Proposal Summary

See here for a Google drive link.

This link contains 3 attachments: 1) our formal proposal 2) our draft operating model for ENS and 3) presentation version of our proposal.

For convenience, an abridged version of proposal is also included below (shortened due to character limits on ENS’s forum):

Proposal

We propose that ENS dedicates 30,000 ETH (~$40M) to the initial endowment with a target endowment value of $80M. We propose that ENS commits to setting aside 50% of go-forward revenues on a monthly basis to fund the endowment until the target size is reached. Using our Base Case set of ENS projections we estimate the endowment to be fully funded in 12-15 months.

The endowment will be funded 50/50 from the earned and unearned portions of the ENS treasury. The earned portion will be converted into stablecoins and returns will be benchmarked against USD, the remainder will be denominated in ETH and the returns will be benchmarked against ETH. We recommend that this same split of earned vs. unearned revenue also apply to incoming revenue allocation to the extent that the unearned revenue maturation schedule allows for it.

There is inherent ETH price risk that comes along with this base denomination strategy. The intent of this split is to:

- Keep all unearned ETH in its base denomination while still “unearned”

- Materially diversify into stable assets and lower downside scenario capital risk

- Allow for some amount of consistent USD-based returns

- Allow for the DAO to participate in potential ETH upside rather than sell an unnecessarily large amount at depressed prices

We recommend revisiting the base denomination of the endowment every 6-12 months as the DAO evolves, unearned ETH converts, and and the macroeconomic environment shifts.

The endowment will seek to return 5-7% annually (in ETH and stablecoins, respectively). Distribution to the DAO will occur every 6 months. At these yields and at today’s ETH price, the fully funded endowment would be expected to generate between $4M and $5.5M annually, though these figures are highly dependent on the price of ETH given the aforementioned split in base denomination.

Lastly, we believe strongly in the importance of on-chain governance overseeing the endowment, rather than it being unilaterally managed. To that end, while this proposal reflects our recommendations on initial size, future revenue contribution, funding timeline, and ETH/USD split, we believe that these key decisions should be discussed and approved by the DAO before being implemented.

Rationale & Process

Recent & Future ENS Performance

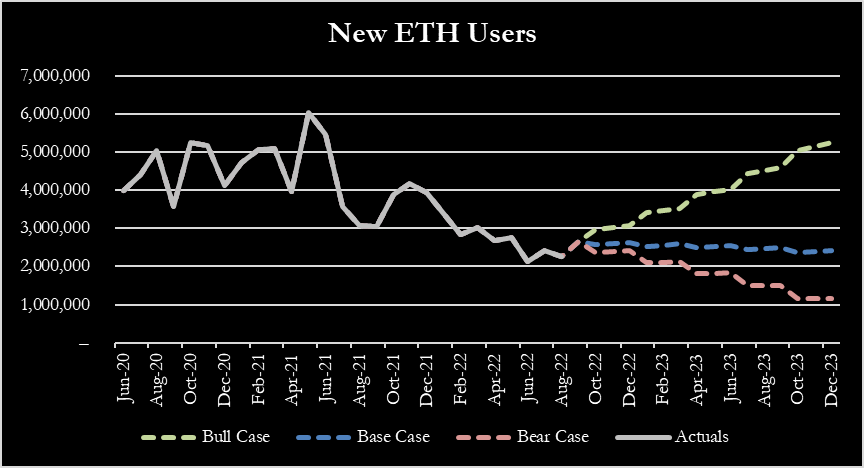

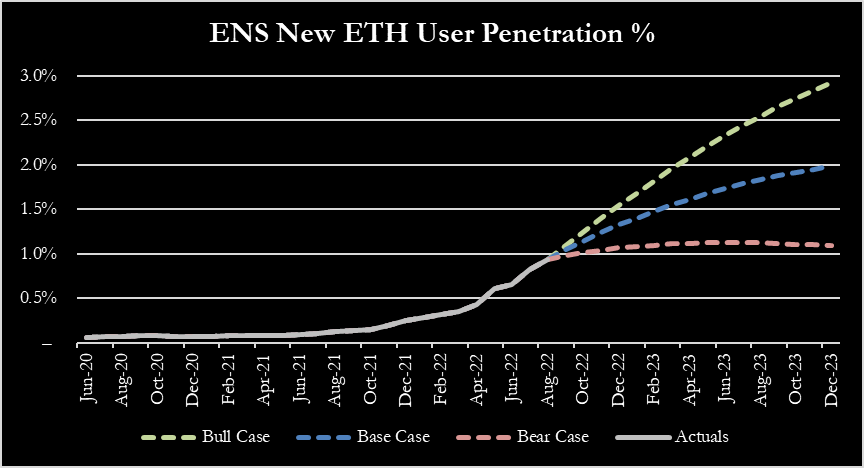

2022 has been a banner year for ENS. Despite unique address growth on the Ethereum network slowing and daily active addresses beginning to decline, the adoption of .eth names has rapidly accelerated.

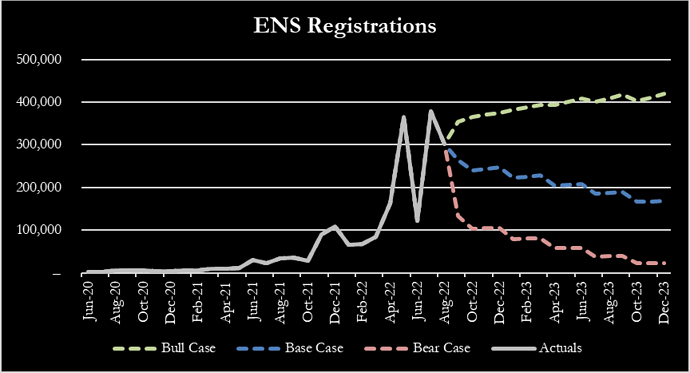

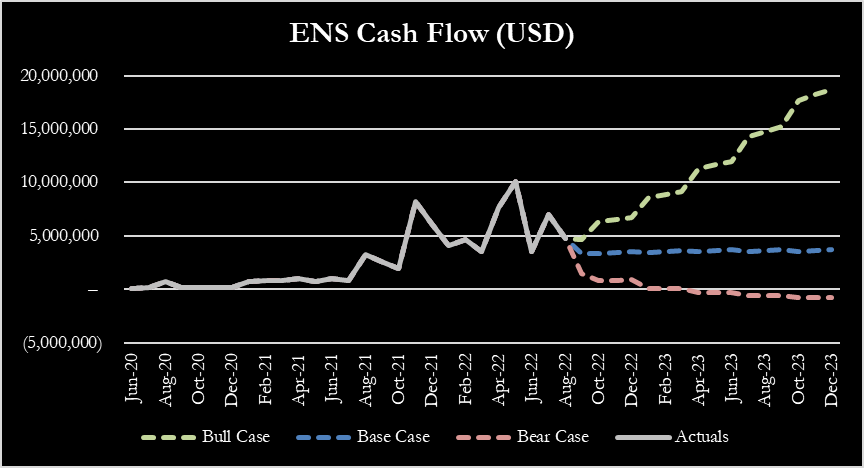

New registrations each month have ballooned from the 20k-30k months ENS saw during DeFi summer to greater than 300k new registrations in three out of the last four months. The protocol recently eclipsed two million active .eth names representing just under 1% of total unique Ethereum addresses, up from the 0.25% penetration rate at the beginning of the year. May of 2022 represented ENS’s best revenue month of all time, generating over $10M in a single month.

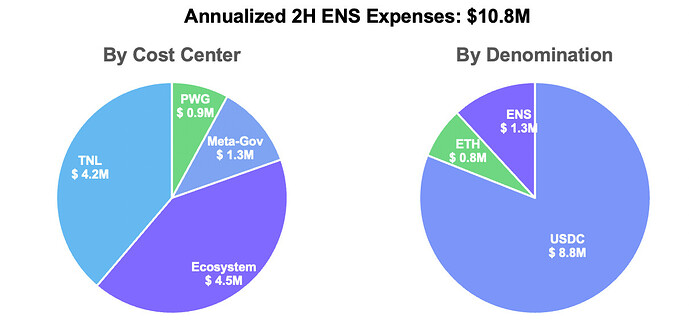

Alongside rising revenues have come rising costs. The Q3/Q4 ENS budget spread across TNL, PWG, Meta-Gov, and Ecosystem WGs has more than doubled relative to Q1/Q2 to nearly $11M annualized, and that’s without factoring in any potential Community WG budget for the latter half of the year. This is incredibly typical for an organization at this stage, particularly given the success and growth seen to-date. While this is not in and of itself a concern, it does highlight the changing and evolving nature and scale of DAO operations and budgetary needs.

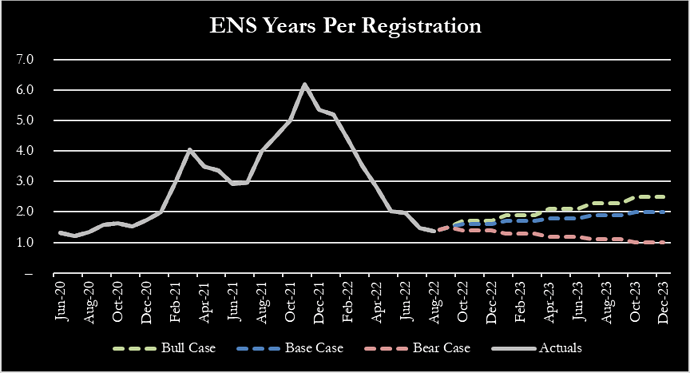

In short - despite tough market conditions ENS is not only growing, but thriving. With that said, there are a few trends worth keeping an eye on, including registration years per name and renewal rates.

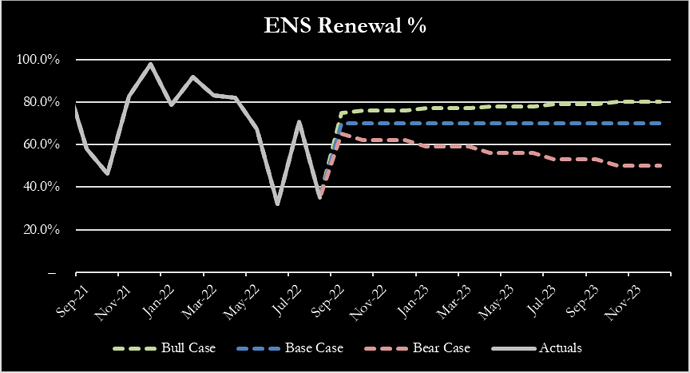

During the preparation of this proposal, we put together a bottom-up forecast model of the ENS protocol and treasury cash flow, taking into account historical performance to-date and running a few different scenarios of key drivers (ETH user trends, penetration %, renewal %, etc.) to inform what that would mean for the protocol. We included a Bull Case (ETH user growth rebounds, ENS continues improving penetration rate), a Bear Case (ETH growth continues to decline, penetration flattens, renewal rates steadily decline), and a Base Case splitting the difference.

Given all of this, it is our recommendation that the ENS endowment should:

- Focus on risk-mitigation over profit-maximization. We view this as an opportunity to capitalize on the protocol’s momentum to-date and invest in the future of the DAO, not run an ENS-backed hedge fund.

- Ultimately solve for USDC-based returns where possible, given the current cost-denomination of the DAO.

- Evolve with the performance and needs of the DAO. It is important that the manager hired to handle these funds monitor the performance of the protocol and the evolving size and cost-denomination of DAO WG budgets in addition to simply endowment performance.

ENS has evolved rapidly over the last six months and there is no reason to believe that this will not continue over the coming years. The DAO needs an endowment manager who is capable of understanding and evaluating protocol performance and working closely with the DAO to update the endowment mandate as the organization’s needs change and evolve. To this end, we will not only plan to manage the ENS endowment funds, but also monitor the DAO’s performance and funding needs and work hand-in-hand with ENS leadership to determine and recommend mandate changes as operational performance dictates. We will include updates on Ethereum ecosystem trends and DAO operations in addition to endowment performance in our regular reporting. We plan to serve not only as endowment managers, but also active contributors to ENS and will provide our perspective, insight, and recommendations on budgeting and operational recommendations, as appropriate.

ENS Treasury Breakdown

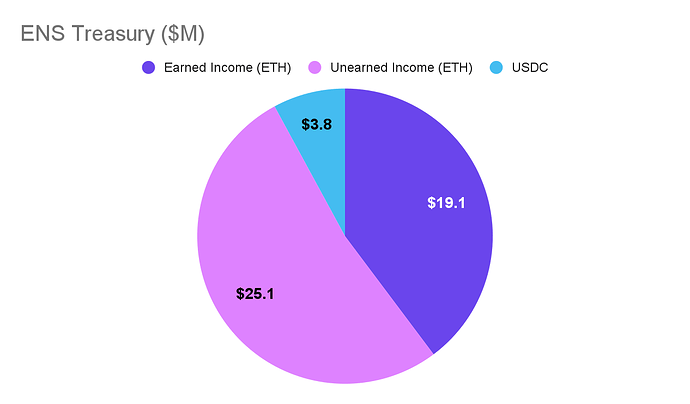

As of 9/21/2022, the DAO’s treasury contained balances of:

- ~14,670 ETH (~$20M) in earned income

- ~19,300 ETH (~$26M) in unearned income

- ~$3,800,000 USDC

Our proposal would leave the DAO with $3.8M in USDC and >4,000 ETH in non-endowment treasury (excluding ENS). The DAO has averaged ~$5.5M in monthly cash flow YTD and we have ~$4.5M monthly in base case cash flow projected for the next 6 months. Barring a significant operational downturn, the initial size of this endowment won’t jeopardize ENS operations.

Background

Llama works with DAOs on treasury management, protocol upgrades, and analytics. Our customers include Aave, Nouns, Uniswap, dYdX, Lido, Maker, Radicle, PoolTogether, and FWB.

Our work includes:

- Designing treasury strategies to deploy Aave’s reserve factor and safety module

- Consolidating Aave’s revenue into a single reserve factor

- Executing a Balancer token acquisition through a bonding curve

- Conducting risk assessments on assets listed on Aave and implementing asset listings across multiple chains

We bring the following to ENS:

- Investment expertise to design strategies

- Risk expertise to construct a portfolio based on the risk-reward of various strategies

- Smart contract expertise to evaluate underlying protocol risk and deploy strategies on-chain

Alastor has been a core contributor to Llama and works with DAOs like Uniswap, Lido, and Decentraland on treasury management and business strategy. Alastor brings decades of experience working with the leadership of Web2 companies to forecast their business performance, construct long-term investment roadmaps, and design capital allocation strategies. We also have significant experience executing a broad array of strategic transactions, which includes pricing and structuring mergers, building sophisticated acquisition models, and leading the preparation of Fairness Opinions publicly-filed with the SEC.

Llama’s experience at the forefront of on-chain governance, combined with Alastor’s decades of experience forecasting the operations of leading software companies, results in a team uniquely qualified for the mandate. Together, we will provide the DAO with highly-professional and sophisticated endowment management, tailored to the needs of ENS.

It’s important to highlight that two members from our team who will work on ENS’s endowment management have previously worked at one of the largest and best-performing university endowments.

Our Values:

- Rigor. Our work is of the highest quality. We care deeply about getting the details right.

- Ownership. We treat the problems of our customers as if they were our own. There is little to no separation between us and the DAOs we work with.

- Trust. We seek to actively earn the trust of our customers. We involve the community in our work and incorporate feedback where relevant.

- Transparency. We believe in open lines of communication and are comfortable working in a DAO-native manner.

Bios

Shreyas Hariharan is the co-founder of Llama. He has worked on treasury strategies for Aave and Uniswap and has authored two of the most-cited pieces on DAO treasury management (1, 2). He was previously on the investment team at Duke University’s endowment, leading Duke’s crypto efforts.

Austin Green is the co-founder and CTO of Llama. He was previously a senior software engineer at Chainalysis. He has worked on smart contract upgrades and on-chain treasury allocations for leading DeFi protocols such as Aave and Balancer.

Daniel Schlabach is a core contributor at Llama working on DeFi strategies for DAOs. Daniel attended Harvard Business School before taking leave to join Llama in a full-time capacity. He was previously an analyst at Duke University’s endowment investments team, where he focused on public markets strategies and crypto.

Matthew Graham is a core contributor at Llama working on DeFi strategies for DAOs. Matthew has designed and executed treasury strategies for Aave and Balancer.

Sam Bronstein is a co-founder of Alastor and a core contributor at Llama. Prior to founding Alastor, he was an investment banker at Qatalyst where he priced, structured, and executed an array of strategic and financial transactions, including the sales of Slack to Salesforce, LinkedIn to Microsoft, and many others.

Jordan Stastny is a co-founder of Alastor and a core contributor at Llama. Prior to founding Alastor, he was an investment banker at both Citigroup and Qatalyst where he priced, structured, and executed an array of strategic and financial transactions, including the sales of Mailchimp to Intuit, Five9 to Zoom, Roku’s IPO, and many others.

0x_d24 is a core contributor at Llama working on DeFi strategies for DAOs. He has served in a research capacity at a DeFi focused liquid token fund. Prior to working in crypto, he worked in investment banking for several years.

Strategy & Details

Asset Management Guidelines

We envision the ENS endowment split into two separate pools of capital as per the RFP:

- Risk-neutral with regard to USD

- Risk neutral with regard to ETH

Risk-neutral with regard to USD

This portion of the endowment will be seeded by the 15k ETH of earned income. Since the approach will be risk neutral to USD, we’ll need to convert the ETH to stablecoins using various dollar cost averaging strategies.

Planned method for exchanging ETH for stablecoins:

- Automated TWAMM strategy working directly with a market maker (or on an AMM)

- Single-sided staking in the USDC / WETH Uni v3 pool around concentrated tick ranges (allowing us to set liquidity around various ticks we want to DCA out of, swap ETH for USDC without any slippage, and earn a high APY due to the concentrated liquidity position). This pool is very liquid with TVL over $250 million.

Once this portion of the endowment is converted to USD-equivalents, it will be deployed to earn yield in a manner market-neutral to USD (i.e. won’t be deployed to assets where the USD basis is at risk).

Stablecoin Market Opportunity

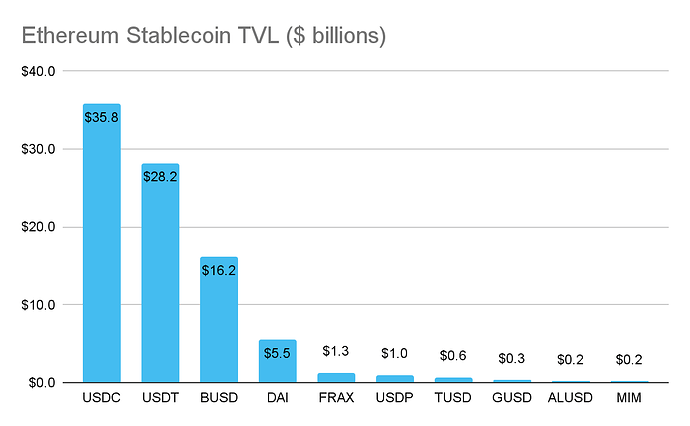

Ethereum’s stablecoin market cap today stands at over $90 billion, with most of the market dominated by USDC, USDT, BUSD, and DAI.

Given our preference for protecting against impairment of endowment funds over returns, we will allocate most of the endowment’s stablecoin bucket to trusted, liquid, reputable, and fully/over-collateralized stablecoins like USDC and DAI.

We will continuously assess risks associated with stablecoins and update our allocations accordingly. From time to time, smaller portions of the stablecoin bucket may be allocated to USD equivalent stablecoins that have undergone our risk assessments, like LUSD. We will also continuously research new stablecoins coming to market, such as GHO and crvUSD, to assess whether they meet our risk criteria.

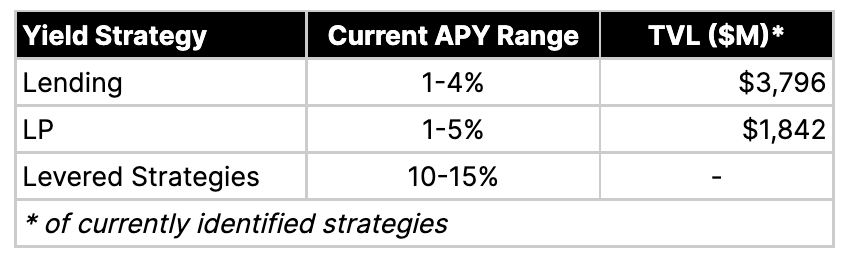

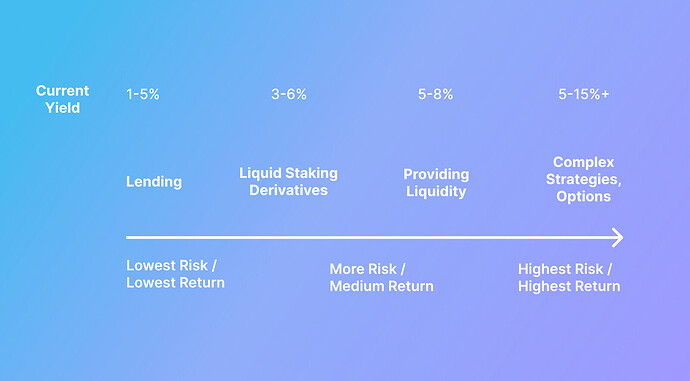

We will seek to deploy the maximum amount of stablecoin assets into productive strategies so that the endowment can earn as much yield as possible. At a high level, these strategies fall into two categories:

- Lending on protocols like Aave or Compound

- Providing liquidity in stablecoin pools that face minimal levels of impermanent loss (Curve LPs, Aura Finance)

Risk-neutral with regard to ETH

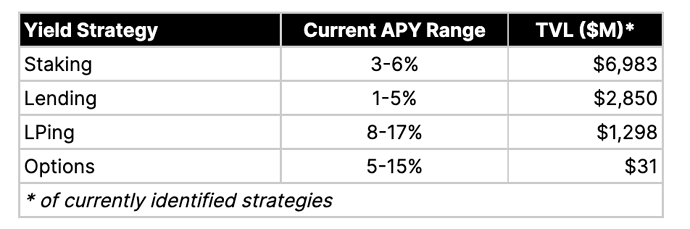

This portion of the endowment will be seeded by the 15k ETH of unearned income and should never suffer losses in ETH terms. All of the strategies in this bucket will be benchmarked to earn a positive return against ETH. There are a five main strategies that enable us to maintain ETH price exposure while generating yield:

- Liquid staking derivatives (stETH, rETH, cbETH, sETH)

- Providing liquidity in pools that include ETH and liquid ETH staking derivatives (crvSTE, bal-wsteth-weth)

- Lending on protocols like Aave or Compound

- Using options to earn income against our ETH with strategy dependent on market environment, i.e., covered calls in bearish market environment, selling straddles in a low volatility/sideways market, or cash secured put in a rising market (Ribbon Finance, Jones DAO, Lyra, Friktion Labs)

- More complex assets or positions that keep underlying ETH exposure (e.g. LP positions staked in Convex Finance, Aura Finance, Notional)

While there is potentially a much larger productive ETH universe, we’ve narrowed the investable universe down to trusted, liquid, and feasible assets and strategies. It’s also important to consider ENS’s size relative to the yield source. For example, ENS should not be the majority liquidity provider and ENS’s allocation should be small relative to the other depositors in the same strategy. Below is shown the approximate size of our investable universe, excluding Complex Strategies, where it’s difficult to estimate TVL and liquidity at a high level.

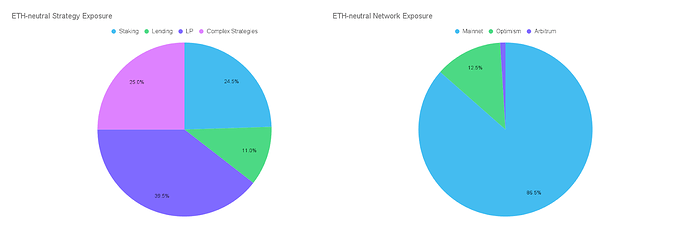

The ETH-denominated bucket of the endowment will contain positions from most, if not all, of the five categories listed above. Each bucket contains varying types and levels of risk, and as a result, comes with different levels of return. We’ll seek to balance the ETH-denominated portfolio with a mix of assets from each bucket (see Risk Management Guidelines for more).

Staking

The liquid ETH staking market has grown significantly over the past year and is nearing over 5.5 million Ether staked. However, the market remains very concentrated, with Lido’s stETH controlling approximately 78% of the liquid staked ETH market share.

While the entrance of players like Coinbase and Rocket Pool is promising, we expect that the ETH-denominated portion of the portfolio will have a high exposure to stETH, at least initially. As more players enter the market, we’ll seek to diversify the ETH portfolio away from stETH and into other alternatives. Though the high exposure to stETH is not ideal, we’re comforted by the fact that Lido has been forthcoming on their decentralization efforts (stated plans to adopt distributed validator technology and stake based on algorithmically determined node operator score), made credible efforts to decentralize and has not experienced any major hacks to date.

Other Notes

From time to time, both buckets may be deployed in strategies that earn tokens other than stablecoins or ETH-equivalents. For instance, depositing liquidity to Curve’s ETH/stETH pool currently yields over 5% in extra LDO returns. To keep returns denominated in USD or ETH, depending on the bucket, we’ll sell these tokens on the market towards the end of each quarter. In some cases, it may make more financial sense to hold these tokens and use them to boost future returns or provide other benefits. For example, BAL or AURA can be used to direct future emissions to certain pools, increasing returns or helping to incentivize ENS liquidity. Decisions regarding how to handle tokens other than ETH or USD equivalents will be made based on the endowment and the DAO’s financial positioning and broader strategic goals.

Risk Management Guidelines

Mitigating risk is our primary concern in managing the endowment, and we view risk through several different lenses, including qualitative and quantitative.

Qualitative Risks:

- Market risk. Market risk is inherent in any investment that trades freely on secondary markets. While it can’t be mitigated entirely, maintaining a portion of the endowment in productive stablecoins will prevent excess volatility in dollar terms.

- Idiosyncratic (position-specific) risk. While idiosyncratic risk cannot be avoided entirely, it can be mitigated through prudent portfolio construction and diversification of protocols/ecosystems.

- Liquidity risk. Liquidity can be a risk during periods of network congestion or in the event liquidity is needed but not available for operational expenses. Thorough liquidity and exit risk analysis will be performed when determining if a strategy is suitable for the endowment.

- Centralization risk. Some protocols present centralization risk. To help mitigate this risk, we’ll avoid overexposure to single assets. For example, to avoid the centralization risk of overexposure to one stablecoin, we will use a basket of stablecoins, mostly USDC and DAI. Ideally, the endowment should steer clear of any protocol with admin keys. If a protocol has admin keys, there should be a timelock in place before changes made by admins go into effect to limit potential risks.

- Smart contract risk. Crypto assets have varying levels of infrastructural risks related to the Ethereum network and smart contracts. Smart contract exploits (e.g., inflation of the stablecoin via exploitation of a minting function), use of admin keys, oracle risk, and more, can all destroy the value of an asset. To minimize smart contract risk, we will use trusted and proven infrastructure (like Safe’s Zodiac module) and deploy the endowment only into well-known and reputable assets. Further, we will generally avoid strategies with smart contracts that are not externally audited; Yearn’s vaults, for instance, undergo internal review but not external audits, and have a higher minimum return threshold required for them to enter the portfolio.

- Oracle risk. Widely trusted and proven oracle feeds are strongly preferred, and we’ll use Chainlink oracles wherever possible. Oracle exploits are one of the most frequent exploits within DeFi. We want to ensure that any investment that utilizes (particularly derivatives) oracles are set up with secure price feeds/data. For example, an options protocol using an ETH price feed for options pricing needs to use an oracle pulling ETH pricing from multiple exchanges; otherwise a bad actor could manipulate ETH price on one source exchange and impact the entire options market.

All investments and strategies will undergo risk assessment whereby each of the above risks are investigated and taken into consideration. Any known risk is to be clearly articulated in any proposal to the DAO.

Quantitative Risks:

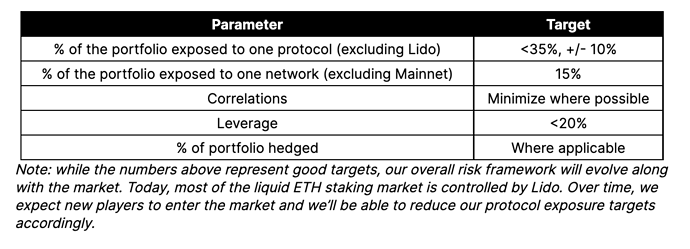

We will actively monitor the following, among other, risk considerations:

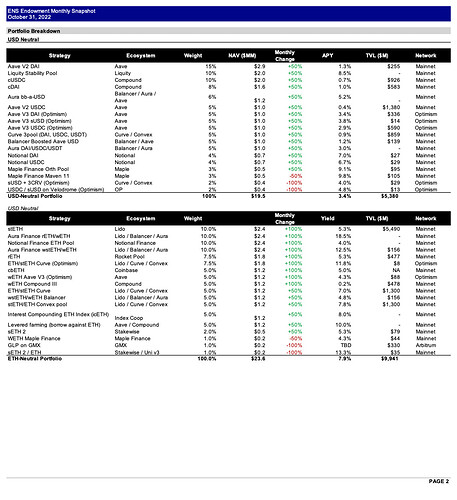

Sample Portfolio within Asset Management & Risk Management guidelines

Note: this is a preliminary framework that will be adjusted based on risk appetite and market dynamics

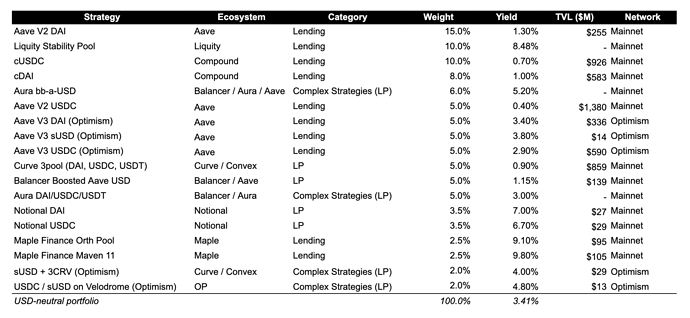

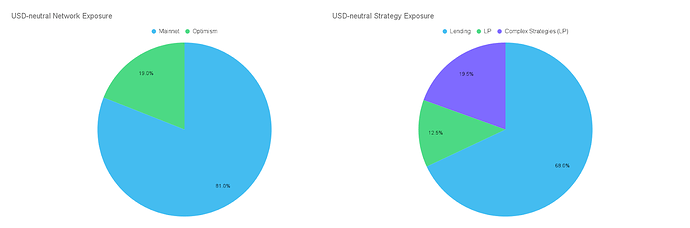

USD Risk-Neutral Strategies

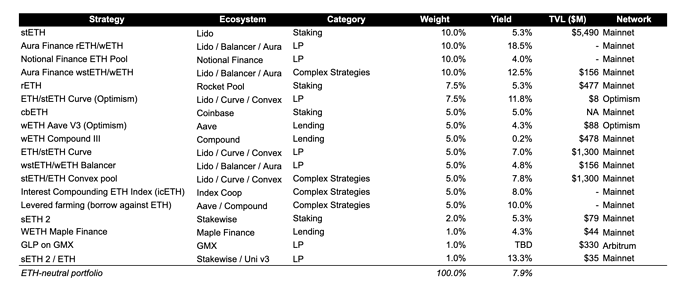

ETH Risk-Neutral Strategies

It’s important to note that today’s yields, and those achieved in the past, may not represent future yield. Available yield is subject to many factors, including TradFi interest rates and the total amount of Ethereum staked.

Hedging

There are several potential hedging strategies we can use to mitigate potential downside to ETH price. Currently, ETH volatility is high so the cost to hedge outweighs many of our sources of ETH yields. We will continually monitor funding rates and trends so hedges can be employed when cost effective. There are three main hedging strategies we will monitor regularly.

- Perpetual Futures: Off-chain (Binance, FTX, Kraken) and on-chain (dydx, GMX and GNS)

- Fixed Rate Expirable Futures: Off-chain (Binance, FTX, Deribit) and on-chain (Contango DEX)

- Out-of-the-Money Put Options: Off-chain (Deribit, Binance, FTX) and on-chain (Opyn, Lyra, Dopex)

We explain hedging strategies in more detail in our full proposal.

Logistics

We will operate the endowment entirely through on-chain governance via periodic proposals. We believe this sets the best precedent for ENS because it doesn’t put the endowment at the risk of attack by a single actor. ENS is one of the most prominent DAOs and will be in the regulator’s spotlight. It is best to set the right precedent to protect tokenholders and contributors.

A key differentiator with our group is that we have the necessary smart-contract engineering talent in-house to implement strategies on-chain for the endowment. On-chain governance is best suited to execute the strategies we have planned, account for the custodial and legal risks, and set the right process for the DAO.

We have already engaged with lawyers to understand and mitigate any potential legal risks associated with the proposal.

Note that we are open to revisions if the ENS community disagrees with our approach.

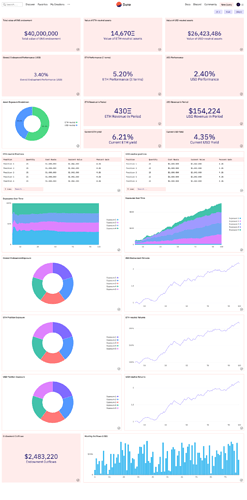

Reporting

We will develop a live dashboard that allows DAO members to receive on-demand updates on the performance of the endowment. This dashboard will display up-to-date statistics including NAV (total endowment value), portfolio positions and respective sizes, yield statistics, and historical portfolio composition, among others.

A mock up of this dashboard is shown below. Note that all numbers are for illustrative purposes only, and additional charts and tables may also be included in the live version.

We will regularly provide monthly snapshot and detailed quarterly reports to the DAO on both endowment and protocol performance.

-

Monthly Snapshots (shown below)

- Position balances and breakdown

- Month-to-month strategy changes

- Monthly yield generated

-

Quarterly Reports

-

Endowment Snapshot

- Position balances and breakdown

- Month-to-month strategy changes

- Quarterly yield generated

-

Key Position Update

- TVL changes

- Yield trends

-

Macro Environment Update

- ETH and other L1 Performance

- DeFi pricing trends

- Regulatory updates

-

ENS Protocol Performance and Commentary

- State of the Treasury

- Topline ETH Ecosystem Trends

- Registrations / Renewals / Active Names

- Implied Churn / Renewal Rates

- Revenue & Breakdown

- Expense & Breakdown

-

We will maintain a detailed, bottom-up forecast model for ENS. This model will include, but is not limited to:

KPIs: ETH Unique User Count/Growth, Daily Active ETH users, ENS Registrations, ENS Renewals, Active ENS Names, Renewal/Churn %, Registration Years

Financials: Revenue, COGS, Gross Profit, Operating Expenses, Operating Profit, Cash Flow

We will update and revise monthly as trends change and the DAO evolves. This model will form the basis of our recommendations for any endowment adjustments (i.e., base split, risk appetite, appropriate size, future revenue contribution, etc.). It will also serve to inform the growth strategy for the DAO.

We will maintain a channel in ENS’s Discord server so community members can ask questions on the endowment’s management. We will also host a call with the community to share updates and insights on a quarterly basis.

Legal

We have worked with outside counsel to consider the legal risks presented by ENS’s request for a proposal for a fund manager to manage its endowment fund. In view of the potential regulatory risks associated with fund management, as well as regulatory uncertainty in the crypto space more generally, we believe the smartest approach is for us to frequently and periodically present proposals to the DAO to aid the community to make its own decisions concerning the deployment of its endowment fund assets.

Our fees will be earned based on the amount of work that we perform to research and present the proposals. We believe this is a more thoughtful approach that reduces the regulatory risks for the ENS community and ourselves, and protects ENS from opportunistic and unqualified actors, but still leverages our experience and reputation to help ENS and the community accomplish its goals.

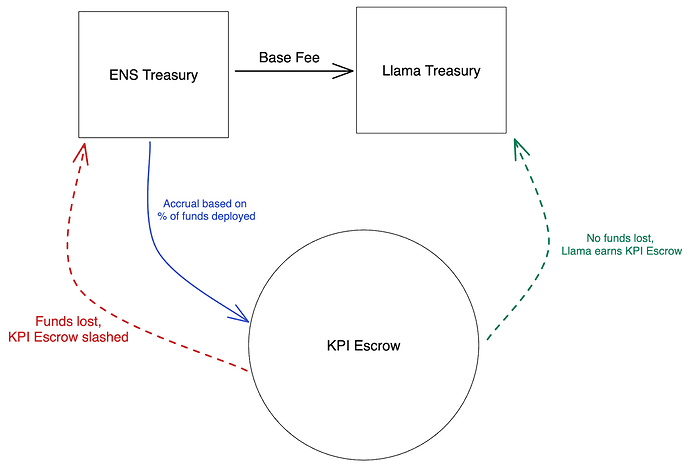

Compensation Model

We charge a fee of $1.2 million, 70% ($840k) of which will be streamed over a 12 month period, with the remaining 30% remaining in an escrow contract controlled by ENS DAO. This escrowed payment will be earned only if the endowment has no capital loss.

Capital loss is defined as:

- ETH-neutral: Value of the ETH-neutral portion, in ETH terms, 365 days after the Start Date is less than NAV at the Start Date, after adjusting for outflows to ENS DAO

- USD-neutral: Value at the End Date is less than value after all ETH in this portion is converted to stablecoins. This starting value will be reported to the community as soon as the conversion is complete. This value will also be adjusted for any outflows to ENS DAO.

This compensation model aligns our performance with the goals of the DAO: to protect against any capital loss (risk-mitigation) and to generate revenue to sustain the DAO. We believe that an external fund structure not only poses legal risks (noted above), but is also not aligned with the DAO’s incentives or structure. External fund managers earning performance fees based on returns generated are incentivized to seek maximum returns and are not incentivized to minimize capital loss, nor do they operate in a DAO-native, fully trustless manner via smart contracts in which the DAO has a say in each capital deployment.

For reference on pricing, we charged Aave a $2 million fee to work on treasury management and smart contract upgrades. The proposal recently passed its on-chain vote with overwhelming community support (>99.9%).

The diagram below demonstrates how this escrow contract will function:

Notes:

- Start Date = Date of official selection by Meta-Governance Committee

- End Date = 365 days after date of official selection by Meta-Governance Committee

- USD-neutral starting NAV will be reported to the community after the conversion of ETH to stablecoins is complete

- Net Asset Value (NAV) will be benchmarked to ETH and USD for each portion of the endowment

- DAO spending and other outflows will be subtracted from starting NAV when determining whether or not the escrowed payment should be made

- Loss of funds from proposals from groups other than Llama will not be included in any refund calculations

- While we’ve outlined a proposed structure for the escrow contract, we’re open to other architecture (e.g. multisig) if it’s easier for the DAO to implement.

Summary

We outline a proposal to manage ENS’s endowment, along with expectations for asset management, risk management, reporting, logistics, and compensation. We look forward to feedback and questions from the Meta-Governance Committee.

Disclaimer: This post has been provided for informational and discussion purposes only. It is not intended to, and does not, constitute legal, financial, business, or tax advice. This post should not be relied upon to provide any form of protections or business advice. No decision to buy, sell, exchange, or otherwise utilize any digital asset is recommended based on the content of this framework.