Summary

This proposal aims to initiate the Endowment by requesting the ENS DAO to transfer 10,766 ETH to a newly created SAFE provided by kpk and owned by the DAO.

This transfer represents the first installment of a series of three equal monthly transfers until the Endowment reaches its full funding goal.

Abstract

This proposal builds on a previous post outlining the initial conditions and steps for creating the Endowment. It provides updated information reflecting current market conditions, and covers the following topics:

-

A summary of the previous post

-

The size of the Endowment and allocation rate

-

Strategies and projected results

-

Technical implementation

- A list of Zodiac Roles Modifier permissions for the Manager Role

- Future permissions and roles

- Next steps

- Additional requirements for the creation of the Endowment.

Specification

A summary of the previous post

The previous post presented the following topics regarding the Endowment:

-

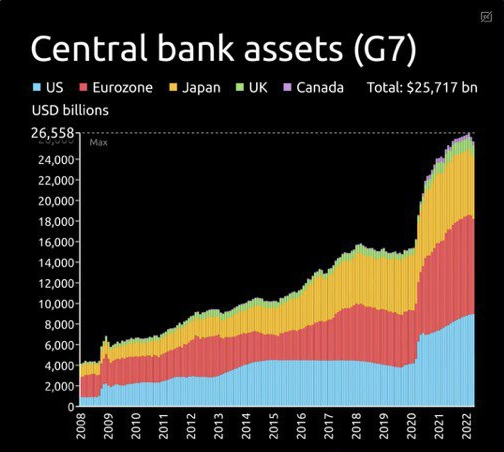

The Endowment will consist of the entire treasury, minus $16,000,000, which is equivalent to two years of expenses for the DAO. This amount was discussed in the ‘Routine DAO treasury management’ post.

-

The DAO will keep unearned ETH as is and convert all remaining funds to USDC.

-

To take a cautious approach, the Endowment will be seeded gradually.

-

kpk will implement two types of risk-adjusted strategies using reputable and proven protocols:

- USD-neutral stablecoin strategies aimed at earning a positive return measured against USD.

- ETH-neutral ETH and derivatives strategies aimed at earning a positive return measured against ETH.

- 100% of the rewards will be converted to stablecoins and re-invested in USD-neutral strategies.

Size of the Endowment

The breakdown of the total funds currently held by the DAO is:

| Total account balances | ||||

|---|---|---|---|---|

| Token | Description | Amount | Price | Value |

| ETH | Unearned (controller) | 18,971 | $ 1,593.00 | $ 30,220,962 |

| ETH | Earned (controller) | 17,731 | $ 1,593.00 | $ 28,245,021 |

| ETH | DAO | 4,091 | $ 1,593.00 | $ 6,517,409 |

| USDC | DAO | 2,467,026 | $ 1.00 | $ 2,467,026 |

| Total | $ 67,450,419 |

The DAO plans to establish a separate fund to cover expenses for two years, estimated at $16,000,000. This will be achieved by keeping USDC in the DAO’s wallet and converting the required earned ETH into USDC.

| 2-year Runway Fund | |||||

|---|---|---|---|---|---|

| Token | Description | Destination | Amount | Price | Value |

| USDC | DAO | ENS main wallet | 2,467,026 | $ 1.00 | $ 2,467,026 |

| ETH | Earned (controller) | ENS main wallet | 8,495 | $ 1,593.00 | $ 13,532,974 |

| Total | $ 16,000,000 |

The remaining ETH will be sent to the Endowment. kpk will manage the unearned ETH by deploying it into ETH-neutral strategies. Earned and DAO’s ETH will be gradually converted to USDC. After discussing with the ENS stewards, we decided that it would be more efficient for the ENS DAO to transfer all funds in ETH to the Endowment and then grant kpk specific permission to handle the gradual conversion to USDC.

| Endowment assets | |||||

|---|---|---|---|---|---|

| Token | Description | Destination | Amount | Price | Value |

| ETH | Unearned (controller) | Endowment | 18,971 | $ 1,593.00 | $ 30,220,962 |

| ETH | Earned (controller) | Endowment | 9,235 | $ 1,593.00 | $ 14,712,047 |

| ETH | DAO | Endowment | 4,091 | $ 1,593.00 | $ 6,517,409 |

| Total | 32,298 | $ 51,450,419 |

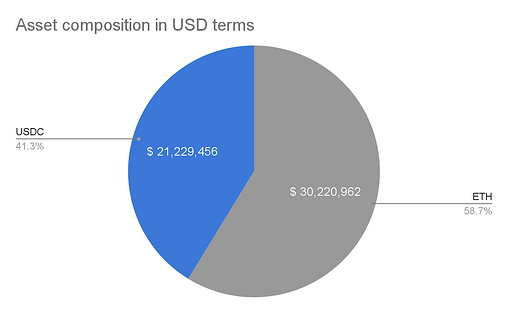

After converting the earned and DAO’s ETH into USDC, the approximate resulting balance is as follows:

| Endowment assets | ||||||

|---|---|---|---|---|---|---|

| Token | Description | Destination | Amount | Price | Value | Share % |

| ETH | Unearned | Endowment | 18,971 | $ 1,593.00 | $ 30,220,962 | 59% |

| USDC | - | Endowment | 21,229,456 | $ 1.00 | $ 21,229,456 | 41% |

| Total | $ 51,450,419 | 100% |

It should be noted that these figures are approximate and the final numbers will depend on the price of ETH at the time of each swap.

Seeding rate

The Endowment’s construction will be done moderately, starting with a portion of the funds and gradually increasing to 100% as kpk demonstrates their capabilities and meets their commitments outlined in the Fund management proposal. After consulting with the ENS Stewards, it was decided that the most suitable approach is to seed the Endowment in three equal monthly installments of 33%. This approach allows the ENS DAO enough time to evaluate progress before committing all the funds while minimizing opportunity cost for the Endowment.

The first installment will be carried out through this executable proposal and the second and third installments will be executed through new proposals that will be posted on the forum in a timely manner.

After the ENS DAO seeds the Endowment with the first installment of 10,766 ETH, kpk will convert approximately 41% of it into USDC, creating the following initial scenario for deploying the intended strategies:

| Initial Scenario | ||||||

|---|---|---|---|---|---|---|

| Token | Initial % | Initial amount | Price | Initial Value | Share % | Strategy |

| ETH | 33% | 6,324 | $1,593.00 | $ 10,073,644 | 58.7% | ETH - neutral |

| USDC | 33% | 7,076,478 | $1.00 | $ 7,076,478 | 41.3% | USD - neutral |

| Total | $ 17,150,122 |

Strategy and projected results

The list below shows the strategy that kpk will initially deploy after the Endowment has been seeded. The final allocation may vary depending on the current market conditions at the time of deployment.

| # | Protocol | Assets | Strategy | Share per Strat | Allocated Funds | Share of Portfolio | Proj. APR | Proj. Rev | Pool TVL (MM) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Compound v2 | DAI | USD - neutral | 50% | $ 3,538,239 | 20.63% | 2.02% | $ 71,472 | $465 |

| 2 | Compound v2 | USDC | USD - neutral | 50% | $ 3,538,239 | 20.63% | 2.04% | $ 72,180 | $539 |

| 3 | Aura Finance | wstETH - WETH | ETH - neutral | 40% | $ 4,029,458 | 23.50% | 10.21% | $ 411,408 | $162 |

| 4 | Curve | stETH - ETH | ETH - neutral | 40% | $ 4,029,458 | 23.50% | 6.37% | $ 256,676 | $1,400 |

| 5 | Stakewise/ Uniswap v3 | sETH2 - ETH | ETH - neutral | 20% | $ 2,014,729 | 11.75% | 15.81% | $ 318,529 | $62 |

| Total | $ 17,150,122 | 100.00% | 6.59% | $ 1,130,265 |

If implemented, the projected annual results for the presented strategies are:

| Annual results | |

|---|---|

| Total Funds | $ 51,450,419 |

| Utilized Funds | $ 17,150,122 |

| Capital Utilization | 33.33% |

| Gross Revenues | $ 1,130,265 |

| Gross APR | 6.59% |

| Management Fee (calculated over AUM) |

0.50% |

| Performance Fee (calculated over revenue) |

10% |

| Net Revenues | $ 931,488 |

| Net APR | 5.43% |

After the launch of the Endowment, kpk will conduct a thorough review of the strategy before the transfer of any new installment. If an expansion is recommended, the necessary permissions will be promptly provided for a new on-chain vote. The transfer of the new installment and the corresponding modifications to the preset will be executed simultaneously in accordance with established protocols.

Technical implementation

A list of Zodiac Roles Modifier permissions for the Manager Role

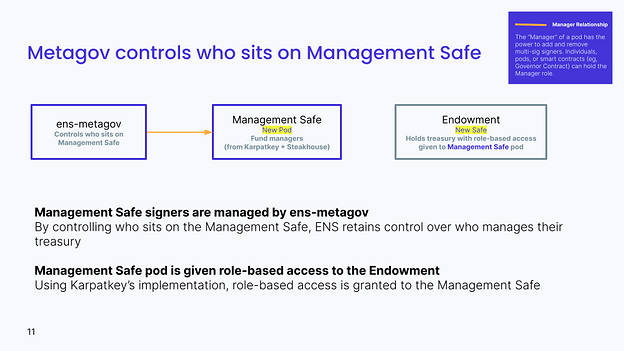

The non-custodial solution for managing the Endowment relies on a proxy Management SAFE and the Zodiac Roles Modifier. The Zodiac Roles Modifier limits kpk’s actions by only allowing the execution of predetermined transactions defined by the allowlisted preset or role.

A preset or role is a set of permissions for specific smart contract functions that need to be applied by the Endowment’s owner (the DAO) through a batch of specific transactions. Once executed, kpk can operate the Manager SAFE in accordance with the granted permissions. The Manager Role preset, which contains all required permissions for the strategy outlined, can be found in the Annex Document.

To simplify the setup process for the ENS DAO, kpk proposes to take responsibility for creating the new SAFE and applying the Manager Role outlined in the Annex Document. More details can be found in the Next Steps section.

Future permissions and roles

In order to adapt to changing market conditions, new permissions may be required. For example, if a particular strategy no longer provides sufficient yield or a pool in which the ENS DAO has a position becomes deprecated and needs to be migrated. New roles may also be needed to improve or expand operations. Two new roles are planned for the near future: the Harvester Role and the Swapper Role. Both roles will be granted specific subsets of the Manager preset permissions and will be assigned to EOAs to automate certain tasks. The Harvester Role will be allowed to claim rewards, while the Swapper Role will be allowed to swap these rewards for ETH or stablecoins.

When deemed appropriate, kpk will create a new forum post requesting the ENS DAO to update the preset or deploy new roles. The post will include an explanation of why the permissions and/or roles are needed and the executable payload. The proposal will need to be passed by the community and, once approved, it will be executed according to the DAO standard operating practices. To minimize opportunity cost, the process should be as simple and straightforward as possible. A summary of the new permissions and/or roles will be included as a separate section in every corresponding weekly report.

Next Steps

To simplify the process for the ENS DAO, the proposed implementation steps are:

-

kpk will create a new SAFE, deploy the Roles Modifier contract, and apply the Manager Role preset (as outlined in the Annex Document).

-

kpk will conduct a small-scale replication of the strategy for further testing. ENS stewards are invited to participate in this process.

-

Once the SAFE is created, tested, and permissions are applied, kpk will transfer ownership of it to the ENS DAO and remove themselves as owner.

-

This proposal will be submitted to on-chain voting.

-

If approved, the first transfer will be executed.

Additional information

Audits

Audits have been conducted on the Zodiac Roles Modifier to ensure its security and functionality. The first audit was completed by G0, and the official report can be found here. Additionally, Ackee and Sub7 have recently conducted external audits and found no critical issues. The official reports will be released shortly and shared with the community for review.

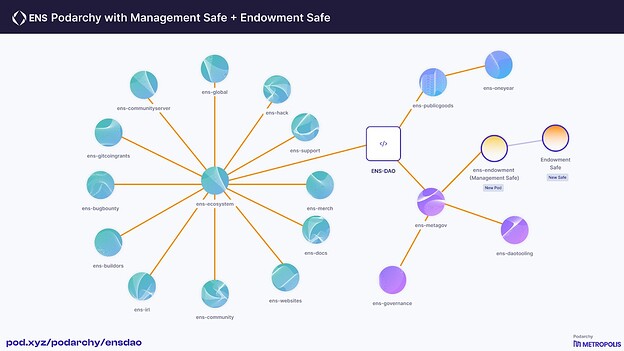

Ens-endowment subgroup

To integrate the Endowment into the existing structure of the DAO, a subgroup called ens-endowment must be created. Please note that it was previously referred to as the Finance Core Unit but has recently been renamed to align with ENS’s current naming conventions.

The ens-endowment subgroup will be attached to the ENS DAO podarchy with the assistance of Metropolis. kpk will create the ens-endowment pod consisting of the Manager SAFE through the Metropolis app. Three fund managers from kpk will be appointed as members of the pod and the ENS-metagov pod will be set as the subgroup manager, with the power to add and remove members at any time. The ens-endowment role will be limited by the permissions granted to the Manager SAFE through the application of the permissions set in the Manager Role.

To be clear: the SAFE which holds the endowment funds will not be a pod. Rather, the SAFE which has the permission to execute specific transactions on the Endowment SAFE will be a pod, which gives ENS ultimate control over who has access to manage the endowment funds.

Below are two slides borrowed from the Metropolis’ presentation that offer more information about the intended structure. Thanks to the Metropolis team for your collaboration.