TL;DR

A study was conducted to identify opportunities to change the ENS pricing policy. Based on the dynamics of gas and the secondary market, the risks of losing registrations in the event of a price increase were calculated. For each of the domain categories, it is proposed to introduce a price that will both satisfy users and allow ENS to receive additional funds for development. The price should be curved and decrease with each year added to the registration, which will also increase the average selected registration duration.

- For 3L domains: $640 for the first year, $430 for the second year, $360 for the third, and so on according to the formula P(t) = 420/t + 220.

- For 4L domains: $160 for the first year, $107.5 for the second year, $80 for the third, and so on according to the formula P(t) = 105/t + 55.

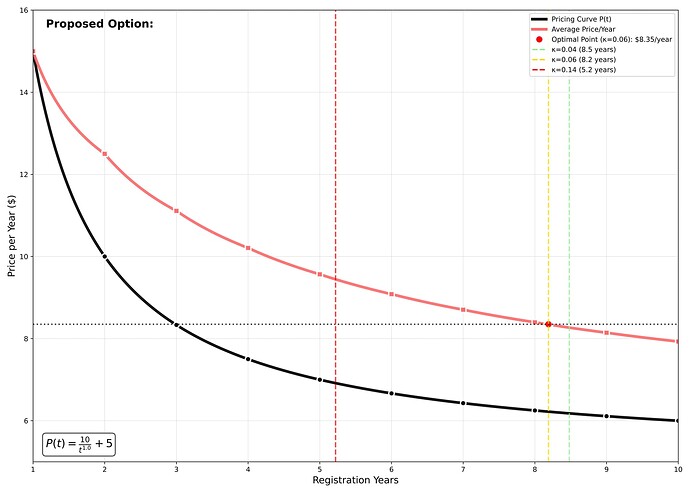

- For 5L+ domains: $15 for the first year, $10 for the second year, $8.33 for the third, and so on according to the formula P(t) = 10/t + 5.

Motivation

Domain prices were set 8 years ago and have not changed since then. During this time, the US dollar has inflated by 30%, and the industry has grown tenfold.

Recently, funding for Labs and SPP has been expanded. There are also governance token distribution programs, regular grants are issued, and new organizations are emerging that are ready to contribute to the development of ENS.

Therefore, it seems necessary to increase ENS revenue from registrations in order to maintain the ability to continuously improve the product. At the same time, it is extremely important to keep the price within the limits that would satisfy users, so as not to jeopardize scalability and the social purpose.

Under the guidance of Labs and MG Stewards, I analyzed risks and developed pricing strategies aimed at increasing domain revenue and average registration duration without significantly reducing the number of registrations.

Overview

5L+ Price

Flat Model

The base price of domains has never changed, but the gas varies for each transaction. Based on its dynamics and the subsequent reaction of users, we can estimate the risks of losing registrations when the base price increases.

The study found that the gas value does indeed have a negative effect on the number of registrations. The dependence has a power-law form – that is, each new dollar added to the price will have less and less impact on registrations (for example, a step from $5 to $6 will have a much stronger impact than a step from $10 to $11).

This form of dependence opens up opportunities for us to set a flat price even at $20/domain and incur only about 17% of losses. However, it is certainly worth considering the social side of the issue. An extremely important task when changing the price will be not to hit vulnerable categories of users. Therefore, the sample was divided in different ways in order to find some category of users that would react to the gas in a special way.

The most eloquent and important division in the context of the issue was the division into users registering their 1-3 domains and users registering 4 or more domains.

- Those registering 1-3 domains (or regular users) are newbies or just ordinary users who most likely have no commercial interest in registrations. They are important for the scalability of ENS, since there are a lot of them and they have a large potential for word of mouth. It turned out that they are much more susceptible to the influence of gas and they can safely be called a more vulnerable category to price increases. At the above-mentioned price of $20/domain, we will lose up to 30% of their number, which can be detrimental to the future of ENS.

- Those registering 4 or more domains (or heavy users) are speculators or just a very active group. They are certainly also important for ENS, but they almost do not react to the offered gas. Even with a price increase to $20, we will lose only a couple of percent of them.

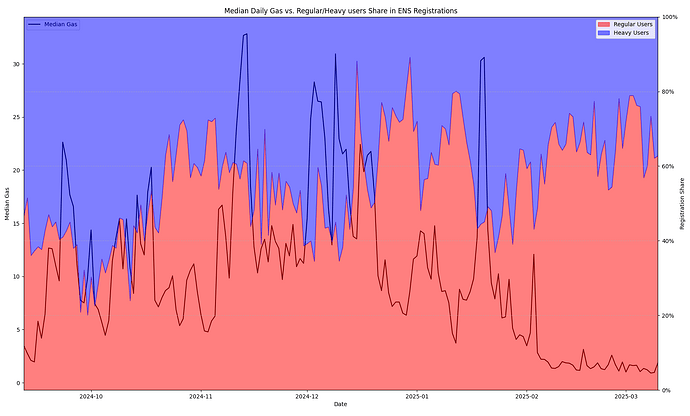

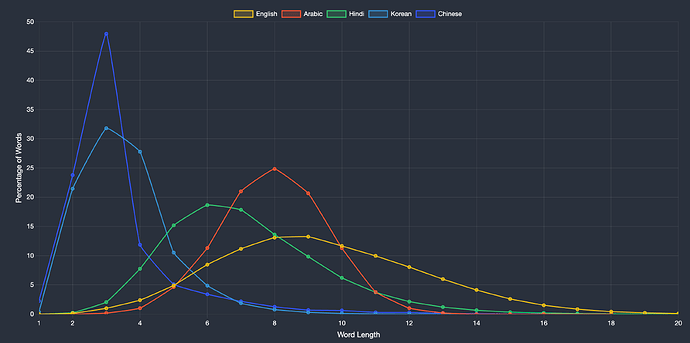

The difference in their behavior is clearly visible in this graph:

As the gas decreases, the share of regular users in registrations increases and vice versa. Therefore, when choosing the final price, we need to focus on the change in regular users. You can see a table of possible flat prices here. However, a flat price is not recommended and here is why:

Curve Model

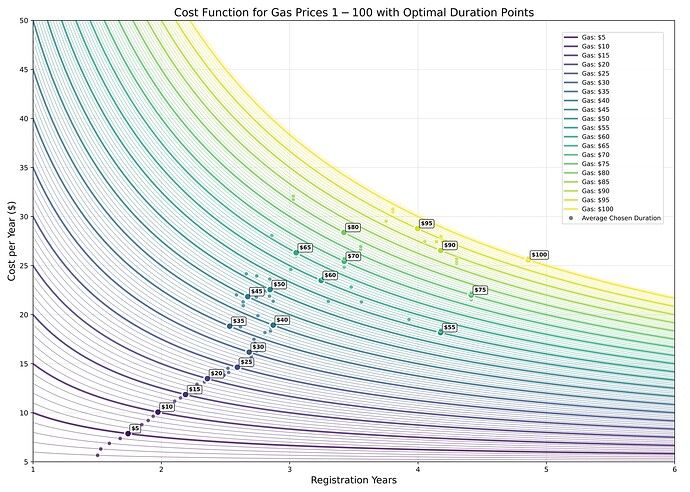

The fact is that users have been found to have pronounced rational behavior. They register domains for a longer period, the higher the gas. You can clearly see this in this infographic:

Up until the $40 gas price, there is a clear pattern. Users tend to average out the price per domain/year until they reach a certain sweet spot. For example, you are offered $10 gas. You would then choose 2 years of registration to make the price per domain/year $10 instead of $15 if you chose 1 year of registration.

We are currently seeing very low gas, and ENS will be releasing NameChain in the future. If we have a flat base price and negligible gas, users will lose financial incentive to register domains for more than 1 year (they currently register them for about 2 years on average).

Users are not aiming for a specific average figure (for example, $10/year), but for a point where the graph will have a certain curvature. To be precise, they stop their choice at the point of the average price with a curvature of 0.04-0.14 (with a median of 0.06). With this insight, along with other known user behavior patterns, we can model a discounted pricing curve for each subsequent year – simulating gas fees as an added cost.

4,300 different price curve options were built that would both satisfy users and bring ENS additional funds for development (you can see all the curves in this table). Extrapolating the curvature rule, which we can do with some reservations*, we can assume that users will choose a registration duration such that the curvature of the average price function is in the range of 0.04-0.14.

It is recommended to introduce a price curve that would set the price for the first year at $15, for the second $10, for the third $8.33, and so on according to the formula P(t) = 10/t + 5. Projectedly, this will give users such a financial incentive to register longer that it will increase the average duration to 5-8 years*.

With such a duration, the average price per year of a domain will be $8-9, which will give ENS an additional 70% of income from 5L+ domains with a loss of 5-10% of regular users. This will also give ENS a lot of money here and now, due to the increased duration of registration.

*The estimated duration of registration is just an extrapolation. Users may not perceive the newly added price exactly the same way they perceive gas, so it is worth treating the estimates as approximate.

3L and 4L Price

There was an attempt to calculate the loss of short name registrations using the same algorithm as with 5L+. However, it turned out that registrants of these domain categories are absolutely not affected by gas. Even if it is $100, it does not reduce the volume.

These domain categories are now more of a point of speculative interest, so it is important to look at the secondary market. It turned out that the volume of registrations correlates with the volume of secondary sales. However, the causation is not so obvious – now we can rather say that these factors are interdependent. Therefore, it is important to prevent the death of the secondary market – not to satisfy speculators, but to prevent the loss of primary registrations.

Analysis of the secondary market revealed its deplorable state. Almost in all categories of 3/4L domains, 60% of sellers are at a loss relative to the funds spent on maintaining the domain, platform and network commission. The only “alive” category turned out to be 1k club, however, the dynamics of their prices, as well as the average time-to-sale, indicate that soon the owners of this category of domains will be at a loss, which will lead to a complete collapse of volumes:

So it is proposed not to increase the average price that they must pay, but for them it is possible to introduce a pricing curve with a starting point at the level of the current base price ($640 and $160, respectively). We can say that by introducing such a system, we make a discount on these domain categories, but at the same time encourage registering them for a longer period. Here are the curves, roughly similar to the one developed for 5L+:

- For 3L domains: $640 for the first year, $430 for the second year, $360 for the third, and so on according to the formula P(t) = 420/t + 220.

- For 4L domains: $160 for the first year, $107.5 for the second year, $80 for the third, and so on according to the formula P(t) = 105/t + 55.

Due to the aforementioned lack of impact of gas on these registration categories, we cannot model the changes in registrations when such a price curve is introduced.

Timing

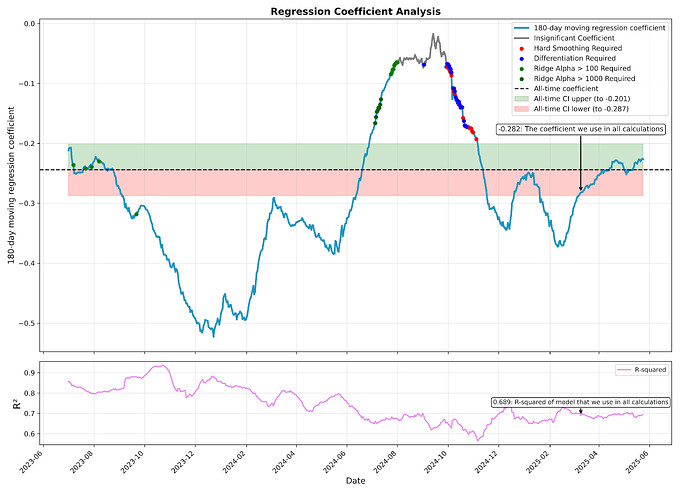

Choosing the optimal timing for introducing a new pricing format is a very important aspect. Take a look at this graph of the 180-day moving regression coefficient for gas:

The higher the graph is now, the more users are willing to pay. Introducing changes when the indicator is at the bottom can lead to a cascading and long-term collapse of registrations. However, introducing changes at the top points is also not worth it – at these times, user behavior is simply so unpredictable that any modeling can only be done within the framework of large assumptions.

The ideal time for new prices is when the 180-day coefficient is within the confidence intervals of the global coefficient. We are in this situation now, and presumably will be in it for the foreseeable future.

Additional Considerations

5L/6L+ Separation

The supply volume of 5-character domains is generally not much higher than 3- and 4-character domains, and this is especially true for meaningful words. Therefore, it would be logical to assume that the price optimum for 5L domains is higher than, for example, for domains 6 or more characters long. Then the 5L+ category could be price-separated into 5L and 6L+.

However, after splitting the sample and using the same gas-based algorithm, it turned out that users do not show any behavior that would suggest that they are willing to pay more for 5L than for 6L+. Sometimes it even works the other way around, and 6L+ domains are valued higher.

That is, there is currently no objective reason to use such price separation. It is safe to say that at some point the market will react to the limited supply of 5L and we will see a willingness to pay a higher price. It is proposed to reconsider this issue in a few years.

Increasing the minimum registration term

Currently, it is possible to register domains for a period shorter than a year (from 28 days). This is most actively used by those registering 3/4L domains and speculators.

We would certainly like to see more long-term registrations, so the possibility of cutting this feature was considered. However, presumably this will not motivate users to register domains for a longer period, but will simply reduce the number of registrations.

The proposed price curve will be a softer force that will solve the problem of a large number of very short-term registrations, so the minimum possible registration period is proposed to remain unchanged.

Methods and Reliability

While the main hypotheses were tested using regularized regression models within a 180-day time window, the findings were also rigorously cross-validated:

- with other models, including tree and vector machine learning models. For a more accurate risk calculation, over 30,000 non-overfitted models were built, the best of which were selected using Grid Search;

- within time windows of other sizes and other historical periods. All hypotheses were confirmed to be either homogeneous over time or did not differ much;

- with classic statistical tests. All variables were also examined using univariate analyses (autoregression, distribution analyses) to eliminate any questionable interpretation.

This post is just a very brief summary of the research. The full study is provided to ENS Labs and MG stewards. If anyone is interested in reviewing the full documentation, it can be provided.