ENS Monthly Community Update - August 2025

The August 2025 Endowment Report is now available on kpk’s website.

kpk is pleased to present its Community Update for the month of August to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

The digital asset market closed August on a strong note, with both BTC and ETH reaching new all-time highs (ATHs).

- BTC (-4.5% for the month) reached a new ATH of $124.12k mid-August, before retracing to close the month at $108.41k. ETH (+18.4% for the month) outperformed the broader market, peaking past $4.95k before closing the month at $4.38k.

- Institutional inflows slowed down to $4.37B, driven by growing adoption of ETH-based products ($3.96B), but partially offset by outflow from BTC-products (~$301M).

- Bitcoin dominance declined further (from 61% to 58%), driven by strong ETH outperformance. Some exchange-related tokens also made strong gains (OKB +262%, CRO +113%, MNT +67%, KCS +38%). OKB was up sharply after OKX announced the token supply will be cut in half. CRO was up on news of a new digital asset treasury company that will hold CRO, established in partnership with the Trump family. Other strong performers were LINK +48%, POL +43%, PUMP +36% and ARB +36%.

- The rest of the Top 20 digital assets by market cap showed mixed returns, with most underperforming ETH (XRP -5%, SOL +23%, BNB +13%, HYPE +3%).

- The worst performers for the month were BONK -17%, PENGU -16% and surprisingly SKY -16% as it failed to capitalize on the wider stablecoin narrative in August.

- The total implied network value (market cap) of the digital asset market stood at $3.84tn at the end of August and was largely flat for the month.

- Crypto funding rates fluctuated significantly during August without reaching extreme levels:

- Off-chain Funding Rates: Both BTC and ETH funding rates stayed between 5% to 12% on Binance despite choppy price action. Open interest for Binance BTC and ETH was almost flat (BTC Perps: 130k to 131k (BTC), ETH Perps: 2.56M to 2.64M (ETH))

- On-chain Funding Rates: On Hyperliquid, the rate fluctuations were much more pronounced; ETH funding moved between -6% and 38%, while BTC funding was between 5% and 38%. Interestingly, open interest for ETH and BTC was almost equal at $3.70B towards the end of the month.

Several notable developments in the crypto space during August were:

- Digital asset treasuries continued gaining traction, driving ETH demand.

- Tom Lee’s BitMine Immersion Tech (BMNR), which is targeting to hold 5% of total ETH supply, bought almost 1.30M ETH in August, and finished the month with a total of 1.80M ETH in their treasury.

- Sharplink (SBET) also continued to stack their ETH treasury, growing from 361K to 798K ETH.

- Other companies like The Ether Machine (DYNX) and ETHZilla Corporation (ETHZ) also followed suit. The total ETH held by public companies is now a staggering amount of 3.5M ETH or about 3% of the total token supply.

- In a landmark shift, the Commodities Futures Trading Commission announced that spot crypto asset contracts can now be traded on futures exchanges under its jurisdiction—ushering in enhanced federal-level clarity and collaboration with the SEC under “Project Crypto.”

- BlackRock crossed $100 billion in crypto holdings. As of August 14, BlackRock has accumulated approximately $104.00B in crypto assets, with Bitcoin comprising the lion’s share—underscoring a massive institutional commitment to digital assets.

- Crypto enters U.S. retirement plans as a Trump administration executive order now permits 401(k) and other retirement plans to invest in cryptocurrency investment vehicles, private equity as well as other alternative investments, potentially opening trillions in new capital flows, while raising concerns about risk for ordinary savers.

As we pointed out in last month’s report, many digital asset treasury companies are now trading below a multiple of net asset value (mNAV) of 1, meaning the market values these companies below their net asset value. This suggests that the frenzy of DAT may begin to slowly fizzle out, potentially leading to the drying up of corporate demand for crypto. This dynamic remains a vital market signal, and we are monitoring it closely as part of our treasury outlook.

ENS Token Update

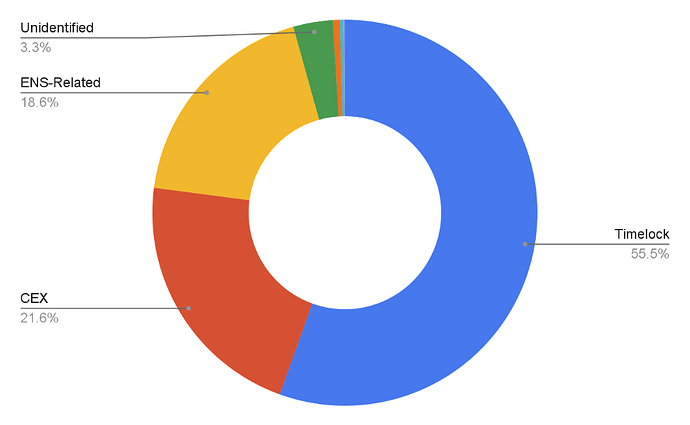

- Token holder distribution across the top-50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (‘CEXs’) and ENS-related wallets (DAO, ENS Labs, etc.).

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- The ENS token’s price dropped 12% in August, underperforming both BTC and ETH as crypto majors siphoned liquidity from smaller-cap tokens.

- Trading volume for ENS was lower in August as well. On the CEX side, Binance’s ENS/USDT daily spot trading volume fell from 653K ENS/day in July to 481K ENS/day in August, and Upbit’s ENS/KRW volume fell from 1.2M ENS/day to 974K ENS/day.

DAO Financial Update

Endowment Update

Please refer to the August kpk monthly report for further details.

- Asset Allocation

- Assets under management (AUM) of $145.7M, with a capital utilisation ratio of 100.0%.

- Endowment Allocation split into 73.3% ETH ($106.8M) and 26.7% stablecoins ($38.9M).

- Yield Generation (“DeFi Results”): $370.5k gross yield generated in August.

- Marked-to-market (“MTM”) valuation: increased by $18.4M, driven by the rise in ETH price.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) consists of staked ETH in Stader and Stakwise v3, each comprising about 21% of total funds. On the stablecoin side, sUSDS (Sky Savings Rate) is the highest allocation complemented by small allocations to Compound v3 and Aave v3. Morpho lending markets will be introduced following the next permissions update request, further allowing the Endowment to diversify its protocol distribution.

- Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

For further details on our financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the August Steakhouse monthly report, which now presents financial statements both with- and without $ENS tokens.

Other Updates

- Starting July 24th, the Endowment started rebalancing by selling ETH. ~2,486 ETH were sold in August at an average price of ~$4.04k, netting ~$10.04M in stablecoins, which were deployed into yield-generating strategies.

- In total, ~3,63k ETH were sold at an average price of ~$3.95k, netting ~$14,35M in stablecoins.

- Permissions Update Request #6 has been posted on the ENS forum; the permissions update continued to focus on diversification of protocols, and alignment of permissions with evolving market landscape and liquidity.