Abstract

Following the approval of EP2.2.5, Karpatkey has been appointed as the endowment fund manager of the ENS DAO. In order to move forward with the execution of the proposal, it is necessary to establish the initial conditions and the required steps to create the endowment.

Based on the last meetings between Karpatkey and the ENS stewards, the following paragraphs are intended to openly share the ongoing conversation, namely to:

- Establish the scope and initial scenario to construct the endowment;

- Agree upon an investment thesis for the ENS DAO;

- Define the initial yield-generating strategies to be deployed;

- Establish the necessary safeguards and due diligence process to ensure ENS DAO assets remain safe at all times; and

- Determine next steps.

Specification

Introduction

In order to establish the initial scenario, the following topics need to be addressed and defined:

- ENS investment thesis according to the Endowment risk profile and balance sheet composition

- ENS operational treasury vs ENS endowment

- Initial endowment size

- Initial asset composition

- Subsequent steps toward endowment expansion

- Rewards management

It is also necessary to think about the management of future income, newly converted earned ETH and endowment rebalancing. These topics will be addressed in detail in future posts.

DAO account balances

As of the day of this writing, the ENS DAO account balances are as follows:

| Current Portfolio | ||||

| Token | Description | Amount | Price | Value |

| ETH | Unearned (controller) | 19,506 | $ 1,330.00 |

$ 25,943,592 |

| ETH | Earned (controller) | 15,550 | $ 1,330.00 |

$ 20,681,340 |

| ETH | DAO | 4,091 | $ 1,330.00 |

$ 5,441,402 |

| USDC | DAO | 2,467,026 | $ 1.00 |

$ 2,467,026 |

| Total |

$ 54,533,361 |

According to the plans outlined on the Routine Treasury Management post, the DAO intends to build a separate fund whose size should be enough to cover 2 years of runway, which is estimated at $16,000,000 USD, denominated in USDC and/or DAI. There is also a current draft proposal to convert only $12,000,000 to start. Regardless of the decisions made on these two independent proposals (whether they are executed or not), the endowment will contain the entire treasury less $16,000,000.

The $16M runway will come from converting earned ETH. The remaining excess ETH will be sent to the endowment, where it will also be converted to USDC as part of the endowment fund.

After seeding the 2-year runway fund

| Token | Description | Destination | Amount | Price | Value |

| USDC | 2-year runway | ENS main wallet | 16,000,000 | $ 1.00 | $ 16,000,000 |

| ETH | Unearned (controller) | Endowment | 19,506 | $ 1,330.00 | $ 25,943,592 |

| ETH | Earned (controller) | Endowment | 3,520 | $ 1,330.00 | $ 4,681,340 |

| ETH | DAO | Endowment | 4,091 | $ 1,330.00 | $ 5,441,402 |

| USDC | DAO | Endowment | 2,467,026 | $ 1.00 | $ 2,467,026 |

| Endowment Total | $ 38,533,361 |

In addition, considering the significant exposure to ETH given by the unearned ETH sitting on the controller’s wallet, it makes sense to also convert the ETH holdings in the DAO’s wallet to USDC. Adding the remaining earned ETH after seeding the 2-year runway fund and the ETH in the DAO’s wallet, a total of 7,611 ETH will be converted to USDC.

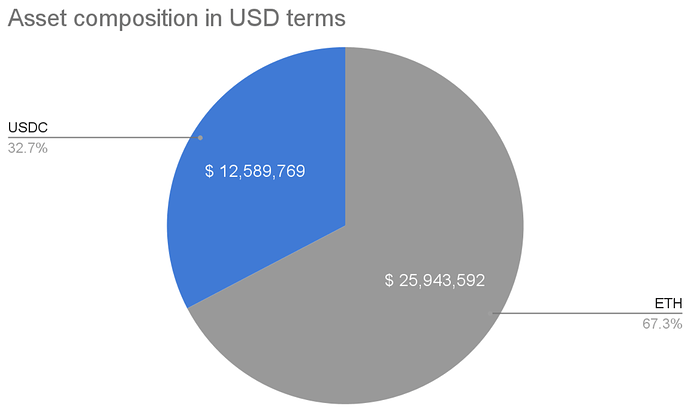

After executing the proposed transactions, the resulting balance is as follows:

| Initial Scenario | ||||||

| Token | Description | Destination | Amount | Price | Value | Share % |

| ETH | Unearned | Endowment | 19,506 | $ 1,330.00 |

$ 25,943,592 |

67% |

| USDC | - | Endowment | 12,589,769 | $ 1.00 |

$ 12,589,769 |

33% |

| Endowment Total |

$ 38,533,361 |

Endowment construction and expansion

Although the total funds available to build the endowment amount to approximately $38.5 MM USD, it is prudent to take a cautious approach, starting with a portion of the funds and gradually building up to 100% of the funds, provided Karpatkey demonstrates their capabilities and fulfill their commitments outlined in the Fund management proposal.

Therefore, the proposal is to start with 20% of the available funds and deploy a subset of yield-generating strategies that will be scaled up as the endowment grows. The remaining funds will be injected in 4 equal monthly installments until 100% of the funds are sent.

Stage 1: 20% of funds to initially seed the endowment

| Token | Initial % | Initial amount | Price | Initial Value | Share % | Strategy |

| ETH | 20% | 3,901.29 | $1,330.00 | $ 5,188,718 | 67.3% | ETH - neutral |

| USDC | 20% | 2,517,953.84 | $1.00 | $ 2,517,954 | 32.7% | USD - neutral |

| Endowment Total | $ 7,706,672 |

Strategies and results

Having defined the initial endowment size, the asset composition and the expansion pace, the list below exhibits the strategies that will be deployed on Stage 1.

Additional context and information about the strategies:

- Stablecoin exposition is equally split between USDC and DAI.

- Stablecoin strategies aim to take a very simple and conservative approach by depositing the funds on Compound v2.

- ETH staking positions are diversified between stETH (Lido) and sETH2 (Stakewise).

- Lido staking positions are diversified between Balancer / Aura and Curve.

- The stakewise position is considered within Uniswap V3 (this strategy is part of the Stakewise native farming design).

Stage 1 Strategy

| # | Protocol | Position | Strategy | Share per Strategy | Allocated Funds | Share of Portfolio | Proj. APR | Proj. Revenue |

Pool TVL

(in MM) |

| 1 | Compound v2 | DAI | USD - neutral | 50% | $ 1,258,977 | 16.34% | 1.90% | $ 23,921 | $412 |

| 2 | Compound v2 | USDC | USD - neutral | 50% | $ 1,258,977 | 16.34% | 1.64% | $ 20,647 | $586 |

| 3 | Aura Finance | wstETH - WETH | ETH - neutral | 40% | $ 2,075,487 | 26.93% | 7.93% | $ 164,586 | $190 |

| 4 | Curve | stETH - ETH | ETH - neutral | 40% | $ 2,075,487 | 26.93% | 5.88% | $ 122,039 | $866 |

| 5 | Uniswap v3 | sETH2 - ETH | ETH - neutral | 20% | $ 1,037,744 | 13.47% | 11.20% | $ 116,227 | $43 |

| Total | $ 7,706,672 | 100.00% | 5.81% | $ 447,420 |

At the time of this writing, if the presented strategies were implemented, the annualized results for Phase 1 would be as follows:

| Annual results | |

| Total Funds |

$ 38,533,361 |

| Utilized Funds |

$ 7,706,672 |

| Capital Utilization |

20.00% |

| Gross Revenues |

$ 433,722 |

| Gross APR |

5.63% |

| Management Fee

(calculated over AUM) |

0.50% |

| Performance Fee

(calculated over revenue) |

10% |

| Net Revenues |

$ 351,816 |

| Net APR |

4.57% |

Rewards management

Given that the DAO has a considerable exposure to ETH (unearned ETH represents ~48% of the current balance without considering ENS), the best approach is to convert 100% of the generated rewards into stablecoins and re-deploy them onto USD-neutral strategies, growing the stablecoin existences upon time.

Next steps

Before being able to deploy the presented strategies according to the initial scenario, the additional ongoing audits on the Zodiac Roles Modifier should be completed. Two independent auditors are finishing additional audits for the smart contracts being deployed:

- Ackee

- Sub 7

We will keep the ENS community updated on further developments.