Details

Time: Tuesdays at 9:00 am ET (1pm UTC)

Google Meet Link: meet.google.com/bms-grvp-jbw

Stewards:

- @5pence.eth (5pence.eth | X), Lead Steward

- @alextnetto.eth (netto.eth | X)

- @daostrat.eth (daostrat.eth| X)

Agenda

- Weekly Endowment Updates (@karpatkey + @Steakhouse)

- General DAO Updates Section

- [EP 6.1] & [EP 6.2] Endowment Proposal Updates

- Service Provider Program Updates

- SpikeWatanabe.eth discussing delegate forum threads

- Open Discussion

—

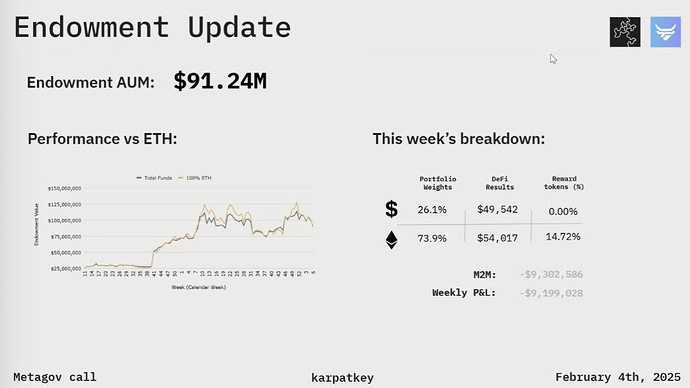

1. Weekly Endowment Updates (@karpatkey + @Steakhouse)

- Not the greatest start to the week due to unfavorable market conditions.

- Largest liquidations in a while according to CoinGlass ($2.2B in long positions).

- Hopefully market will recover in the upcoming weeks

- Since last Tuesday, netted a negative 9.3%

- DeFi netted positive $103k

- M2M: - $9.3M

- Weekly P&L: - $9.2M

- Waiting on the execution of EP 6.2

- Still fully (99.9% allocated) with ~5% APR.

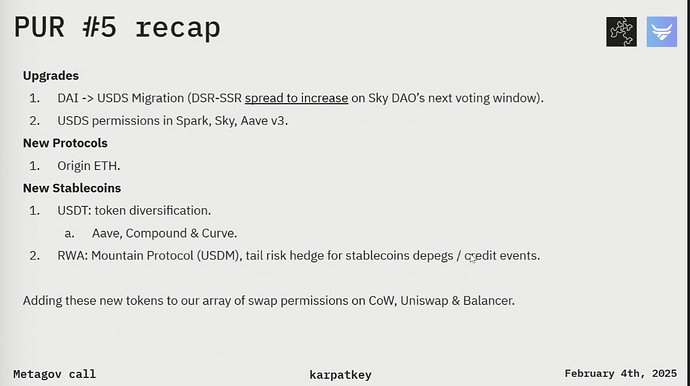

- Recap on the upcoming changes:

- Considered adding oETH (origin ETH) as a new protocol.

- USDT for stablecoin diversification. (Aave, Compound, & Curve)

- Using RWA Mountain Protocol (USDM) as a risk hedge against stablecoin depegs. (preemptive risk mitigation strategy to be available for emergency cases, not necessarily immediately to be implemented)

- More here

Improving financial understanding (terminology and acronyms)

- Discussed ideas on how to help people in the DAO and in the call understand financial terminology and acronyms better.

- ELI5 approach needed when discussing financially-technical terms.

- We need to be able to make sure people without financial background understand financial DAO discussions.

2. General DAO Updates Section

2.1 [EP 6.1] & [EP 6.2] Endowment Proposal Updates

- Both passed

- Proposals review:

- Convert 6,000 ETH to USDC

- Endowment expansion (3rd tranche)

- Quick Proposals Review by @estmcmxci

- For Kartpatkey to be able to swap into any asset like USDM, they need to have permission explicitly defined.

- Everything Kartpatkey does is limited to the specific needs the DAO gives permission for.

- Proposal lifecycle overview:

- Executable proposals stay onchain for ~7 days

- After the vote finishes, they can be queued for execution

- When they are queued, they can be executed 24 hours later

2.2 Service Provider Program Updates

- Service Provider Program Season 2

- Comments are welcome and encouraged on the program.

- First there will be voting on the budget amount, then selecting providers, and then executing streams.

2.3 SpikeWatanabe.eth discussing delegate forum threads

Delegate incentivization, activation, compensation, and more, by @SpikeWatanabe.eth

- Suggested creating a separate section (Delegate Threads) on the forum that would contain individual delegate statements.

- Outdated delegate threads and posts cause confusion, especially for new members.

- Discussed decreasing the barrier to entry for new people to join and become delegates.

- Discussion about creating a delegate incentivization program.

- Delegate compensation was brought up as a financial incentive to increase governance participation and bring more delegates.

- Unlikely to see more delegates if they are expected to commit years of work upfront without any indication of financial inclusion.

- Instead of one dedicated Delegate Announcement Thread, Delegates are encouraged to post comments on the given topic/proposal instead of a separate thread.

- Not mandatory but delegates can post in the separate Delegate Announcement Thread elaborating on their voting decisions

- Social pressure might help with keeping everyone accountable to doing it

- Downside: it’s a delegate overhead

- Potentially creates post-congestion on the forum

- Adds more friction to delegate participation

- Is it more positive to incentivize people to interact with a proposal thread instead of a separate thread?

- Discussion around different Delegate incentivization programs.

- Delegate Incentivization and Delegate Activity are 2 very hot topics.

- Delegate engagement is always a challenge for all DAOs.

- Generally speaking, the percentage of tokens engaged in governance is relatively low. And of those delegated (delegated/votable supply), about 5-10% are active in governance.

- Long-term dedicated DAO participants want to be able to instigate the change with their votes and know their efforts have value.

- There’s an issue with incentive alignment

- There’s a difference between having Delegated tokens vs Ownership of those tokens.

- Having influence vs having ownership for your effort in the DAO.

- Next steps: Consolidate ideas and put a temp check on the forum

3. Open Discussion

- The idea of borrowing USDC against ETH instead of selling it was brought up as mentioned here in this post: https://x.com/DeFi_Made_Here/status/1886072825192325434

- For now, DAO needs to sell the ETH to cover operational expenses but in the future Metagov + Kartpatkey will look into this option as well.