined risk triggers, including suspected exploits, unusual pool behaviour, and rapidly decreasing collateral ratios, amongst others. Further details on guardians can be found here. This new feature will be introduced to the ENS community soon for discussion.

- The karpatkey team is working with Hypernative to assess alerts accuracy and 3rd parties models, to enhance guardian precision and minimise false positives.

- Continuous research of protocols and setting of alerts for risk management. To enhance efficiency, karpatkey is also working on automating a significant portion of this process via smart contract mapping and categorisation of risks.

Reporting

- karpatkey has been providing regular Endowment updates during the weekly MetaGov Working Group meetings. In response to community feedback, details such as comparison against benchmarks (of 100% ETH portfolio) and breakdown of DeFi-generated yield by strategy, have been incorporated into the weekly update.

- In August 2023, karpatkey launched its web-based UI monthly reports for its clients. This year, our tech team has implemented significant improvements to mobile responsiveness, enhancing accessibility and user experience for the reports.

Future Reporting Endeavours

- Further enhance user experience of karpatkey’s reports and dashboards, and incorporate more bespoke metrics for ENS. Including the web-based reporting, and Metagov Endowment update presentations.

Community

- Fund Flow dashboard built for the community to get further insights into DAO-owned assets and its activities.

- Continued engagement with the Agora team for their development of Proposal Lifecycle Management tool.

- 100% attendance to MetaGov calls.

Community Roadmap

- We are committed to ongoing engagement with the community, contributing our knowledge and insights for the common good.

- We remain alert and proactive in identifying ways to enhance the ENS community’s value.

We appreciate the trust you have placed in us with this critical responsibility. We look forward to maintaining our commitment and efforts in the upcoming semester and beyond, ensuring the lasting success of the ENS DAO.