Abstract

We propose to convert 6,000 ETH into USDC to replenish the USDC reserves in the DAO’s treasury.

Motivation

In February 2023, the DAO executed a swap of 10,000 ETH into USDC via EP 3.3, generating approximately $16.2M in USDC. The rationale at the time was to secure 18–24 months of operational runway.

Over the past 21 months, the USDC reserves have been effectively utilised to fund ENS DAO’s operations. However, these reserves have now been fully depleted. To ensure financial stability and effective liquidity management, it is prudent to secure a 12-month runway in the DAO’s wallet to cover operating expenses.

We propose ENS convert 6,000 ETH (~$20.4M at $3,200/ETH) to replenish the USDC reserves. These funds will be used to meet ongoing commitments, such as payments to ENS Labs, and Service Provider streams and DAO Working Groups.

Specification

karpatkey will deploy a new Safe dedicated solely for TWAPs, with karpatkey and ENS representatives as signers. This allows for segregation of funds between other ENS-related wallets (e.g. the Endowment Safe). This proposal sends 6,000 ETH to the newly created Safe.

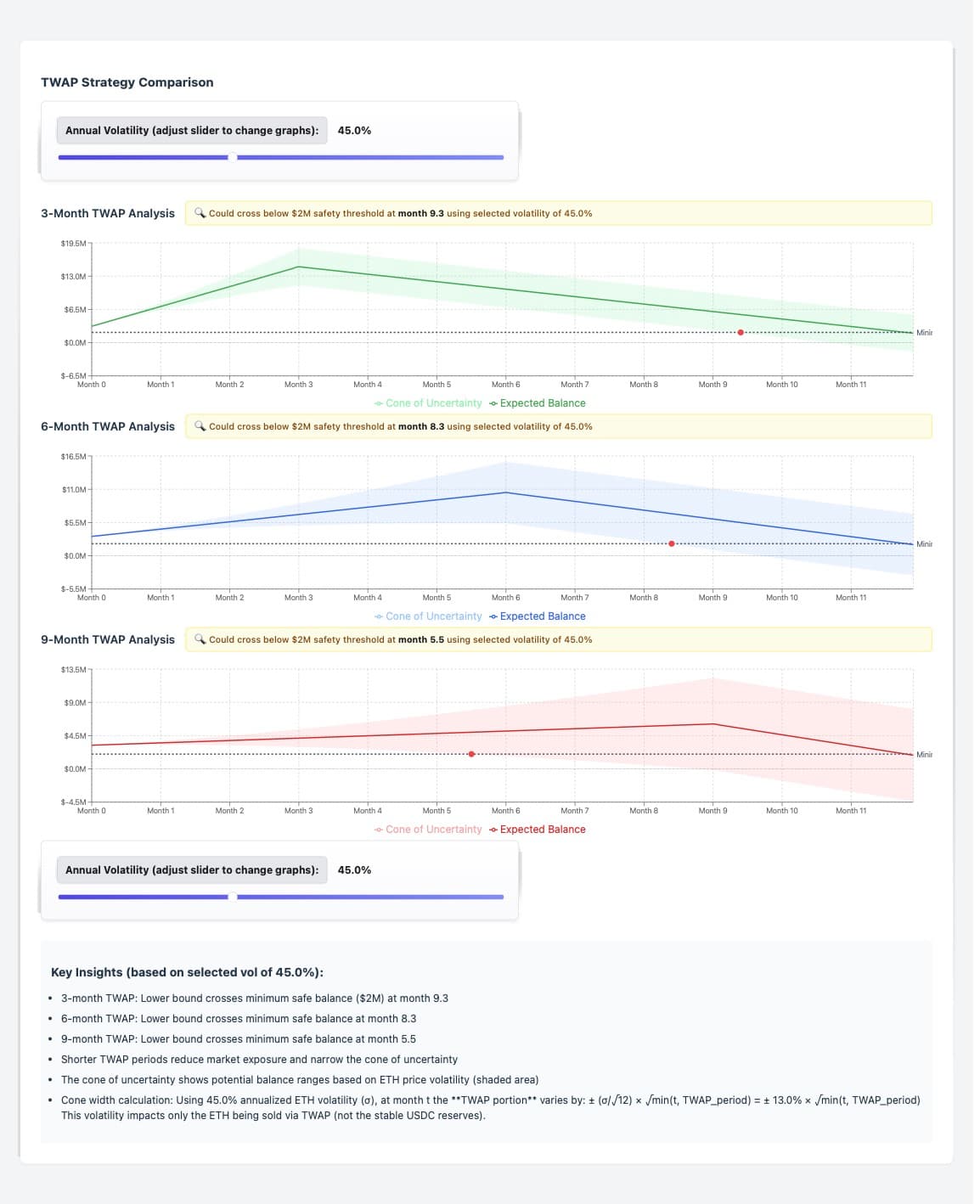

Signers will swap ETH to USDC via Cow’s TWAP mechanism.

The rationale behind this framework is that Cow’s TWAP function is currently not supported by Tally or the Zodiac Roles Modifier (ZRM) permissions. Once TWAP permissions are integrated, ZRM can be onboarded to this Safe, allowing for the removal of the ENS signers.

The Safe will be deployed with a threshold of 3 signatures and the following signers:

- DAO Wallet (wallet.ensdao.eth)

- karpatkey’s Endowment manager Safe (0xb423e0f6E7430fa29500c5cC9bd83D28c8BD8978)

- ENS Labs’ cold wallet (coldwallet.ens.eth)

- Metagov Working Group Safe (main.mg.wg.ens.eth)

Safe keyholders will execute the following swaps:

- 1,000 ETH swap to meet immediate funding needs by the ENS DAO, executed as soon as funds become available.

- 5,000 ETH swap via a 3-month TWAP, conducted in 90 parts (~55.6 ETH sold per part), with wallet.ensdao.eth as recipient.