The February 2025 Endowment Report is now available on karpatkey’s website.

karpatkey is pleased to present its first monthly Community Update to the broader ENS Community to increase awareness and transparency of its activities.

Market Update

- February saw heightened volatility across macro and crypto, with persistent trade war concerns and the Fed signalling higher rates amidst inflation concerns.

- The total implied network value (market cap) of the digital asset market stood at $2.92tn at the end of February, down 21% from January (from $3.71tn).

- Over the month of February, BTC is down 17.5%, and ETH is down 32.2%.

- Bitcoin dominance is 59.0%, up 4.1% from January.

- Major market news:

- Bybit hack: Hackers stole over 500,000 ETH, stETH, and mETH ($1.4bn at the time of hack) from Bybit by gaining access to a Safe developer’s computer to control the Safe UI. The broader Bybit hack has shone a light on critical vulnerabilities that can arise from blind signing practices and front-end security.

- FTX began redistributing funds to creditors on February 18; the initial round of distributions included $1.2bn for small claims creditor group (<$50k), recovery ratio is estimated to be ~120% of the account value. Next claims distribution is scheduled for May 30.

- Unichain went live on mainnet on February 11, less than 2 weeks after the launch of Uniswap V4 on January 31. Taken together, the two developments signal a rapid acceleration in new innovation from Uniswap, as Unichain becomes one of the first to host primarily V4-style liquidity.

- Lido announced v3 on February 11, introducing stVaults, which allows stakers to have complete control over the validator set, MEV management, and liquidity access. This can be seen as Lido vying for institutional adoption, especially as a potential provider for staking ETH ETF.

ENS Token Update

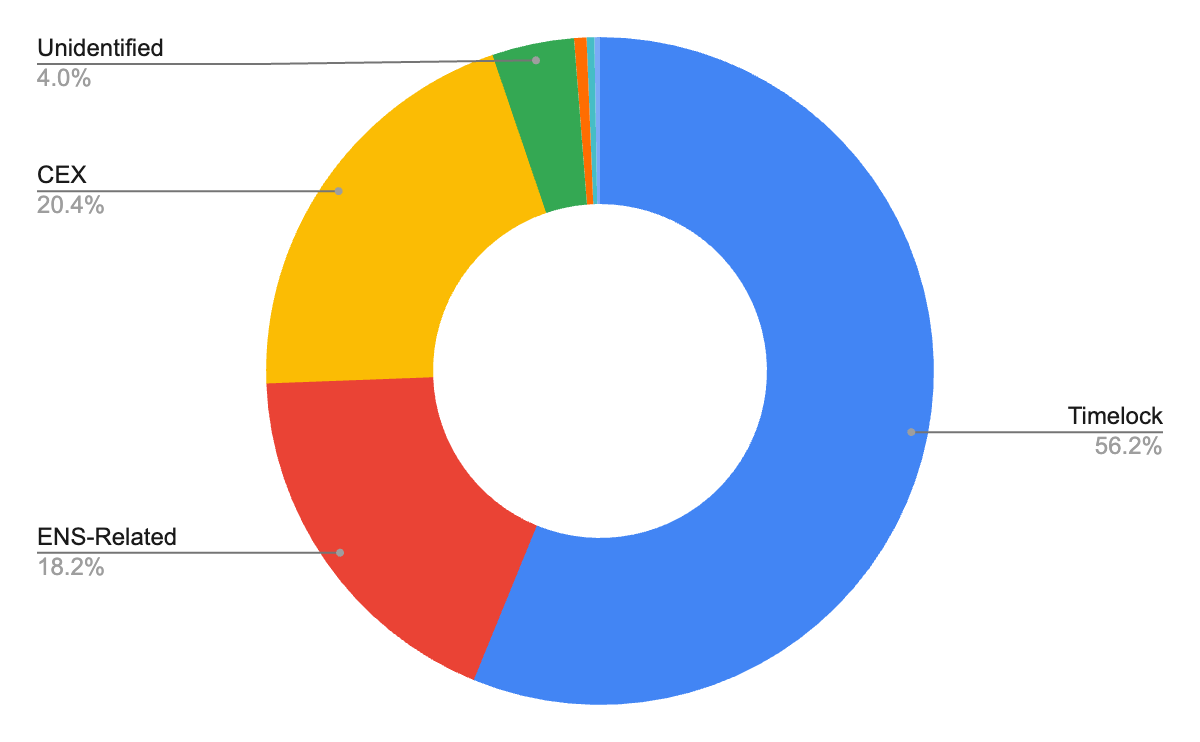

- Token holder distribution for Top 50 ENS token holders remain concentrated in the hands of Centralised Exchanges (“CEXs”) and ENS-Related wallets (DAO, ENS Labs, etc.)

- For further information on ENS Governance and Delegation statistics, please refer to ENS DAO Governance Dune dashboard.

- ENS token price dropped 36.7%, in line with ETH price

- Despite the volatility, trading volume of ENS token also dropped across the venues. Binance’s ENS/USDT daily spot trading volume dropped from ~620k ENS/day to ~509k ENS/day, whilst Upbit’s ENS/KRW dropped from ~1.6M ENS/day to ~1.0 ENS/day; Uniswap v3 ENS/WETH 0.3% trading volume went up from ~38k ENS/day to ~52k ENS/day.

DAO Financial Update

Endowment Update

Please refer to the February karpatkey monthly report for further details.

- Asset Allocation

- AUM of $86M, with capital utilisation ratio of 99.9%

- Endowment Allocation: 72% ETH ($62M), 28% Stablecoins ($24M)

- Yield Generation (“DeFi Results”): $260k gross yield

- Marked-to-market (“MTM”): ENS Endowment’s suffered from $24.2M drawdown in MTM, due to decrease in ETH token price from $3,290 to $2,333.

- Protocol Distribution

- Endowment’s biggest position (protocol exposure) is to Sky/Maker as DAI/USDS continued to offer higher yield vs. USDC in other lending markets. However, Sky/Maker reduced Dai Savings Rate from 11.25% at the start of February to 4.75% at the end of February, resulting in narrowing of the interest rate differential across the lending markets.

- Across the Endowment’s various positions, exposure to each protocol does not exceed 30% of the total Endowment.

For details on the financial accounting, please refer to Financial Reporting Dune Dashboard, as well as the February Steakhouse monthly report.

Other Updates

- Permissions Update #6 for the Endowment has been posted and will be put to vote shortly this month.

- TWAP to procure USDC for the DAO is successfully undergoing execution, and has executed 1,166.67 ETH at an average price of $2,642 for the month of February.