Hi, I’m Bram, and I’m with Glo Dollar, the stablecoin that funds public goods.

Overview

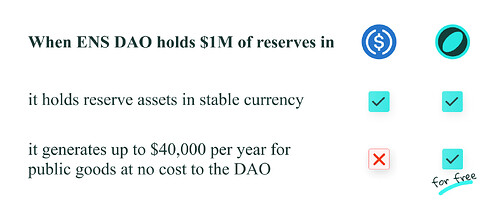

We propose that ENS DAO converts 20% (~$920,000) of USDC holdings from the ENS DAO Wallet to Glo Dollar (USDGLO) to fund Web3 Public Goods at no cost.

Doing so has three distinct benefits:

- Program Web3 Public Goods Funding into ENS DAO’s treasury through Glo Dollar’s Automatic Public Goods Funding (AutoPGF) Mechanism. By holding Glo Dollars and selecting ‘Web3 Public Goods’ as its funding cause, ENS DAO funds Web3 Public Goods without having to donate.

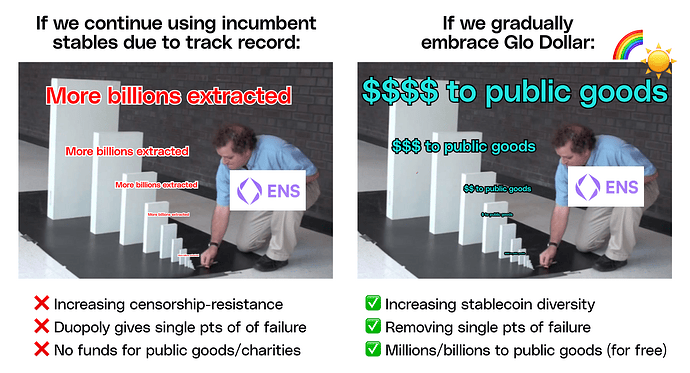

- Strengthen ENS DAO’s resilience by diversifying USDC holdings into multiple native, USD-backed stablecoins.

- Support the development of an alternative US regulated stablecoin that benefits the public and the broader crypto ecosystem.

What is Glo Dollar?

Glo Dollar (USDGLO) is the stablecoin that funds public goods.

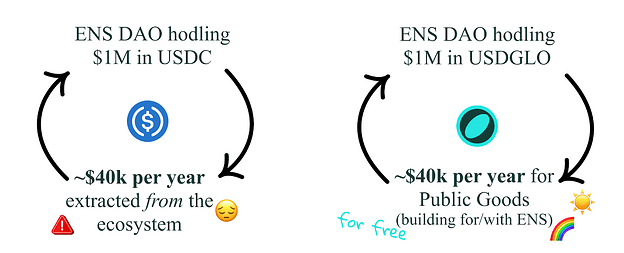

Stablecoin companies generate $7.4 billion in profits/yield annually from their stablecoin reserves. Our approach is different—we funnel 100% of our profits to public goods and charities.

Holding Glo Dollars creates a virtuous cycle to grow ecosystems, instead of extracting yield for gains. By choosing Glo Dollar, you fund the causes that matter to you, at no cost. Organizations like Mento Labs, Gitcoin, and Polygon Labs are already embedding zero-cost philanthropy into their operations by holding part of their treasury in Glo Dollars.

Choosing the causes to support can be done from our dApp. In ENS DAO’s case, we’d suggest generating funds for Web3 Public Goods (other cause areas focus on poverty eradication and climate action).

Holding $920k in Glo Dollars, ENS DAO would generate up to ~$37,000 in public goods funding per year—this would be akin to funding an extra Small Grants Round at no cost to ENS DAO.

Glo Dollar is available on 7 chains: Ethereum, Celo, Polygon, Optimism, Arbitrum, Stellar, and Base.

How it works

What happens when you buy and hold Glo Dollars:

- The fiat backing Glo Dollar is invested and earns revenue (similar to other stablecoins).

- We donate 100% of our profits on these investments to public goods and charities.

- The user decides which public goods and charities we’ll fund. ENS DAO has the option to allocate all of its generated funds towards supporting Web3 Public Goods.

- ENS DAO is funding Web3 Public Goods at zero cost.

We call this Automatic Public Goods Funding, because it is:

- Simple: just hold a stablecoin

- Zero-cost: holding a stablecoin is free

- Embeddable: in treasuries, payroll, card transactions, …

Glo Dollar’s Web3 Public Goods cause area

Right now, the Web3 Public Goods cause area generates funds for Gitcoin, Giveth, and Protocol Guild. We’ll be broadening support to include more initiatives on a rolling basis.

We’re eager to know if there are any specific Web3 Public Goods that ENS DAO would like us to add as a funding recipient.

Learn more about our Cause Areas and How we select Causes to support.

How we’re making Glo Dollar usage zero-cost and straightforward for ENS DAO

- Swapping Glo Dollars for free. There are multiple routes for ENS DAO to swap USDC for Glo Dollars at zero fees. The Glo Foundation will assist in setting up the easiest route.

- Direct offramps. We’re partnering with many offramp providers to make instant USDGLO offramps without intermediaries.

Other DAOs and organizations embedding zero-cost philanthropy into their treasury

- Mento Labs: $1M. In August, this proposal passed with a 99.9% ‘Yes’ vote from the Celo community. We’re now working with Mento Labs on finalizing the transfer. We shared the news this week.

- Shutter DAO: $300k. Following this proposal, Shutter DAO swapped $300k of USDC into Glo Dollars to pay out grants and contributors.

- Polygon Labs: $150k. Polygon Labs bought Glo Dollars in May—see this tweet from Polygon Co-founder Sandeep Nailwal about the purchase.

- Gitcoin: $100k. A few months after our launch, Gitcoin swapped $100k of USDC into Glo Dollars following this proposal.

Many other organizations are embedding philanthropy into their treasury with Glo Dollars, many of which are shown on this page.

Risks

Glo Dollar is 100% fiat-backed, always redeemable 1:1 for USD and USDC, issued and regulated in the United States, and receives monthly independent attestations.

In April, we received our Bluechip rating, with an initial B grade. This places us in the top 10 fiat-backed stablecoin, and we’re deemed safer than Tether’s USDT, FRAX, FDUSD, among others. Glo Dollar received the following assessments:

- Stability: Stable

- Management: Very low risk

- Governance: Low risk

Glo Dollar is developed by the Glo Foundation and is issued by Brale. Brale is a US regulated money services business, which is the same regulatory framework under which Circle issues USDC.

Voting

The voting options will be:

- ‘Yes’ - Swap 20% of ENS DAO’s USDC into USDGLO.

- ‘No’ - Do not swap 20% of ENS DAO’s USDC into USDGLO.

- ‘Abstain’