Updated 14 November 2022

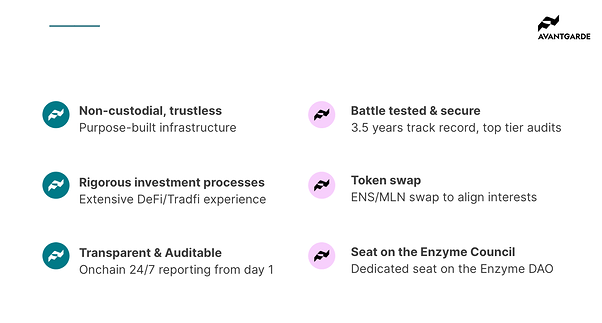

Authors: @Eek637, @Moss, and @elisafly from Avantgarde Finance. Avantgarde is ISO27001 certified and has been a core contributor to the Enzyme protocol since it was decentralised in Feb 2019. Enzyme has a four year track record on chain as the first decentralised asset & treasury management protocol.

Avantgarde also runs an asset management business which currently manages more than $30m in assets for its clients. Customers include Nexus Mutual, ADEX Protocol, Unslashed Finance and more. References have been provided to the Metagov Stewards.

TL;DR

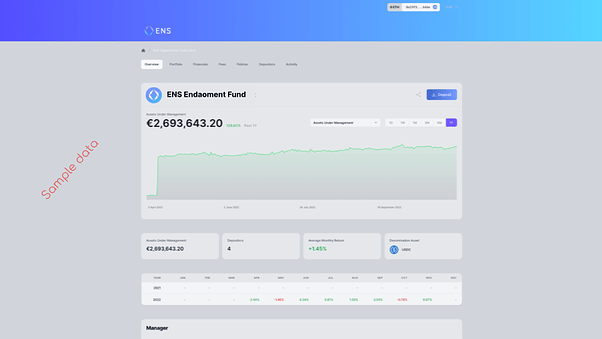

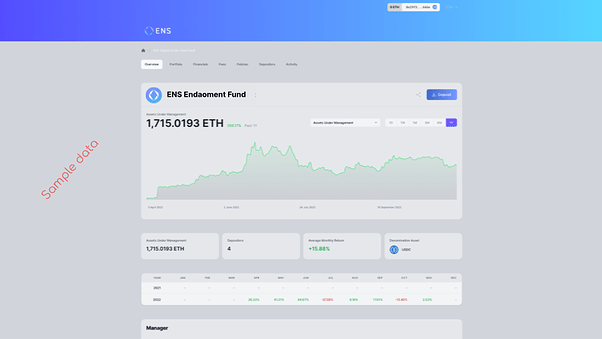

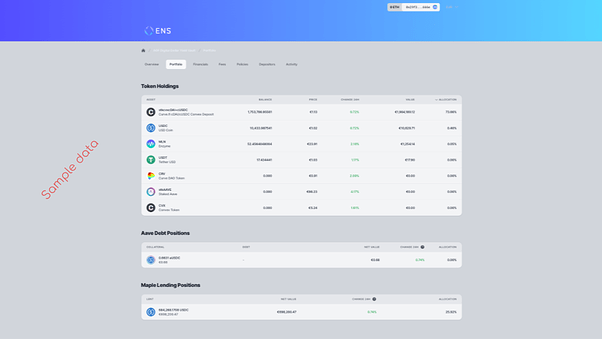

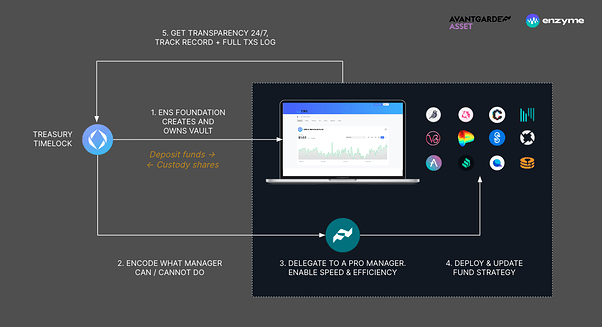

We propose that ENS engages Avantgarde Finance to build and manage the ENS Endaoment on Enzyme. The Endaoment’s goal is to earn returns that can sustainably fund the protocol’s expenses in perpetuity by investing the DAO’s resources. Our solution would enable the DAO to maintain custody of its assets at all times while allowing for flexibility and efficiency in day-to-day management. Additionally, a publicly-available website would display the Endaoment’s balances and transaction history in real-time. In the following document, we will describe the processes and tools by which we will accomplish these goals.

You can also watch the recap video we recorded here:

Why Us

Overview: The DAO’s Current Assets and Resources

Current resources include balances of ETH, USDC, and ENS sitting in the Timelock contract (controlled by governance) and ETH sitting in the Registrar Controller (controlled by the Timelock). The ENS is not included in the RFP’s list of investable assets, so we did not consider it in this proposal.

As of 13 Sep, 2022, the available USDC and ETH balances are approximately:

- 13,887 ETH in earned income

- 18,977 ETH in unearned income

- 3,817,067 USDC

Revenues have averaged about 2k ETH per month over the last year, split roughly evenly between earned and unearned income.

We recommend that a portion of the current resources and the majority of future revenues are contributed to the Endaoment until a target AUM of $100m is achieved.

The Endaoment should allocate these assets to manage for two goals:

-

Fund DAO operations - generate income equal to 4 million USDC annually to fund the ongoing operations of the DAO, with the ability to adjust to changing market conditions by scaling contributions from protocol revenue.

-

Optimise capital efficiency of unearned ETH - Maintain ETH exposure equal to the unearned income on the protocol’s balance sheet and earn interest on that balance

While the second goal is achievable immediately, we believe the first goal requires a phased approach that plays out over the course of 24-36 months.

This approach comes with tradeoffs. While the Endaoment will not be able to fund its 4 million USDC commitment within the first year, it will be able to grow in a controlled and transparent manner, acting as a steward of the DAO’s assets. Over the course of several years, its investment portfolio will grow across a diversified group of battle-hardened protocols. This conservative approach will allow the Endaoment to responsibly generate the required returns within the timeframe indicated above.

Building the Endaoment

The Endaoment should be composed of two Enzyme vaults, one denominated in WETH and earning WETH-denominated yield, and the second denominated in USDC and earning yield in the same. While it adds a little complexity to the deposit process, the two-vault setup enables a simplified fee structure, where each vault generates fees for the manager based on its performance against the denomination asset. In other words, fees will be insulated against outsized moves in the price of ETH in USDC in either direction.

Phase I: Seeding (short-term)

Ideally, the ENS DAO should seed the Endaoment with a deposit of 25,000 ETH. This should be composed of all of the protocol’s unearned ETH (~18k) deposited to the WETH-denominated vault and a portion of its earned ETH (7k of the ~13k available) deposited to the USDC-denominated vault. The earned ETH, once it is in the Endaoment, should be traded for USDC and put to work earning yield in USDC across a variety of money market and fixed-income protocols. The unearned ETH should be staked amongst a variety of staking service providers. Post-merge but pre-Shanghai hard fork, the ETH earned by staking will be partially withdrawable (rewards from the transaction layer). Those rewards should be harvested monthly and staked as increments of 32 ETH are earned. Post-Shanghai, all rewards should be harvested monthly and re-staked.

Phase II: Ramp Up (medium-term)

Directing a substantial portion of the protocol’s revenue to the Endaoment will drive its growth and we would recommend that the DAO makes regular investments to that end.

The amount of each investment should be equal to all of the period’s unearned ETH as well as most of the period’s earned ETH. The unearned ETH should be deposited to the Endaoment’s WETH-denominated vault to be staked and earn yield. The earned ETH should be deposited to the Endaoment’s USDC-denominated vault, where it will be sold for USDC and deployed across all active strategies. The earned ETH reserved in the Registrar Controller contract will be available for the DAO to spend at its discretion.

We recommend that The Ramp Up period takes place over approximately three years, until the Endaoment’s AUM reaches a target of $100m and it will be able to sustain a $4m annual draw with a very conservative approach to risk management. Note that the Endaoment will be funded in ETH and retain a very large ETH position to account for the protocol’s unearned income, so this AUM number may be reached sooner or later than forecast.

Phase III: Stabilisation (longer-term)

Once the Endaoment’s target size has been reached, deposits from the protocol to the Endaoment could slow to a yearly cadence and amounts should be subject to discussion amongst the community, with input from the Endaoment manager (though they should continue to include at least the total amount of unearned ETH earned by the protocol between deposits).

Staking rewards generated in the WETH-denominated vault should be sent to the USDC-denominated vault and deployed across all currently active strategies there.

Withdrawals of USDC from the Endaoment to the DAO’s timelock contract can be discussed at the same time, and either executed once yearly or on a quarterly basis to smooth out returns.

Our Investment Process

Strategy

The Endaoment’s primary obligation is denominated in USDC, but it will also be required to hold a substantial balance of ETH to account for unearned revenue. We propose that all funds deposited into the Endaoment vaults be invested according to a strategy that is constantly evolving to match market conditions and driven by two goals:

-

Earn USDC on USDC balances

-

Earn ETH on ETH balances

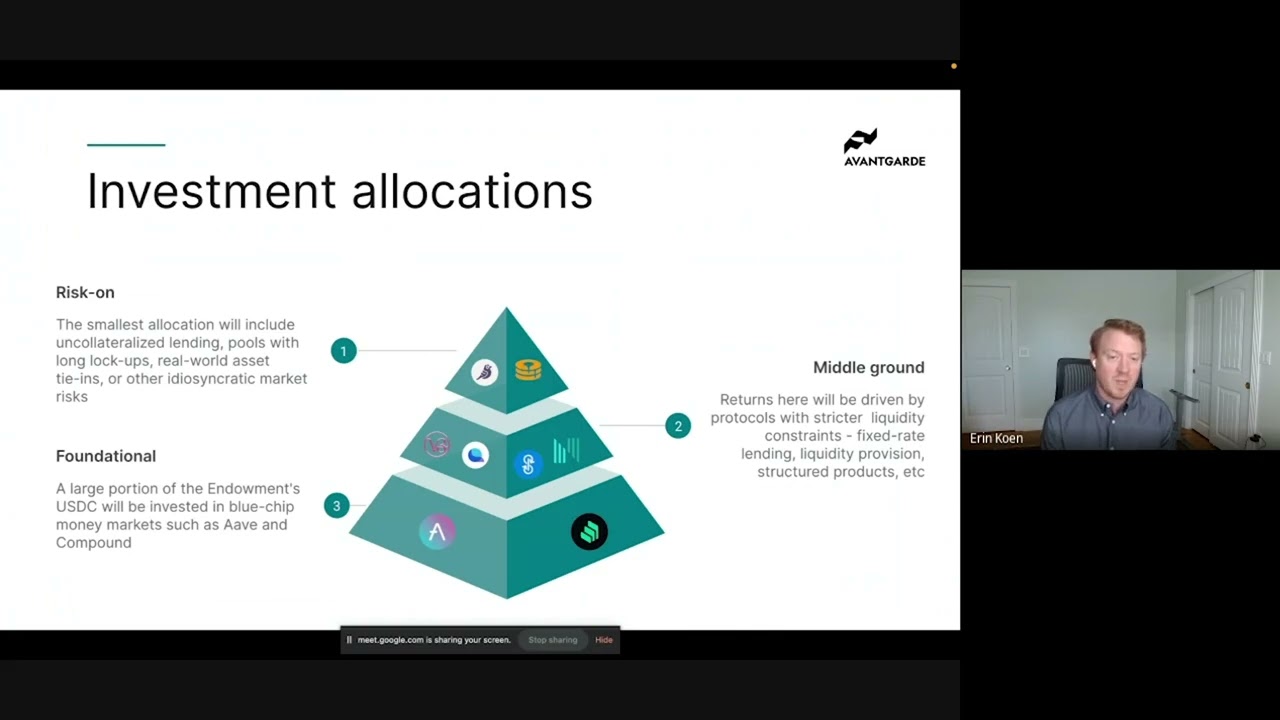

Our ability to optimise for these two goals will drive the Endaoment’s returns, which we are targeting at 4% net of fees. With that in mind, we would suggest the following high-level allocations for both the USDC and ETH positions as a starting point:

USDC

We believe that complexity in the implementation of asset management strategies can serve to both hide and amplify unknown unknowns. Like unit tests versus integration tests, yield generation strategies that layer multiple smart contracts on top of eachother can create weaknesses at the points of overlap that do not necessarily exist in isolation. Avantgarde’s strategy for earning yield on the USDC would be to allocate it across lending protocols with a variety of risk profiles such that provide a sensible reward for the risk.

Though onchain money market funds are currently yielding ~1% annually, they should represent a large proportion of the Endaoment’s USDC allocation given their generally battle-tested nature and instant liquidity to USDC. These include the big names like Aave and Compound v2, but also potentially recently-launched protocols such as Interest Protocol and Compound v3.

Collateralized and fixed-rate lending protocols should also make up a substantial portion of the Endaoment’s USDC allocation. While these protocols may provide higher yield, they do come with tradeoffs in terms of liquidity. For example, Goldfinch’s Senior pool earns a relatively high (and non crypto-derived) yield, but conversions back to USDC at the contract’s internal exchange rate are gated by available liquidity. Similarly, Notional fixed-rate lending positions that haven’t reached maturity are redeemable, but at a potentially high cost.

Finally, a portion of the Endaoment should be reserved for opportunities with a higher risk and reward. Such opportunities include the Goldfinch Borrower pools, which come with long lockups but pay a high interest rate. Another example is Maple lending pools, which are uncollateralized and thus represent the largest risk of principal loss of any of the protocols mentioned above.

Given that liquidity requirements (withdrawals from the Endaoment) are known ahead of time, it is straightforward to manage the split between these three types of investment and their varying liquidity restrictions.

The table below represents a hypothetical starting portfolio allocation for USDC across the various protocols:

| Protocol | Weight | Yield | Contribution |

|---|---|---|---|

| Aave | 20.0% | 0.75% | 0.15% |

| Compound | 20.0% | 0.75% | 0.15% |

| Compound III | 10.0% | 2% | 0.20% |

| Interest Protocol | 10.0% | 2% | 0.20% |

| Notional | 10.0% | 4% | 0.40% |

| Goldfinch Senior | 10.0% | 7% | 0.70% |

| Goldfinch Junior | 10.0% | 15% | 1.50% |

| Maple | 10.0% | 8% | 0.80% |

| Total | 100.0% | 4.10% |

A couple of notes about the table above. The yield figures quoted are approximate headline rates as of 4 October 2022 and do not take into account any compounding. As described in a section below, Avantgarde plans to allocate excess cash monthly. That cash will be generated by incremental investment from the DAO as well as returns from current positions, so the APY of the Endaoments investments will likely be marginally higher than headline rates.

Also, Importantly, this table represents a snapshot view of what is available today. Over the course of the Endaoment’s ramp up (and continuing post-stabilisation), the Avantgarde team will be busy researching new protocol allocations and recommending those that are worthy to the investment committee. Such allocations will be drawn from the money markets in the table above. By the end of the ramp up period, we would envision closer to 40% of the Endaoment’s USDC sitting in lower-yielding opportunities such as Aave and Compound with the balance spread amongst higher-yielding protocols with varying degrees of risk and liquidity constraints.

Such an allocation might look like:

| Protocol | Weight | Yield | Contribution |

|---|---|---|---|

| Aave | 10.00% | 0.75% | 0.08% |

| Compound | 10.00% | 0.75% | 0.08% |

| Compound III | 10.00% | 2% | 0.20% |

| Interest Protocol | 10.00% | 2% | 0.20% |

| Notional | 10.00% | 4% | 0.40% |

| Goldfinch Senior | 10.00% | 7% | 0.70% |

| Goldfinch Junior | 10.00% | 15% | 1.50% |

| Maple | 10.00% | 8% | 0.80% |

| Centrifuge (various) | 10.00% | 8% | 0.80% |

| Opyn | 10.00% | 8% | 0.80% |

| Total | 100.00% | 5.55% |

ETH

The Endaoment will maintain a balance of ETH exposure equal to the ENS protocol’s unearned ETH. It will be important for Avantgarde to have clear visibility into the protocol’s balance sheet to forecast and manage this position, which will be staked amongst various staking providers. The ETH will earn two sets of fees:

- Execution layer fees that will be collected from the validator nodes and re-staked in increments of 32 ETH. Our research leads us to believe these fees will generate between 2-4% return annually.

- Consensus layer revenues will not be available for withdrawal until some point in the future following the Shanghai hard fork. In the meantime, these fees will accumulate and help to offset unearned revenue.

Further to the points above, all ETH earned by the Endaoment’s staking positions will be credited against the protocol’s unearned ETH balance, freeing up incremental revenue to be deposited into the USDC-denominated vault each month.

If chosen for this mandate, Avantgarde reserves the right to implement other, non-staking strategies to earn yield on ETH balances. However, any new strategy will need to go through our diligence process and be approved by the investment committee. We expect non-staking strategies to be few and far between.

Management Team

Avantgarde Asset Management is a wholly-owned subsidiary of Avantgarde, which also has a vertical called Avantgarde Technology. Avantgarde Technology has been and will continue to be a primary contributor to the Enzyme ecosystem.

Over the past 3 years, the team has:

- deployed two new versions of the protocol as well as numerous incremental improvements to the contracts

- built and managed extensive monitoring and data collection infrastructure including seven separate subgraphs

- maintained a user-friendly dApp

- performed ad hoc contract work for large protocol users

This work creates a strong edge for the organisation as a whole. We have a deep understanding of the protocols integrated with Enzyme and our work in building that understanding gives us valuable insight into the bleeding edge of DeFi.

Core Investment Team

Erin Koen (CIO & Investment Committee) | eek637.eth | Twitter | LinkedIn

Erin spent two years as a full-stack developer at Avantgarde Technology before starting the firm’s asset management and protocol governance verticals in late 2021. As a developer, he has contributed to the ecosystem at every layer of the Enzyme app stack above the blockchain. In his current roles, he has grown the firm’s assets under management from $0 to $25m and has contributed meaningfully to governance actions in both the Compound and Uniswap communities. Previously, Erin spent 10 years working in the FX options market. He has an MBA from New York University’s Stern School of Business.

Mona El Isa (Risk Management & Investment Committee) | monaelisa.eth | Twitter | Linkedin

Mona is the CEO and Founder of Avantgarde and the Founder of Enzyme. Prior to establishing one of the industry’s leading decentralised asset management protocols, Mona managed portfolios at her own fund and at Jabre Capital. She developed extensive experience in building portfolios and structuring their investment, risk management, reporting and governance processes. Mona started her career at Goldman Sachs, where she was promoted to Vice President by the age of 26 and made the “Top 30 under 30” list in Trader Magazine in 2008 and Forbes Magazine in 2011 after profitably trading the 2008 and 2011 crashes. She is the President of MAMA and sits on the board of the Near Foundation. Mona studied Economics & Statistics at University College London.

Carlos Buendía (DeFi R&D & Investment Committee) | buendiadas.eth | Twitter | LinkedIn

Carlos is a Senior Solidity Developer at Avantgarde. He has designed, written, reviewed and deployed the smart contract architecture that makes up Enzyme. Prior to Avantgarde, Carlos founded and led a Consensys spoke called Helena. Carlos is an early and active investor across many DeFi protocols.

Full time investment analyst dedicated to ENS

Conditional to this mandate, Avantgarde Asset Management will work to hire an analyst to support the management team with investment diligence and operational activities relating to the Endaoment.

The ideal candidate would have the following qualifications:

- 5+ years experience in private credit/structured debt, including deal origination and diligence, risk modelling, execution and monitoring

- Strong demonstrated interest or hands-on experience in crypto generally and decentralised finance in particular

- Portfolio/risk management experience monitoring and managing existing loan positions

- Excellent writing & communication skills

Other nice to haves include experience with:

- Deal structuring – experience structuring debt deals, including reviewing legal docs

- Credit policy – experience developing credit policy or underwriting standards

- DeFi credit – experience in DeFi lending, especially in the real-world asset (RWA) space

- Credit trading – experience identifying and trading credit arbitrage opportunities

Extended embedded Avantgarde Technology team

Avantgarde Technology is made up of top-tier talent across development, financial engineering and mathematics departments. Access to this talent pool will help our team fast-track Enzyme-specific development and integrations for the ENS Endaoment on an as needed basis.

Investment Process

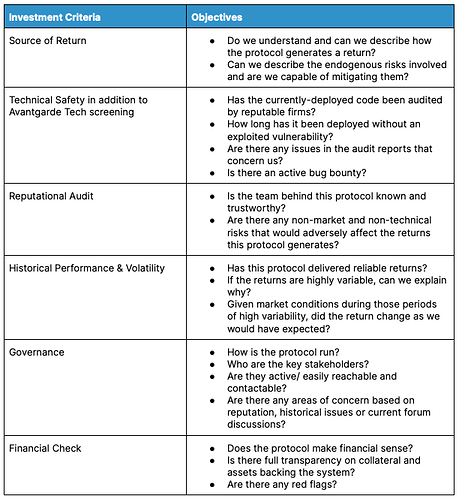

Enzyme is currently integrated with 17 protocols. Each of those protocols was extensively researched and audited by the Avantgarde Technology team before the adapter contract was deployed to connect it to Enzyme. Any future integrations will face the same scrutiny and research, and the resulting documentation and subject matter experts will be at Avantgarde Asset Management’s disposal.

In the context of the Endaoment, in order for a protocol to qualify for the investable universe it needs to pass through the above-noted technical diligence. At that point, we can consider research into the protocol’s mechanism design, financial sustainability, and other more qualitative attributes. The below framework is copied from our internal SOP when adding a new position to our Treasury fund.

The above information is gathered from publicly available sources and the analysis of open source code, but we also work with protocol teams directly to satisfy our questions when we’ve exhausted those resources.

This framework will result in memos that summarise our findings and make an investment recommendation (or not). This process resulted in a recommendation to avoid LUNA or UST exposure in early April of this year; we circulated a memo internally and amongst our investors summarising our findings.

Investment Decisions

We will produce similar memos for the Endaoment in a process led by our CIO. In the case that our research is promising, we will recommend an allocation in the memo and present it to the Investment Committee for challenge and review.

It should be noted that in general we believe that the Endaoment should only be allocated to protocols that have stood some test of time. We don’t foresee making more than one or two new allocations a year once the initial strategy is implemented.

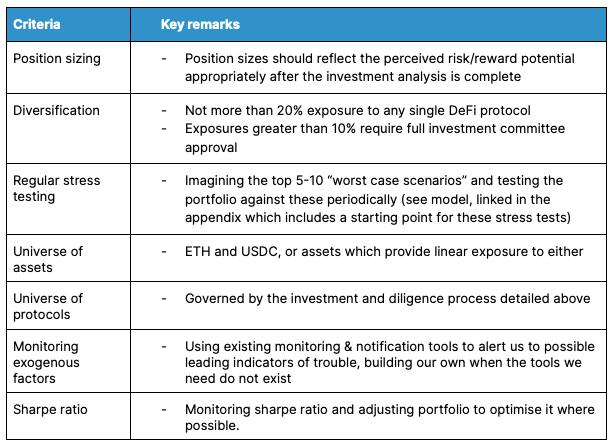

Risk & Capital Adjusted Returns

The goal of our risk and capital adjustment strategy is that if there is another vulnerability or Celsius-type blowup in any single protocol that we are exposed to, it should not materially affect the Endaoment’s solvency.

Monitoring & Reporting Structures

The investment team will regularly monitor news and data relating to the portfolio and any changing implications they have to the Endaoment’s objectives as follows:

Monitoring:

- Building & nurturing close relationships with protocols we are working with to ensure good communication flow. (As an example, we were contacted by both multiple ecosystem stakeholders regarding last month’s Wintermute hack before WM posted on Twitter)

- Building custom alerting infrastructure to notify team on any news or events related to positions or topics that might affect the portfolio, including, but not limited to large transfers into or out of smart contracts to which the Endaoment is exposed

Reporting Structure

Internal reporting:

- Monthly minuted meetings of the Investment Committee to discuss any changing external or internal conditions and how to address or handle them in keeping with the Endaoment’s dual mandates to earn USDC returns and preserve a dynamic balance of ETH

- More immediate and frequent meetings when there is a hot or time-sensitive topic that needs to be addressed

Reporting to the DAO:

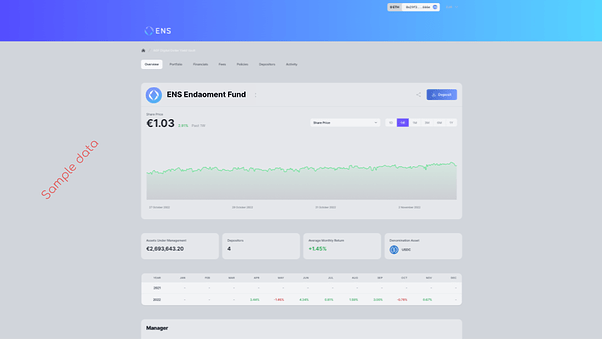

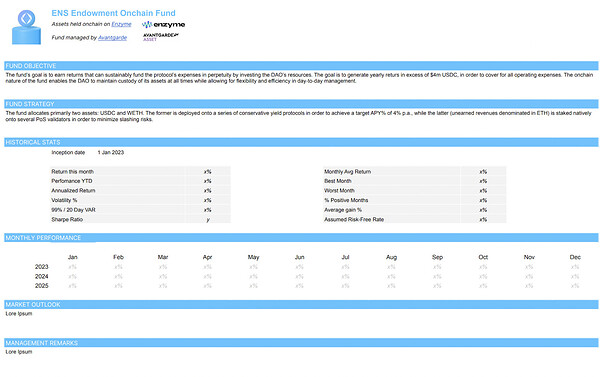

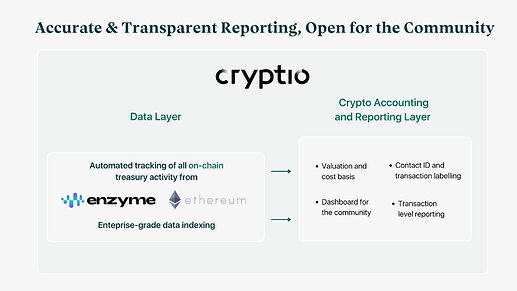

- Provision of monthly factsheets including data which is provable on-chain through subgraph infrastructure (see Appendix for a more detailed format)

- Avantgarde Investment Committee minutes will be available in a shared Notion document

- ENS Foundation can call a meeting with Avantgarde’s investment team at a cadence of their choosing. Ad hoc meetings can be organised if urgent topics or situations arise

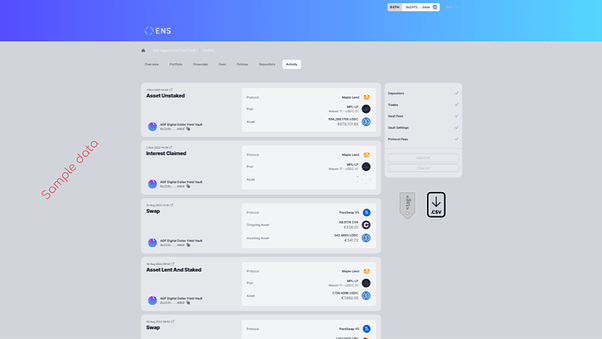

- Providing a link to an overview of the ENS Endaoment Vaults with 24/7 reporting on performance, positions at all times (examples below, available on day 0)

Fees

Fee payouts will be managed by the Enzyme protocol, which itself charges 0.25% annually on the assets managed in its vaults (see appendix for link descriptions of the protocol’s fee mechanisms). Additionally, based on a target allocation of $100m within 36 months, Avantgarde proposes a 0.25% management fee on AUM and a 12.50% fee on the Endaoment’s performance. Performance fees will be benchmarked against ETH for the ETH strategy and USD for the USD strategy. Fees are paid out by issuing shares of the vaults themselves.

These fees are inclusive of the development and audit work required to enable our proposed technical solution, as well as the cost of maintaining any custom code written during the onboarding process.

Operations, Management and Security

Our chosen infrastructure for this proposal is Enzyme, the first and oldest on-chain asset management protocol. It is trustless, non-custodial and secure with more than three and a half years’ track record on mainnet.

Enzyme Vaults - Overview and Trust Model

By leveraging Enzyme’s asset management infrastructure, the ENS DAO can minimise custodial risk by retaining ownership and ultimate control of assets at all times whilst still allowing for efficient and secure management of funds in a trustless way. A key component of Enzyme’s architecture are “vaults”. These highly customizable contracts hold tokens and allow for them to be managed actively by connecting directly to the contracts of various DeFi protocols. There are three primary roles in a vault, each of which is represented by an Ethereum address. We’ll describe them below.

Vault Owner

Each Vault is a distinct contract deployed to the Ethereum mainnet. These contracts can be configured at the time of their deployment to have various characteristics. The contract’s configuration and deployment is executed by the Vault Owner, who retains sole control over reconfiguration of the vault’s parameters throughout the life of the Vault .

Depositor

Vaults exist to manage the assets of Depositors. They can be configured to accept any address as a Depositor, or Depositors can be limited to a list of permissioned addresses controlled by the Vault Owner. Depositors send assets to the vault and in return receive a number of share tokens that represents their pro-rata contribution to the vault’s AUM. Generally the share token allows the Depositor to redeem from the Vault at any time. There are some nuances around redemption linked in the appendix.

Asset Manager

Vaults can interact with a large number of decentralised finance protocols to allocate the assets they hold. Asset Managers are addresses that have been delegated permission by the Vault Owner to interact with those protocols on behalf of the Vault. They can either trade on all the protocols with which the Vault has been enabled to interact, or the Vault Owner can specify a subset of those protocols for each Asset Manager. Additionally, the Vault Owner can always remove an Asset Manager address’ permissions instantly and without notice. By default, the Vault Owner is also an Asset Manager that can trade on all of a Vault’s enabled protocols.

In practice, these three roles, along with more precise policies that govern their permissions, allow for Depositors to engage an Asset Manager to allocate on their behalf across a wide range of protocols and strategies without also needing to trust the Asset Manager (or the Vault Owner) with custody of their assets.

Beyond the core functionality of trustless asset management, Enzyme Vault contracts and the dApp used to access them also ship with a wide variety of convenience features. They give the protocol tools and characteristics that make it an ideal platform for deploying an onchain endowment such as:

-

Accounting: Vaults always know how much of which assets they hold, and each asset in the Enzyme asset universe has a price feed (currently provided by Chainlink). Given these two facts, a Vault always knows the gross asset value of its holdings and can calculate a share price that’s accurate to the minute.

-

Record Keeping: Enzyme’s contracts are supplemented by seven subgraphs that track events emitted by every action taken on a vault. Beyond the price data provided by Chainlink, being able to ingest and interpret the transactions executed in the vault in a human-readable way can provide great insight.

-

Transparency: The two features above are combined in the Enzyme web app to show stakeholders exactly what’s happening with the assets in the Vault on a real-time basis. This will soon be programmatically accessible via a unified API, allowing stakeholders to build tools to slice and dice and display the data however they might choose.

Vault Implementation - Removing Custodial Risk

We suggest that the ENS Endaoment is run as two Enzyme Vaults where the Vault Owner is a Gnosis Safe controlled by the ENS Foundation’s directors and the only permissioned Depositors are the ENS Timelock contract. The Asset Manager will be a wallet or several controlled by Avantgarde Finance.

This setup enables two key features:

- The ENS Foundation will have root administrative powers over the vaults - this means that it can trade and manage the vaults’ assets directly, as well as add or revoke Asset Management permissions at any time without notice

- The ENS DAO will maintain custody of its assets at all times

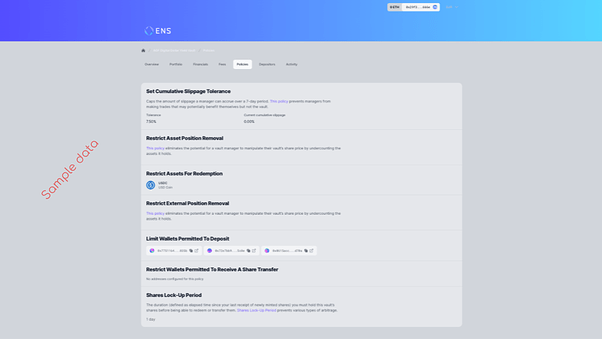

An Enzyme vault’s trust model as described above can be fine-tuned to a specific application by configuring additional smart contracts known as Policies. There are many policies that ship with the current deployment of Enzyme, and Avantgarde could write and deploy additional policy contracts if the need arose.

We suggest that the ENS Endaoment vaults make use of the following currently-available policies:

-

Deposit allowlist: Limit the addresses that can deposit to the Endaoment to the Timelock contract and the Helper Contract

-

Share transfer allowlist: Limit the address that can receive Endaoment share tokens to the Timelock and the Helper Contract

-

Allowed external positions per manager: External positions are one mechanism by which a Vault can interact with DeFi. This policy will limit the external position types with which the Asset Manager can interact to a predetermined list. Adding protocols to the list as a result of a new asset allocation will require a vault reconfiguration.

The initial configuration of these policies and any subsequent adjustments would be managed by the ENS Foundation with help from Avantgarde Finance.

Creating the Endaoment as an Enzyme vault owned by the ENS Foundation where Avantgarde Finance manages the ENS DAO’s funds has the following benefits:

- Zero custodial risk

- Controlled access to vetted DeFi protocols

- Flexibility to respond to changing market conditions without having to gather signatures or votes

- Total transparency into the Endaoment’s trading activity, accounting, and fees

Technical Requirements

Enabling ENS governance to execute the initial seeding of the Endaoment, the ongoing deposits, and any subsequent withdrawals will require custom development work and potentially the audit and deployment of some custom contracts. We’ll detail a high-level spec for each step along with our rationale (pending further input from our contracts team, who will be responsible for writing and auditing this code).

Seeding

Because we suggest that the DAO invest a portion of its current ETH balance to the Endaoment’s Enzyme vaults, we envision a governance vote that calls functions to perform two actions for each vault, each of which requires two steps:

- Seed vault with initial ETH deposit

- Depositing a token amount of the denomination asset

The DAO needs to hold Endaoment vault shares in order to redeem for the value held within it. Depositing a 100 USDC will return 100 vault shares. This requires an “approve” step and a “buy shares” step.

This will not require any custom contract work, but Avantgarde will coordinate with the ENS Metagovernance stewards to create and test the transactions that will ultimately be voted on.

A couple of notes on the process above:

- Sending ETH to the USDC-denominated vault will allow us to manage the conversion of the liquid ETH position to USDC on a trade by trade basis, minimising slippage and reducing the number of votes required by the DAO.

- Buying shares of the vault has two effects. First, it initiates the vault’s share price at 1, which allows for an easy high-level review of the vault’s performance. If at some point in the future, the share price is 1.10, it means that the manager has earned 10% on the assets under management. Second, the shares are how the DAO will access the value stored in the vault. As an example, if the above process happened and no other actions were taken, the DAO could redeem the 100 shares for the entirety of the WETH held in the vault.

Ramp Up

Post-seeding, we suggest that the DAO invest a portion of its revenue into the Endaoment on a regular basis for three years. Pending planned upgrades to the ENS Protocol’s Registrar Controller contract, we will design a process to invest a portion (or all) of the protocol’s accrued revenue on a monthly basis. This process will be designed with the following key principles in mind:

- It is a light touch from the perspective of ENS Governance delegates and token holders

- It allows the DAO to maintain unimpeachable custody of its funds, and provides multiple opt-outs for continuing to fund the Endaoment

- It allows Avantgarde to manage the Endaoment’s ETH price risk for the USDC-denominated vault in a manner similar to dollar cost averaging

Withdrawal

Withdrawing assets from the Vault to fund the ENS DAO’s operations will look similar to the operations in the Seeding stage. Governance can vote to call the Vault share tokens’ redeem() function and specify a number of shares and the asset that it would like to redeem. Avantgarde will help to create and test these redemption transactions prior to any governance vote. This will require further coordination with the Vault manager to ensure that a balance of that asset is available for redemption. Otherwise, the DAO can opt to redeem a pro-rata slice of each asset held by the Endaoment, but that would require further governance votes to get back to USDC.

Aligning ENS x Enzyme

To further align the ENS community with our chosen infrastructure, we propose the following:

Governance Seat:

Enzyme is governed by a Technical Council DAO along with two User Representatives. The Council is responsible for all contract deployments, as well as contracting with providers of research, development, audit, security, and other services to drive the protocol’s continued development.

Subject to us winning this mandate, we have negotiated with the Enzyme Council that ENS would be eligible for one seat on the Council. We’d propose that ENS DAO be represented on the Enzyme Council by one of the ENS Stewards that would be able to attend regular council meetings and discussion.

Token Swap:

To further align the incentives of the two protocols, the terms of a token swap have been agreed between the Enzyme Technical Council and the Metagov Stewards; the ENS DAO will have the option to exchange 75,000 ENS for 50,000 MLN for 30 days following the conclusion of a vote where Avantgarde is selected the winner of this RFP. Both DAOs will be subject to a holding period that is still under discussion. Avantgarde will help with the implementation and execution of this swap if requested by the Metagov Stewards.

Conclusion

Avantgarde Asset Management is uniquely positioned to build and scale a fully on-chain investment vehicle for ENS. We’ve spent years building the infrastructure that makes non-custodial asset management possible, we have deep technical and financial insight into the protocols that we will use to generate returns, and we have the systems and frameworks in place to evaluate new opportunities as they arise. We appreciate the opportunity to prepare this proposal for the ENS Metagov stewards, and we are excited to continue the conversation.

Appendices and Links

Proposed Reporting Format