The March 2025 Endowment Report is now available on karpatkey’s website.

kpk is pleased to present its Community Update for the month of March to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

- March continued to see heightened volatility across macro and crypto, with crypto being whiplashed by macro headlines surrounding trade war / tariffs. Reintroduction of sweeping tariffs has disrupted markets and increased concerns about inflation and recession. The Fed held interest rates unchanged at 4.25%-4.50% and in line its 2025 interest rate projections.

- The total implied network value (market cap) of the digital asset market stood at $2.76tn at the end of March, down 5.3% from February ($2.92tn).

- Over the month of March, BTC showed relative strength, as market prices dipped ‘only’ 2.3% (vs. -6% for S&P 500 Index), while ETH suffered net decreases amounting to 18.4% on the month.

- Bitcoin’s dominance continued to inch upwards, reaching 62.8%, up 3.8% from the end of February.

- Major market news:

- The White House confirmed the issuance of an executive order establishing the long-awaited Strategic Bitcoin Reserve and Digital Asset Stockpile. The stockpile will use tokens (estimated 200k BTC) already owned by the US government. The executive order disappointed some in the market, who had hoped for purchase of new tokens.

- Gamestop announced updates to its Investment Policy, approving Bitcoin as a treasury asset, and completing a $1.5b debt offering, with the proceeds earmarked for strategic purchases of BTC and dollar-denominated stablecoins.

ENS Token Update

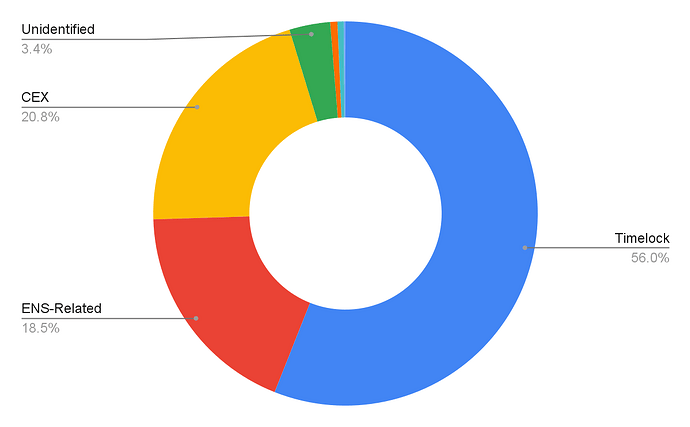

- Token holder distribution across the Top 50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (“CEXs”) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price dropped 26.5% in March, outpacing the drawdown in ETH, and therefore resulting in a decline in the ENS/ETH ratio.

- Trading volume continued to drop on CEXs. Binance’s ENS/USDT daily spot trading volume fell 23% from 509k ENS/day to 390k ENS/day, whilst Upbit’s ENS/KRW daily spot trading volume dropped 29% from 1.0 ENS/day to 733k ENS/day.

- Meanwhile, decentralised exchanges (“DEXs”) bucked the trend, as the Uniswap V3 ENS/WETH (0.3%) pool saw trading volume increase an inch (4%) from 52k ENS/day to 54k ENS/day.

DAO Financial Update

Endowment Update

Please refer to the March kpk monthly report for further details.

- Asset Allocation

- Assets under management (“AUM”) of $74.8M, with capital utilisation ratio of 99.9%.

- Endowment Allocation split into 68% ETH ($51M) and 32% Stablecoins ($24M).

- Yield Generation (“DeFi Results”): $232k gross yield generated in March.

- Marked-to-market (“MTM”) valuation: ENS Endowment’s suffered from an $11.2M drawdown in its MTM valuation. This was primarily due to the decrease in ETH token price from $2,333 to $1,826 throughout March.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) is to Sky/Maker, as DAI/USDS continued to offer higher yield when compared to. USDC in other lending markets. However, Sky/Maker continued to reduce its Dai Savings Rate in March, bringing the rate down from 4.75% at the start of March to 3.5% at the end of March. This resulted in a narrowing of the interest-rate differential across various lending markets, reducing the attraction to DAI/USDS over other assets.

- On-chain yields have been trending lower than off-chain yields throughout March, as US Fed Funds Rate stands at 4.25-4.50%. This is a sign of firmly bearish sentiments across the on-chain economy.

- The Endowment’s introduction of RWA through its upcoming Permissions Update #6 will allow kpk to deploy its assets into RWAs with flexibility, and to take advantage of the difference between on-chain and off-chain yields.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

- Endowment’s biggest position (protocol exposure) is to Sky/Maker, as DAI/USDS continued to offer higher yield when compared to. USDC in other lending markets. However, Sky/Maker continued to reduce its Dai Savings Rate in March, bringing the rate down from 4.75% at the start of March to 3.5% at the end of March. This resulted in a narrowing of the interest-rate differential across various lending markets, reducing the attraction to DAI/USDS over other assets.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the March Steakhouse monthly report.

Other Updates

-

Permissions Update #6 for the Endowment has been posted, and will be put to vote in the upcoming voting cycle.

-

TWAP to procure USDC for the ENS DAO is undergoing execution, but has been disrupted due to volatilities in the price of ETH. The execution limit price was initially set at $2,062, but the ETH price has subsequently broken firmly below the psychological $2,000 level. In total, 3,000 ETH has been sold at an average price of $2,556. For the month of March, 833.33 ETH was sold at an average price of $2,156.