2024 was the first full calendar year of Endowment operations, and karpatkey is excited to provide a summary of our collaborative efforts with the ENS DAO for 2024.

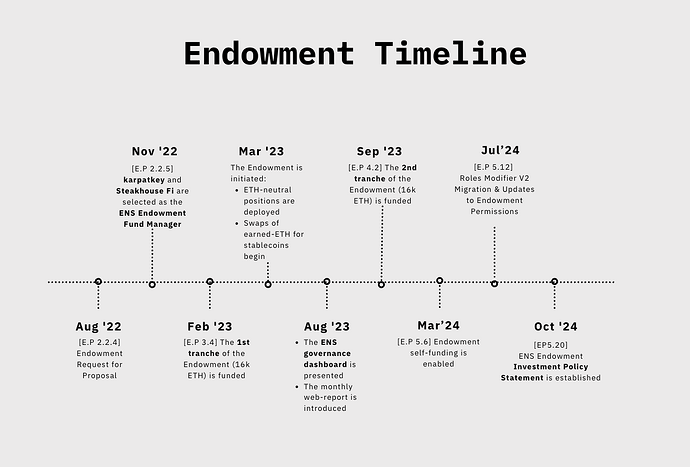

To begin, we present a summary tracing the timeline from the Endowment’s Request for Proposal (RFP) to the current state:

Endowment Update

For 2024, the Endowment has achieved (net of fees):

- Accumulated net revenue of $2.97M

- A net average Annual Percentage Yield (APY) of 3.7%

According to the latest monthly treasury report, the following key metrics were observed:

- $99.31M of ncAUM (non-custodial assets under management)

- 100% capital utilisation

- Projected APY of 5.1%

- Projected annual revenue of $5.06M

Additionally, based on the latest monthly financial report compiled by @steakhouse, the following financial details were noted for 2024:

- Operational Revenues for the DAO amounted to $27.07M

- Operational Expenses for the DAO amounted to $16.72M, with a 22.9% of expense now covered by Endowment revenues

- DAO reserves concluded the year at $134M, indicative of an 8-year operational runway

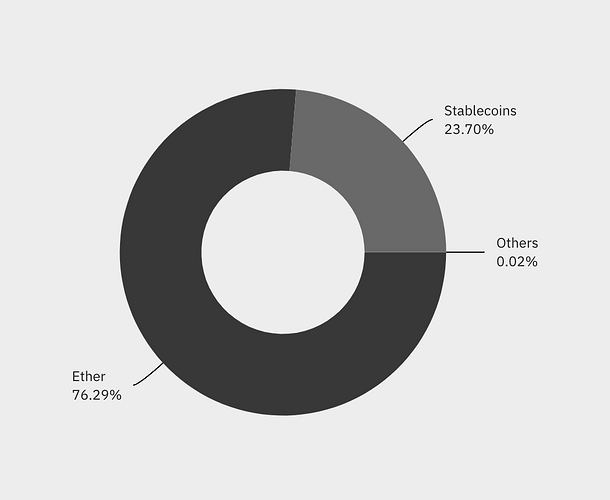

Furthermore, as per the December 2024 report, the distribution of funds by asset-class can be seen in the following graph:

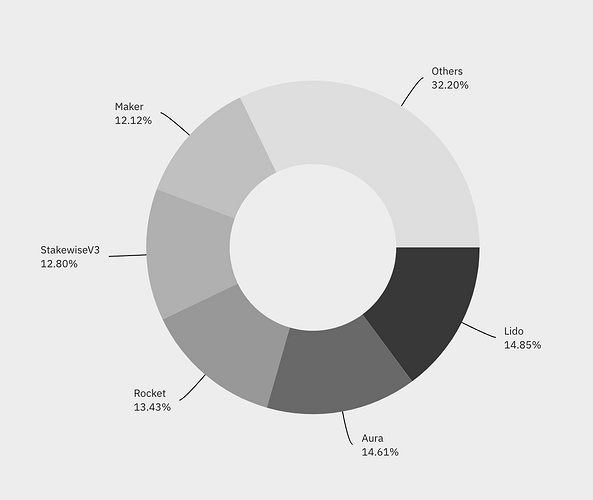

Subsequently, the protocol distribution of the Endowment’s funds is as follows:

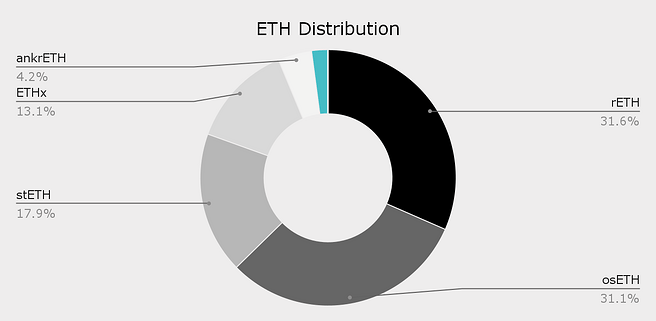

The Endowment established a maximum limit of 20% for its Ether (ETH) holdings to be allocated to Lido’s staked Ether (stETH). Below is a breakdown of the current ETH allocations.

Strategy & Implementation

Since the beginning of 2024, karpatkey has advanced several proposals within the ENS DAO, demonstrating our ongoing commitment to enhancing the protocol. The proposals we have put forward are:

- EP 5.6 enables a self-funding mechanism for the Endowment to autonomously finance its operations.

- EP 5.12 migrating the permissions module to Zodiac Roles Modifier v2. The migration allows for a more sophisticated filtering of encoded calldata and enhanced logic for complex permissions, and an interface that makes it simple to identify updates and deprecated permissions.

- EP 5.14 updating Endowment Permissions, and introducing independent, 3rd-party code review for the payload.

- EP 5.20 introducing a new Investment Policy Statement for the ENS Endowment, which establishes clear and agreed principles and guidelines for effective management of the Endowment.

- [Temp Check] Endowment Expansion third tranche.

- Protocol Fee Rebates Agreement with Stader Labs enabling higher effective staking yields for ETH on Stader Protocol. The agreement has recently been revised from protocol fee rebates to yield boost.

Future Roadmap

Looking ahead to 2025, karpatkey has identified a number of areas across ENS DAO where we would like to add or expand new efforts to continue fortifying the DAO’s financial health or working towards its collective goals. These include:

- Expansion of the ENS Endowment to enhance the financial health of the DAO through Endowment expansion (3rd tranche), and future, regular transfers of revenue from the Controller to the Endowment.

- Continued monitoring of ENS’ financial health, especially given increased expenses committed for 2025 in relation to Namechain development and continued Service Provider streams.

- Continued monitoring of $ENS token and potential governance attacks on the Endowment, as well as suggestions of open-market methods to minimise any such attack vectors.

- Continued assessment and broadening the spectrum of liquid-staking tokens (LSTs) within the Endowment in order to advocate for validator diversity, and integration of more protocols and strategies that resonate with the Endowment’s risk appetite and long-term vision.

- Remain vigilant about market trends and explore new investment opportunities for the Endowment.

Risk Management

To support the strategic and operational initiatives outlined above, karpatkey continues to develop and maintain a comprehensive risk management framework and operation on behalf of ENS DAO. Current and recent highlights in this area include:

- Hypernative alert set up for every single position in the Permissions Policy.

- A comprehensive list of protocols, smart contracts, and financial risk factors are monitored real-time.

- karpatkey conducts both weekly internal risk review and weekly external review with the Hypernative team.

- Development of karpatkey’s Execution App to meet the objectives of ENS DAO, which addresses the need for rapid, error-minimised execution in high-pressure situations, such as hacks, exploits, and governance attacks.

- Development of new Guardians, which are automated bots that execute portfolio management and/or risk management strategies. The Guardians will act based on predefined risk triggers, including suspected exploits, unusual pool behaviour, and rapidly decreasing collateral ratios, amongst others. karpatkey’s team is currently working with Hypernative to assess alert accuracy and 3rd-party models, to enhance the precision of the new Guardians, and to minimise the number of false positive results.

- Continuous research of new protocols and setting of alerts for risk management.

Community, Reporting & Accountability

Underlying all of our recent and ongoing work remains our commitment to participating in the ENS community, and maintaining high standards of reporting and accountability. We’re pleased to share the following highlights across 2024:

-

karpatkey has been providing regular Endowment updates during the weekly MetaGov Working Group meetings. In response to community feedback, details, such as providing comparisons against benchmarks and breakdowns of DeFi-generated yield by strategy, have been incorporated into our weekly update.

-

In August 2023, karpatkey launched our web-based UI monthly reports for each client. In 2024, our tech team has significantly improved mobile responsiveness, enhancing accessibility and user experience for these reports. In 2025, we are working on more comprehensive reports (higher time frequency, more performance metrics, etc.).

-

karpatkey has developed a Fund Flow Dune dashboard for the ENS community to get further insights into DAO-owned assets and our ongoing activities.

-

We have continued our close engagement with the Agora team in relation to their development of a Proposal Lifecycle Management tool.

-

karpatkey was pleased to attend frENSday 2024 in Bangkok, including as a speaker in the day’s Lightning Talks sessions.

-

We maintained our record of 100% attendance to MetaGov calls.

As we bring this annual review to a close, we want to reiterate our appreciation for the trust that ENS DAO has placed in us. We look forward to maintaining our commitment and efforts in the upcoming year and beyond, ensuring the lasting success of the ENS DAO.

Thank you for reading.