Proposal Update

Summary of Changes

Hi all, we’d like to share a few updates on our proposal with the forum. After discussions with the Meta-Gov committee, we amended our proposal to better align with the needs of ENS. With these changes, the committee has included us in the final shortlist. We also received a lot of positive interest and feedback from the community. There are several noteworthy points:

- Fees: After discussions with the Meta-Gov committee, we have proposed a contributor fee of 1% of the endowment with a $500k minimum floor. Llama will trustlessly deploy ENS’s endowment through the use of non-custodial smart contracts which will be approved by ENS through periodic on-chain proposals. Related to the endowment efforts, we will support the community with relevant analytics, reporting, and governance work.

- Strategy: We have simplified the endowment’s strategy; our primary focus is risk management. We will only deploy the endowment on battle tested protocols.

- Logistics: We plan to manage the endowment through on-chain governance without having any custodial control, either directly or indirectly. This approach sets the right precedent for ENS (especially given recent market events) and makes sense for our strategy.

Background

Llama works with DAOs on treasury management, protocol upgrades, and analytics. Our customers include Aave, Nouns, Uniswap, dYdX, Lido, Maker, Radicle, PoolTogether, and FWB.

Our work includes:

- Designing treasury strategies to deploy Aave’s reserve factor and safety module

- Consolidating Aave’s revenue into a single reserve factor

- Executing a Balancer token acquisition through a bonding curve

- Conducting risk assessments on assets listed on Aave and implementing asset listings across multiple chains

We bring the following to ENS:

- Investment expertise to design strategies

- Risk expertise to construct a portfolio based on the risk-reward of various strategies

- Smart contract expertise to evaluate underlying protocol risk and deploy strategies on-chain

Alastor has been a core contributor to Llama and works with DAOs like Uniswap, Lido, and Decentraland on treasury management and business strategy. Alastor brings decades of experience working with the leadership of Web2 companies to forecast their business performance, construct long-term investment roadmaps, and design capital allocation strategies. We also have significant experience executing a broad array of strategic transactions, which includes pricing and structuring mergers, building sophisticated acquisition models, and leading the preparation of Fairness Opinions publicly-filed with the SEC.

Llama’s experience at the forefront of on-chain governance, combined with Alastor’s decades of experience forecasting the operations of leading software companies, results in a team uniquely qualified for the mandate. Together, we will provide the DAO with highly-professional and sophisticated endowment management, tailored to the needs of ENS.

It’s important to highlight that two members from our team who will work on ENS’s endowment management have previously worked at one of the largest and best-performing university endowments.

Our Values:

- Rigor. Our work is of the highest quality. We care deeply about getting the details right.

- Ownership. We treat the problems of our customers as if they were our own. There is little to no separation between us and the DAOs we work with.

- Trust. We seek to actively earn the trust of our customers. We involve the community in our work and incorporate feedback where relevant.

- Transparency. We believe in open lines of communication and are comfortable working in a DAO-native manner.

Endowment Objective

As originally discussed via Temperature Check and then later via the RFP posted by Nick, ENS would like to establish an endowment and engage an endowment manager to define investment strategy and recommend allocation, mandate, and investment adjustments on an ongoing basis. The RFP was later passed as a Snapshot vote.

The RFP called for the endowment to generate a minimum of $4M USDC annually once fully funded to “insulate the DAO from economic fluctuations, ensuring it can continue its core operations regardless of the wider economic outlook” in order to support withdrawals while not reducing the endowment’s principal.

Proposal

We propose that ENS dedicates 32,000 ETH (~$40M) to the initial endowment with a target endowment value of $80M. We propose that ENS commits to setting aside 50% of go-forward revenues on a monthly basis to fund the endowment until the target size is reached. Using our Base Case set of ENS projections we estimate the endowment to be fully funded in 12-15 months.

The endowment will seek to return 5-7% annually (in ETH and stablecoins, respectively). Distribution to the DAO will occur every 6 months. Our top priority is risk management and mitigating principal loss. If it is not possible to achieve a 5-7% return given appropriate risk in battle tested protocols, we will not take undue risk and will keep the DAO informed of market conditions.

Lastly, we believe strongly in the importance of on-chain governance overseeing the endowment, rather than it being unilaterally managed. To that end, while this proposal reflects our recommendations on initial size, future revenue contribution, funding timeline, and ETH/USD split, we believe that these key decisions should be discussed and approved by the DAO before being implemented.

Rationale & Process

During the preparation of this proposal, we put together a bottom-up forecast model of the ENS protocol and treasury cash flow, taking into account historical performance to-date and running a few different scenarios of key drivers (ETH user trends, penetration %, renewal %, etc.) to inform what that would mean for the protocol.

The model can be viewed here.

Based on our understanding of ENS’s goals as well as its current operating position, our recommendation is that the ENS endowment should:

- Focus on risk-mitigation over profit-maximization. We view this as an opportunity to capitalize on the protocol’s momentum to-date and invest in the future of the DAO, not run an ENS-backed hedge fund.

- Ultimately solve for USDC-based returns where possible, given the current cost-denomination of the DAO.

- Evolve with the performance and needs of the DAO. It is important that the manager hired to handle these funds monitor the performance of the protocol and the evolving size and cost-denomination of DAO WG budgets in addition to simply endowment performance.

ENS has evolved rapidly over the last six months and there is no reason to believe that this will not continue over the coming years. The DAO needs an endowment manager who is capable of understanding and evaluating protocol performance and working closely with the DAO to update the endowment mandate as the organization’s needs change and evolve. To this end, we will not only plan to manage the ENS endowment funds, but also monitor the DAO’s performance and funding needs and work hand-in-hand with ENS leadership to determine and recommend mandate changes as operational performance dictates. We will include updates on Ethereum ecosystem trends and DAO operations in addition to endowment performance in our regular reporting. We plan to serve not only as endowment managers, but also active contributors to ENS and will provide our perspective, insight, and recommendations on budgeting and operational recommendations, as appropriate.

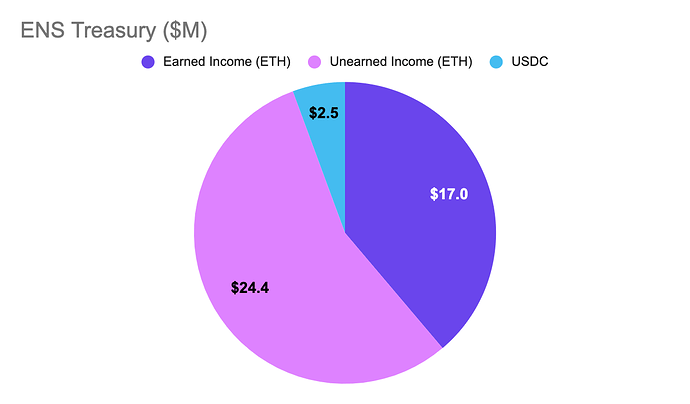

ENS Treasury Breakdown

As of 11/14/2022, the DAO’s treasury contained balances of:

- ~13,922 ETH (~$17M) in earned income

- ~19,921 ETH (~$24M) in unearned income

- ~$2,500,000 USDC

Our proposal would leave the DAO with $2.5M in USDC and >4,000 ETH in non-endowment treasury (excluding ENS). The DAO has averaged ~$5.5M in monthly cash flow YTD and we have ~$4.5M monthly in base case cash flow projected for the next 6 months. Barring a significant operational downturn, the initial size of this endowment won’t jeopardize ENS operations. Further, if needed, the DAO may use the endowment to fund operations at any point, given that no funds will leave the treasury.

Strategy & Details

After feedback from the ENS community, we’ve decided to simplify the endowment’s strategy. This updated, simplified strategy is also more compatible with our plan to manage the endowment entirely through on-chain governance.

We will focus on deploying the endowment to 5-10 very trusted assets and protocols. Rather than deploying the endowment into more complex strategies to earn more yield, we’ll focus on making the treasury productive with as little risk as possible. Our monthly proposals will deploy the endowment into trusted positions like stETH, rETH, and lending positions on Aave and Compound.

This approach reduces smart contract risk and other risks. Additionally, we will not take on any leverage or use any off-chain strategies.

Asset Management Guidelines

We envision the ENS endowment having two pools of capital as per the RFP:

- Risk-neutral with regard to USDµ

- Risk neutral with regard to ETH

Note that specific implementation of this strategy will be subject to community feedback.

Risk-neutral with regard to USD

Since the approach will be risk neutral to USD, we’ll need to convert the ETH to stablecoins using various dollar cost averaging strategies.

Once this portion of the endowment is converted to USD-equivalents, it will be deployed to earn yield in a manner market-neutral to USD (i.e. won’t be deployed to assets where the USD basis is at risk).

Given our preference for protecting against impairment of endowment funds over returns, we will allocate most of the endowment’s stablecoin bucket to trusted, liquid, reputable, and fully/over-collateralized stablecoins like USDC and DAI. We will continuously assess risks associated with stablecoins and update our allocations accordingly.

Risk-neutral with regard to ETH

All of the strategies in this bucket will be benchmarked to earn a positive return against ETH. We will focus on battle-tested strategies with minimal smart contract risk. We’ll primarily focus on deploying ETH to liquid staking derivatives (LSDs) like stETH, rETH, and other LSDs that match our risk criteria. If there is a desire from the community to take on more risk, we’ll also explore providing ETH/LSDs liquidity on trusted DEXes, like Uniswap or Curve.

While there is potentially a much larger productive ETH universe, we’ve narrowed the investable universe down to trusted, liquid, and feasible assets and strategies.

Risk Management Guidelines

Mitigating risk is our primary concern in managing the endowment, and we view risk through several different lenses, including (but not limited to):

-

Market risk. Market risk is inherent in any investment that trades freely on secondary markets. While it can’t be mitigated entirely, maintaining a portion of the endowment in productive stablecoins will prevent excess volatility in dollar terms.

-

Idiosyncratic (position-specific) risk. While idiosyncratic risk cannot be avoided entirely, it can be mitigated through prudent portfolio construction and diversification of protocols/ecosystems.

-

Liquidity risk. Liquidity can be a risk during periods of network congestion or in the event liquidity is needed but not available for operational expenses. Thorough liquidity and exit risk analysis will be performed when determining if a strategy is suitable for the endowment.

-

Centralization risk. Some protocols present centralization risk. To help mitigate this risk, we’ll avoid overexposure to single assets. For example, to avoid the centralization risk of overexposure to one stablecoin, we will use a basket of stablecoins, mostly USDC and DAI. Ideally, the endowment should steer clear of any protocol with admin keys. If a protocol has admin keys, there should be a timelock in place before changes made by admins go into effect to limit potential risks.

-

Smart contract risk. Crypto assets have varying levels of infrastructural risks related to the Ethereum network and smart contracts. Smart contract exploits (e.g., inflation of the stablecoin via exploitation of a minting function), use of admin keys, oracle risk, and more, can all destroy the value of an asset. To minimize smart contract risk, we will operate through on-chain proposals and deploy the endowment only into well-known and reputable assets. Further, we will generally avoid strategies with smart contracts that are not externally audited; Yearn’s vaults, for instance, undergo internal review but not external audits, and have a higher minimum return threshold required for them to enter the portfolio.

-

Oracle risk. Widely trusted and proven oracle feeds are strongly preferred, and we’ll use Chainlink oracles wherever possible. Oracle exploits are one of the most frequent exploits within DeFi. We want to ensure that any investment that utilizes (particularly derivatives) oracles are set up with secure price feeds/data. For example, an options protocol using an ETH price feed for options pricing needs to use an oracle pulling ETH pricing from multiple exchanges; otherwise a bad actor could manipulate ETH price on one source exchange and impact the entire options market.

All strategies will undergo risk assessment whereby each of the above risks are investigated and taken into consideration. Any known risk is to be clearly articulated in any proposal to the DAO.

Logistics

We will operate the endowment entirely through on-chain governance via periodic proposals. We believe this sets the best precedent for ENS because it doesn’t put the endowment at the risk of attack by a single actor. ENS is one of the most prominent DAOs and will be in the regulator’s spotlight. It is best to set the right precedent to protect tokenholders and contributors.

Given recent market events and increasing regulatory scrutiny, it’s more important than ever to structure the endowment in the right manner. Our proposal will allow ENS DAO to retain full control over the treasury; no assets will ever leave the treasury, and the DAO will be able to approve every proposed deployment of assets.

On a periodic basis (likely monthly), Llama will publish a proposal to deploy the endowment into various productive DeFi positions. Assuming the DAO-wide vote passes, the proposals will be executed autonomously. Any position can be changed via on-chain governance.

The endowment’s positions will not require daily or weekly trading or rebalancing, and are battle-tested and highly secure. We’ll outline any risks associated with the positions in our governance proposal so the community can make informed judgements about the proposed endowment position.

Reporting

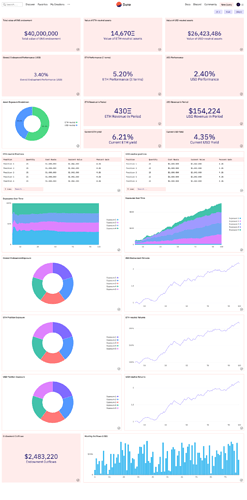

We will develop a live reporting dashboard on Dune or a similar platform that allows DAO members to receive on-demand updates on the performance of the endowment. This dashboard will display up-to-date statistics including NAV (total endowment value), portfolio positions and respective sizes, yield statistics, and historical portfolio composition, among others.

A mock up of this dashboard is shown below. Note that all numbers are for illustrative purposes only, and additional charts and tables may also be included in the live version.

We will regularly provide monthly snapshot and detailed quarterly reports to the DAO on both endowment and protocol performance.

- Monthly Snapshots

- Position balances and breakdown

- Month-to-month strategy changes

- Monthly yield generated

- Quarterly Reports

- Endowment Snapshot

- Position balances and breakdown

- Month-to-month strategy changes

- Quarterly yield generated

- Key Position Update

- TVL changes

- Yield trends

- Macro Environment Update

- ETH and other L1 Performance

- DeFi pricing trends

- Regulatory updates

- ENS Protocol Performance and Commentary

- State of the Treasury

- Topline ETH Ecosystem Trends

- Registrations / Renewals / Active Names

- Implied Churn / Renewal Rates

- Revenue & Breakdown

- Expense & Breakdown

- Endowment Snapshot

We will maintain a detailed, bottom-up forecast model for ENS. This model will include, but is not limited to:

- KPIs: ETH Unique User Count/Growth, Daily Active ETH users, ENS Registrations, ENS Renewals, Active ENS Names, Renewal/Churn %, Registration Years

- Financials: Revenue, COGS, Gross Profit, Operating Expenses, Operating Profit, Cash Flow

We will update and revise monthly as trends change and the DAO evolves. This model will form the basis of our recommendations for any Endowment adjustments (i.e., base split, risk appetite, appropriate size, future revenue contribution, etc.). It will also serve to inform the growth strategy for the DAO.

We will maintain a channel in ENS’s Discord server so community members can ask questions on the endowment’s management. We will also host a call with the community to share updates and insights on a quarterly basis.

Legal

We have worked with outside counsel to consider the legal risks presented by ENS’s request for a proposal for a fund manager to manage its endowment fund. In view of the potential regulatory risks associated with fund management, as well as regulatory uncertainty in the crypto space more generally, we believe the smartest approach is for us to frequently and periodically present proposals to the DAO to aid the community to make its own decisions concerning the deployment of its endowment fund assets.

Our fees will be earned based on the amount of work that we perform to research and present the proposals. We believe this is a more thoughtful approach that reduces the regulatory risks for the ENS community and ourselves, and protects ENS from opportunistic and unqualified actors, but still leverages our experience and reputation to help ENS and the community accomplish its goals.

Compensation Model

After discussions with the Meta-Governance committee, we have updated our compensation model to a 1% contributor fee with a $500k minimum floor.

We will trustlessly deploy ENS’s endowment through the use of non-custodial smart contracts, which will be approved by ENS through periodic on-chain proposals. We will additionally contribute to other areas of the DAO, including analytics, reporting, and governance.

Notes:

- The contributor fee will be paid on a monthly basis. The endowment’s value (in USD) will be calculated as the average of the value at the start date (day 1 of the month at close, UTC) and end date (last day of the month at close, UTC). 0.083% (1% / 12 months) of this value will be paid in a mixture of ETH- or USD-equivalents.

- Should the sum of all payments over the course of 12 months not exceed $500,000, the remaining amount will be paid in the last month. For these calculations, the ETH price on the day of the transaction will be used.

- Either party can decide to terminate the agreement with a 4 week notice. Should either party decide to terminate the agreement, the contributor fee floor will be calculated on a pro-rated basis. Ex: If the agreement is terminated after 6 months, Llama will earn at least $250,000.

Summary

We outline a proposal to manage ENS’s endowment, along with expectations for asset management, risk management, reporting, logistics, and compensation. We look forward to feedback and questions from the Meta-Governance Committee.

Disclaimer: This post has been provided for informational and discussion purposes only. It is not intended to, and does not, constitute legal, financial, business, or tax advice. This post should not be relied upon to provide any form of protections or business advice. No decision to buy, sell, exchange, or otherwise utilize any digital asset is recommended based on the content of this framework.