Very difficult to comment or to make a financial plan without expense accounting over the operating life of ENS.

Is there such an expense accounting record in existence? If so please(and thank you) point me to it.

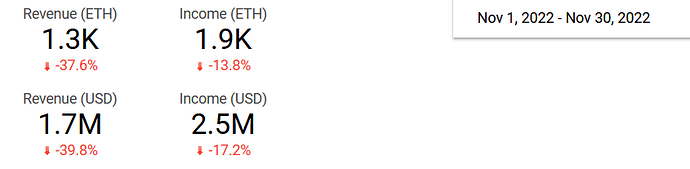

I see the following revenue/income dashboard.

And can check the DAO wallet and Cold wallets and Registrar Controller.

ENS Cold Wallet

0x690F0581eCecCf8389c223170778cD9D029606F2

86.445 ETH 111,140

1,480,003.39 ENS 20,674,539

4,149,984.46 USDC 4,154,134

2,779,037.24 DAI 2,779,037

ENS DAO Wallet

4091.278 ETH 5,260,034

10,061,834.59 ENS 140,556,296.44

2,467,026.38 USDC 2,469,493.41

ENS ETH Registrar Controller 0x283Af0B28c62C092C9727F1Ee09c02CA627EB7F5

34538.2318 ETH 44,345,708

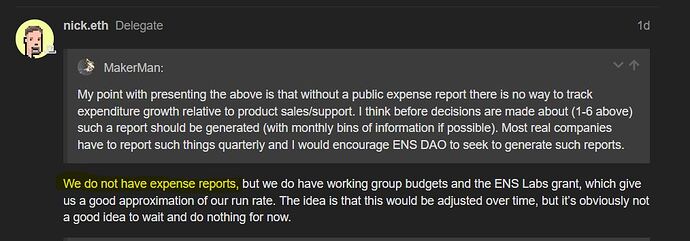

My point with presenting the above is that without a public expense report there is no way to track expenditure growth relative to product sales/support. I think before decisions are made about (1-6 above) such a report should be generated (with monthly bins of information if possible). Most real companies have to report such things quarterly and I would encourage ENS DAO to seek to generate such reports.

Next point is that the above reports like to state ETH revenues converted into $$ but unless these are actually converted into $$ this revenue is effectively left invested in ETH which according to (5) above will be sold to do which

- satisfy $16M cash equivalents in the treasury OR

- to add $16M to treasury.

The way (5) is written this is entirely unclear whether this sale will satisfy (1,2) or is now setting a fixed amount of $16M to be raised by the ETH sale and added to the existing treasury.

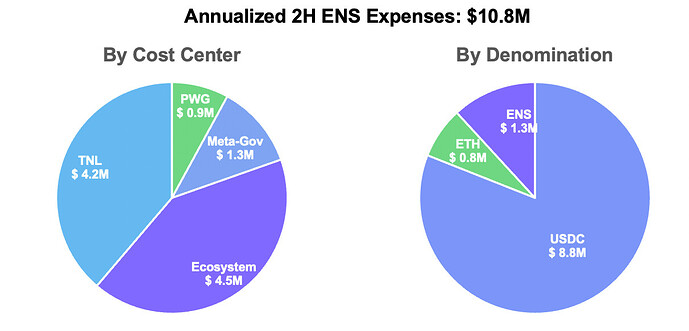

I first heard that ENS expenses were running 4M/yr and now with the above this looks to be projected to be 8M/yr. To satisfy the 2yr runway in cash wouldn’t it be prudent to actually provide actual expense numbers?

Final points. I think each of the points above (1-6) should be discussed AFTER a financial report is produced including expenses, earned and unearned income and have the DAO decide how many years of runway (or how many millions) to try to provide for based on expenses and ecosystem growth. Given that ENS has actually allowed sales of ENS domains FAR into the future one could look upon these as actual ‘contracts of obligation’. Meaning the ‘unearned income’ actually has ETH slated to pay for operating expenses to satisfy customers with product service FAR into the future. Highly unlikely ENS has set aside sufficient funds to guarantee operations 5 years from now, much less 100yrs, so some consideration as to length of registrations should be thought about in this light of ‘unearned revenues’.

Example: What does this unearned income graph look like over time in ETH based on past registrations so far.

With regards to ETH sales. Provided ETH income holds up it, instead of drop kicking $16M worth of ETH to sell rapidly I would prefer the amount (what 12.8K ETH at $1280/ETH) to be sold 1:1 with monthly revenues. Last month in above ENS dashboard I see ENS earned 1.3K ETH revenue claimed to be 1.7M.

So in this case I would slate the 1.3K ETH income to be sold with 1.3K ETH in the DAO treasury ideally to be done daily over the next month (so 2.6K/30 something like 87ETH/day for about $110K/day cash DCA out). This would translate to about $3M/month provided ETH price holds up) and generally reduce and distribute selling pressure. A real discussion about why ENS can’t wait a few months to clear $16M I think should be had given I see something like 4M USDC and 2M DAI in wallets currently (sufficient for what 8-12 months at 6-8M yearly run). Even at current prices and income levels it would be like 4-5 months before $16M could be raised by selling all ETH revenue with same amount of ETH in treasury steadily.

While the DAO can choose to sell all $16M or 12.8K ETH over a short period and rely on unearned ETH and future earned ETH as the ETH investment base I think a real discussion about what to do with incoming ETH revenues generally is warranted in light of a wholistic approach to proper ENS ‘business’ management (doesn’t matter if you are a profit or non-profit here - every org has to manage finances to pay people, buy stuff and generally manage what they are doing). If you look at the above ENS dashboard on how revenues in ETH came in over the past year you’d see that the highest ETH revenues were closest to the ETH price highs and have been coming down since then. Realize even with same $$ price per ENS domain and ETH price at the highs, ENS was still earning more ETH than when the ETH price was down (for the most part). This says something about ENS revenue models and business flow cyclicality to pay attention to btw.

As to:

I absolutely think some idea of how much value to allow a single manager to manage IS an important discussion. It is better to spread your risk and return profiles over many investments (and hence investment managers) both from a risk and return diversification perspective. I see no reductions in fees or any changes in the cost profiles from these ‘managers’ based on the amount managed so there is no real cost incentive not to diversify funds with different investment managers.