MetaGovernance Working Group Budget for Term 5, Q1/Q2 2024

This post outlines the MetaGovernance Working Group’s budget for the upcoming 6-month period, Term 5 Q1/Q2.

Below, we’ve outlined the previous term’s projected budget and actual spend, as well as the planned budget for the upcoming 6 months of Term 5, specifically Q1/Q2.

Descriptions of various categories can be found below the tables.

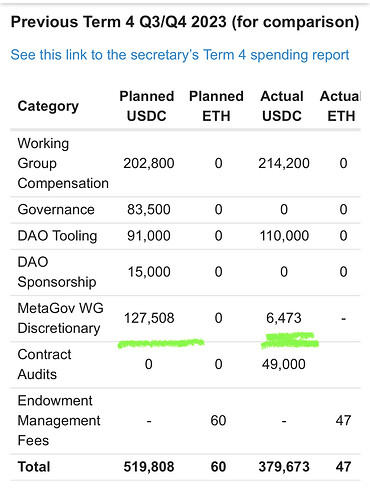

Previous Term 4 Q3/Q4 2023 (for comparison)

See this link to the secretary’s Term 4 spending report

| Category | Planned USDC | Planned ETH | Actual USDC | Actual ETH |

|---|---|---|---|---|

| Working Group Compensation | 202,800 | 0 | 214,200 | 0 |

| Governance | 83,500 | 0 | 0 | 0 |

| DAO Tooling | 91,000 | 0 | 110,000 | 0 |

| DAO Sponsorship | 15,000 | 0 | 0 | 0 |

| MetaGov WG Discretionary | 127,508 | 0 | 6,473 | - |

| Contract Audits | 0 | 0 | 49,000 | |

| Endowment Management Fees | - | 60 | - | 47 |

| Total | 519,808 | 60 | 379,673 | 47 |

Term 5 Q1/Q2 2024 Budget

| Category | USDC | ETH |

|---|---|---|

| Working Group Steward Compensation | 294,000 | |

| Governance | 0 | 5 |

| DAO Tooling | 130,000 | |

| Sponsorships | 5,000 | |

| MetaGov WG Discretionary | 30,000 | 5 |

| Contract Audits | 90,000 | |

| DAO Bylaws Initiative | 25,000 | |

| Endowment Management Fees | 132* | |

| Total | 574,000 | 142 |

Category Descriptions

- Working Group Steward Compensation - Compensation for Working Group stewards and the Working Group secretary.

- Governance Reimbursements - Fee reimbursements and initiatives related to reducing friction in the governance process. Examples include gas fee reimbursements for voting or delegation changes, or reimbursements for proposal submissions and execution.

- Tooling - Developing interfaces and dashboards to improve the governance process and increase transparency across the DAO. Examples are agora.ensdao.org and a proposal interface for the Executable and Social proposals.

- DAO Sponsorship - Sponsoring DAO-specific events such as DAO NYC, DAO Tokyo, the Aragon DAO Hackathon, etc.

- Discretionary - Funds distributed at the discretion of stewards towards new initiatives + governance experiments from the MetaGov Working Group Multisig.

- Contract Audits - These are funds that will be used to pay for smart contract review and formal security audits. An example would be the code4rena audits on the namewrapper contracts.

- DAO Bylaws Initiative - An RFP was begun in November of 2023 to select a provider to write a comprehensive set of DAO Bylaws. The expense for this is a one-time event, but we’re including it here in the budget for transparency. (For avoidance of doubt, this process will contemplate feedback from all DAO participants).

- Endowment Management Fees - Fees paid to vendors or service providers for treasury management services. The current treasury management services are provided by Karpatkey and Steakhouse per [EP 2.2.5] with strategies described in this post here.

*The Metagov group is currently evaluating alternatives that would allow the endowment management fees to be paid directly from the endowment itself, allowing for this operating expense to be removed from our budget.

$ENS Governance Token Distribution

The MetaGov Working Group continually evaluates the distribution of $ENS governance tokens to our various partner projects and contributors whose contributions allow for, and improve, the ENS DAO and Working Group operations.

The goal of $ENS distributions from the MetaGov WG is to increase ENS DAO participation from key individuals and DAO-related projects who continue to build the infrastructure that the DAO relies on.

One of the more significant changes we have planned this term is a more substantial initiative to distribute $ENS governance power through vesting contracts. The MG stewards are beginning an evaluation of several strategies that would ultimately allow for the full voting power of a grant to be available on day 1, while the full control or ability to transfer those tokens would vest over a multi-year period. This will be a public initiative, and we will openly seek feedback to ensure general consensus from the DAO.

For the Term 5 Q1/Q2 period, the following governance distributions are planned:

| Recipient Category | Amount of $ENS | Method |

|---|---|---|

| Contributors and Developers | 60k | Vesting contracts |

| Elected Stewards | 45k | Change to vesting contracts is planned for the 2025 guidance |

Current Metagov Wallet Balances

| Address | ETH | USDC | $ENS | Notes |

|---|---|---|---|---|

| ens-metagov.pod.xyz | 75.138 | 463,380 | 15,540 | |

| ens-governance.pod.xyz | 0 | 0 | 0 | To be deprecated |

| ens-daotooling.pod.xyz | 0 | 0 | 0 | To be deprecated |

| ens-endowmentfees.pod.xyz | 10.55 | 0 | 0 |

*as of Jan. 22nd, 2024