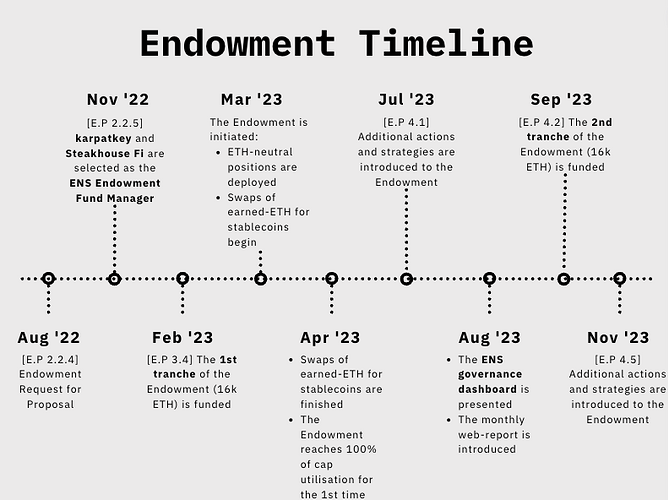

The ENS Endowment was officially established in March 2023, following the acceptance of the joint proposal presented by karpatkey and @steakhouse, and the successful execution of E.P 3.4 - Fund the Endowment (first tranche). As we move into 2024, we are excited to provide a brief overview of our collaborative efforts with the ENS DAO to date and outline future initiatives.

To begin, we present a graphical summary tracing the timeline from the Endowment’s Request for Proposal (RFP) to the current state:

Endowment Update

The Endowment has followed a phased initiation. Since March 2023 funds were gradually deployed and additional funds were granted in September 2023 with the execution of the second tranche. Since its inception, the Endowment has achieved*:

- Accumulated revenue of $1.06 million USD

- An average Annual Percentage Yield (APY) of 3.28%.

According to the latest monthly report, which assesses the Endowment’s performance in December 2023, the following key metrics were observed:

- $70.89M of ncAUM (non-custodial assets under management)

- 99.1% of capital utilisation

- Projected APY of 4.33%

- Projected annual revenue of $3.07M

*ncAUM doubled in September 2023, following the allocation of the second tranche.

These figures will be updated with the forthcoming release of the January 2024 report.

Additionally, based on the 2023 reports compiled by steakhouse, the following financial details for the DAO were noted:

- Operational Revenues for the DAO amounted to $29.8M

- Operational Expenses for the DAO were reported at $8.9M, with an anticipated coverage of 34% by Endowment revenues in 2024*

- DAO reserves concluded the year at $98.2 million, indicative of an 11-year operational runway.

*The projection of operational expenses does not encompass the potential costs related to new initiatives planned for funding in 2024, nor does it account for any additional expenses that might arise starting that year.

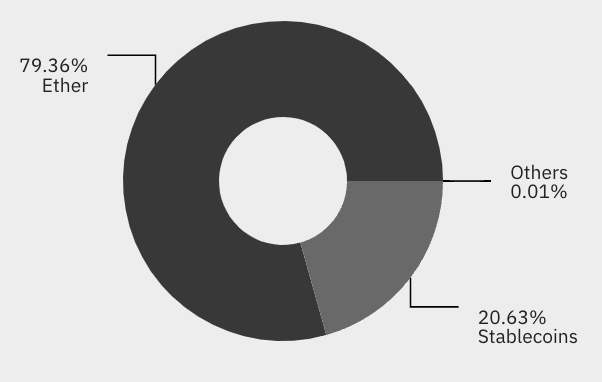

Furthermore, as per the December report, the distribution of funds by investment categories can be seen in the following graph:

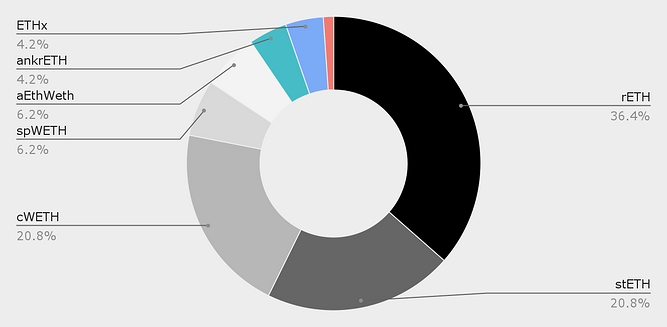

Subsequent to the execution of E.P 4.1 and E.P 4.5, new strategies were introduced into the Endowment. According to the most recent report, the fund allocation across various investment positions was as follows:

The Endowment established a maximum limit of 20% for its Ethereum (ETH) holdings to be allocated to stETH. Below is a breakdown of the current ETH allocations. It’s important to note that stETH currently constitutes 20.8% of the holdings, which exceeds the set cap. This slight discrepancy will be addressed and corrected in the coming days.

Strategy & Implementation

- We harnessed the Zodiac Module, specifically the Roles Modifier, to ensure a trust-minimised, non-custodial management of the Endowment. Our steps included:

- Launching a new Safe (Avatar), applying the preset containing the permissions granted by the ENS DAO to another new Safe (Manager) owned by karpatkey as per the Endowment initiation plan.

- Conducting rigorous testing of the preset and offering comprehensive documentation to the ENS DAO detailing specific permissions granted to karpatkey.

- Post audit, the ownership of the Safe (Avatar) was transferred to the ENS DAO, now officially termed as the Endowment (endowment.ensdao.eth).

- Upon the green light for E.P 3.4 and E.P 4.2, a transfer of 16,000 ETH was made from the ENS DAO to the Endowment (first tranche), followed by the second tranche, which made another 16,000 ETH available from the DAO to the Endowment. Subsequently, we executed the strategy according to the plan:

- First tranche:

- Converted the earned-ETH segment (around 7,000 ETH) into stablecoins (USDC and DAI) in seven tranches of 1,000 ETH each over several weeks. These funds were then channelled into USD-neutral strategies, targeting positive results measured against USD.

- The remaining ETH (approximately 9,000 ETH) was directed towards ETH-neutral strategies, aiming at positive results measured against ETH.

- Second Tranche:

- Continued diversification by swapping ETH to stablecoins and deploying them to USD-neutral strategies.

- Remaining ETH was deployed into newly approved staking and lending strategies, aimed at diversifying exposure with the objective of progressively divesting away from a single LST provider and supporting a wider range of options.

- First tranche:

- Post strategy deployment, we diligently monitored positions, claimed rewards, and reinvested for compounding benefits.

- E.P 4.1 was introduced to refine the Endowment’s adaptability, performance, and diversification. With its approval, we fine-tuned our strategy to align with market dynamics and seize new opportunities.

- E.P 4.5 represented an extension of E.P 4.1 (focusing on the continuous adaptation to a dynamically evolving market) and the introduction of a range of sought-after alternatives for diversifying ETH strategies.

- To enhance the community’s comprehension of Manager Role preset updates and streamline the auditing process, we implemented Self Audits along with a payload decoder designed for report generation. This initiative was directed towards delivering more transparent and comprehensible information, equipped with the necessary tools for effective implementation.

- Additionally, multiple discussions were conducted with the Agora team, all aimed at augmenting the transparency and auditability of the payloads.

Future Roadmap

- Continue to enhance the preset update auditing process. We aim to offer a more intuitive visualisation of potential Zodiac preset changes before executing a proposed payload. We will continue working with the Agora team on this vertical to improve auditability and the overall voting experience for preset changes.

- Zodiac Roles Mod v2 roll out. This will allow for a much sophisticated filtering of encoded calldata to scope contract functions with more complex parameters and enhanced logic for more flexible permissions.

- Continue broadening the spectrum of LSTs (liquid staked tokens) within the Endowment in order to advocate for validator diversity, integrating more protocols and strategies that resonate with the Endowment’s risk appetite and long-term vision.

- Remain vigilant of market trends and explore new investment opportunities for the Endowment.

Risk Management

- Developed a detailed risk assessment framework specifically for the Endowment, identifying key risk factors and detailing both preventative and mitigative strategies.

- In partnership with specialist providers, we set up a comprehensive monitoring system to keep a close watch on our investment portfolio and wider market trends. This system is designed to detect anomalies or major occurrences that may necessitate the activation of emergency procedures.

- Conducted war-room sessions to assess potential risks and formulate suitable responses to unexpected incidents, including the USDC depegging event, the Curve exploit resulting from the Vyper compiler issue, and the vulnerability discovered in some Balancer v2 pools.

Upcoming Risk Management Initiatives

- Bolster the resilience of our risk management framework by:

- Introducing new Zodiac Roles, including the disassembler bot, designed to autonomously pull liquidity from any position if certain criteria are triggered.

- Augmenting the automation capabilities of our emergency protocols.

- Expanding and refining our alert system through the integration of innovative metrics and machine learning algorithms, as well as expanding the monitoring capabilities.

Reporting

- Maintained a steady cadence of weekly operational reports, continually refining them in response to community feedback. In July 2023, we made the transition to monthly web-based reports, introducing new metrics tailored to the interests of the ENS community.

- @steakhouse delivered:

- A detailed monthly financial report, highlighting the Endowment’s performance while also offering a broader perspective on the ENS DAO’s financial health.

- A Power BI report where people can navigate and slice and dice.

Future Reporting Endeavours

- Elevate the user experience of our reports and incorporate more bespoke metrics.

- Unveil a real-time iteration of our web-based report.

Community

- We’ve consistently engaged in the weekly MetaGov discussions, maintaining a 100% attendance record since the inception of the Endowment. This commitment ensures we stay in tune with the community’s goals and effectively integrate valuable feedback.

- We launched the ENS DAO Governance dashboard on Dune Analytics. This platform offers an in-depth view of governance activities, delegate profiles, voting power distribution, and other key indicators, playing a crucial role in assessing the transparency and fairness of governance processes.

- Participated in the 2023 ENS Town Halls.

Community Roadmap

- We are committed to ongoing engagement with the community, contributing our knowledge and insights for the common good.

- We remain alert and proactive in identifying ways to enhance the ENS community’s value.

Thank you for placing your trust in us with this pivotal role carried throughout 2023. We’re eager to sustain our contributions and dedication this next year and beyond, ensuring the enduring prosperity of the ENS DAO.