1. Weekly Endowment Updates (@karpatkey + @Steakhouse )

2. General DAO Updates Section

2.1 Updates from Karpatkey

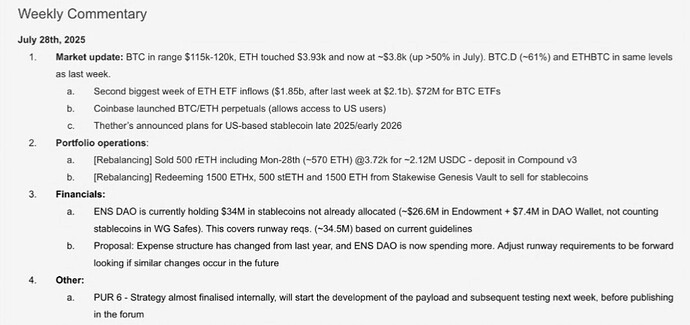

- The endowment is at $133M.

- Stablecoins are approaching 20%

- Last week’s total result was around $4M, with $73k in rewards, resulting in an APR of 2.85%

- ETH saw the second-biggest week of ETF inflows with $1.95B, following the previous week’s $2.1B

- Tether announced plans for a US-based stablecoin in late 2025 or early 2026

- More Weekly commentary:

- Sold 570 Rocket Pool ETH for around $3.72k each, totaling $2.12M USDC, deposited into Compound, yielding ~5% APY

- Redeeming 15k stETH from Lido and 15k from the Genesis vault in wstETH to sell for stablecoins

- The goal is to get closer to the 40/60 mark.

- The DAO is holding $34M in stablecoins

- Proposed reviewing the calculation of the cash balance due to increased ENS labs funding

- Using last year’s expenses results in a minimum cash balance of $34.5M, while using this year’s expected expenses would require $45M

- Strategy update:

- next update almost finished, testing planned for next week

- Focused on adding more money market strategies for existing assets

- Potentially adding Morpho markets and/or vaults for higher stables yield

- Ratio Estimate

- Aim to be near 70:30 in the next month and a half, potentially reaching 60:40 if the price increases.

- To achieve 70:30 at current prices, 4.5k needs to be sold, with 500 already sold.

- Rebalancing will respect the guideline of every other week in clips of 1K.

- Considering reporting on higher-risk, higher-yield assets separately from the Endowment

- Opportunity to create a separate initiative focusing on higher risk appetite for the DAO

- Sharing opportunities, including custom deals and bootstrapping new protocols, with the DAO

- Sharing of opportunities to start as soon as next month.

2.2 OpenBox Proposal Committee Update

- Formal questions sent to Josh and his team based on previous conversations and community input.

- Urbelis is discerning the legal side of things.

- Another conversation with Josh is scheduled.

- Aiming to formalize findings in the format outlined in the original proposal.

- The investment committee had an initial conversation and estimated the process would take two to three months.

- The committee has a high bar for information and wants to present a detailed, well-formatted opinion to the DAO.

3. Open Discussion

3.1 Lighthouse Team Update

- James reports that not much has happened since last week other than Telegram chatting

- The next meeting is on Thursday at the same time as the MetaGov meeting

- The team is considering starting a new forum thread for updates

- The original idea came from needing a way to represent DAO and organizational data.

- They were calling it the DAO registry industry, but they need a name that is generalized enough to show that it can be applied to all sorts of stuff

3.2 Other

- The L2 reverse registrars executable proposal looks like it will pass.

- Next week will be the delegate all-hands call, and an agenda will be posted a couple of days ahead of time

3.3 Voting on technical proposals

- Some feel that having participants vote on an executable is a mere formality because not many people understand the code.

- Suggested the DAO give Labs autonomy to build and release technical protocol development after internal review.

- Questions who is accountable if something goes wrong: the DAO voters or ENS Labs, and suggests trusting ENS Labs with protocol development if they are trusted to build it.

- Some believe the current setup works well because the DAO only has a couple of protocol updates per year

- DAO serves as a security for the protocol.

- Potential solutions:

- AI integration with governance practices

- Experiment with optimistic governance on a case-by-case basis

- Labs representatives (devrel) could explain smart contracts on calls, with notes distributed via newsletter and social media.