Introduction

As we move into the second half of 2025, kpk is excited to provide a brief overview of our collaborative efforts with the ENS DAO so far this year and outline our future initiatives.

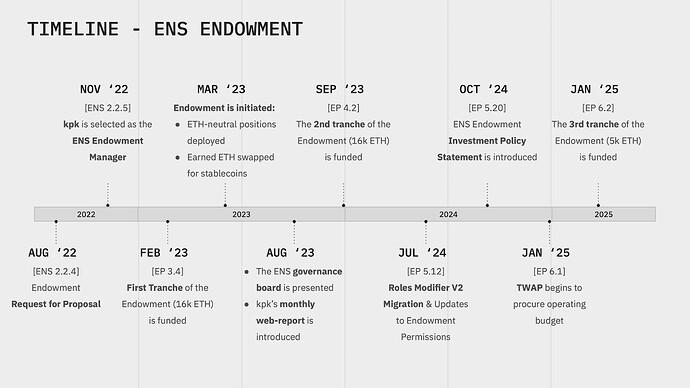

To begin, we present a summary tracing the timeline from the Endowment’s Request for Proposal (RFP) in August 2022 to the current state:

Financial Update

ENS DAO

Based on the latest accounting report, the following financial details for 2025 year-to-date (“YTD”) were noted:

- Operational Revenues for the DAO amounted to $7.71M.

- Operational Expenses for the DAO were reported at $7.55M (excluding ENS tokens).

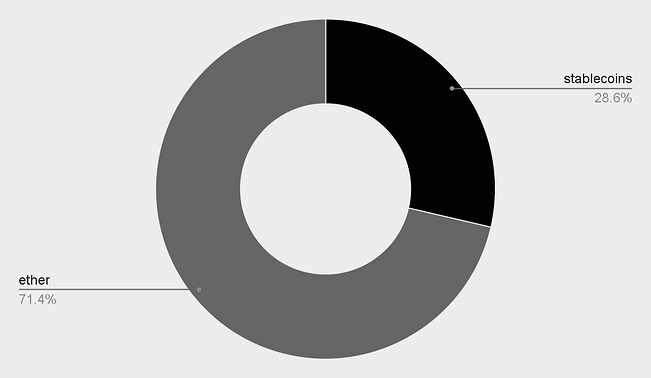

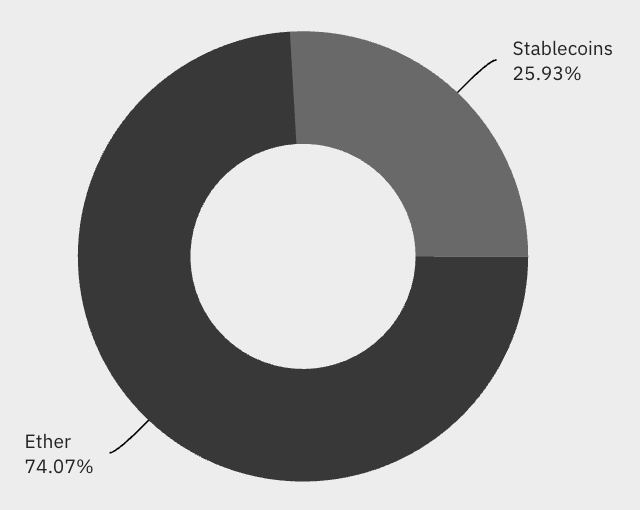

- DAO assets, comprising ETH and stablecoins, stood at $115.00M, indicative of a 9.8-year operational runway (based on last 12 months of cash burn).

Figure 1: ENS DAO asset allocation

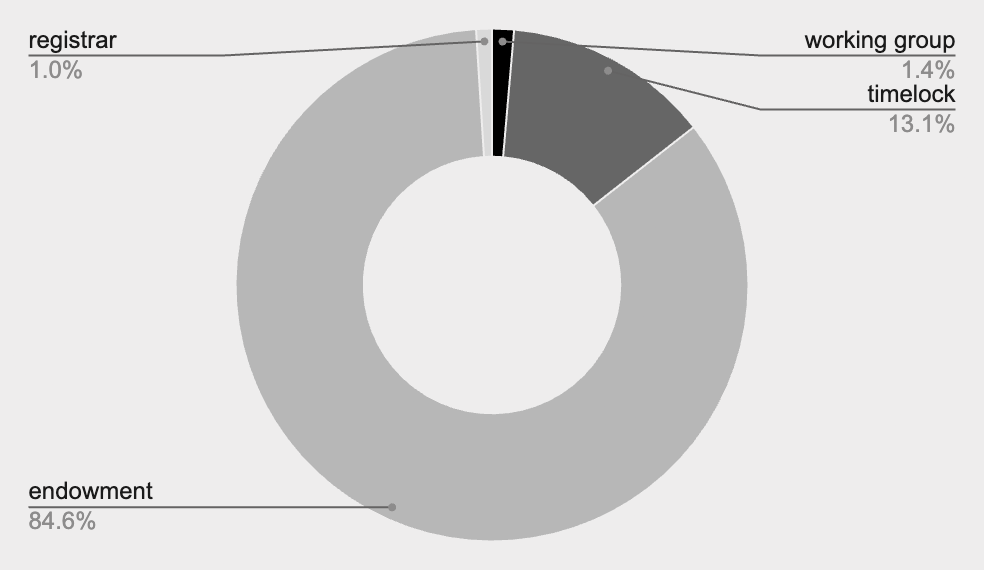

Figure 2: ENS DAO asset distribution by address

Endowment

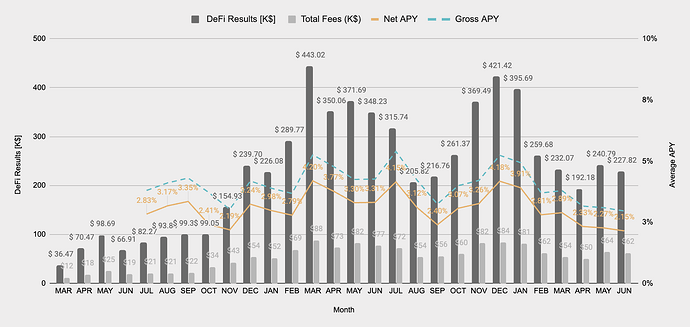

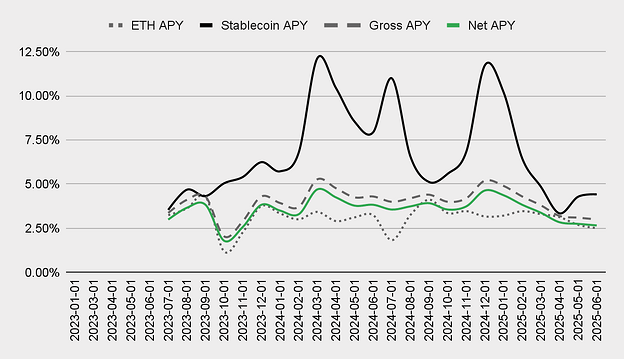

Since its inception, the Endowment has achieved:

- Accumulated net revenue of $4.92 million from DeFi strategies.

- A net average Annual Percentage Yield (APY) of 3.09%.

Figure 3: Endowment historical performance

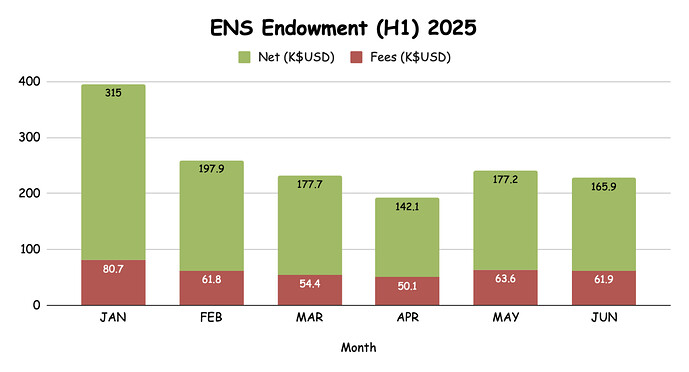

In the first 6 months of 2025, the Endowment has achieved:

- Accumulated net revenue of $1.18 million from DeFi strategies. For context, this means the Endowment could have covered 15.6% of the DAO’s Operating Expenses ($7.55M) in H1 2025.

- A net average Annual Percentage Yield (APY) of 2.72%.

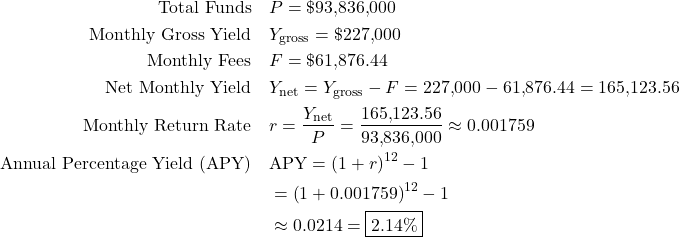

According to the latest June 2025 Endowment monthly report, the following key metrics were observed (Endowment-only metrics, DAO-wide included above):

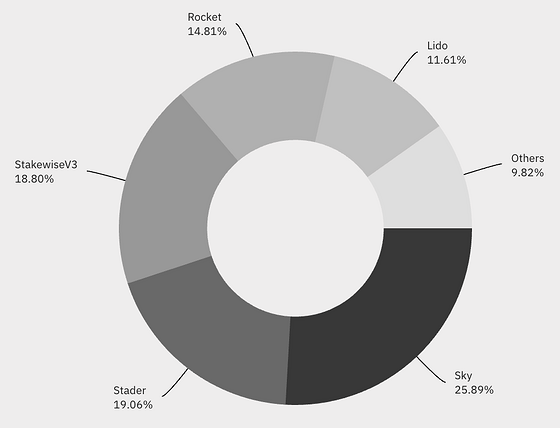

- $93.84M of ncAUM (non-custodial assets under management).

- 100.0% of capital utilisation.

- Projected APY of 3.0%.

- Projected annual revenue of $2.73M.

Figure 4: Endowment asset allocation

Figure 5: Endowment protocol allocation

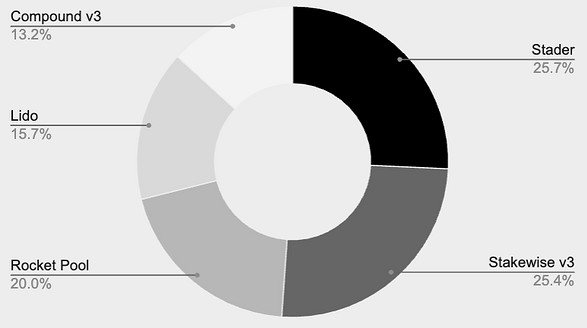

Figure 6: Endowment ETH allocation

Lookback on the Mandate

In the last year, we have advanced several initiatives within the DAO, demonstrating our ongoing commitment to supporting ENS.

The introduction of the Investment Policy Statement in October 2024 was a pivotal moment for the Endowment. Since the adoption of the IPS, kpk has advanced initiatives that both execute on the IPS and extend the scope of our mandate, adding measurable value to the DAO.

1. Fiduciary Execution of the IPS

With clear risk parameters in place, we’ve adhered closely to the IPS guidelines, balancing yield generation with capital preservation. The Endowment’s asset mix, strategy selection, and diversification efforts (e.g. LSTs, protocol spread) are all conducted in direct alignment with these constraints. Key parameters like maximum exposure thresholds, protocol allowlists, and liquidity minimums are monitored continuously.

2. Enhanced Transparency through Reporting

A crucial part of the endowment management is establishing accountability and ensuring ease of access to the information for the DAO. Recognising the importance of accountability, we continued to upgrade our reporting processes:

- Enhanced Monthly Community Update, starting February 2025. The Community Update complements the existing, numbers-focused monthly reports, by providing broader context into market colour and Endowment activities.

- Weekly Dashboard, starting April 2025. The Weekly Dashboard provides deeper, strategy-level granularity to the public.

- Enhanced financial reporting, starting March 2025. The enhanced financial reporting now provides 2 versions: the original version with ENS token expenses; and the new version without ENS token expenses.

3. Operational Expansion beyond Mandate

In response to community needs, kpk has also taken on expanded responsibilities, mainly in respect of ENS DAO’s cash flow management. kpk will be closely monitoring the ENS DAO’s cash positions to ensure the DAO can meet its ongoing commitments for various expenses which remain crucial for the continued development of ENS’ infrastructure and ecosystem.

An example of the cash flow management is the recent TWAP facilitated by kpk, Meta-Governance Stewards, and representatives from the ENS Lab. Over the course of 4 months, we helped swap 6,000 ETH for ~$15M at an average price of $2,553. Through skilled execution, we exceeded the average daily price over the same period of $2,160, thereby achieving a $2.36M surplus. We published a thread highlighting the success of this operation.

The IPS has also been revised (v1.0, v1.1, v2.0) based on ongoing community feedback, and changes in the investment mandate have been voted on and approved by the community. The IPS is meant to be a living document, evolving alongside the ENS DAO; we will continue to revisit and refine it to ensure its policies remain aligned with the DAO and are publicly available to the DAO.

We hope to serve the ENS DAO not just as an instrument and guardian of the Endowment’s core mission, but also as a strategic partner responsive to the DAO’s evolving needs.

ENS DAO Trends

Key trends emerging in H1 2025:

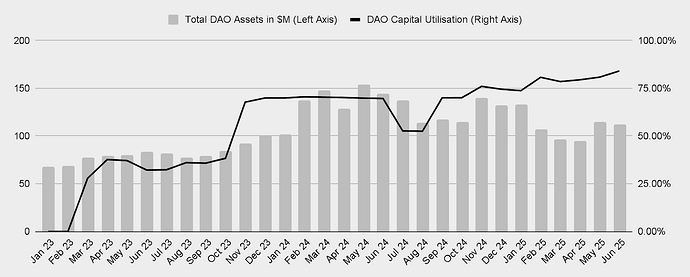

1. Increasing capital efficiency. Assets deployed for yield generation have steadily increased since 2023. As a result, the DAO’s capital utilisation ratio has increased from 0.0% in January 2023 (before the Endowment was initiated) to the current level of 84.4% (June 2025). The Endowment has transformed previously-idle capital into a productive asset base by allocating idle assets into yield-generating strategies that meet the DAO’s risk and governance parameters (as outlined in the IPS). The result is a growing, independent revenue stream that supports core operations and enhances financial resilience. In turn, this positions ENS to fund innovation, retain contributors, and uphold its commitments to the community, all without compromising the decentralised values of the DAO.

Figure 7: ENS DAO capital utilisation (considering DAO invested assets/total DAO assets)

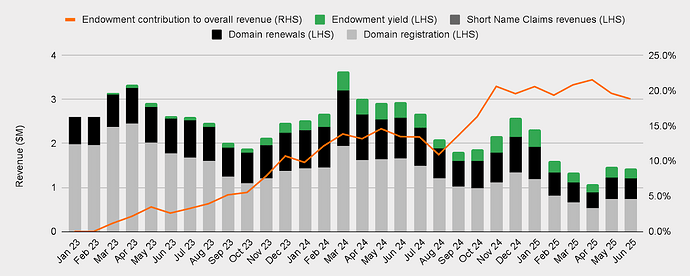

2. Increasing financial contribution of the Endowment to the ENS DAO. Endowment contribution to the overall revenue of the ENS DAO has also increased steadily since 2023; in H1 2025, Endowment revenue accounted for 20.1% of ENS’ total revenue. This underscores the Endowment’s growing role as a reliable source of passive revenue to support ENS operations — a model of financial responsibility that sets a benchmark among DAOs.

Figure 8: ENS Endowment contribution to ENS DAO revenue

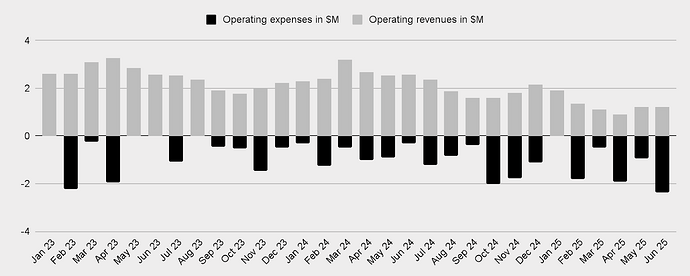

3. 2025 net operating income is likely to be lower. Despite the positive points above, lower net operating income is expected, driven by a plateau in domain registrations and renewals and an increase in operating expenses. In the first half, the DAO reported operating net income of +$0.2M, driven by operating revenue of $7.71M and operating expenses of $7.55M. However, the DAO has also committed to increased current and future expenditures for core contributors and grants, hinting that negative net operating income for 2025 is possible. The expenses commitments mentioned above include a $9.7M ENS Labs budget, a $4.5M budget for SPP Season 2 and the upcoming October funding window for working groups.

4. Lower income is driving discussions about alternative revenue sources. The reversal in revenue trends is pushing DAO discussions to explore alternative ways to increase its revenue, whilst respecting the ENS DAO Constitution. Two initial discussions have emerged in relation to:

- Exploration of new pricing policy: a deep dive into pricing mechanism revisions to better optimise long-term revenue.

- Investment into Open Box: a novel venture aimed at ENS integrating with global namespace, while providing an alternative source of revenue for the DAO.

Figure 9: ENS DAO revenue & expenses since Jan-2023

Looking Forward

As we look forward to the second half of 2025, there are a number of key areas where we plan to expand our work and continue delivering against ongoing objectives and milestones:

Endowment Management

- Continued assessment of the investment landscape, and broadening the investment universe for the Endowment within the confines of the Endowment’s IPS.

- We plan to introduce another set of Permissions Update Requests within the next 1-2 months.

- Continued monitoring of risks, in coordination with our risk providers (Hypernative and Cyvers). Currently, 100% of the Endowment positions are being monitored.

- Various protocol, smart contract, and financial risk factors are monitored, including oracle pricing, contract ownership transfers, pool liquidity checks, withdrawal queues, collateral ratios / health factors.

- As new strategies are introduced and new risk monitoring methodologies continue to emerge, so will our work continue to refine and improve coverage.

Cash Flow Management

- Continued monitoring of ENS’ financial health, especially given increased spending of the DAO in 2025.

- Migration of the TWAP Safe from current multi-sig to a DAO-owned Safe, with Manager Safe.

Reporting

- The Weekly Dashboard will be replaced by kpk’s enhanced reporting, which will allow the Community to visualise the portfolio snapshot and trends with ease.

We appreciate the trust you have placed in us with this critical responsibility. We are committed to ongoing engagement with the community, contributing our knowledge and insights for the common good, and we look forward to maintaining our commitment and efforts in the upcoming semester.