Hey Frens ![]()

Yesterday I tweeted about this (1,2,3,4). And although I got some great replies by @184.eth and others, my question still hasn’t really been answered, so I thought I’d write a temp check. To hear the opinions of delegates and other interested people.

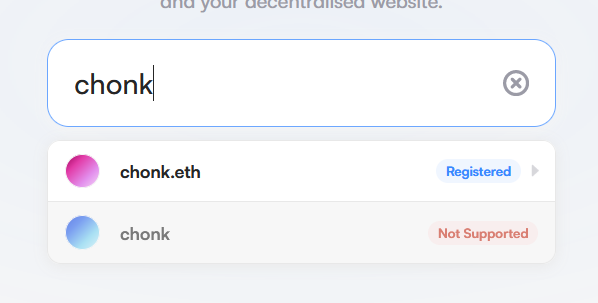

Currently when a .eth expires, after it goes through a 90 day grace period, it becomes available for general registration again. To prevent this from becoming a race, a ‘temporary premium’ is attached that starts at $100 million and exponentially decreases to zero over 21 days; ‘the dutch auction’. This premium fee goes to the ENS treasury just like the yearly registration fee.

I am curious, what is the reason that ENS receives the proceeds of the dutch auction instead of past owners? Wouldn’t that be more fair? If ENS gets to sell my .eth if I forget to renew it, doesn’t that mean that ENS owns it a little bit too? And shouldn’t I be the owner?

For context, ENS revenue from premium registration fees in 2023 was $3.84m (in eth) over 36k names, in 2022 $9.08m over 255k names and in 2021 $2.01m over 6774 names. The total revenue of registration + renewal fees in 2023 was $18.9 million, in 2022 $50.2m, in 2021 $26.1m. I’m unsure how correct this info is tho, the source is ENS on dune, but revenue data on steakhouse differs. Anyway, its not nothing.

In order to prevent me from registering all the possible .eth names, registration fees exist. A consequence of those registration fees is that names expire. But not that when a name expires it goes to auction, of which the proceeds go to ENS. That’s just another rule. And for what?

According to the ENS Constitution the only way for ENS to justify fees, presumably because fees infringe upon name ownership, is if they “prevent the namespace from becoming overwhelmed with speculatively registered names. A secondary purpose is to provide the DAO with enough revenue to fund ongoing development and the improvement of ENS”. So, does ENS receive premium fees because if the owners would receive them instead there would be overwhelming speculation? And why would that be the case?

Or is that wrong framing? Is ENS receiving the premium fee simply not infringing upon name ownership? I feel like ENS has at least the responsibility to justify this, what stops ENS from arbitrarily introducing new fees otherwise, if there are no requirements for raising them? I have only been able to find one mention, by @slobo.eth, of this choice in the many topics about the dutch auction(1, 2, 3) on the forum: “Given a choice between intermediaries profiting of expiring domains and ENS profiting of them, it is preferable that ENS does.” But even if that is preferable, is ENS profiting from premium fees in the spirit of the ENS Constitution?

To prevent gaming of the grace period through short registrations and reregistrations I would propose for only the amount above the value of the grace period to go to previous owners. So everything below ~$160 for 3L, ~$40 for 4L and ~$1.25 for 5L still would go to ENS. Seems like a clean option.

Love to know what others think. gm

broke.eth