on expense reports - this is so simple, why is it causing any commotion at all

I’ve put general structure already here - ENS DAO Financial management v001

your total expense report = spending of WG1 + spending of WG2 + … + spending of WGN

the reason it’s not put together, is that there was noone with formal role to do it, there were no clear users of that information, and there was no framework where it should be plugged into. Framework would define the form of that information - how it structured sliced and diced

The substance is available - check the forum, you can see that there are budgets being proposed and approved

ENS core team spending is black box, because salaries are confidential, so it’s treated as lump sum of money

in fact these guys over here did the exercise to certain extent, I really don’t understand why is it causing difficulties

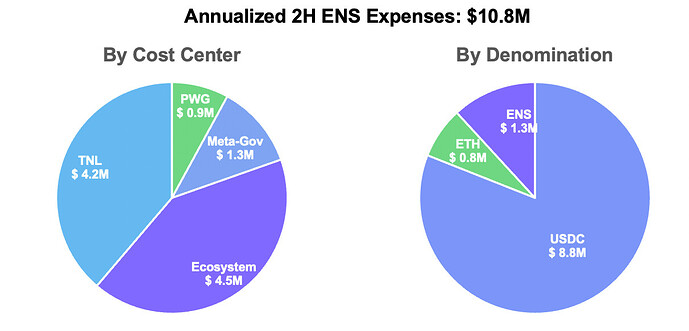

EDIT: Like so

You can extend this logic and present it in anyway which is applicable