Disclaimer: I currently represent a delegation for flipsidecrypto.eth

As ENS welcomes new users and contributors we are hoping to steer this DAO towards continued product development, refinement, and growth.

TLDR: Flipside Crypto is proposing an enhancement to the ENS voting system, intended to more fairly distribute voting power within the DAO and create demand for ENS names. Two options to do so:

- A hybrid model, incorporating both ENS names and ENS tokens

- A quadratic NFT-based voting system (using ENS names) on Snapshot to boost protocol revenue and create a more fair distribution of voters.

The Problem

ENS is in a unique position as it lays claim to two types of tokenized assets:

- ERC20 ($ENS)

- ERC721 (ENS names: NFTs)

While ENS names remain coveted due to social pressure and widespread integrations, their durability is challenged and $ENS tokens are being criticized for their lack of utility (See post)

These critiques can be attributed to two problems:

- governance power is unfairly distributed across $ENS holders

- buying ENS names is no longer being incentivized

ENS’s revenue is entirely dependent on ENS registrations and renewals. With the introduction of a governance token, this is often forgotten. New ENS name holders are no longer incentivized with the allure of a possible airdrop nor does it give them voting rights. The current voting powers of ENS are archaic and rewarded early adopters of the product.

Delegation & Distribution of Governance Powers:

According to Tally, there are 11.85K voters out of 57.3K token holders - equating to a 20% participation rate. This is good for crypto, but not good enough.

We would like to see this number 2X with an end goal of majority participation - 51%

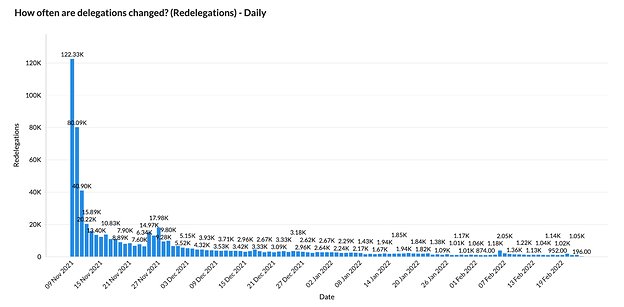

Redelegations are low. This means delegation has remained mostly the same since the original airdrop, see the chart below:

This steep decline and flatline result in stagnant voting power without much change. On average, there are 1.015 ENS delegations per wallet.

After receiving the airdrop, users are neither incentivized to buy more ENS tokens nor names.

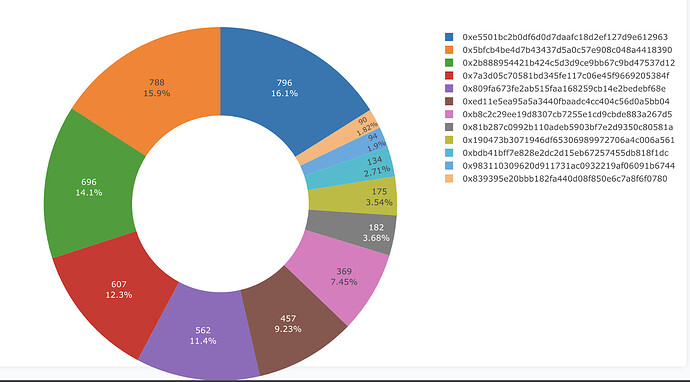

Let’s look at the distribution between top delegates:

These 10 addresses account for 99% of the voting power within the top 100 delegates (see post). This is not ok.

ENS Registrations & Renewals:

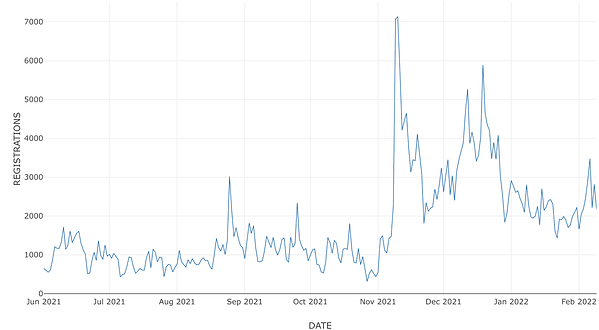

Below is a chart showing the total registrations since inception:

After a spike in November in users’ attempts to airdrop farm, new registrations have retraced a bit. It shows growth from August numbers but is depressed from its November/December highs.

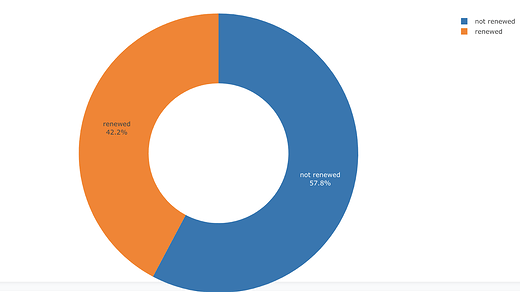

Renewals remain less than non-renewals:

With 57.8% of all ENS holders not renewing their name, we as a DAO need to do a better job of incentivizing renewals and creating more revenue for the DAO.

The Solution

This is the first draft for a framework for improved liquidity of $ENS and improved utility of the ENS names themselves, ERC721s.

Our goal is to benefit both the community and the DAO. This means creating greater revenue, driving ENS name registrations, and a more fair distribution of voting power.

To do so we propose the following potential paths forward:

A hybrid voting system:

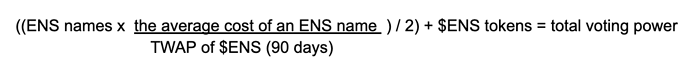

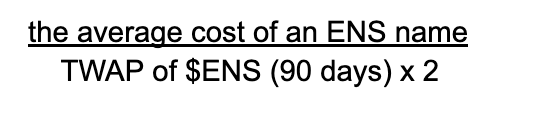

One option would be allowing $ENS holders to still have voting power while incorporating ENS name holders. These ERC721 tokens voting power would also be subject to a multiplier, to balance the voting power. An example calculation for this multiplier would be:

With this calculation, we are able to see the name equivalent of ENS tokens. In this case, one ENS name is worth 1.29 ENS tokens. Multiply this value by ENS names to derive total voting power:

This could be viewed as an aggregate voting power, ala a SUHSIPOWAH construct.

Please note this is an early calculation and open to suggestions. Dividing by 2 aims to avoid placing a premium on ENS, eliminating delegation, and creating selling pressure for $ENS.

Quadratic voting via ENS names:

1 ENS name = 1 VOTE.

For example, if someone has 3 ENS names they have three votes. 10 names,10 votes etc.

And furthermore, you could make it quadratic - where shorter names (more expensive) have a multiplier and wield more voting power.

This is possible through metadata and would prevent people from farming names for a vote.

This is a much better model than if one person with one name has 500 tokens versus someone who bought 3 at an early stage and is now left with 10,000 tokens due to a multiplier.

Stats per Flipside crypto:

- 76% of holders have a single domain registered on the service

- currently, 541k total ENS names are in circulation

In this model, users will still be able to delegate and can create a variable quorum, a function of current names in circulation.

Each ENS name is an ERC721 token, capable of holding its own power. Current Snapshot strategies support NFT-based voting and can integrate this change if approved.

Next Steps?

We would love to gather feedback from the community on implementing one of these options within the DAO.

If there is interest, our next proposal would aim to outline a world where $ENS is more than another governance token. A world where the token can be used to buy ENS names.

This acts as a buy-back function for the DAO while prices remain depressed.

By pairing these two proposals, it benefits both the community and DAO:

- The DAO owns more ENS and is incentivized to make its value worth more

- $ENS added utility - ability to spend and more yield

- More revenue for the DAO due to incentivized renewals and registrations

- More fair distribution of voting rights

Worth discussing? We’d love to hear your feedback below!