As the metagov-steward elect, I’d like to formally open a request for proposals for Streaming platforms for which we will use for the Service Providers. The goal is to have the stream start by mid-january to February so I understand it’s a short time, but over the past few weeks we’ve already seen demos from Sablier (@prberg), Superfluid, LlamaPay and Hedgey Finance. I ask these projects (and any other) to formally apply by simply answering the post below.

Starting next year, 9 separate projects will be paid from the ENS DAO with streams. ENS DAO also will be paying 9 stewards through the Metagov group, as well as a secretary role, and these could also be streams, depending on the platform chosen.

Process

The Metagov steward will read through the proposals, ask relevant questions and come to a decision. It is not a matter that will be put on a social vote, but it will lead to an Executable proposal in the January voting season.

Request for Proposals

We request a stream technology platform, meaning the ability to transfer tokens over time. It must be live on MainNet ethereum. If you are a representative of such platform (if there’s no company behind it, anyone can decide to advocate for an open source solution) then please answer the questionnaire below.

Name and website of the stream platform

For how long have you been on Mainnet Ethereum? How much value have you streamed in total so far? What’s the current Total Value Locked of the platform?

Platforms must be on main net ethereum for over at least one year and have a streamed over $100 million in total value streamed

What tokens you support?

Our main requirements will be USDC, ENS and WETH

Report any important security incidents you’ve encountered and how you managed it

Does your app have the possibility of having a public custom UI so that anyone can follow the state of multiple streams?

All streams will be public and we want there to be a place where anyone can check the values being streamed to all participants

Are you able to create indefinite streams? How easy is it to renew, pause or edit an existing stream?

*Our current stream providers will be receiving funds for at least one year, but there’s no end date. The goal is to have a new Stream Provider election in Q1 or Q2 2025, followed by an Executable Proposal which will remove some recipients, add others and maybe change the value of some. Your stream must be able to support that without any interruption in the service. This can be done by natively editing a live stream or being able to cancel and start a new one in a single transaction *.

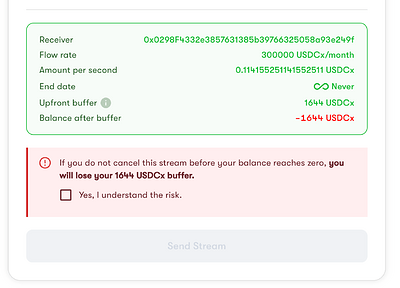

How much value must be locked in order to create a one year minimum stream of $3.6 million?

Please explain how much capital needs to be locked as well as the strategies to reduce smart contract risk of the locked up capital.

What are the gas costs and fees associated with your service?

Does your service charge fees? If not, what’s the business model? How much does it cost to withdraw from a stream, typically?

Are you able to have a developer from your team to support ENS?

We only expect to need support on the initial creation of the executable transaction to the DAO and in case of any emergency. Will that come with a cost?