1. Weekly Endowment Updates (@karpatkey + @Steakhouse )

- Daniel is the new member from kpk at the call

- Worked with kpk for almost a year, works on treasury subjects for ENS, Arbitrum, etc., before kpk, he was a VC in web3

- Endowment at $142M

- 76% ETH

- 24% stablecoin

- Week to week, it’s up $19.3M due to ETH price appreciation

- Yield results were around $76.8k, with a realized APR of around 2.8%

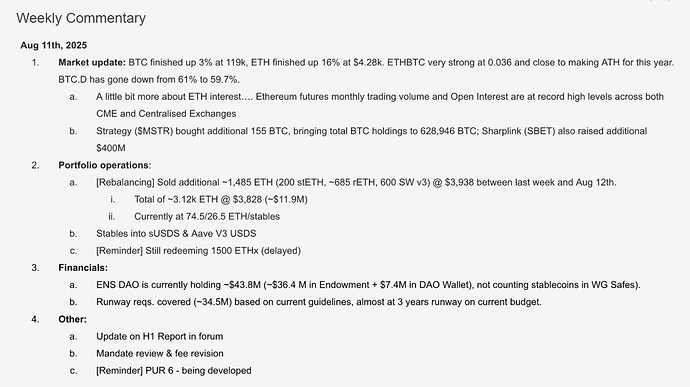

- Weekly commentary

Highlights:

- Digital asset treasury companies like MicroStrategy and Sharplink are buying Bitcoin and Ethereum

- 1485 ETH sold at an average price of around $3.9k

- ENS DAO is holding $44M in stablecoin, which is more than three years of runway based on last year’s spending

ETH Sales and TWAP

- Selling ETH can be done via a Time Weighted Average Transaction (TWAP).

- TWAP involves selling a little ETH daily over a period of time and converting it to stablecoins at the prevailing price, similar to dollar-cost averaging.

- This approach aims to avoid price volatility.

- The previous setup involved moving ETH to a safe and using a TWAP to send the proceeds to the DAO cold wallet for expenses.

- This required trust among multisig holders from Karpatkey, MetaGov, and Labs.

- The goal is to remove individuals from this process to improve security.

- The new TWAP multisig ownership will be fully owned by the DAO, similar to the endowment.

- A DAO proposal will be required to initiate a TWAP with specific parameters.

- The proposal will be executed like a permissions update.

2. General DAO Updates Section

2.1. Updates from Karpatkey

2.2. OpenBox Proposal Committee Update

- There is no material update regarding the Open Box proposal committee.

- Engagement with Intercap is ongoing, but Josh from Intercap is very busy.

Public goods and ENS Labs

- Public Goods is subsidizing research related to TLD done by ENS Labs.

- Alex Urbelis from ENS Labs brought forward an opportunity to fund research on how decentralized names can interface with ICANN auctions and policy.

- The research will be helpful for the general community.

- It’s being conducted by Emily, who is independent and does not work for the DAO or Labs.

- The grant is for Emily, and the output of her work will be for the DAO, Labs, and the broader community.

- Emily has been researching ICANN and will distill information around ICANN’s preparations for the auction.

- The Public Goods Working Group is funding this research because it benefits the entire decentralized ecosystem.

2.3. SPP Stream Cancelation Update

- There was a glitch in the Superfluid system that caused the SPP streams to be canceled.

- Netto explains that the auto wrapper contract, which transforms USDC to USDCx, failed because the relayer system from Superfluid didn’t work, causing the DAO wallet to run out of funds.

- Superfluid will refund the liquidation fees, and a new DAO proposal will be needed to reactivate the streams from the DAO wallet to the stream pod.

Implications and Next Steps

- Concerns are raised about relying on a free, mission-critical service without an SLA or agreement.

- The recipients will need true-up payments, potentially costing around $250,000, before the streams can be restarted.

- Marcus suggests writing a single sentence explaining the fail point and the next step, which is restarting the streams through a DAO vote.

Stream Failure Cause and Measures

- The cost of the stream failure was around $3,000 in liquidation fees.

- Superfluid is covering the liquidation fees and ensuring the systems that trigger the auto wrapper are up.

- They are also updating the UI due to a bug discovered.

- Superfluid is acting proactively, even though they are not obligated to fix it since ENS isn’t a paying customer.

- Suggestion to ask Superfluid for a post-mortem and offer financial recompense for their service, requesting an SLA in the process.

- Could run own infrastructure to ping contracts for reliability.

3. Open Discussion

DAO Organizational Identity Specification

- Lighthouse petitioned MetaGov to subsidize their mission, which fits into DAO tooling and supports all DAOs, including ENS.

- ENS will subsidize Lighthouse to offset costs and ensure they can continue their mission.

- ENS wants public commitment that this is an officially sanctioned thing that ENS wants.

- Uniswap announced that they are registering a DUNA, a real-world legal entity governed by a DAO.

- This could make things more mainstream.

- Project where DAOs can upload data publicly to ENS could be important from a regulatory standpoint.

ENS Legal Structure

- The question is raised whether the current Cayman foundation structure is optimal for maximizing participation, innovation, and proposal quality, especially with ICANN’s next round approaching.

- The Cayman structure offers tax efficiency and low operational overhead, but might deter US entities from engaging in innovative proposals.

- A MetaGov-sponsored research into this could be a good idea.

- A DUNA offers explicit limited liability for token holders and trustees, whereas the Cayman foundation model lacks legal precedent and may expose trustees (and potentially voters) to risk.

- Some businesses may hesitate to partner with ENS due to the Cayman foundation’s regulatory gray area.

- DUNA is legally designed to recognize DAOs, while the current foundation is a general-purpose wrapper without DAO-specific legal clarity.

- Transitioning to a DUNA is expensive (Nouns spent ~$1M) and would require significant legal work; ENS already has a functioning foundation.

- Need more clarity – Delegates lack a clear understanding of their liability, and the Meta-Governance WG may commission a report to evaluate whether a DUNA would be a better fit.