Updated ENS Endowment Fund Management Proposal | Karpatkey & Steakhouse Financial

Updates Summary

Hi ENS community, we’d like to share some updates and clarifications on our proposal based on your feedback. Here’s a slideshow with a TL;DR, and a short video summary. We’ve updated the following:

- Strategy: An example of our proposed strategy, and the ones we would avoid. Removal of the 3rd investment scenario and exclusion of ENS tokens from the investment scenarios;

- Update of the diversification strategy and earned/unearned distribution neutral to USDC-ETH respectively;

- Fee clarification: our performance fee would only take into consideration the revenues generated by Karpatkey’s strategies since we believe that the price upside of ETH and ENS should be captured entirely by ENS DAO; and

- The performance fee will be denominated in ETH instead of ENS

Description

We propose Karpatkey DAO, in partnership with Steakhouse Financial, to lead the constitution and allocation of ENS’ endowment fund to sustain ENS DAO’s development indefinitely by obtaining yield from tailored low-risk DeFi strategies.

The funds would be managed transparently and completely on-chain through a non-custodial solution combining Safe and Zodiac’s extensively battle-tested technology. These tools would allow us to only use previously authorised delegated protocols by a majority of ENS holders via Snapshot.

We would also propose coordinating the constitution of a Finance Core Unit, which would deliver ongoing support to operating and strategic financial needs. This proposal is a starting point from which we can adjust according to ENS DAO’s preferences, selectively excluding sections upon request.

Combining the complementary services of Karpatkey DAO and Steakhouse Financial will allow us to provide ENS DAO with a unique, comprehensive solution, bringing the most experienced treasury advisors together with industry-leading reporting experts.

Abstract

Summary

This proposal provides limited delegation of the ENS Endowment Fund to Karpatkey DAO in a non-custodial way. Karpatkey will partner with Steakhouse Financial to deliver ongoing operating financial reporting and strategic financial support.

Karpatkey DAO is the most experienced DeFi-native DAO treasury development team in the industry, with a track record of over 3.5k transactions, +$397MM NAUM (non-custodial assets under management, including the recent addition of Balancer), executed along 2+ years.

Steakhouse Financial is a DeFi-native partnership with extensive experience in financial advisory and strategic finance in the space. Steakhouse partners work with MakerDAO and Lido, the biggest Ethereum protocols by TVL today.

This proposal has two main goals:

- Deliver operational sustainability through ethical treasury management within the Ethereum ecosystem.

- Build open-source, transparent, and intuitive financial reporting to support the treasury management & DAO to ensure all stakeholders have clear visibility of the treasury.

Our operation would be transparent at all times, and any member of ENS DAO would be able to monitor it on-chain and through the periodic reports posted on the ENS Forum.

If ENS DAO approves this initiative, we will hire full-time contributors to work exclusively with ENS under our guidance, who will be fully trained to follow our procedures and ENS’ vision.

Motivation

Creating a professionally managed endowment fund is a natural next step to protect and sustainably grow the treasury created by the success of ENS DAO’s efforts. Therefore, to focus on its core business, ENS DAO must secure enough runway to keep moving forward along its roadmap, boosting grants and bounties, and supporting public goods, regardless of economic junctures.

The endowment will both minimise risk exposure and be aligned with the ethos of ENS DAO by choosing investment solutions that improve the health of Ethereum and avoid allocating funds to speculative positions.

The motivation for this initiative lies not in earning yield for the sake of profit, but in ensuring ENS DAO’s long-term viability. An idle fund has a significant opportunity cost. Therefore, delegating limited treasury access to a specialised DAO such as Karpatkey would optimise its growth through carefully curated and tailored strategies within a risk-controlled framework powered by the Zodiac Open Standard.

Regarding the coordination between both teams, Steakhouse Financial will mainly overlook reporting, and Karpatkey will take care of risk management and strategy design and execution.

Fund Allocation

The core of Karpatkey’s non-custodial solution relies on the most battle-tested tooling to manage DAO treasuries: a proxy Management Safe and the Zodiac Roles Modifier.

Safe is the most trusted platform to manage digital assets on Ethereum, currently holding circa $40B in funds. Zodiac is a collection of tools built according to an open standard outlining a composable design philosophy for DAO tooling, developed by Gnosis Guild. Zodiac’s tools can be easily deployed and managed through the Zodiac Safe App. The Roles Modifier is a tool that enforces granular, role-based permissions for attached modules.

Through a rigid and fail-safe allowlisting enforced on the Management Safe by the Roles Modifier, we would be allowed to execute only a constrained set of pre-approved transactions on behalf of ENS DAO’s Safe flexibly and efficiently, guaranteeing the funds will always remain under ENS DAO’s custody. Namely, the process of funds allocation starts with Karpatkey DAO proposing a delegation on ENS DAO’s Snapshot, which most token holders must approve. Once this happens, the target addresses, function signatures, and calldata for the transactions composing the strategy are allowlisted transparently. The Management Safe is then allowed to execute only this set of approved transactions on behalf of ENS DAO’s safe. E.g., The Management Safe signers can only carry out the strategy if it abides by the allowlisting that the Zodiac Roles Modifier enforces.

If the Management Safe attempted to execute any other transaction, it would be reverted by the Roles Modifier. No transactions that could compromise ENS DAO’s custody of the funds will ever be allowlisted, ensuring that ENS DAO has absolute power to withdraw or transfer funds without our intervention.

Benefits of Pre-approved Strategies vs Other Alternatives

The main advantage of this proposal vs carrying out transactions with a time lock to allow the DAO to reject them within a timeframe is that it doesn’t expose the treasury to front-running, and it allows for dynamic strategy adjustments, improving capital efficiency and risk management.

The delegation posted in Snapshot would hold a broad list of protocol options without granular specification of parameters nor the exact moment when they’d be executed (although the level of detail could be increased according to ENS DAO’s preference). We would then operate within those boundaries without going through a DAO-wide vote on every trade.

Also, we would put together a periodically reviewed emergency withdrawal protocol to be able to quickly de-risk/liquidate/swap all positions in the event of a market crash, hack or any fortuitous event that requires stopping loss.

Karpatkey DAO’s professional treasury development consists of carrying out tailored strategies that vary weekly, adjusting to the constantly changing DeFi market.

Finance Core Unit

After reviewing ENS DAO’s structure, we concluded that conforming a Finance Core Unit (CU) that would include existing ENS DAO members would increase the overall management efficiency and provide ENS DAO with the necessary financial infrastructure and information to make sound capital allocation decisions. If ENS DAO agrees, this CU would be composed of full-time contributors sourced and recruited with Karpatkey DAO and Steakhouse Financial’s support.

The CU members would be trained and assisted by Karpatkey DAO and Steakhouse Financial, observing strict security standards. They would be on Karpatkey DAO or Steakhouse Financial’s payroll and would be in charge of the following tasks, among others:

- ENS Value Proposition: Improve the value proposition of the governance token and the ENS DAO treasury:

- Availability: Increase ENS availability on other networks and markets.

- Liquidity: Increasing ENS liquidity so more traders and investors can acquire it with a lower price impact.

- ENS Health Monitoring: Propose buybacks if we consider ENS is undervalued.

- Treasury Asset Allocation: Analyse asset diversification or buybacks based on an ENS price model.

- Protocols Integration: Promote Integrations of the ENS token on DeFi protocols to increase its utility.

- EP Funding: Any ENS Improvement Proposal involving funding will be comprehensively analysed by the CU to plan how token transfers should take place in a timeline, and ensure that liquidity requirements are met and executed properly.

- OPEX Funding: All ENS DAO’s budgets from the working groups will be analysed to meet liquidity requirements and make timely transfers if needed.

- Financial Analysis and Controlling: Ongoing tracking of operating expenses and analysis of operational investment and capital plans.

- Drafting and Maintenance of an Emergency Token Withdrawal Protocol: In case of a sudden severe market fluctuation, the team will execute a carefully structured protocol to de-risk all positions and avoid losing funds. This protocol will be periodically updated to ensure its readiness at any given time.

- Capital Optimisation: Collateral positions will be continuously monitored and managed to prevent liquidation (more details in the Risk Management section below).

- Endowment Fund Reporting: Dashboard creation and maintenance to monitor the yield of investments, rewards distribution and overall growth trend, health, and diversification.

- Operational Reporting: Dashboard creation and maintenance to set internal KPIs, design of a full set of P&L and balance sheets.

Endowment Specification

Endowment Strategies

The strategy would use low-risk medium-complexity DeFi strategies, such as providing liquidity to AMM, farm governance tokens.

We believe low-risk strategies will be a commodity in the future so our value-added resides in risk management and small weekly optimisations.

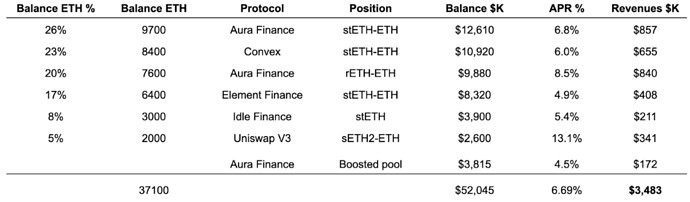

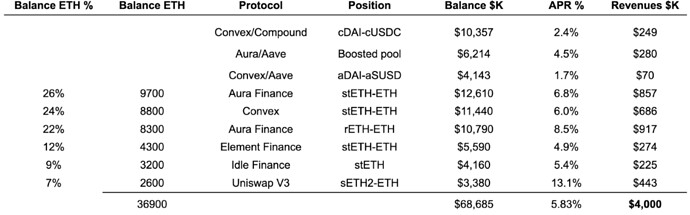

This a simple strategy example that could be deployed today:

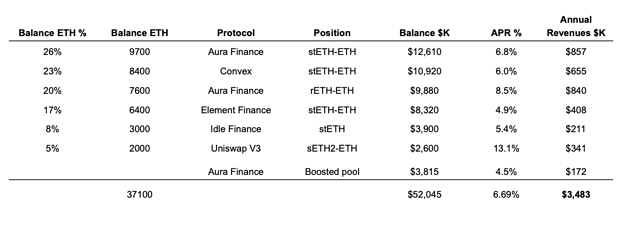

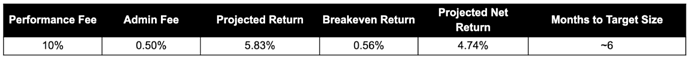

Initial Stage - $52MM

Earned/Unearned Distribution

We intend to diversify into stablecoins through DCAing the current earned income (around 13K ETH) and accumulating the future earned+unearned income in ETH until we can deliver around $350K/month or $4MM/year, around 6 to 8 months from the beginning of the execution.

The initial stage refers to the moment Karpatkey starts managing the endowment and considers both the earned and unearned ETH, which is valued at $1300.

The final stage refers to the moment the endowment reaches the target size and includes the additional ETH that will be provided by ENS until the goal is reached.

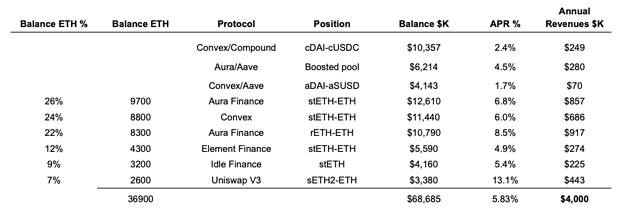

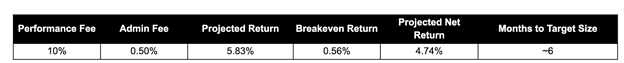

This is how a simple strategy would look like considering its final target size.

Final Stage - $69MM - Projected return 5.83%

Disclaimer: The above-mentioned are strategy examples. These strategies don’t intend to be and do not constitute financial advice, investment advice, trading advice, or any other advice.

Strategies we commit not to do

- No sendings funds offchain which includes:

- No centralized exchanges;

- No lending to real world companies like depositing on Maple, Truefi or Goldfinch. We shared the high risks of this and our rationale in this Twitter thread.

- No price forecast based trading or any speculative trading;

- No leverage;

- No sending funds to EOAs

Funds Availability

ENS DAO would be able to withdraw any token amount from the Endowment Fund for any reason at any time.

It’s important to mention that retrieving funds from the endowment fund would be a frictionless process for ENS DAO.

Karpatkey DAO would periodically adapt capital utilisation, portfolio composition, and yield strategy to allow ENS DAO to react to financial contingencies on time. Generally, a variable part of the funds will be held as liquid reserves, to secure a sufficient runway for ENS DAO, even amidst severe market fluctuations.

Yield Strategy

The yield strategy would vary weekly to maintain risk parameters and optimise cash flows. It would resort to different combinations of staking derivatives solutions, AMM. It’s important to clarify that, given the risk entailed, we don’t do any kind of price forecast based trading.

The following protocols would be considered to obtain an adequately diversified yield strategy with low-risk and reduced ETH price exposure. This is just a sample list, the final one would suit ENS DAO’s preferences and risk profile:

Aave, Ankr, Aura, Balancer, Compound, Convex, Curve, Element, Idle, Lido, Liquity, Maker, Nexus Mutual, QiDAO, Reflexer, Rocket pool, Stakewise, Sushiswap, Synthetix, Uniswap.

Risk Management

At Karpatkey DAO, every decision and action taken ponders risk exposure. We go above and beyond standard risk assessment protocols, and we have developed a multilevel approach to curate yield strategies, assess protocols, and carry out transactions safely.

This approach includes the management of different risk factors and their corresponding mitigation measures:

| Protocols' category | Risks | Risk parameter | Prevention & mitigation actions | Scenarios potentially affected |

| Lending and Collateralized Positions (CPs) | Liquidation | Collateral Ratio (CR) | Threshold settings for each strategy. CR tracking. Early alerts. Anti-liquidation / position-disassembler protection bots. Execution of CRs corrections with sufficient frequency (daily manual CR correction) | Scenarios 2 and 3 |

| Poor diversification | Positions' relative size vs total portfolio | Up-to-date assessment of all ETH staking opportunities.

Weekly review of optimum volumes: portfolio’s diversification optimisation. Alpha research on robust opportunities. Identification of new strategies to be deployed. |

Scenarios 1, 2, and 3 | |

| Lending, CPs, AMM, liquidity mining | Bad debt / low fees | Net Liquidity Flows | Netflows tracker. Whales activity tracker. Thresholds settings. Alarms settings. Activation of disassembler bot if the threshold is met. | Scenarios 2 and 3 |

| Lending and CPs | Bad debt | Collateral Ratio Distribution | Distribution tracking across protocols.

Activation of disassembler bot if the threshold is met. |

Scenarios 2 and 3 |

| Staking, lending, CPs, AMM, liquidity mining | Hacks, exploits | Protocols' security internal assessment | Positions' size capped depending on the assessment. | Scenarios 1, 2, and 3 |

| Staking, lending, CPs, AMM, liquidity mining | Rules change | Approved proposals with new detrimental rules | Forums checking and new proposals tracking, analysis on protocols' decentralization, and Karpatkey's decision on position disassembling. | Scenarios 1, 2, and 3 |

| Lending and CPs | Bad debt | Open Liquidations | Open liquidations tracker. Thresholds settings. Alarms settings. Activation of disassembler bot if the threshold is met. | Scenarios 2 and 3 |

| Lending and CPs | Bad debt | Value of loans/value of collateral | Ratio tracker. Thresholds settings. Alarms settings. Activation of disassembler bot if the threshold is met. | Scenarios 2 and 3 |

| Lending, CPs, AMM, liquidity mining | Depeg risk | Price deviation vs. target | Main pools' composition balance tracker. Thresholds settings. Alarms settings. Activation of disassembler bot if the threshold is met. | Scenarios 2 and 3 |

| Staking | Low liquidity at the time of exiting the position | Liquidity | Pool's balance tracker. Swap/AMMs slippage tracker. Thresholds settings. Alarms settings. Activation of disassembler bot if the threshold is met. | Scenarios 1, 2, and 3 |

| Staking, lending, CPs, AMM, liquidity mining | Price deviation | Derivative's exit price | Price tracker. Thresholds settings. Alarms settings. Activation of disassembler bot if the threshold is met. | Scenarios 1, 2, and 3 |

| AMM, liquidity mining | Loss of funds | Impermanent loss at the time of exiting the position | Identification of profitable and low IL pools. Accurate IL tracking. Threshold settings. Alarms settings. Activation of disassembler bot if the threshold is met. | Scenarios 2 and 3 |

Fund Reporting

The Finance CU will post a weekly treasury development report on the ENS forum and assist in identifying data elements upon request from the ENS community. Also, the Finance CU would review data reported and assist in performing analytics and quality reviews to confirm the accuracy of the information.

The following metrics would be included:

- Portfolio Summary: shows 1) the current holdings in stablecoin and ETH equivalent, considering both the allocation by blockchain and the allocation of the most relevant assets, 2) the share of funds allocated to each strategy/goal that are of interest to ENS (i.e. farming, staking, available funds for x purpose, etc), and 3) purpose and brief summary of the last strategy deployed for the corresponding period.

- Revenues: shows the performance of the portfolio strategy, displaying the current APR, annual revenues, capital utilisation, and past performance.

- Positions: shows the strategy implemented for the considered time period, explaining the type of investments, protocols, underlying assets, expected APR, and expected revenues.

- Loans Management: shows the loan strategy to quickly assess the health status of the active loans, considering the borrowed assets and funds, the lent assets and funds, the collateral ratio, and the minimum (liquidation) collateral ratio.

- Portfolio Details: shows the composition of the portfolio by type of asset.

- Improvement Proposals: shows the list of executed proposals and a summary of their corresponding weight.

Financial Reporting

The Finance CU will post monthly financial reports outlining the operating performance of the protocol on the ENS forum, and support in identifying data elements upon request from the ENS community as well as make proposals for regular accounting standards.

The following metrics would be included:

- Period P&L: crypto-native operating P&L to track and measure the performance of the business.

- Revenues: detail into the performance of the ENS protocol.

- Operating Expenses: overview into regular use of protocol expenses.

- Financial Analysis Support: support on analysing capital expenditures or ad-hoc financial questions material to the protocol.

Fees

The fees have been adjusted to make this proposal self-financing and sustainable in the long term, without hindering ENS DAO’s growth:

Management fee

A yearly management fee of 0.5% of the NAUM would be charged to finance fixed costs like hiring full-time contributors to ENS DAO and it would be collected in ETH in monthly instalments.

Management fee = Weekly portfolio balance * 0.5% / 52, converted to ETH

Performance fee

A monthly performance fee of 10% of the yield obtained during the last month would be 100% collected in ETH.

The price increase of ETH or any other base tokens would not be considered for the performance fee as it is calculated in traditional finance Hedge funds or Endowments.

Performance fee = (Weekly liquidity mining rewards - trades slippage - deposit/withdrawal fees) * 10%, converted to ETH

Termination

ENS may terminate Karpatkey DAO and Steakhouse Financial’s engagement under this agreement for any reason by Governance Mechanism. Karpatkey DAO and Steakhouse Financial may terminate this agreement upon four weeks’ notice posted as a new discussion thread in the ENS forum. In case the termination is requested by ENS without at least a 4-week notice, Karpatkey DAO will be granted an exit fee equal to the fees collected during the last two months, which will be paid in ETH. Regular fees will be collected until the day of termination.

In case Steakhouse Financial decides to terminate the proposal on its own, and Karpatkey DAO decides to continue, this proposal will be valid. Karpatkey will continue providing the committed services without the need of putting forward a new proposal.

Custody of Funds

Karpatkey DAO and Steakhouse Financial are not custodians of funds. Karpatkey DAO will only have the capacity to allocate the funds in a manner such that the ENS DAO authorised signers will have at all times absolute control over them.

Karpatkey DAO and Steakhouse Financial are not responsible for the loss of funds caused by the existence, identification, and/or exploitation of vulnerabilities through hacks, consensus failures, sophisticated cyber-attacks, denials of service or other security breaches, attacks, or deficiencies with smart contracts or protocols which are not owned by ENS, Karpatkey DAO, or Steakhouse Financial.

The plans outlined in this proposal are subject to discussion by ENS and may need to be (re)structured to account for legal, regulatory, or technical developments as well as governance considerations. This document should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in any transactions.

About Karpatkey

Background

Karpatkey is a DeFi-native DAO specialising in professional treasury development through industry-leading research and best-in-class tooling. We continuously evolve to maximise efficiency, manage risk, and increase security.

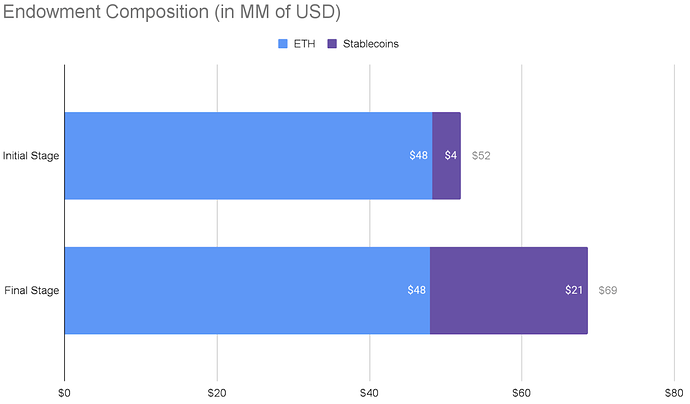

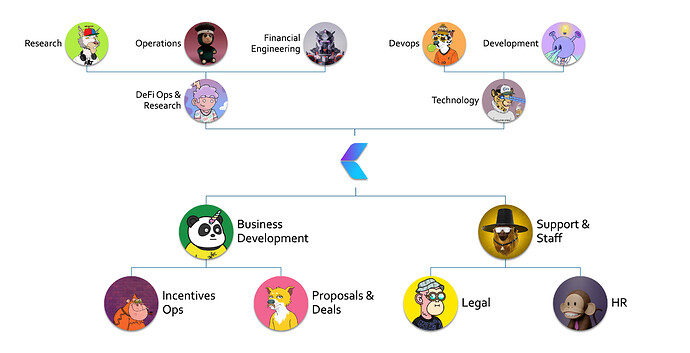

We have had a remarkable performance with Zodiac, Gnosis Ltd., and Gnosis DAO’s treasury portfolios, sustainably increasing their size, profitability, and diversification since our inception in September 2020. We have executed over 3,500 transactions related to DAO treasuries, and have evolved to cater for the specific needs of DAOs. Our organisational structure can be found in this proposal’s Annexe.

The appointment of Karpatkey DAO as Gnosis’ treasury management consultant has resulted in a consistent revenue stream for Gnosis, increasing its treasury size by circa $1.5 M a week while reducing risk through diversification (YTD tracked since May 2021. Their portfolio includes but is not limited to: 71K GNO, 350K BAL & 20K FLX | NAUM ~$550M). At the top of the bull market, our NAUM raised to circa $1B. Sample reports have been included in the Annexe. We share them on Twitter every week.

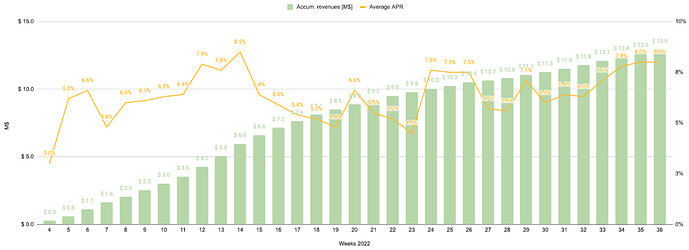

The chart below shows our past performance managing the treasury of our primary user, GnosisDAO, when the main goal was to obtain a sustainable growth of funds before we shifted the focus to maximising the development of the Gnosis Chain.

Gnosisdao’s yield assets are valued at more than half of all other DAO yield assets put together. Source: Autonolas independent research (link to original report here).

About Steakhouse Financial

Background

Steakhouse Financial is a team of seasoned crypto-native collaborators with broad experience including finance advisory, strategic action planning, investment banking, analytics, accounting, legal research, and coding. Our members have extensive experience working with protocols such as MakerDAO, Lido, Angle Protocol and others, delivering financial reporting expertise, crypto-native accounting and strategic advisory including partnership negotiations and growth.

Our main business areas include:

- Crypto-native financial reporting including strategic analysis

- DAO operations such as budgeting, decentralised operations, and balance sheet management

- Strategic advisory on partnerships and tokenomics, among other matters.

Some examples of our past performance can be found here.

Annexe

Sample Reports

Karpatkey

19-Sep

12-Sep

5-Sep

29-Aug

22-Aug

15-Aug

8-Aug

Steakhouse Financial

Financial Reporting (August 2022)

ALM Forecast for MakerDAO

Dune directory of queries

RWA Yield venues

Past Performance

The following chart displays Karpatkey’s 2022 YTD performance.

Organisation Structure

Karpatkey

Karpatkey DAO is organised in different functional teams, as shown in the following org chart.

Functional Chart

Steakhouse Financial’s Organisation Setup

Steakhouse is a partnership between individual contributors working at various DAOs, under the umbrella of Steakhouse Financial. You can consult some of the bios on this page.

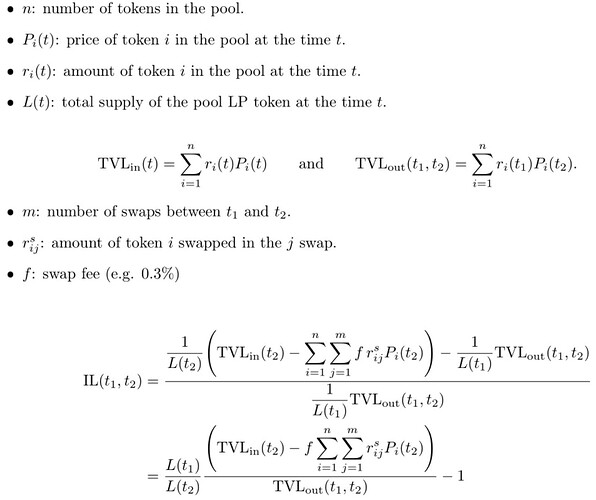

Impermanent Loss Calculation

The way in which we calculate IL differs across protocols and specific cases within protocols, but it’s primordially based on the formula detailed below, which calculates the IL per LP token for any AMM with constant swap fees.

Our Financial Engineering team is currently preparing a paper on the equations we use for IL calculation in different cases, encompassing single isolated financial positions and more complex allocations, including composability.

!

!