TL;DR

An automated tool was created in Dune to track the effectiveness of distributions conducted by ENS DAO via vesting through Hedgey. It monitors how well each distribution and the set of distributions as a whole achieve the goals of token usage in voting, governance decentralization, and preservation of token value under the vesting format. Each distribution was reviewed, and recommendations were made to improve their effectiveness, including the creation of unified token distribution rules, a recipient notification system, more efficient vesting contracts, and the transition of all ENS distributions to Hedgey.

Overview

ENS regularly conducts various token distribution initiatives among key players – Service Providers, Stewards, Security Council members, and individual contributors. Decisions to launch these initiatives can be made either through direct DAO voting (e.g., EP 5.19) or as part of working group budget approvals (e.g., EP 5.9.1).

Starting with the 90,000-token distribution to Stewards in 2024, a new standard was established for major distributions: tokens are now allocated through two-year linear vesting contracts. All such distributions have been executed via Hedgey – a platform that not only facilitates the creation of vesting contracts but also supports Voting Vaults, enabling recipients to delegate and participate in governance while their tokens remain locked.

To evaluate the effectiveness of these distributions, several Dune dashboards have been created, featuring advanced analytics and performance metrics:

| Distribution | Date | Amount | Vote | Dashboard |

|---|---|---|---|---|

| Stewards 1st | 2024-07-18 | 90,000 | 5.8 | Dune |

| Sec. Council 1st | 2024-09-17 | 8,000 | 5.9.1 | Dune |

| Service Providers 1st | 2024-09-17 | 72,000 | 5.9.1 | Dune |

| Contributors 1st | 2025-01-25 | 30,000 | 5.19 | Dune |

| Stewards 2nd | 2025-08-06 | 21,636 | 6.6.1 | Dune |

To evaluate ENS’s overall token distribution activity, a mega dashboard has also been created, providing an aggregated overview of all distributions.

Goals and Metrics

After reviewing all distribution initiatives and their underlying motivations, I concluded that ENS generally pursues three main objectives when allocating tokens: to increase the total voting volume, promoting governance decentralization, and providing additional financial incentives to key actors.

Below is a breakdown of these objectives and the metrics designed to track their fulfillment. Each of these metrics can be found both in the individual distribution dashboards and in mega dashboard.

1. Increase the Voting Pool

Despite the fact that ENS governance votes currently reach around 120–150% of the quorum, there is no guarantee that this level of participation will remain stable in the future – especially given the lack of direct financial incentives for voters. Back in 2022, participation levels reached 250–300% of the quorum. ENS still holds roughly 50 million tokens in its treasury, and these funds need to be distributed periodically to ensure that DAO voting remains active and sustainable.

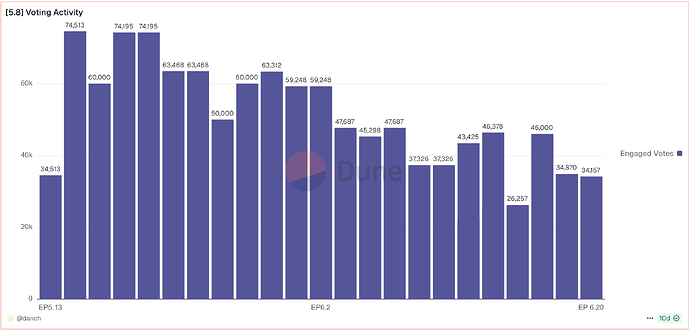

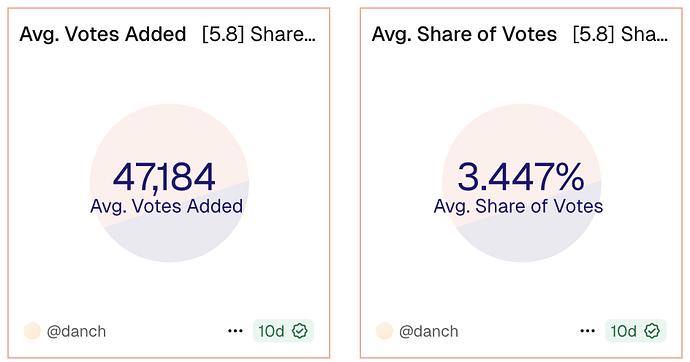

Engaged Votes Tracker

Shows how many votes from the tokens distributed within the initiatives were used in each individual DAO vote.

Average Value Counters

Calculate the average number of votes added to each vote since distribution, and what their share of the total pool was.

2. Decentralize Governance

In the latest DAO vote, the top 10 voters accounted for 80% of all voting power. I personally hold 1k votes and got curious: how often would my votes actually be decisive?

Using a Monte Carlo simulation of 10 million hypothetical votes, I calculated my Banzhaf power index and found that my vote would be decisive in only 1 out of 1,393 cases. At the current rate of proposal submissions in the DAO, that means it would take around 41 years for my vote to have any practical impact – beyond a purely declarative one. For comparison, the largest current delegate would face such a decisive situation roughly once every six weeks.

If token distributions continue regularly, and recipients choose to delegate their votes to smaller holders, this won’t necessarily change my individual voting power. However, it would at least create the potential to form coalitions of small voters – giving us a realistic chance to influence outcomes without relying on whales. The lack of such opportunities is one of the factors contributing to low engagement among voteholders with 200-10,000 votes: only 13 out of 960 of them participate in votes, compared to 20 out of 54 in the 10,001+ group.

For this reason, the dashboards also include metrics tracking how token distributions affect voting centralization:

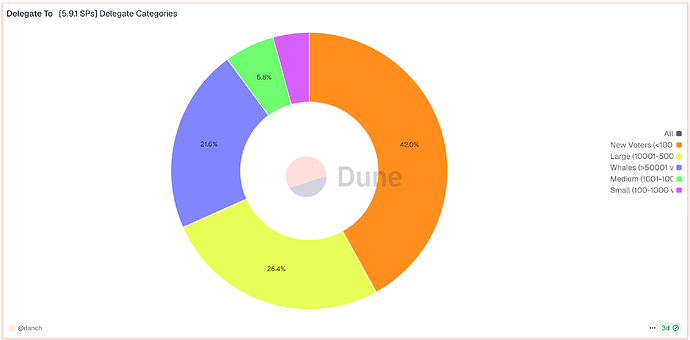

Distribution of votes by Delegate Categories

Contains information about which group of delegates (by number of votes before delegation) were entrusted with votes.

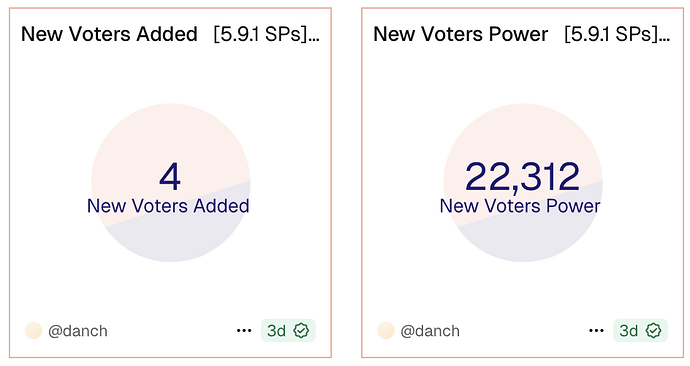

Counters of New Voters

Calculate how many new voters were created as a result of distribution, and their power.

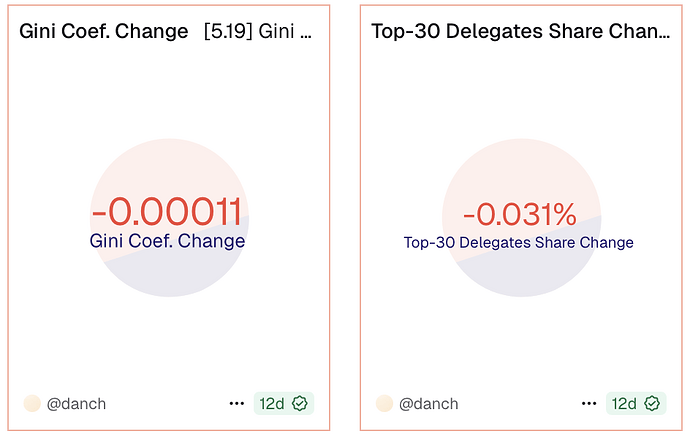

Decentralization Metrics

Calculate how the initiative currently affects the Gini index and the share of the top 30 delegates. Negative values lead to decentralization.

3. Reward Recipients

Distributions can always be seen as an additional financial incentive for recipients. At least, some recipients likely see it that way.

Since the recipient is rewarded in any case if the ENS token is worth anything, the metrics in this block compare the current situation (in which the tokens were issued in a two-year vesting) and a hypothetical situation in which ENS sent them the tokens via a regular transfer, with the ability to immediately sell them.

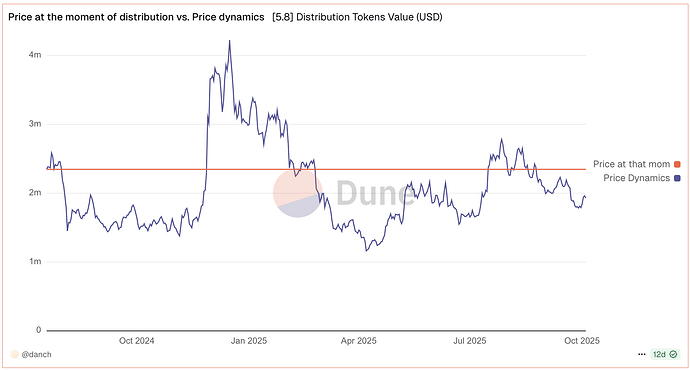

Token Value Chart

It simply shows the line of the cumulative value of tokens at the time of their distribution (the cost of the initiative for ENS) and the dynamics of the value on each day since the distribution.

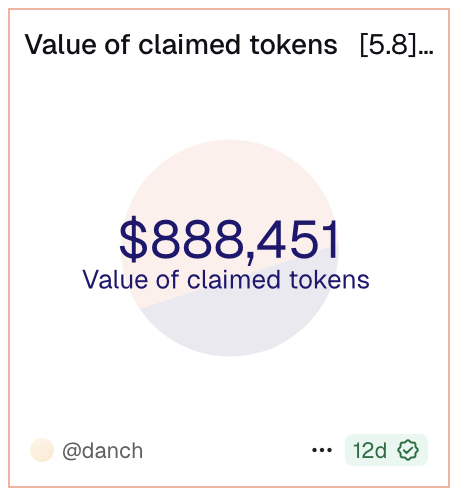

Claimed Value

Shows how much the portion of tokens that was claimed was worth at the time of claiming.

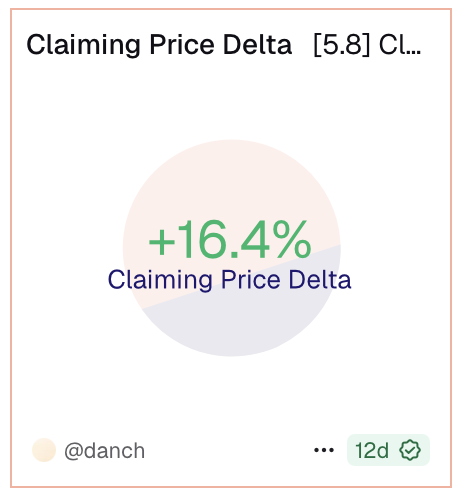

Price Delta

Calculates the PnL of claimed tokens, where the entry point for each recipient was the moment of distribution (for example, at the time of distribution, $ENS was worth $20, and at the time of claiming it was $30, meaning the delta will be +50%).

4. Other Tools

The dashboards also contain various queries that do not evaluate the initiative but contain important technical information:

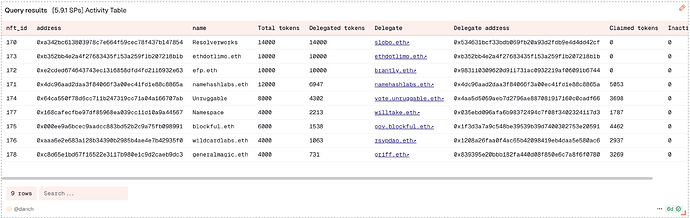

Activity Table

List of recipients, their vesting NFT ID, number of allocated, delegated, and claimed tokens, current delegate’s address, and a link to delegate’s Tally page.

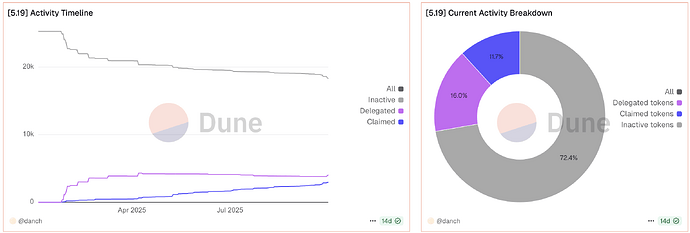

Activity Timeline

Chronology and current ratio of claims and delegations.

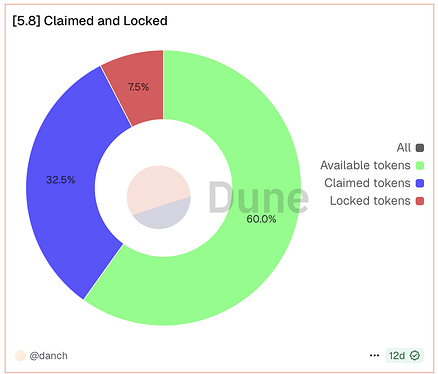

Claimed and Locked Chart

Tracks how many tokens are still locked, how many are available for claiming, and how many have been claimed.

Review of Initiatives

[5.8] – Stewards 1st distribution (Dashboard)

Distribution of 90,000 tokens to ENS stewards of the 2024 convocation (10k each) in the form of a two-year vesting.

This is the first ENS distribution facilitated by Hedgey. @James first proposed this option here. The 10,000-token allocation per steward was dictated by the need to empower stewards to independently initiate social proposals. If any of them had the ability to sell these tokens immediately, it would have undermined this goal.

Increase the Voting Pool

The large volume of distributed tokens, combined with the high level of steward engagement in the DAO, led to a substantial increase in voting power. On average, this distribution added 47,000 votes to the total voting pool – a notable 3.5% increase. However, the number of active votes per proposal inevitably declined over time (75,000 → 35,000), primarily due to claiming dynamics.

Decentralize Governance

Despite the fact that this distribution resulted in the creation of two new voters, it negatively affected decentralized voting, as most stewards delegated the tokens to themselves, already being among the largest voters. This outcome was expected, since the initiative was designed to provide stewards with a stable instrument for submitting social proposals.

Reward Recipients

Stewards claimed a total value of $900,000. On average, they claimed 16% more profitably than if the tokens had been sent via a regular transfer.

Conclusion

The main concern is the continuous decline in the number of votes derived from this distribution. This trend is not observed, for example, among service providers (see below), even though both the number of tokens and the timing of the distribution are comparable. It may be necessary to apply a longer vesting period for stewards while maintaining the token amounts. A figure of 10,000 tokens per steward seems reasonable, providing sufficient voting power to initiate social proposals.

[5.9.1] – Security Council 1st distribution (Dashboard)

Distribution of 8,000 tokens to Security Council members (1k each) in the form of a two-year vesting.

At the time of distribution, the recipients collectively held over one million votes, making it unlikely that an additional 8,000 would have had any meaningful impact on their individual voting power. The MG WG justified this distribution as a form of compensation for council members, who otherwise perform much of their work on a largely voluntary basis.

Increase the Voting Pool

The allocated tokens have not been widely utilized – on average, only 2,600 out of 8,000 are in use. This is partly due to the fact that three out of eight recipients did not delegate their tokens at all.

Decentralize Governance

Only one of the recipients delegated their tokens to someone other than themselves. Given that most council members were already whales, this had a minor yet negative effect on decentralized voting.

Reward Recipients

Only 1 recipient has ever claimed their tokens, so there is no point in analyzing this aspect yet.

Conclusion

Overall, distribution does not achieve either goal well.

[5.9.1] – Service Providers 1st distribution (Dashboard)

Distribution of 72,000 tokens to Service Providers of 2024 (different amounts depending on the size of the stream) in the form of a two-year vesting.

The service providers were quite diverse in nature. Some were affiliated with the whales, while others had never previously participated in ENS Governance. It could be said that this distribution pursued all three goals to an equal degree.

Increase the Voting Pool

Despite tokens being claimed on a regular basis, the number of votes actively used in governance has remained relatively stable – approximately 38,000 votes, representing 2.5% of the total.

Decentralize Governance

The initiative added four new voters. Because these voters immediately became moderately or even large in power, decentralization indicators worsened anyway.

Reward Recipients

Service providers claimed tokens worth $700,000, and their profitability increased by 100% compared to the distribution day.

Conclusion

Overall, the distribution achieves each goal, if not perfectly, then adequately.

Also, I’ve observed that the smaller the recipient’s allocation, the more of it they claimed. Perhaps it’s worth considering allocating the same number of tokens to all Service Providers, rather than allocating a number based on their stream size.

[5.19] – Contributors 1st distribution (Dashboard)

Distribution of 30,000 tokens to ENS participants and grantees (different amounts depending on the size of the grants received) from January 1 to October 1, 2024 in the form of a two-year vesting.

The goal was both to engage new voters among active participants in the ENS improvement process and to provide additional financial incentives for them and future contributors.

Only 25500 of these tokens are distributed at the moment

Increase the Voting Pool

This distribution has the worst ratio of distributed votes to participating voters – only 1,800 out of 25,500. I’ve outlined the reasons for this here. Since 72% of tokens are inactive (having never been claimed or delegated), it can be concluded that recipients never knew such an initiative even existed.

Decentralize Governance

This is the only initiative that has a positive impact on decentralization, as both the Gini index and the share of the top 30 delegates fall.

Reward Recipients

The claimed value is only $66,000. This is also the only initiative whose recipients, on average, lost a significant amount of value (-33%) compared to if they had received these tokens via a regular transfer.

Conclusion

Distribution only serves decentralization purposes effectively. Distributions to contributors should be seen as the primary tool for decentralizing DAO voting, as tokens go to smaller nodes.

Regarding the effectiveness of other goals, there were some mistakes in the program’s implementation. We expected that disseminating information via the forum and Twitter would be effective, but in reality, most recipients weren’t notified. Now that I’ve contacted some of them personally, it’s been a year and a half since their interaction with ENS, so they’re unlikely to be interested in governance.

[6.6.1] – Stewards 2nd distribution (Dashboard)

Distribution of 21,636 tokens to ENS stewards of the 2025 convocation (~2k each regular steward and ~3k each lead steward) in the form of a two-year vesting.

Unlike the 2024 distribution, the goal of giving stewards a sufficient number of votes to initiate a social proposal was not pursued, but in all other respects, the same goals were pursued.

Increase the Voting Pool

An average of 7,700 (0.5% of total) votes are added to each vote. It’s worth noting that four stewards did not delegate their tokens, so this figure could be increased in the future.

Decentralize Governance

We’re only seeing self-delegations. The 2025 stewards include both newcomers and veterans, so the initiative hasn’t had any impact on this aspect.

Reward Recipients

The distribution took place 2 months ago, so it’s too early to talk about it.

Conclusion

It’s too early to say anything, but such a radical reduction in tokens does not seem entirely justified.

DAO in general (Dashboard)

Over the entire period, (from July 19th, 2024) the DAO distributed 216,929 tokens through Hedgey vesting contracts.

Increase the Voting Pool

On average, 86,000 of tokens are involved in voting, which is 6.5% of the total number of votes.

Decentralize Governance

Overall, all distributions made in ENS had virtually no impact on voting decentralization. Given the large number of tokens, the Gini coefficient remained virtually unchanged, indicating that centralizing and decentralizing distributions generally balance each other.

Reward Recipients

A total of 1.7 million USD worth of tokens were claimed. The delta for these transactions is +45%, indicating that recipients have now acquired significantly greater monetary value than when ENS allocated these tokens.

Conclusion

ENS’s token distribution efforts can be described as good and balanced, but there are still areas for improvement.

It would be great if 10% (instead of 6.5%) of the total votes came from distributions.

Also, while distribution hasn’t resulted in centralization overall, it would be beneficial if it led to decentralization.

It’s good that ENS distributed these tokens through vesting contracts rather than direct transfers, as the tokens not only participated in voting but also provided additional financial value to the recipients.

Recommendations

This post simply introduces the toolkit and provides a brief overview of distributions, but some recommendations can already be outlined.

Creating a unified ENS statement on distributions

At the moment, all distributions appear somewhat chaotic in terms of goals, timing, and token amounts. It would be ideal to have a single, voted-on document that defines:

- The objectives and purposes of distributions

- Which categories of individuals or organizations can receive tokens

- The number of tokens distributed each year

- The rule by which the number of tokens increases or decreases year by year

- A breakdown of the total number of tokens by recipient category

Such a statement would allow ENS to have predictable forecasts for improving governance quality, and it would give recipients clear expectations.

Transitioning all distributions to a vesting format

In addition to the distributions reviewed in this post, the Ecosystem WG (@Ecosystem_Stewards) regularly sends tokens to grant recipients via standard transfers. Tracking these token movements is much more difficult, but at a glance, many are sold immediately.

Based on this analysis, it can be concluded that distributions through vesting have proven effective in maintaining recipient engagement in ENS governance. Therefore, my recommendation is to establish vesting as the standard token distribution method.

Starting vesting only after delegation

This idea was suggested by Spencer (@5pence.eth). Since some distributions have recipients who do not delegate their tokens, a system could be created where vesting begins on the date of first delegation, and the cliff occurs when delegated tokens have been used a certain number of times in votes. We could coordinate with Hedgey to help develop such a contract.

Recipient notification system

This is relevant for distributions where recipients are not closely involved with ENS (e.g., contributors). I discussed this issue here. When I noticed that tokens from [5.19] were not being used, I sent personal messages to 10 recipients as a trial. It turned out that almost none of them were aware that a distribution had occurred. Therefore, it would be ideal to personally notify recipients after the contracts are sent.

Whale ethics

This may not fit into any formal document, but it could become a customary practice. If you have more than 100k votes and receive 500 votes, it would be commendable to give them to someone with fewer than 100k votes.

Miscellaneous

Claimed ≠ Sold. Although 80% of tokens are transferred to an exchange account after a claim, this isn’t 100%. It’s impossible to create a system that would accurately determine the fact of a sale, as this would require knowing all exchange and deposit account addresses.

The dashboards will be updated weekly, starting on the 25th, as I completely ran out of tokens during testing, deployment, and the materialization of all queries.

Dashboard creation is automated. If a new distribution happens, I’ll be able to post a link to its dashboard in this thread almost immediately.

Watch on desktops. Dune is very poorly optimized for mobile browsers.