ENS Monthly Community Update - September 2025

The September 2025 Endowment Report is now available on kpk’s website.

kpk is pleased to present its Community Update for September to the broader ENS Community, to increase awareness and transparency of its activities.

Market Update

The digital asset market consolidated in September following the record highs of August. While volatility remained elevated, major assets saw a rebalancing of flows and relative positioning.

Market Performance

- BTC (+4.85.% for the month) traded lower after failing to reclaim its $124k ATH, closing September at ~$113k. Market sentiment around BTC weakened amid continued outflows from institutional products.

- ETH (-5.68% for the month) remained resilient, briefly testing the $4.7k level before closing the month at $4.11k. ETH remained the top institutional focus, with derivatives activity and treasury accumulation providing strong demand support.

Institutional Flows

Public ETF data showed that institutional flows cooled in September, with net inflows of ~$1.4 billion into Bitcoin ETFs, while Ethereum ETFs recorded net outflows of ~$669 million, reversing the prior month’s rotation trend toward ETH.

Market Structure & Dominance

- Bitcoin dominance declined from 58% to 55%, driven by ETH’s continued strength and increased participation in mid-cap assets.

- Exchange-related tokens remained in focus, though returns were more muted than in August: OKB (+22%), CRO (+14%), MNT (+8%), KCS (+5%).

- Other notable movers: LINK (+17%), ARB (+12%), DOGE (+9%), while POL (+3%) and PUMP (+2%) slowed after strong August gains.

Underperformers

Underperformers included BONK (-12%), PENGU (-9%), and SKY (-8%), all of which failed to recover from their losses in August.

Market Capitalisation

The total digital asset market capitalisation closed September at $3.72T, down 3.1% MoM, reflecting BTC’s retracement despite resilience across ETH and select altcoins.

Funding & Derivatives

- Off-chain funding rates (Binance):

- BTC: ranged between 4–9%, with open interest fell from 131 K to 127 K BTC.

- ETH: ranged between 6–11%, with open interest up slightly from 2.64M to 2.68M ETH.

- On-chain funding rates (Hyperliquid):

- ETH: ranged between -4–26%.

- BTC: ranged between 3-24%.

- Open interest remained balanced, with ETH and BTC both near $3.5B in OI by month-end.

ENS Token Update

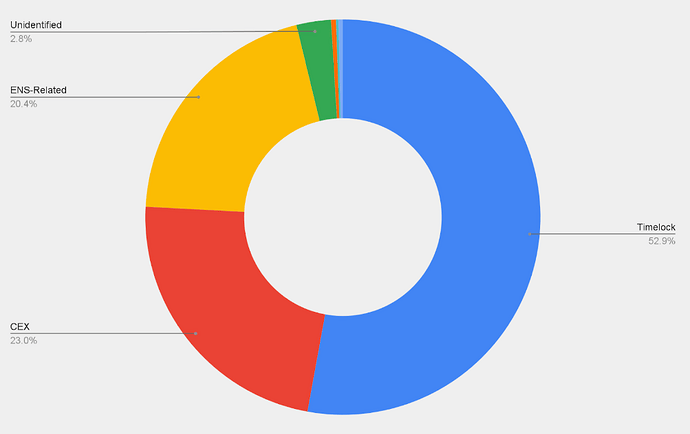

Token holder distribution across the top-50 ENS token holders remains relatively unchanged, and concentrated in the hands of centralised exchanges (‘CEXs’) and ENS-related wallets (DAO, ENS Labs, etc.).

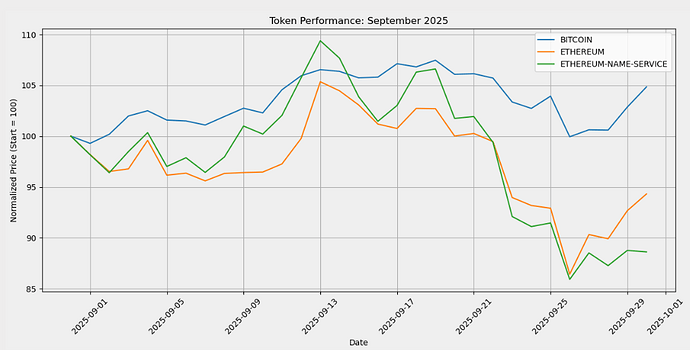

The ENS token’s price dropped -11.38% in September, underperforming both BTC (+4.85%) and ETH (-5.68%) as crypto majors siphoned liquidity from smaller-cap tokens.

Trading activity for ENS declined in September, with total monthly volume reaching 7.68M ENS, equivalent to ~$171.35. On centralised exchanges, Binance’s ENS/USDT daily spot trading volume fell from 481K ENS/day in August to 256.26K ENS/day in September.

DAO Financial Update

Endowment Update

Please refer to the September kpk monthly report for further details.

-

Asset Allocation

- Assets under management (AUM) of $140.14M, with a capital utilisation ratio of 100.0%.

- Endowment Allocation split into 72.13% ETH ($101.08M) and 27.87% stablecoins ($39.06M).

- Yield Generation (“DeFi Results”): $361.26k gross yield generated in September.

- Marked-to-market (“MTM”) valuation: decreased by $5.79M, driven by the decline in ETH price.

-

Protocol Distribution

- Endowment’s biggest position (protocol exposure) consists of staked ETH in Stader and Stakwise v3, each comprising about 20.41% of total funds. On the stablecoin side, sUSDS (Sky Savings Rate) is the highest allocation complemented by small allocations to Compound v3 and Aave v3.

-

A selection of Morpho markets (cbBTC/USDC (86% LLTV), wstETH/WETH, (96.5% LLTV), wstETH/WETH (94.5% LLTV), WBTC/USDC (86% LLTV), wstETH/USDC (86% LLTV)) will be introduced following the next permissions update request, further allowing the Endowment to diversify its protocol distribution and aim for more attractive yield opportunities.

-

Across the Endowment’s various positions, no single protocol exceeds 30% of the Endowment’s total exposure.

As a complement to our financial accounting, please refer to Financial Reporting Dune Dashboard and September Steakhouse monthly report, which now presents financial statements both with- and without $ENS tokens.