Proposal Summary

This proposal invites the ENS DAO to invest $1 million/ year over five years ($5 million total) for a 10% equity stake in OpenBox Inc. The investment gives the ENS community direct exposure to the 2026 ICANN gTLD round and, if approved, marks the DAO’s first investment‑for‑equity program.

Proposal Overview

This Temp Check seeks DAO feedback on a strategic proposal for the ENS community to take an equity stake in OpenBox Inc., a new venture launched by Intercap — the team behind .box, .inc, and other innovative naming projects.

OpenBox’s mission is to bridge DNS and ENS through the creation of the Open Domain Protocol (ODP). This open-source layer allows DNS top-level domains (TLDs) to integrate natively with ENS and the broader Ethereum ecosystem. ODP is the same core technology that powers the .box <> ENS integration announced here, and it will also be integrated into Namechain.

OpenBox will be the legal entity that:

- Builds and evolves the Open Domain Protocol (ODP);

- Acquires and operates key ICANN gTLDs in the 2026 round to advance ENS-native identity;

- Partners with brands and communities to launch ENS-compatible gTLDs onchain via ODP.

OpenBox Inc. has secured a $45 million capital commitment from Intercap and believes that this ENS investment is a strategic long-term positioning that is mutually beneficial.

Motivation

ENS is the leading naming system for web3, but the broader identity landscape remains fragmented. Across DNS and blockchain-based protocols, there are now dozens of overlapping and often incompatible systems competing to define “ownership” of names on the internet. This fragmentation creates user confusion, dilutes trust, and undermines the values ENS was founded to protect.

Fragmentation will accelerate when ICANN opens its next gTLD application window in April 2026, introducing a fresh wave of operators and suffixes. Without a unifying framework, these new namespaces will further diverge from ENS.

In response, we are launching OpenBox Inc. to help unify the naming ecosystem around a shared, open standard – one that prioritizes the Ethereum Name System at its core. Our mission will be:

-

Ship the Open Domain Protocol (ODP)—an open‑source layer that extends ENS directly into the DNS stack, giving any top‑level domain native ENS functionality.

-

Acquire and operate a portfolio of strategic and branded gTLDs, applying the ODP from day one.

This effort is being led by Intercap, a long-standing ICANN registry operator and early investor in ENS ecosystem projects, in close collaboration with ENS Labs, which brings protocol expertise, engineering capabilities, and strategic alignment with the DAO. Our team has already delivered the v1 of this vision — .box — as a fully ENS-integrated TLD built using ODP principles.

What the DAO gets

A strategic equity stake in OpenBox gives the ENS DAO direct influence over the future of onchain naming—and a share in its success. By acquiring and launching key TLDs natively on ENS and Namechain, OpenBox further solidifies ENS as the backbone of decentralized web identity.

Perhaps most importantly, this will serve as a case study in how to build a profitable business on top of the ENS protocol. The investment has the potential to deliver meaningful returns: a $5M investment could conservatively generate $1–1.5M in annual cash flow, based on a 20–30% dividend yield.

Technical Overview: Open Domain Protocol

The Open Domain Protocol is a registry and identity infrastructure designed to bring ICANN-approved TLDs into full technical alignment with the ENS ecosystem. It allows DNS-compatible TLDs (e.g. .box) to behave like .eth names across web3 applications, while preserving DNS compliance and operational standards.

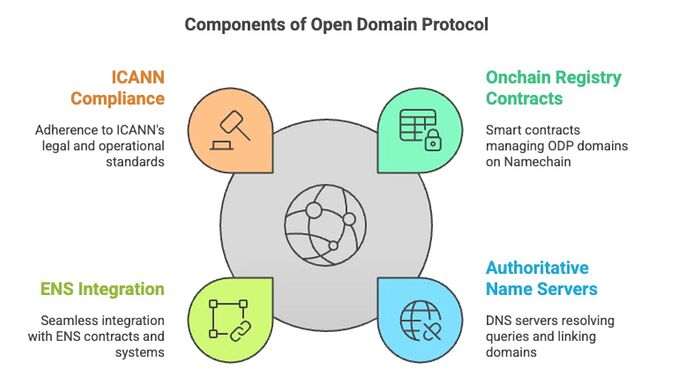

At a technical level, ODP consists of the following components:

- ICANN-Compliant Operating Stack – ODP respects the legal and operational requirements of being an ICANN registry operator. That includes.

- EPP (Extensible Provisioning Protocol) support for registrars

- WHOIS/RDAP services

- Backend integration with ICANN’s root zone processes

- Onchain Registry Contracts – ODP domains will be represented and managed through smart contracts deployed on Namechain. Each ODP-operated TLD has its own:

- ERC-721-compatible name wrapper

- Ownership and metadata registries

- ENS resolver support

- Authoritative Name Servers - DNS-based authoritative nameservers, operated by OpenBox and compliant with ICANN’s technical standards. These nameservers:

- Resolve traditional DNS queries (e.g., josh.box)

- Interface with ENS-compatible infrastructure via signed zone data

- Support cross-chain ownership resolution, enabling domain-to-wallet linking

- ENS Integration & Namechain Compatibility – ODP is designed for native integration with ENS contracts and Namechain, ENS Labs’ upcoming onchain naming system. That means:

- All ODP domains will be resolvable through ENS resolvers

- Ownership records will sync with ENS’s universal ownership tree

- Names will show up in the ENS Manager App and any dapp that supports .eth

Roles & Contributions

Intercap

Intercap is leading the formation and funding of OpenBox Inc. We are contributing the following:

- $45 million in committed capital, with access to additional resources as needed to scale operations and pursue future TLD acquisitions.

- Operations of .box, the first TLD of its kind to be natively integrated with ENS.

- The formation of a core team, including leadership, product, engineering, growth, legal, and ICANN specialists, all of whom have deep experience building decentralized naming infrastructure.

- Over a decade of operational expertise as an ICANN Registry Operator, including the development and launch of .box as a next-generation, ENS-compatible TLD.

ENS Labs (Proposed)

We propose that as part of this investment, ENS Labs would consider contributing resources, expertise, and strategic alignment to support the development and adoption of the ODP. Specifically:

- Engineering resources to support the co-development of the Open Domain Protocol, with a particular focus on its native integration with Namechain and the broader ENS infrastructure.

- Collaboration on marketing and business development, including integration of ODP-based TLDs into ENS-facing products and public-facing communications.

- Act as a key partner in protocol alignment, technical delivery, and ecosystem integration.

ENS DAO (Proposed)

The proposal invites the ENS DAO to become a shareholder in OpenBox Inc. by investing up to $5 million. This participation would allow the DAO to:

- Signal support for the Open Domain Protocol (ODP) as the foundational standard for ENS-native DNS integration.

- Share in the long-term financial upside of a venture built to advance ENS’s mission at the infrastructure layer.

- Help define governance that extends the ENS Constitution into DNS—prioritizing openness, decentralization, and neutrality wherever possible.

Risks & Tradeoffs

This would represent the DAO’s first direct investment in exchange for equity, a meaningful step that introduces new considerations around financial exposure, treasury management, and legal structuring. Unlike grants or service provider agreements, an equity stake implies a longer-term relationship and a shared interest in the commercial success of the entity.

These considerations are real, but they are also manageable. Intercap brings a proven team of founders, investors, and ICANN registry operators. Their experience and capital reduce execution risk while aligning with ENS’s mission. This structure offers strategic alignment and a credible path to long-term value for the ENS treasury.

Alternatives Considered

Why ENS DAO?

ENS DAO represents the values, users, and governance model we want to align with. DAO participation gives this initiative legitimacy, accountability, and broad ecosystem support — especially in a space where trust and openness matter.

Why Equity Investment?

Because OpenBox is a for-profit venture, equity is the most appropriate structure — it aligns incentives, reflects a fair exchange of value for the DAO’s capital contribution, and enables the DAO to participate in the financial upside.

Why Now?

The 2026 ICANN gTLD round presents a rare window of opportunity. Acting now allows ENS to help define the standard for DNS-onchain integration before others move to fill the gap with competing or closed systems.

Specifications

The ENS DAO will invest $5 million, which will be streamed over a 5-year period to a designated wallet address owned and controlled by OpenBox. The stream will be facilitated via an audited smart contract, subject to DAO approval.

The ENS Foundation, the legal entity that represents the ENS DAO, will serve as the equity holder in OpenBox. This arrangement is subject to final legal and compliance review, though no material obstacles are currently anticipated. For context, The ENS Foundation is a Cayman Islands foundation that exists to serve as a legal entity representing the DAO.

In the event of a profit distribution by OpenBox, any proceeds due to the ENS DAO will be converted to USDC and transferred to the ENS DAO treasury wallet: wallet.ensdao.eth (0xFe89cc7aBB2C4183683ab71653C4cdc9B02D44b7).

In the event that the DAO treasury wallet is moved to a new wallet address, the ENS Foundation board will alert Openbox within ten (10) working days.

Next Steps

Thank you for reviewing this Temp Check. We welcome all feedback and questions as we open the discussion with the community. This is a big idea, and we want to get it right. We’re excited to explore what meaningful collaboration with the DAO could look like.