I believe that management is an integral part of any project with over $1M in holdings and continuous income. It’s clear that the treasury holds well beyond that amount. We should have a management plan. I wholeheartedly agree with that.

As much as we have instilled this sort of a shared new age ideology or proxy business model as a DAO per se, and regardless of any terminology or approach to collective decisions this is easier described as a ‘community ran entity’. When it comes down to the nitty gritty, one of the prominent accolades to be recognized for is self-governed internal financial management as a DAO.

To me – a DAO in web 3 should be their own service provider, developer, social management, media source etc…and a solid team that make strategic decisions about DAO financial positions of their own domain, internally.

Although the output goal is the product, having a strong core of financially focused working group members speaks numbers. I don’t want anyone who is outside of the DAO to manage any of the treasury.

Know finance or no finance. Know when or non win.

It comes with the package in crypto. There are plenty of people who have the best interest in the progress of this project to achieve greater greats. If it takes getting on a voice call or video call from dinner time until sunrise, then so be it. As a DAO putting out a project along with internally managing it’s finances is what would make an even stronger success story to be proud of. I would like to see ENS DAO be creme de la creme of all product initiative DAOs. In my view, financial responsibility should sit on the DAOS shoulders as a mainpiece that coincides with the deliverable product.

I would be totally fine if (some) money was lost on behalf of the strategy decided within. I would be extremely upset if a fund manager outside to the DAO would lose funds or not profit up to the projected expectations.

ENS is unique and has multiple perspectives of business methodology.

- ENS (the product) (income aggregator)

- ENS Labs (a mechanism to specifically fund developers)

- Open-Source (allows contribution of all changes that would enhance deliverable)

- DAO (encapsulates decision processing, organizational function spanning the ecosystem)

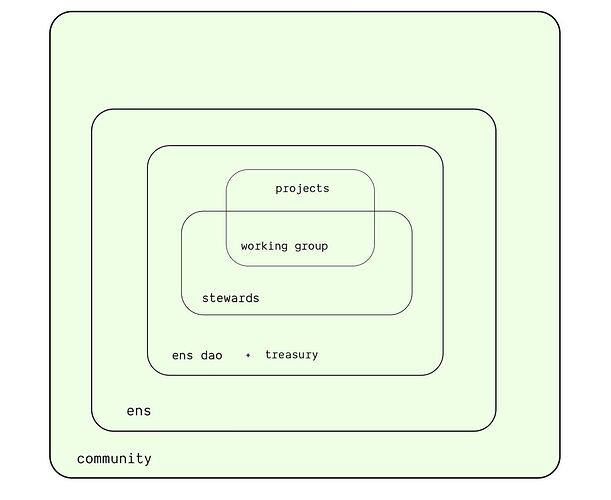

Functional layers of ENS. Ecosystem. (ref. fig.1)

- ENS

- The Governance of the DAO as a whole.

- Working groups within the DAO

- Stewards over their respective Working Group

- Onboarded Members

- Projects Building on ENS

- Community Dedication

This presents a linear funding self sufficiency mechanism to perpetuate ENS existence, sustainability and growth by registration income free and clear of outside contributors.

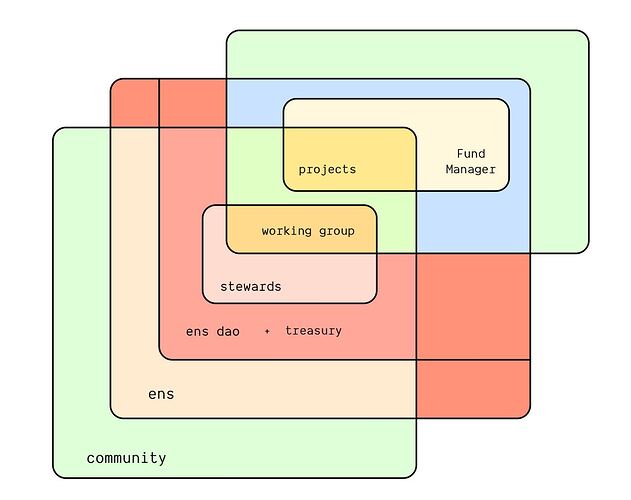

Adding a fund-manager introduces a extremely high level of risk that has potential to compromise the every aspect of this project. (ref. fig. 2)

As. you can see in my ‘encapsulation diagram of inherent risk’

All ENS funded projects extend outward towards the community while the community interaction influences the projects being developed and generally inherits almost zero risk or chance of any monetary loss.

As ENS becomes reliant on the fund manager entity-- both become one in the same in terms of reliancy, so they exist in the same encapsulation.note Except that the fund manager has essentially zero-risk of loss due to poor performance—without the loss of being compensated for the opposite outcome of a high performing yield aggregating successful strategy.

A complete loss of funds would compromise the DAO, Treasury, Stewards, working groups and ultimately the ability to further fund projects developing ENS. The existence of ENS would be less affected as it has become a permanent contract on the Ethereum Blockchain and would continue to exist even without guidance from the DAO or ENS Labs. Adding an external fund management entity is too much of a risk on the project. Loss of funds happens far too often in a myriad of ways. Risk reduction is extremely important. Adding new contracts to the mix isn’t favorable when comparing risk off exploitation vs reward by chance. This isn’t meant to discredit any contract writers in any way.

That basically I have to contribute towards the initiative.

Sustainability, Management, Responsibility until the core of ENS projects is complete needs focus first. We don’t have any data on income with the most anticipated feature of ENS–the subdomains. This must wait or be managed internally or the whole project assumes great risk.