ENS Endowment Proposal

This is a proposal to provide an automated endowment fund for ENS DAO’s current treasury and ongoing revenue. The goal is to ensure a stream of revenue for the DAO to support its core operations while minimizing custodial risk by limiting what actions a manager can do with Mimic.

1. About Mimic

Mimic is a platform that allows you to deploy tailored infrastructure to automate (and/or delegate) access to DeFi, in a secure and 100% non-custodial way. Mimic is especially suitable for treasury management, where you can simplify and speed up complex tasks while standing on top of every detail. This is achieved through our innovative Smart Vaults concept: an automated and trustless solution that can be customized to suit your operation needs.

Deploying a Smart Vault is simple. We only need to figure out the best management and investment strategy that better suits your needs and configure one for you. Moreover, Mimic provides you with lots of multi-layer flexibility, it can be easily scaled up by deploying and connecting additional Smart Vaults.

Our team members have a large experience in blockchain and especially in DeFi protocols. We have previously worked for many well-known projects like Aave, Balancer, Open Zeppelin, Aragon, POAP and The Graph.

2. Specification

We propose to create an automated endowment fund where operations can be predefined and customized to limit how they can be executed in a trustless way. This will be achieved by deploying customized Smart Vaults for ENS DAO.

Our proposal is to configure a few DeFi investment strategies for the ENS Smart Vaults along with a set of automated actions to make sure we can provide a secure and smooth experience. The ENS Smart Vaults will be fully owned by ENS DAO, funds will never be controlled by anyone else and these can be withdrawn by the ENS DAO at any point in time.

Actions will only be allowed to invest any deposited assets in the list of strategies that were authorized by the ENS DAO beforehand. Additionally, these actions will be in charge of re-investing yield revenue periodically. On the other hand, in order to pay expenses, an automated action will be set up to withdraw a portion of that revenue to the ENS DAO. Note that all this behavior will be enforced by smart contracts code, actions won’t be allowed to perform any further logic.

Optionally, rebalancing actions can be set up to make sure ENS Smart Vaults are properly balanced over time. Moreover, the ENS Smart Vaults behavior is not set in stone, additional investment strategies or new automated actions can be configured in the future with the DAO’s approval.

3. Treasury diversification

We understand that the goal of the DAO is not to make a 5x on its treasury, but to earn enough revenue to pay operational costs. This is why we suggest tackling this issue in a progressive and secure way, with incremental deposits and enabling low-risk strategies for the ENS Smart Vaults, while having the chance to include others in the future in case it is desired.

Here is the list of low-risk investment strategies we think the ENS DAO should start with:

- Unearned income, two pools with ETH and staked ETH related risk.

- Curve stETH (ETH + stETH) ~ APY 4%

- Balancer stETH (ETH + wsteth) ~ APY 3.5%

- Earned income, linked to USD

- Balancer Boosted AAVE USD (aUSDT + aUSDC + aDAI) ~ APY 7%

DeFi Safety score:

Curve: 93% (more info)

Balancer V2: 94% (more info)

These rates are computed considering:

- 1-year average APY

- No boosting based on exchanges’ native token staking

- Bear-markets conditions

To continue a progressive way of working, we suggest a vesting approach where current treasury income is transferred to Smart Vaults in a series of stages while future income will be collected automatically.

Considering current market conditions and income stream from earned and unearned revenue, ENS DAO will reach ~4M USDC for annual operating expenses in less than 2.5 years depending on how much of the treasury is allocated.

Up to this day, Mimic already has strategies implemented for many popular DeFi protocols such as Uniswap, Balancer, Aave, Compound, and Curve. However, as mentioned above, we suggest starting with a more conservative approach but remaining flexible to invest in higher-risk strategies in the future if desired.

4. Technical details

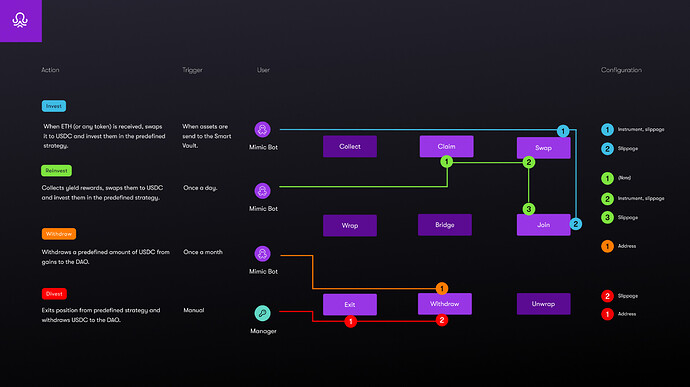

Mimic will deploy two Smart Vaults, one for earned income and another one for unearned income. Both Smart Vaults will be owned by the DAO and contain a series of predefined actions to manage the assets automatically or manually.

Here is a proposed list of actions for the earned income Smart Vault:

| Number | Name | Description | Executed by |

|---|---|---|---|

| #1 | Invest | When ETH (or any token) is received, swaps it to USDC and invest them in the predefined strategy. | Mimic bot |

| (automated) | |||

| #2 | Reinvest | Collects yield rewards, swaps them to USDC, and invests them in the predefined strategy. | Mimic bot |

| (automated) | |||

| #4 | Withdraw monthly | Withdraws a predefined amount of USDC from gains to the DAO on a monthly basis. | Mimic bot |

| (automated) | |||

| #5 | Divest | Exits position from predefined strategy and withdraws USDC to the DAO. | Manager |

| (manual) |

This architecture assumes that assets are sent by the ENS DAO to the Smart Vault to start managing them automatically. However, Smart Vaults can be configured to collect assets from a wallet or smart contract if needed.

Similar actions will be configured for the Smart Vault for unearned income, with the difference that it will handle and allocates ETH instead of USDC.

In case external conditions change, the deployed infrastructure can be adjusted as necessary on an ongoing basis to reach the endowment’s objectives. Smart Vaults provide full flexibility to add new allow-listed actions, change permissions or incorporate new strategies.

For example, if a new strategy is added to the Smart Vault for unearned income to diversify 50% of its allocation to it, then an action to move assets between them can be easily created and automated.

More information here: https://docs.mimic.fi/general/how-it-works

5. Operational details

5.1. Reporting

Mimic offers a reporting site where users can follow all their Smart Vaults activity. Mimic also supports subscribing to a notifications service that can be easily integrated with some chat rooms like Discord. Additionally, users can subscribe to be notified with periodic reports that will be emitted by Mimic automatically. These reports include details such as yield revenue, charged fees, treasury diversification, and transaction activity, among others.

5.2. Maintenance

Mimic will be in charge of monitoring the ENS Smart Vaults on a daily basis, making sure the reporting tools are kept up-to-date accordingly. Additionally, Mimic will make use of its own bots infrastructure to execute the automated actions when needed.

5.3. Performance fees

Mimic will charge a 4% performance fee based on the yield revenue coming out of the investment strategies set up for the ENS Smart Vault.

5.4. Termination

As mentioned before ENS DAO will be in full control of its Smart Vault and the funds that were deposited into it. This means ENS DAO is allowed to exit at any point in time. Neither Mimic nor anyone else, unless it was previously allowed by the ENS DAO, will be never in control of those funds.

6. Timeline

Once the final details of the ENS Smart Vaults are finalized, the Mimic team will take full responsibility to set up the required automated actions and investment strategies. Mimic already counts with infrastructure to deploy and test Smart Vaults that can be applied for this use case.

Assuming the proposed investment strategies and automated actions are accepted by ENS DAO, setting a Smart Vault for it shouldn’t take longer than a month. After that, we will schedule an audit process for the configuration before the deployment which shouldn’t take more than two weeks.

7. Contact

Website — mimic.fi

Docs — docs.mimic.fi

Whitepaper — mimic.fi/whitepaper

Twitter — twitter.com/mimicfi

Discord — discord.mimic.fi

Medium — medium.com/mimicfi