I’m still ignoring code issues, but isn’t there any mechanism that would help protect this?

Fully agree with @AvsA here on the choice of infrastructure being just as important.

This is the wrong problem to focus on, as this has been resolved a long time ago with open-source tooling like Enzyme and Zodiac.

The two tools work very differently beneath the surface. The differentiating factors for Enzyme are:

- Our data pipelines are built on the graph protocol making it easy for anyone to automate + query any data (Eg. Net asset value, trades, interaction with DeFi protocols, etc) in an easy and human-readable way.

- From day 1, we can have an interface providing these live and historical data feeds to the entire ENS community

- The contracts that enable trustless interaction between the DAO and the manager of the DAO’s assets have been audited and battle tested on main-net for nearly four years. This is literally the only thing we have been focused on since 2016. I don’t know much about the track record of Zodiac’s trustless asset management contracts and how much they have been used in practice by DAOs, but its something I would love to know. My impression though is that Zodiac is a much broader organisation with competing priorities.

I’m a bit late to this discussion but:

I think we should keep the treasury management the responsibility of the DAO.

Perhaps this involves making some changes to the DAO structure to enable more timely and effective decision making, but IMHO it would be worth it.

All of the teams suggested are worthy custodians of funds, worthy managers of money, and trustworthy folks. However, the structure of assigning management of funds to a custodian is IMHO not aligned with the values of web3.

Instead I propose a more web3 native construction of management entirely on-chain, via the DAO directly.

Currently the ENS Governor Contract is responsible for managing both the protocol and the funds it holds. What we should do, is simply deploy a second Governor Contract with different proposal parameters to enable higher speed decision making with lower quorum requirements.

Instead of a timelock, the funds are held in a Gnosis Zodiac Powered Safe with the Governor Module developed by @auryn and team, which allows the DAO to control the safe.

We use @julz Metropolis (previously Orca) Pods technology on the Safe to manage the human “Fund managers” on the safe.

Additionally: We pay delegates for their service and require them to be active participants and knowledgable around fund management. Fast decisions can be taken on the second governor contract, to block transactions or to shuffle permissions. The DAO remains always the root of authority and the ultimate arbiter.

Pros:

- This system (or one like it) is Web3 Native and keeps the oversight power of the Fund in the hands of the people who participate in the DAO.

- This system allows for multiple strategies to be employed: There is no reason that we can not use all three options presented here simultaneously and fluidity. Experienced delegates are responsible for actively participating in either directly managing positions, or directly managing fund managers with smaller tranches of the funds.

- This system prevents the capture of the ENS Endowment

Cons:

- Requires more overhead.

@Griff Mentioned in his twitter post (no intention to pick on you Griff!)

“@Llama is asking for a DAO vote for every tx. I’m not interested in that.”

I have to push back on this to say: being a delegate is a job that requires potentially a large number of votes and decision making.

We should think long and hard: are we picking a solution because it’s the best, or because it reduces the workload and responsibility of the delegates who vote? (Again, not picking on any delegates- just wanting to lay it out there)

Would a more Web3 aligned system not instead find a way to make the decentralized organization itself a more efficient mechanism?

I understand this might be an unpopular take, but I think it’s worth considering: What is the job of the DAO if not it’s own long term preservation? Is this really a task we can outsource to third parties? Can we actually fairly select a third party with such an opportunity for capture?

Disclosure: I run Tally and have a vested interest in people deciding things together on chain.

Love you all!

+1 to this — I get that on-chain voting isn’t always easy or fun, but something of this nature warrants it in my opinion. After watching the process and discussions around this EP, I am beginning to think a DAO managed fund might be better… that being said, ENS might not be ready for that at this moment.

Also, I think it’s important for everyone to remember that a decision on this right now doesn’t dictate things forever into the future. The fund could be managed by one of these parties for a year, and then the DAO might decide it would be better to go in another direction. The ENS DAO is still incredibly young, and I think whatever happens we’ll learn a lot through this selection process.

Hi all, we wanted to share a few thoughts on why we structured our proposal the way that we did. All these decisions were made with the intention of 1) setting the right precedent for ENS as well as other DAOs, 2) maximizing the alignment between ENS and Llama, and 3) reducing risk of principal loss from ENS’s endowment, i.e. being as safe as possible.

First, we decided to manage the endowment entirely through on-chain governance via periodic proposals. There are a number of reasons that this is the best structure for ENS:

- Prioritize the rights of ENS community members and token holders. Endowment decisions are critical and we would like ENS delegates and holders to be involved, albeit in a lightweight manner. While the endowment manager has delegated responsibility, if we propose allocating part of the endowment to a strategy the community opposes, we would like the community’s vote to supersede our suggestion. From our experience with Aave, we expect this to happen quite rarely but it’s still an important precedent to set.

- Reduced custody risk. Storing assets in external vaults on which ENS DAO has a claim increases custody and smart contract risk. We strongly believe that the DAO’s endowment should live in the treasury, where it can truly be governed by tokenholders. Given recent market events, it is now more important than ever to get this right.

- Reduced smart contract risk. The endowment should live in the treasury, where no one actor can make unilateral decisions on its allocation. Using external smart contracts with permissioned roles increases the surface area for attack, both at a smart-contract level (vault contracts) and at a social level (wallets of multi-sig members controlling vaults being hacked). Keeping the endowment in the treasury allows ENS tokenholders to retain their fundamental rights as members of the DAO without transferring assets to a Safe or Vault.

- Lower regulatory risk for ENS and the treasury manager. ENS is one of the largest and most successful DAOs and it should set the right precedent for operating its endowment. We spoke with leading lawyers in the crypto space and concluded that this structure poses the least regulatory risk to ENS.

Of course, in exchange for increased security and full self-custody, there are tradeoffs we needed to make. For one, the endowment won’t be as nimble and won’t be able to trade in and out of positions on a daily basis. We think this is a good trade to make. The endowment manager should not allocate to positions which require frequent rebalancing. Instead, it should allocate to positions that are straightforward and have minimal smart contract risk. It is more important that the DAO retain full control over its assets than gaining an additional 1-2% of yield.

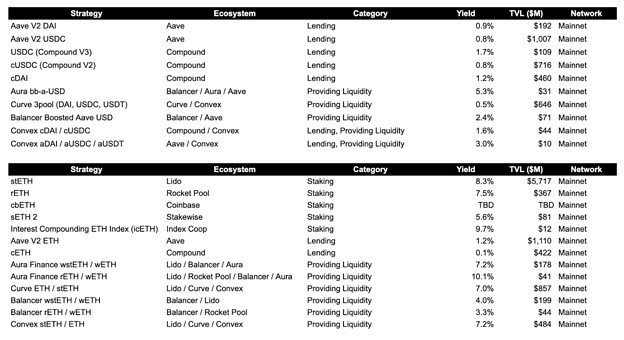

Though our strategies emphasize lower risk, that does not mean that the approach is “simple.” The tables below show an example of strategies we will consider. Note that specific allocations are dependent on specific market conditions and additional diligence.

Lastly, we decided to charge a flat 1% contributor fee. Few of us have worked at endowments and know that real world endowments do not charge performance fees, and we feel strongly that such structures result in misalignment between the DAO and treasury manager. The primary goal of any manager should be to minimize risk; incentivizing a manager to generate the most yield possible will inevitably lead to increasingly risky investments that could seriously jeopardize the DAO’s treasury. The endowment should not be operated as a hedge fund.

tbh we should be voting on every transaction, why should we not? If it’s a hassle to vote in this DAO, a self-governed entity–then this isn’t for you. This is the core function of governance existence. I would be more than glad to accept your tokens or delegated votes so that I can proudly vote with no hesitation or grief.

If funds are compromised by any contract, exploit, hack, bad actor or simply because a net profit isn’t met.

I say funds as in all funds; having an external fund manager puts every aspect of this project at risk when looking at how the ecosystems funding mechanism currently works. The DAO shouldn’t become reliant on a third party for the assets. I can’t justify that risk of paying someone to essentially stake eth so that it relieves any blame on a DAO member if something were to happen.

I had said before, this is cryptocurrency…managing finances are core DAO responsibilities.

Realistically-- we will all be having a say(vote) in what happens to any of the funds when the endaoment is “done”?

If that’s the case, I don’t see why would shouldn’t be managing the funds internally. We are spending this time voting on external Ideas when we could be doing it ourselves.

If the vote were to pass. Then How much of the DAO will be of use? If there will be an amount allotted from then endaoment and already figured budget for the next ‘x’ years. What will become of this DAO? What purpose will this DAO have when name wrapper is finished and everything is self sufficient?

Steward’s View - coltron.eth

Everything stated here is my personal opinion and an attempt at using my best judgment.

My Framework

-

Like many of you, I don’t have a financial background. My decision-making process is subjective and rooted in identifying whether the endowment manager and the suggested allocations have an initial size, risk profile, and underlying ethos that makes sense for our needs. The endowment’s goal is to, “insulate the DAO from economic fluctuations, ensuring it can continue its core operations regardless of the wider economic outlook.”

- Note: All options expose the protocol’s future to inherent smart contract risk, regulatory risk, and market volatility. Many of us are comfortable with the Crypto and DeFi environment, but it’s essential to understand and acknowledge where we are operating.

-

This proposal is optional. “None of the Above” is also a viable option.

-

We need a better-defined plan for our treasury management. An endowment does not solve this alone and should remain separate from our strategy used to manage our operating capital.

-

Seperate from the Endowment, the DAO needs to secure a healthy runway in stables that can weather an extended downturn. It will be years until the endowment fund can meet its intended goal of adequately insulating and funding continued core operations.

-

The Finalists

All the options presented are qualified, competent, and meet minimum specifications in the initial RFP.

Karpatkey & Steakouse

Karpatkey has been professional and responsive throughout this process. Built on Zodiac, the smart contract risk here is a non-factor for me as I consider it tested. Compared to Avantgarde, their breakeven return and fee structure are similar. The initial size is admittedly high.

They promise to reporting services, which sets them apart from the other finalists. Reporting was not required by the RFP. It was unfair to weigh this during the finalist selection, but in my personal vote, this type of transparency provides obvious value and promotes trust. See Gnosis DAO report.

I am concerned about their track record with Gnosis, which has been pointed out (here). For me this is overshadowed by their commitment to a conservative investment strategy.

They represent one of the safest options and have emphasized their commitment to risk management. Still, I am ultimately concerned that the 52M initial fund size increases exposure and is out of touch.

Professional team, Zodaic, Promises Reporting

Avantgarde

This team has been incredibly professional, responsive, and proactive in their interactions with us. The Melon Protocol, now Enzyme, has been around since 2016. Because of this, I have relatively little fear of smart contract risk. Also, their initial allocation size of ~25M makes sense.

Some of the allocations in this proposal trend towards exceptionally risky investments. Specifically, Goldfinch Junior and Senior tranches are non-collateralized loan platforms with a confusing (to me) management structure. I wouldn’t put my own funds here. A rebuttal to this has been posted, but it seems incredibly risky. I know there may be investor relations with Goldfinch on their end. In light of the endowment’s stated goal and our values, these instruments it should not have been included.

Despite this, the 25M initial fund size leaves less exposed than Karpatkey’s 52M. I do believe we could work Avantgarde to ensure our values stay aligned.

Professional Team, Enzyme, Some high-risk instruments

Llama x Alastor

Their initial fund size was entirely too high and has since been changed. I wouldn’t say I like their fees. We had asked them to reduce their fee to a stomachable level, but we will only hit the proposed 1% floor once the fund size reaches more than 50M. I don’t think their services will be provided at a value to the DAO.

During the proposal process I felt that there were mixed-reviews on past performance. I advocated for them to be on the finalist list because they are qualified, but I do not have enough confidence to rank them highly.

Qualified, Mixed Performance Reviews, Potentially low value

My Vote

Avantgarde is my first choice. I beleive we can have a good working relationship with the team to ensure values stay aligned. They have reporting services through Cryptio. For me, the exposure to risk feels relatively low compared the other options.

| Rank | Choice |

|---|---|

| 1. | Avantgarde |

| 2. | Karpatkey |

| 3. | None of the above |

| 4. | Llama |

Note: If you cast a majority vote becuase you aren’t sure, you’re wrong.

For those of us not aware of this situation, can you provide some evidence/detail about this accusation? Prior to this process I was not familiar with any of the top 3 entities, so it’s possible others might be in the same position as me and could benefit from specifics.

Just to be clear, they did nothing wrong. Just my perception. I will rephrase to remove any unintended interpretations.

if you like some particular project but think their fees are too high, choosing “none” above that project is arguably a good way to signal such a thing.

@elisafly and I were chatting and realized that there seems to be some confusion about the value props of each proposal. This is understandable, the proposals are long (we had to get an exception on the post length to post ours!). To help delegates understand the implications of their vote, we’ve put together a quick spreadsheet that compares the three on what we consider to be the main points. It’s available here.

Importantly this is a working document. We’ve tried to be as impartial as possible and request that @llama and @kpk comment in the doc and DM me here (or @Moss if it’s before 9am EST tomorrow) and we’ll update in as close to real time as possible. I posted the same on twitter.

Smart Contracts vs Finance Strategy

fwiw, I’m with @nick.eth and @AvsA on this, the on-chain custody mechanics are my #1 concern with any of the proposals. The finance stuff is all relatively theoretical in comparison, and is easier to adjust later. I appreciated the way @nick.eth and @AvsA broke it down.

Thoughts on proposals

The only group of the 3 I know personally is the Llama crew. That said, I think requiring a DAO-wide vote for each execution is missing the intention behind the RFP, and is simply impractical for a DAO this size.

I’d much rather we do this using a smart custody solution that gives the fund manager the ability to make quick decisions, but keeps the DAO in full control of funds at all times. This is the power a smart-contract blockchain gives us, and we should avail ourselves of that ability!

Finance stuff

I can’t offer smart comment on the finance particulars. The only thing I can say there is I think it’s good that Nick continues to point out that the goal is not to net a “return” for the DAO, but to have a sustainable pool of funds in the future to extend the runway of the public goods mission of the DAO.

Think university endowment, not business.

Advance, advance, stop at nothing to advance

On a personal note, I’d like to see the DAO execute on one of the Gnosis + X solutions, if for no other reason than it will be a very interesting experiment in pushing the envelope of what DAOs can do.

It’s not a break from the “values of web3” or DAOs, as others have suggested, this is how DAOs scale up operations over time: delegating meaningful authority to specialized groups/individuals while still retaining full authority and control of funds, enforced by the unbreakable covenant that is the Ethereum blockchain ![]()

Caney Fork voted:

- Karpatkey

- Avantgarde

- Llama

- None of the above

with its and DXdao’s (46k) ENS tokens.

The three most important items we considered were 1. Fees 2. Financial reporting 3. non-custodial management.

Llama’s fees are too high without a clear understanding of what additional value the extra costs bring.

Karpatkey and Avantgarde both seem like the type of professional manager who can evaluate risk and communicate it to the DAO. We have a slight preference for Karpatkey because their work with Gnosis DAO has overlapped with DXdao a lot, and so we can attest to their work and execution ability.

We are encouraged by the discussion around non-custodial financial infrastructure. Both Avantgarde & Karpatkey have made this a key part of their proposal. ENS should be at the forefront of sovereign treasury management. Again, we have a small preference for the Zodiac module over Enzyme’s. Even though Enzyme infrastructure has been around longer, the Safe ecosystem is a better foundation for DeFi and governance integrations because of its widespread adoption.

Regardless of the selected manager, we think the deployment strategies should be more focused on yield generated through fees (like Uniswap v3) as opposed to token incentives.

Thanks to all who submitted and the stewards for shepherding through the proposals.

I’ve written up a primer on how Ranked Choice voting works, which should help explain how to fill out your vote, and why the results for runners-up are sometimes counterintuitive.

Look I have been trading for almost 30 years now as well as managing my own personal portfolio of assets. While one might invest in an ETF or such that trades in and out of positions (which in the US would incur taxable gains btw) a long term investment portfolio should not be dominated by trading.

IF trading is the way you are going to offer returns I consider this a very high risk investment. It is one reason I was turned off by the ADAM options as they also relied on trading to generate return.

I am going to say this again. It is something I have shared with many DAOs hazarding them taking me up on putting liquidity there decreasing my own personal returns.

Uniswap v2 ETH-USDC LP is earning 8%. The LP value volatility goes as sqrt(ETH_PRICE). Since ENS wants to hold both ETH and USDC this is a no-brainer type of DEX investment that doesn’t require trading, managing or anything. It is a set and forget. This contract auto-compounds and hence DCAs into ETH via fees over time. It earns a high rate of return with a significantly reduced risk profile to ETH. This contract buys ETH when price goes down, and sells it when price goes up provides liquidity for everyone. win-win for the entire ecosystem. This return isn’t based on any farming rewards but is entirely sustained by trading fees. Uniswap v2 contracts I consider to be the most bullet proof and well tested contracts on chain.

But lets be clear there is risk, even if reduced. The above I believe to be the current best way to hold ETH. The beauty of the above btw ‘should Maker keep the ETH-USDC v2 LP as a collateral type’ is that the ENS DAO could borrow DAI (at 1.5%)

should it need cash for any reason. This is true of ETH btw but as one who has used this LP to borrow I can safely say I get more bang for my buck with this collateral than ETH or USDC alone.

This is something else completely ignored in these Treasury Management proposals - the ability to borrow against collateral (must less the collateral earning return). Not saying ENS needs to borrow at all, but every organization when it comes to finances should consider access to capital.

This achieves more or less the opposite of the goal of the endowment. If ETH goes down in price for a prolonged period, the DAO is left with more ETH and less USD, with no choice but to sell ETH at low prices in order to fund operations.

Again, the primary goal of the endowment is to ensure ENS’s long term viability. That’s achieved with a portfolio that is stable in USD terms, takes minimal risks, and offers returns sufficient to fund operations.

The above is simply one suggestion for a long term investment that easily can generate significant return without a manager, or fees, that supports the ETH ecosystem in a way that reduces portfolio volatility risk. One could easily have a few of these. My point is that ENS DAO doesn’t need to have a manager, or pay fees, or even hazard any form of centralization risk(s) to achieve its basic long term goals.

I guess we shall have to wait and see if ENS holders are willing to give up much of the current treasury as well as the next 1-3 years of revenues to be put into a single manager. I wouldn’t do this personally and find the more successful investors and businesses to be well diversified on all fronts, both from asset management (and managers) to debt obligations and access to capital via debt.

I think another factor to consider is this. Typically the one who gets the job, is the one who most want it (all other things being equal).

From what I’ve seen Avantgarde team been hugging the issue pretty closely, monitoring social media and forum, tackling all the questions, actively debating and defending own position.

Llama was also good at that, but that’s not “all other things being equal” because there were some concerns about operational approach - fee and voting, which is causing some pushback from the community.

I can see, that Karpatkey is also somewhat involved in the discussion but it feels not to the extent the other two. This also tells me something about how the work will be prioritised within Karpatkey. That’s not to say, that K is not a good service, clearly one of the powerhouses in the industry, but it certainly is a good idea to have provider which is monitoring your specific case very closely.

Let’s say if you were to choose between two lawyers, to represent your case, which may be not that big in the grand scheme of things, but very sensitive to you personally. One choice is large well established firm, with proven track record, but the chances are that you’ll never get any attention from senior partner, second choice would be smaller / niche / boutique firm (whichever way you want to call it) which will provide to you undivided attention.

This is very subjective choice, some people might go for a larger firm just because. Delagates please make up your mind

Again, we have a small preference for the Zodiac module over Enzyme’s. Even though Enzyme infrastructure has been around longer, the Safe ecosystem is a better foundation for DeFi and governance integrations because of its widespread adoption.

I can’t emphasize enough how different the Zodiac module approach is compared to Enzyme. I haven’t seen audits on the Zodiac contract KK plans to use, no code, no docs or any thinking around how it prevents misappropriation of funds with the various protocols they want to use. There are different ways of ‘hacking’ funds from a SAFE depending on which protocol you’re interacting with.

Some recommended reading (short twitter thread)

Hi Spike,

I’m Defi Foodie from Karpatkey. I understand your point around focus. If we are elected, we will have a dedicated team of full-time collaborators only on ENS. This has been part of our proposal from the beginning:

- 1 FT Endowment Manager (Overseeing the treasury and its alignment with the ENS DAO)

- 1 FT Financial Engineer (Responsible for financial modelling, and reporting)

- 1 FT Operations Engineer (Taking care of strategy maintenance and transaction execution)

They will work hand in hand with our other teams: Research & Strategy, Risk Management, Tech and Reporting. We will also have a frequently maintained emergency protocol in place, and we’ll be available to act quickly in case of a contingency like a sudden market downturn.

Regarding our participation in this forum and social media, we have been answering questions and technical specifics and adding our two cents when we thought it was necessary. We’ve also published a summary including a short video. This is an important and highly technical process that should be weighed on the merits of each proposal. We don’t believe ENS should be investing in risky, undercollateralized strategies. We don’t believe there is a substantial technical difference between plug-in X and Y as Mona describes. We believe our risk management framework is the main differentiator of our proposal.

We’re trying to find a balance between being responsive and not generating noise in the forum, including not voting ourselves. The community should make a sober decision based on merits and facts. If there are any comments you think we should address, please describe them and we’d be happy to go into more detail.