The May 2025 Endowment Report is now available on karpatkey’s website.

kpk is pleased to present its Community Update for the month of May to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

- The market continued its positive momentum in May as concerns over aggressive tariff threats and trade wars were alleviated, and institutional inflows continued.

- BTC (+12%) reached a new all-time high of $112k mid-month, whilst ETH (+47%) strongly outperformed, firmly reclaiming the psychologically-significant $2k level.

- ETHBTC bounced from local lows of 0.018 and ended the month at 0.02416. May was also marked by a bifurcation of performance across the crypto space; despite strong ETH outperformance relative to BTC, most other altcoins (except for memecoins and HYPE) struggled to outperform Bitcoin (XRP -3%, BNB +10%, SOL +7%).

- The end result was an increase in Bitcoin dominance by 1.82 percentage points (from 61.68% at the start of May to 63.50% at the end of May).

- The total implied network value (market cap) of the digital asset market stood at $3.37tn at the end of May, up 10.4% from April ($3.06tn).

- Despite the general market rally, funding rates (both on-chain and off-chain) and open interest still remained subdued, potentially reflecting higher levels of sidelined capital and/or retail and long-term holders selling. This indicates that such short-term rallies are not yet indicative of a longer-term bullish trend, indicating that caution in approach may still be prudent.

A few interesting developments in the crypto space in May were

- Increasing numbers of entities are copying the Microstrategy playbook (i.e. using financial engineering to purchase Bitcoin or other cryptocurrencies to become crypto treasury companies).

- Strategy (formerly Microstrategy) further entered into sales agreement to issue and sell up to $2.1bn worth of its Preferred Stock.

- Metaplanet (a publicly-listed company on the Tokyo Stock Exchange) announced it will adopt Bitcoin as a strategic treasury reserve asset, citing Japan’s poor macroeconomic environment and a weak JPY as motivating factors. It will be leveraging cheap JPY borrowing costs to issue long-dated JPY liabilities to buy Bitcoin (JPY/Bitcoin carry trade).

- SharpLink (SBET) announced a $425M private placement to initiate a first-of-its-kind Ethereum treasury strategy. SBET rallied from $33.93 to a high of $124, but has since mostly retraced its gains.

- Trump Media (DJT) announced that it will raise about $2.5bn ($1.5bn via shares, $1bn via convertible notes) to invest in Bitcoin as it looks to diversify its revenue.

- Circle filed for public listing on the NYSE under the ticker symbol “CRCL”, with target valuation of up to $6.71bn.

- CRCL opened at $69 on June 5th 2025, and finished its first week of trading at $117.2, making its market capitalisation over $26B. Comparing to on-chain tokens, this valuation would make CRCL a top 10 token by market cap.

Off-chain markets have proven to be exciting. Following the successful initial public offering (IPO) of Circle, we expect more crypto companies to target IPOs in the near future, as investor appetite for crypto stocks increases. Crypto treasury companies have also been getting rewarded for buying Bitcoin, and have outperformed Bitcoin in the last 1 year, leading to a virtuous cycle for the growing number of crypto treasury companies.

However, if this trend reverses and the market stops allocating surplus value to corporations following a strategy of buying crypto (as it did for DJT and Gamestop), corporate demand for Bitcoin may start to dry up. In such circumstances, the premium to net asset value (NAV) of these crypto treasury companies would likely compress eventually, like it did for Grayscale’s premium last cycle. We continue to observe these structural drivers as we formulate our market view, and apply caution in the face of short-term market rallies given the backdrop of a lack of participation and compressing premiums.

ENS Token Update

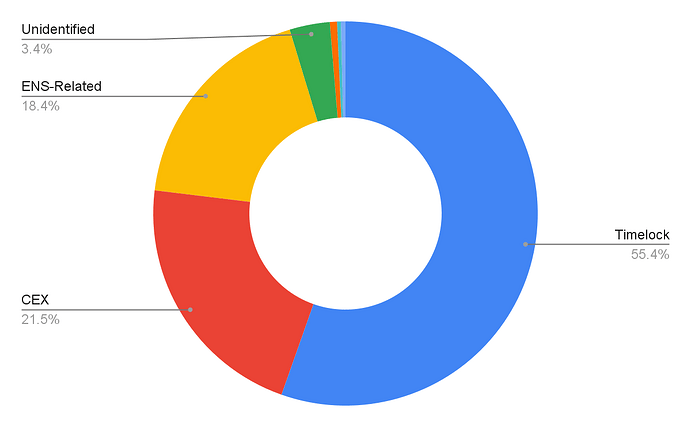

- Token holder distribution across the Top 50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (“CEXs”) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price increased 12.4% in May, narrowly outperforming BTC (but not ETH). Trading volume for ENS picked up strongly.

- On the CEX side, Binance’s ENS/USDT daily spot trading volume rose 16% from 425k ENS/day to 495k ENS/day, and Upbit’s ENS/KRW daily spot trading volume rose 27% from 647k ENS/day to 779k ENS/day.

- On the DEX side, Uniswap V3 ENS/WETH (0.3%) pool’s trading volume saw a good increase of 27% from 58k ENS/day to 74k ENS/day.

DAO Financial Update

Endowment Update

Please refer to the May kpk monthly report for further details.

- Asset Allocation

- Assets under management (“AUM”) of $94.9M, with capital utilisation ratio of 100.0%.

- Endowment Allocation split into 74% ETH ($71M) and 26% Stablecoins ($24M).

- Yield Generation (“DeFi Results”): $241k gross yield generated in May.

- Marked-to-market (“MTM”) valuation: ENS Endowment’s AUM enjoyed a sharp increase from last month, due to $20.5M increase in its MTM valuation.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) has been migrated from DAI (in Dai Savings Module) to USDS (Sky Savings Module) after successful passing of Permissions Update #6. Sky Savings Rate currently stands at 4.5%, offering still- higher yields compared to Aave and Compound USDC lending markets, but lower than other lending markets, such as Morpho, Euler, and Fluid.

- LP positions on Curve and Balancer (as well as Convex and Aura) have been yielding below ETH staking rates due to reduced emissions of incentives (in $ terms). As such, those LP positions have been disassembled and the Endowment is holding LST positions instead, reducing a layer of risk.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the May Steakhouse monthly report, which now presents financial statements both with- and without $ENS tokens.

Other Updates

- TWAP to procure USDC for the ENS DAO Wallet has concluded successfully. Between Feb 7, 2025, and June 4, 2025, 6,000 ETH was swapped for 15.32M USDC (an average price of $2,553). During this period, the average price of ETH was $2,160, effectively saving the DAO $2.36M through prudent execution.

- The initial TWAP expired on May 9, 2025. As ETH traded below the TWAP limit price of $2,062 from March to May, the TWAP execution was incomplete. When the price of ETH fell, the community endorsed the plan to wait for the price to rebound, instead of setting a new TWAP with a lower limit price. On May 16, 2025, the second TWAP was set and has been successfully completed. Details of the trades can be seen on Cow Explorer, and are detailed below:

- Initial block swap: 1,000 ETH swapped for $2.79M USDC (at average ETH Price of $2,788)

- First TWAP (Order Details: 5,000 ETH swap over 90 days; limit price of $2,062): 2,111 ETH swapped for $5.11M USDC (at average ETH price of $2,423)

- Second TWAP (Order Details: 2,889 ETH swap over 20 days; limit price of $2,062): 2,889 ETH swapped for $7.42M USDC (at average ETH price of $2,568)

- The initial TWAP expired on May 9, 2025. As ETH traded below the TWAP limit price of $2,062 from March to May, the TWAP execution was incomplete. When the price of ETH fell, the community endorsed the plan to wait for the price to rebound, instead of setting a new TWAP with a lower limit price. On May 16, 2025, the second TWAP was set and has been successfully completed. Details of the trades can be seen on Cow Explorer, and are detailed below: