Myself and @MazyGio would like to propose that the ENS DAO allocates a percentage of its treasury’s USDC and ETH holdings into Element Finance’s fixed rate vaults so that the current operating expenses can be reliably and predictably covered and budgeted in advance.

Summary

The ENS DAO is currently electing Stewards for its new DAO working groups structure. This new structure will allow the DAO to continue functioning efficiently and effectively in a more organized way moving forward. Within this new structure, it appears that the Meta-Governance Working Group will be in charge of Treasury Management for the DAO.

It’s reassuring to see how important this topic is for the DAO. We’ve taken a look at the financial data that @nick.eth put together (ENS Dashboard), and understand that, just like the DAO has a large volume of Unearned Revenue, it also has a wide range of operating expenses such as:

- ENS Foundation expenses (The ENS Foundation - ENS Documentation)

- Steward Compensation (TBA, under the new DAO structure)

- Funding grants for public goods

With this in mind, we consider that allocating a portion of the Treasury Funds into a set of conservative and safe yield-generating positions can be a solid diversification strategy for the DAO. We propose using part of such allocation towards Element Finance’s Fixed Yield products.

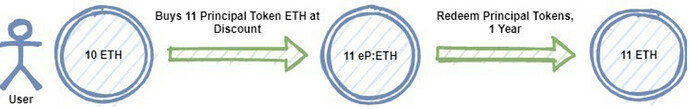

Element Finance’s Fixed Yield products offer a reliable and predictable way of growing the ENS DAO’s treasury. Its fixed nature is particularly well suited for long-term planning and operating budget allocations. The ENS DAO’s treasury holds USDC -which Element’s vaults support- and ETH, which Element supports indirectly through Curve’s ETH/stETH pool (Info: A Guide for Getting crvSTETH). This means the DAO would have to hold ETH/stETH LP tokens rather than native ETH. However, it wouldn’t lose any exposure to ETH since stETH is simply a liquid representation of staked ETH and is pegged to the value of ETH.

Some of the expenses that the ENS DAO has to cover can be quantified well in advance (Foundation expenses), while others are less predictable (grants, Steward/contributor compensation). We want to provide the treasury with the ability to plan budget allocation by relying on Element’s fixed yield generating positions.

Proposed Action

The data available today shows that the ENS DAO holds ~10MM USDC and ~4369 ETH (~13.7MM $USD value at $3250/ETH). Element Finance offers Fixed Yield positions which are liquid and capital efficient. As such, we would like to propose the following allocations:

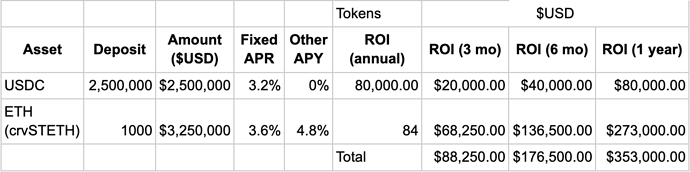

~25% of ENS DAO’s treasury:

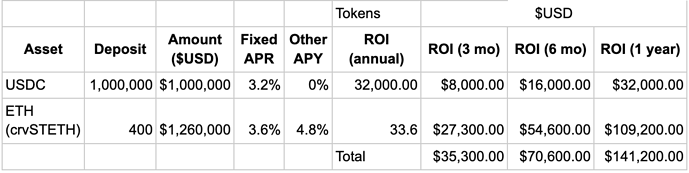

~10% of ENS DAO’s treasury

The Fixed APR in the tables above is provided by Element’s AMM design for the fixed rates positions, while the Other APY is coming from the underlying asset’s properties: Curve stETH LP tokens accrue ~2.5%-3.5% trading fees APY and, since the Curve pool holds about 50% stETH, it gets an additional ~2.3% APY from ETH staking rewards (total ~4.8%).

We’ve aimed for an allocation between 10% and 25% of the current ENS DAO treasury holdings as an initial experiment so that the DAO can explore the benefits of this solution while maintaining most of its treasury available for other immediate purposes. With the yield from this strategy, the DAO can easily cover the yearly Foundation expenses (~$42,050) and use the rest for contributor compensations and grants programs.

We want to highlight that while Element’s fixed yield positions function on a fixed-term basis, and can be exited with the accrued profits at any time, the funds are not ultimately locked up or unavailable for the entire duration.

We’d love to hear thoughts from the ENS DAO community! Keep in mind that this is just an example distribution, and the amounts that have been proposed can be modified.

Sentiment Poll:

- Allocate 10% of ENS DAO’s treasury into Element Finance’s Fixed Yield positions

- Allocate 25% of ENS DAO’s treasury into Element Finance’s Fixed Yield positions

- Use Element Finance’s Fixed Yield products, but under a different allocation structure

- Don’t use Element Finance’s Fixed Yield product

0 voters

Next steps

Let’s all discuss what is the best option for the ENS protocol! We want to take the community’s feedback into account in order to figure out the best path forward. If there is support for using Element Finance’s fixed yield products, we plan to write a formal governance proposal that reflects the DAO’s best interests according to the community’s feedback.

/fin

_

_