Hello fellow ENS community members,

With the recent successful sale of 10,000 ETH for USDC, as per EP3.3, the ENS DAO treasury is now funded with roughly ~17 million USDC. This is intended to cover operational runway for the next 18-24 months.

Separately, ENS is entering into a treasury management engagement with Karpatkey that will deploy ETH and additional stablecoins for yield to prudently grow the DAO’s resources.

I’d like to raise the possibility of swapping a portion of ENS DAO’s stablecoin reserves held in the treasury timelock from USDC to DAI in order to reduce business continuity risk and safeguard the DAO’s operational runway.

This post is intended as a jumping off point for discussions, please share your perspectives below and all feedback is appreciated!

Abstract

Swap 5 million USDC (or another amount to be determined through community discussion) for DAI, and deposit DAI in Maker’s Dai Savings Rate contract.

Justification

Recent treasury management proposals have put the DAO on a much firmer footing, ensuring that critical operations of community working groups and ENS Labs can continue even in the event of a worsening bear market. However, the heavy reliance on USDC for operating runway poses some business continuity risks.

- USDC solvency risk: While USDC’s reserves are held in safe, short duration assets, USDC is organized under state money transmission frameworks which are less robust vs some other centralized stablecoins, and there is no assurance of USDC reserves being bankrupt-remote with respect to the issuers.

- USDC key management risk: If USDC minting keys were compromised this could lead to significant impairment of USDC value.

- USDC centralization risk: USDC can be frozen by the issuer, which exposes ENS DAO to possibility of legal or regulatory risk.

I believe DAI could offer meaningful diversification for each of these risks, while offering the scale, liquidity, broad acceptance, and reliability required to serve as a treasury asset for ENS DAO.

Benefits of Allocating to DAI

Diversify Counterparty Risk

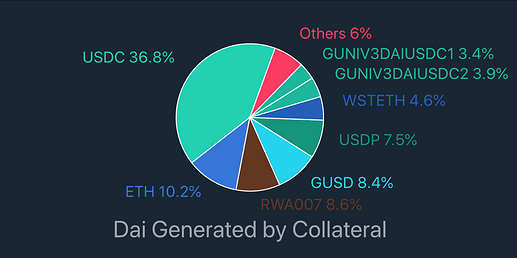

Maker collateral backing is broadly diversified across crypto native collaterals (ETH, stETH, rETH, WBTC, etc), stablecoins (USDC, USDP, GUSD), and real world assets (RWAs), most notably significant holdings of short term US treasury bills which are among the safest investments available.

While DAI has significant exposure to USDC within its collateral base, the share of DAI generated from USDC has been trending down steadily and is expected to continue to fall over time.

Source: Daistats

Between all DAI exposed collateral types (including the PSM and LP tokens containing USDC), total USDC exposure is slightly below 50% of backing. Recent proposals will likely reduce this share further, for example Paxos proposed to increase maximum DAI backed by USDP to 1.5 billion in exchange for incentive payments linked to SOFR (secured overnight funding rate).

Reduce Centralization Risk

The DAI token is immutable, and MakerDAO has no capability to freeze user funds. ENS DAO can be assured of always being able to freely transfer or exchange any DAI in their possession.

Dai Savings Rate

In addition to risk diversification, DAI holders can also benefit from the Dai Savings Rate (DSR), which pays a stable yield set by Maker governance (currently 1%) on DAI deposited within the contract. Funds are not subject to lockups and can be withdrawn at any time.

The risk profile of DAI deposited in the DSR is equivalent to holding DAI in a wallet, other than technical risks involved in the DSR contract itself (which should be minimal considering the contract has held significant funds over a 3 year period with no exploits to date).

Assuming 5 million USDC swapped to DAI, and current DSR rate of 1%, this would generate roughly 50,000 DAI in annual revenue to the ENS DAO.

Risks of Allocating to DAI

TL;DR:

- No bank guarantee

- Not FDIC insured

- May lose value

Solvency Risk

DAI is managed through a smart contract system, and it is possible that unexpected technical or operational faults could lead to loss of funds, up to the total loss of all DAI value. Additionally, impairment of collateral value through market volatility or defaults could result in Maker becoming insolvent, and while the protocol currently has over 70 million DAI in system surplus available to absorb losses this may not be sufficient in all cases.

Liquidity Risk

There is no guarantee that DAI will continue to trade at $1 even if the Maker protocol remains solvent. If the supply of DAI (from vault minting) exceeds demand from users, this could lead to external stablecoin reserves in Maker’s peg stability modules (PSMs) becoming exhausted and DAI trading below $1. If DAI trades below target value due to a supply/demand imbalance, it is expected that Maker governance would increase both vault minting costs and the DAI savings rate to help rebalance supply and demand, but there is no guarantee of governance action or that any action taken would return DAI to target price on a reasonable timeframe.

Governance Risk

Maker governance has broad influence over protocol parameters, including choice of accepted collateral assets and oracle pricing mechanisms. Malicious or incompetent governance actions could result in losses for DAI holders. In the normal course of operations, Maker governance could adopt changes that would have a material adverse effect to DAI holders (for example raising the fees required to swap DAI to USDC through the PSM) and DAI holders would not have a method of recourse for such impacts.

The Maker protocol features an emergency shutdown module (ESM) that can be triggered permissionlessly by a minority quorum of MKR holders burning their tokens (currently 150,000 MKR, roughly 16% of circulating supply). This is intended as a security measure and to safeguard against malicious governance majorities. However, if the ESM is triggered DAI would no longer track target price but would instead represent a pro-rata claim on the protocol’s collateral assets, with the possibility of DAI holders recovering significantly less than $1 of value per DAI depending on market conditions.

Other Risks

This is not a comprehensive list of potential risk factors of holding DAI. ENS DAO should review the risks of holding DAI and come to an independent conclusion on whether it is suitable for use within the DAO’s operational treasury.

Impact on DAO Operations

Assuming a majority of the DAO’s operational stablecoin reserves held in the timelock remain in USDC, this should have an insignificant impact on existing DAO financial operations and payroll. Existing payment streams denominated in USDC can continue to be paid without changes, and semi-annual working group disbursements can be funded with either USDC or DAI at the DAO’s discretion when funding proposals are made. If ENS DAO’s USDC reserves fall below a comfortable threshold (eg. next 6 months expected outflows), DAI can be swapped back to USDC as needed through the PSM assuming there is sufficient liquidity, or on secondary markets at prevailing market rates if not.

Specification

Subject to DAO discussion and rough consensus being reached, an executable proposal to implement the above would involve the following actions:

- Grant approval for 5 million USDC to Maker’s PSM-USDC-A contract

- Swap 5 million USDC for 5 million DAI through PSM-USDC-A

- Deposit 5 million DAI into the Dai Savings Rate contract

If USDC reserves needed for operating expenses fell below 6 months forward looking expected outflows, the deficit can be removed from the DSR and swapped back through the PSM (or on the secondary market if necessary) via a subsequent executable proposal.

Disclaimers

I work with Maker affiliated service provider Block Analitica, may serve as MakerDAO Risk Core Unit facilitator pending an upcoming governance vote, and hold MKR tokens.

The above proposal is provided for informational purposes only, on an “as is” basis, and without warranty of any kind. This is not intended or offered as financial, legal, regulatory, tax, or investment advice. Users should conduct their own due diligence and seek qualified advice where appropriate. This is not an offer, solicitation, or recommendation to engage in a financial transaction or purchase any financial instrument.

Copyright and related rights waived via CC0.