The April 2025 Endowment Report is now available on karpatkey’s website.

kpk is pleased to present its Community Update for the month of April to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

- Financial markets were volatile in April, driven by US trade policy and President Trump’s announcement of tariffs that were broader and more punitive than expected. Following an initial, sharp sell-off across risk assets and extreme market volatility (VIX spiked to 60, the highest level since the pandemic), the market recovered through the month. Gold (reached all-time-high of $3,500/oz) and bitcoin shone through the turmoil as the market bidded assets that typically outperform in heightened geopolitical tensions and flush liquidity conditions.

- The total implied network value (market cap) of the digital asset market stood at $3.06tn at the end of April, up 10.6% from March ($2.76tn).

- Over the month of April, BTC showed relative strength, as price gained 14.2% (vs. -0.7% for S&P 500 Index), while ETH ended the month down 1.7%.

- Bitcoin’s dominance retraced slightly, from 62.8% in March to 61.7%.

- Major market news:

- Repeal of the Biden-era crypto tax rule: Trump signed into law a bill to overturn a revised rule from the Internal Revenue Service that expanded the definition of a broker to include decentralised exchanges (DEXs)

- Launch of 21 Capital, backed by Tether and SoftBank, signalled further institutional interest for Microstrategy- type vehicles for Bitcoin exposures. Twenty One expects to launch with more than 42,000 Bitcoin (~$4.2bn), which would make it the third-largest Bitcoin treasury in the world.

ENS Token Update

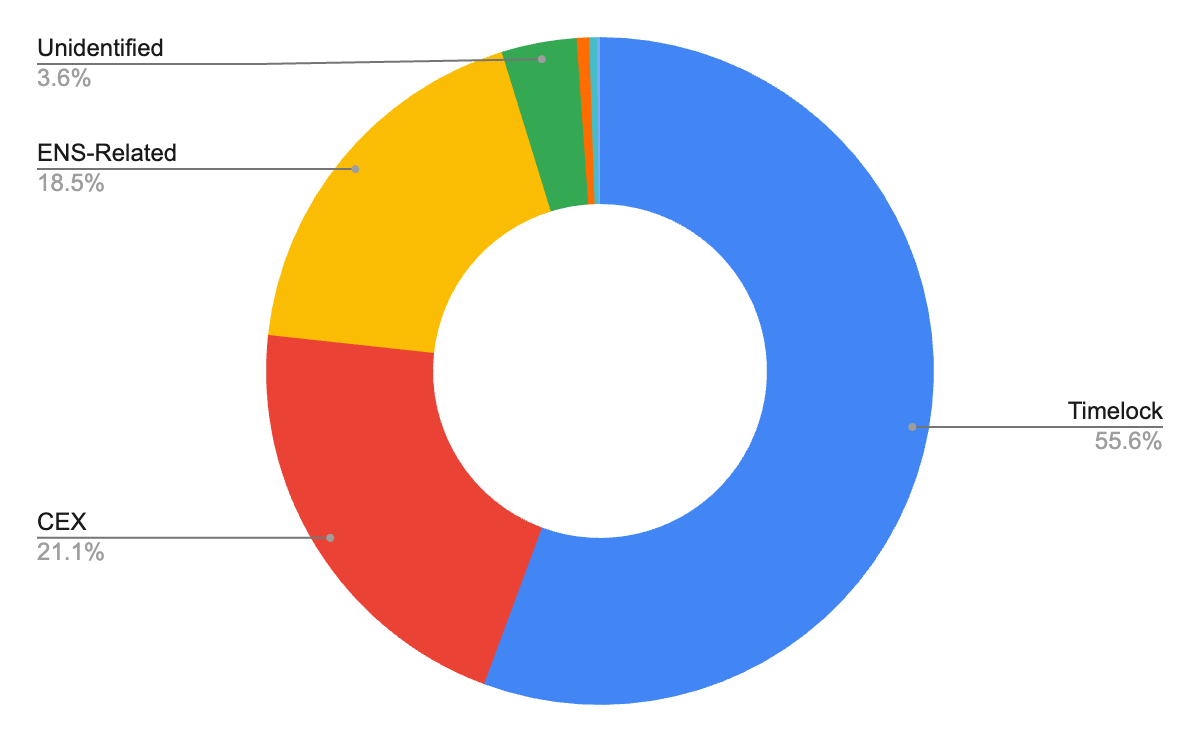

- Token holder distribution across the Top 50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (“CEXs”) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price increased 17.1% in April, outperforming both BTC and ETH.

- Trading volume showed a mix bag as Binance’s ENS/USDT daily spot trading volume rose 9% from 390k ENS/day to 425k ENS/day, whilst Upbit’s ENS/KRW daily spot trading volume dropped 12% from 733k ENS/day to 647k ENS/day.

- Meanwhile, Uniswap V3 ENS/WETH (0.3%) pool’s trading volume saw an uptick (+6%) from 54k ENS/day to 58k ENS/day.

DAO Financial Update

Endowment Update

Please refer to the April kpk monthly report for further details.

- Asset Allocation

- Assets under management (“AUM”) of $74.1M, with capital utilisation ratio of 99.9%.

- Endowment Allocation split into 67% ETH ($50M) and 33% Stablecoins ($24M).

- Yield Generation (“DeFi Results”): $192k gross yield generated in April.

- Marked-to-market (“MTM”) valuation: ENS Endowment’s AUM was largely flat, with small drawdown of $805k in its MTM valuation.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) is to Sky/Maker, as DAI/USDS continued to offer higher yield when compared to USDC in other lending markets. However, Sky/Maker continued to reduce its Dai Savings Rate in April, bringing the rate down from 3.5% (at the start of April) to 3% (at the end of April), whilst keeping its Sky Savings Rate steady at 4.5%. This resulted in a narrowing of the interest-rate differential across various lending markets, reducing the attraction to DAI/USDS over other assets.

- On-chain yields have been trending lower than off-chain yields throughout April, as US Fed Funds Rate stands at 4.25-4.50%, signalling bearish sentiments in the crypto space.

- The Endowment will migrate its DAI positions to USDS positions with the passing of Permissions Update #6, which should give a boost to the Endowment returns.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

- Endowment’s biggest position (protocol exposure) is to Sky/Maker, as DAI/USDS continued to offer higher yield when compared to USDC in other lending markets. However, Sky/Maker continued to reduce its Dai Savings Rate in April, bringing the rate down from 3.5% (at the start of April) to 3% (at the end of April), whilst keeping its Sky Savings Rate steady at 4.5%. This resulted in a narrowing of the interest-rate differential across various lending markets, reducing the attraction to DAI/USDS over other assets.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the April Steakhouse monthly report.

Other Updates

- Permissions Update #6 for the Endowment has been passed

- TWAP to procure USDC for the ENS DAO has been halted due to ETH trading firmly below $2,062, which was the limit price of the TWAP execution. Once the TWAP expires on May 9, 2025, the TWAP will be re-initiated.

- Changes to the Financial Reporting: we have incorporated community feedback with regards to presenting financial statements both with and without $ENS tokens.

- Public Endowment Dashboard: to increase transparency to Endowment activities and performance, we have created a Public Endowment LookerStudio Dashboard; it is still a work in progress, but offers more granular information with regards to the Endowment.